Hershey: Margins Remain High And Price Per Share Continues To Rise

Summary

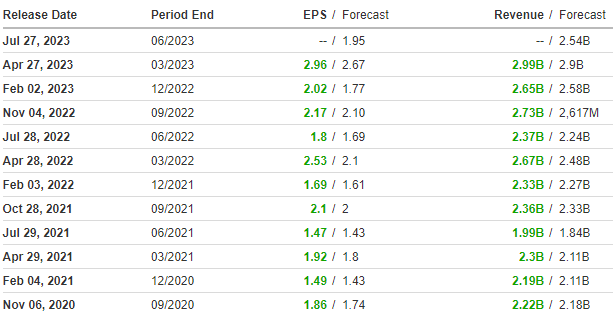

- The Hershey Company continues to beat analysts' estimates.

- Strong net sales growth and high margins make this company one of the best consumer staples.

- The only flaw is that it is currently too expensive.

arlutz73

It is quite impressive how in such a difficult economic environment, The Hershey Company (NYSE:HSY) is growing without any problems. Q1 2023 was another success.

Investing.com

Analysts' estimates have been beaten since November 2020 and the price per share is continually updating new all-time highs. After all, in a difficult macroeconomic environment, investors focus their attention on recession-proof companies with stable revenues and market power. As we will see in this article, The Hershey Company is all of these things as I mentioned in my previous coverage.

Comment on Q1 2023

First, let's start with the income statement, so how much the company earned compared to Q1 2022.

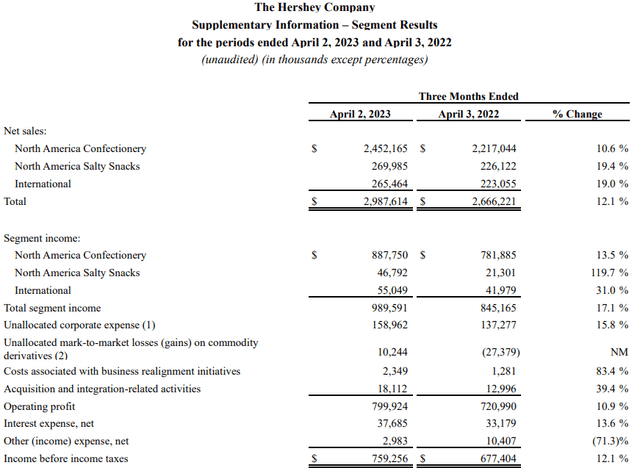

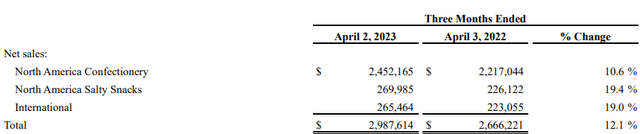

Total net sales increased by 12.10%, driven mainly by growth in the North America Salty Snacks segment and the International segment; they grew by 19.40% and 19% respectively. Overall, net sales in Q1 2023 amounted to $2.98 billion while in Q1 2022 they amounted to $2.66 billion. Now let's look in detail at the performance of individual segments.

North America Confectionery [NAC]

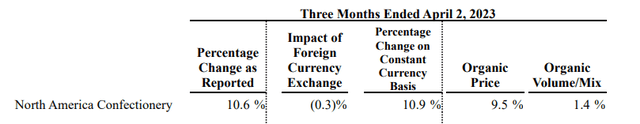

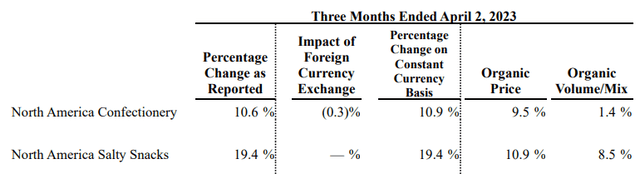

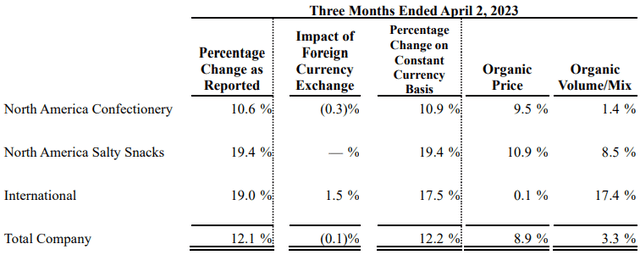

The NAC segment is by far the most important as 82% of total net sales depend on it. It grew overall by 10.60% or 10.90% CC basis. This growth was mainly achieved through price increases (9.50%) but this still did not prevent sales volumes from growing by 1.40%. Shrinkflation also had an impact here.

According to Michele Buck [CEO], the price elasticity of this segment responded well, especially during the holidays of this quarter.

Seasons continued to be a growth driver with category sales for Valentine’s Day up double digits versus the prior year, and despite the shorter Easter season, category sales grew mid-single digits. While consumers are shopping on tighter budgets, candy and snacks remain an affordable way to bring joy to seasonal celebrations with loved ones.

In short, it is true that inflation reduces a family's purchasing power, but on products such as candy and snacks an exception is often made, and that is Hershey's strength. For consumers, it makes little difference if a snack costs a few cents more; for the company, however, it makes a big difference.

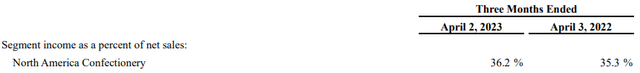

As for the margins in this segment, there is positive news.

A slight improvement, but worth a lot as it shows that the company's profitability is not affected too much by the economic environment, despite the fact that the company has repeatedly referred to the rising cost of key raw materials such as cocoa and sugar. Here are Steve Voskuil's [CFO] words on the matter:

Our goal is to always have a mix of volume and price, that’s part of the balance in our growth formula, and as part of that, we also want to see margin accretion over time from both sources. Confection margins have been strong, but even in the future, across all levers of pricing, including price pack architecture and mix, and other things, we want to continue to put upward pressure on our margins, because that’s part of our growth formula.

Margin growth will probably not stop there, as management believes it can do better. In my opinion it will be very difficult to do so; after all, Hershey's net income is more like a tech company than a consumer staple. Suffice it to say that this quarter it was 19.70%, last year it was 20%. That is why this company is so expensive.

North America Salty Snacks (NASS)

The weight of the NASS segment in total net sales is only 9%, and it was the segment with the highest growth; 19.40%, of which 10.90% was due to price increase and 8.50% due to sales volume increase. The reasons behind this strong growth were mainly two:

- New distribution opportunities for the Dot's brand were exploited. It was previously underdeveloped in Walmart stores and in the Northeast.

- Shelf optimization, Dot's brand advertising to increase awareness and penetration in households, and finally focus on price pack architecture.

According to the CEO, the NASS segment will continue to grow, but no longer at 20%. It is expected to grow at about 15% per year in the coming years.

In this area too, margins have improved from last year.

International

Slightly less important than the NASS segment, the International segment achieved very similar net sales growth, 19%. However, there is one important aspect that differentiates the two growths.

The positive impact of the exchange rate and especially the organic volume growth, 17.40%, weighed in this 19%. Organic price growth was practically not there. But how come?

The answer lies in the different strategy that management is pursuing in this segment. Whereas in the first two growth is driven by both price and volume, international sales first need to have a substantial increase in volume, and only then there will be a price increase. In essence, this is the classic price leadership strategy: enter new markets, gain new trusted customers, and only then