Powell Leans The Wrong Way Ahead Of Next Week's CPI

Summary

- The Fed raised but signaled a data-dependent pause.

- I've been bullish this year, but I'm concerned that the Fed pause comes just ahead of a CPI print next week that has some upside risk.

- Anyway, net net, I'm bullish for this year, but I'm concerned about next Wednesday's reaction.

- Looking for a helping hand in the market? Members of Fed Trader get exclusive ideas and guidance to navigate any climate. Learn More »

Win McNamee

Fed Chair Jerome Powell made sure everybody knew today they pivoted without saying pivot. They stepped off the hike-pedal and moved to the sidelines. That should be good. The market did not react well which is not amazing. But just as Powell is less worried about inflation I think there's risk for next Wednesday's CPI print. That can mean shorter-term market risk. That's coming from a market bull this year.

Fed Day Today

Powell told us quite a few times today that removing "additional policy firming may be appropriate" from their policy statement was a "meaningful change."

He doesn't want to let the word "pivot" slip from his mouth because it could ignite markets but he wanted to make clear that the Fed did something today "meaningful."

He was not so clear about the direction of inflation. Frankly, he sounded like there was more inflation risk but because of credit tightening after bank failures there's reason to pause. That credit tightening can potentially slow the economy, in his mind today, which can ease inflation in the future.

But The Next CPI Inflation Print Carries Risk

I'm not afraid to be a Fed critic. I called out that his transitory inflation call was way off two years ago and told subscribers they'd need to hike big which the Fed said no way at the time but did hike big time anyway.

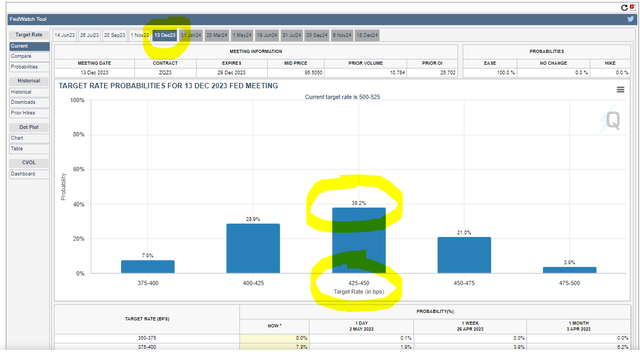

The CME Fed Funds futures which I respect very much calls for three rate cuts later this year. Directionally that's where Powell was begrudgingly headed today.

CME Fed Funds Futures pricing in rate cuts. (CME Group)

Fed Funds were moved to 5-5.25 today. So, a move to 4.25-4.50 by December (as per the chart above) would be, count them, three 25 basis point rate cuts.

The market is pricing in a very bullish Fed move later in the year.

I do think the CME futures traders are going to ultimately be correct but next week's number can throw off markets for a time.

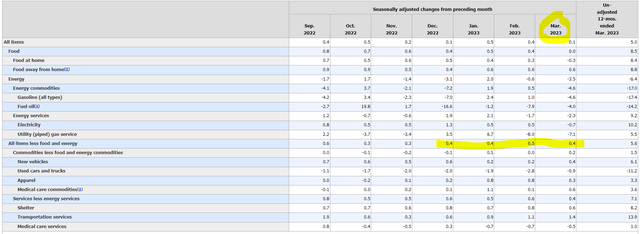

The last CPI print had a stubborn core read-out.

CPI For March stayed high (BLS)

March's print in April's report stayed high despite topline inflation slowing. It was disappointing.

Since then, there's been some higher inflation reads in the market representing the next April timeframe.

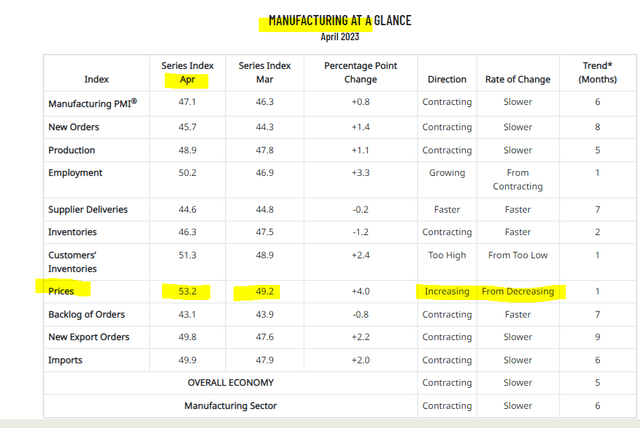

ISM Manufacturing Prices Jumped (ISM Survey)

Above is ISM manufacturing that turned from going down to moving up in April.

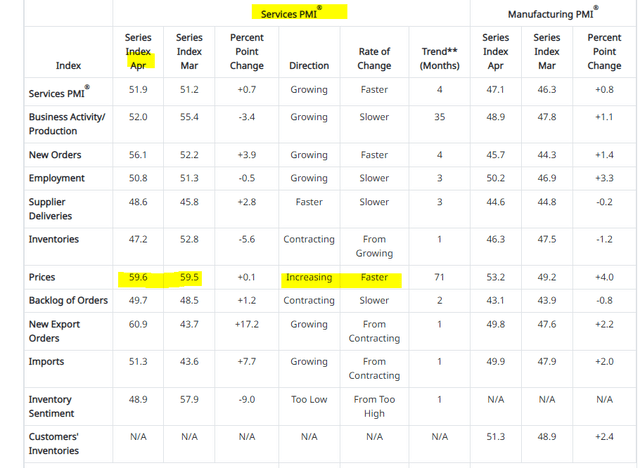

ISM Services Prices Flat But A Little Higher (ISM Survey)

ISM services, which represents the larger part of the economy looks OK at flattish but that was a pickup from March's period reported in April.

So, the change from March is that April's inflation is higher.

Here's one year inflation expectations.

1 year inflation expectations jumped (Trading Economics)

April saw a jump from consumers in the University of Michigan Survey. That tells me that consumers saw higher prices in April.

So net net I think there's some building risk for next Wednesday's CPI print.

That comes just as the Fed backed off hikes to take a breath.

To me, that's causing the market to possibly be leaning the wrong way ahead of a surprise the other way.

What It Means For The Stock Market

Inflation by itself is not a bad thing. Out-of-control inflation is a bad thing but 3%-6% inflation is fine. It even can help stocks go up. Since stocks are measured in prices and inflation is prices, thus higher stock prices can be helped by inflation. That's as long as the Fed doesn't slam on the brakes to kill the economy and so the market.

I don't think the Fed will be aggressive from here in reaction to hike on a high inflation number.

Powell knows when he floated the idea of a 50bp hike ahead of last meeting banks started failing. He views that as fragile and that was top of mind for him today.

Letting inflation run a little and a Fed behind the curve is good for stocks (QQQ)(SPY), gold (GLD) and Bitcoin (BITO). It would be bad for bonds (TLT).

But as a knee-jerk reaction to a high inflation print next week, there's probably shorter-term risk for markets especially after the Fed just leaned a little more dovish.

A high print could catch the market off guard causing them to think the Fed will have to about-face with more hikes. That would go against today's news and what's currently priced in to markets according to Fed funds futures traders that I posted above.

Conclusion

I'm bullish for this year. I think there's a chance for a second half earnings boom and a Fed pivot coming. But timing is of course important and I think the next CPI print could spook some people leaning with Powell the wrong way.

Be smarter about markets and the Fed's immense impact on predicting what's next. Join a pro with 30+ years experience to get markets right.

Two Week Free Trial Click Here

This article was written by

Starting out I could make a mean straight black coffee. But ask me to add some sugar or milk though was a problem. So they got fed up and said, just give him some stocks to follow. That was in the 90s tech boom. Yeah. That worked out.

So, now, mid-life crisis I enjoy second guessing the Fed, which is usually a good strategy. They are not traders, they have no risk discipline, they are having way too much fun with this QE-QT thing and because of their powerful position, are usually way too over-confident in their decision making which is a hint to bad decision making.

My customers have seen that I've been net net pretty good at consistently second guessing the Fed.

Our EPS estimates factor into Street numbers.

I've been on CNBC and a few other places.

But mostly I really just enjoy second guessing the Fed and keeping it simple.

Wishing you all continued success.

https://seekingalpha.com/mp/1072-the-fed-trader/articles

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

All investments have many risks and can lose principal in the short and long term. The information provided is for information purposes only and can be wrong. By reading this you agree, understand and accept that you take upon yourself all responsibility for all of your investment decisions and to do your own work and hold Elazar Advisors, LLC, and their related parties harmless. Opinions given are at this moment and can change rapidly after this is published. If our calls are made public (outside the service) we may or may not update our opinions publicly.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.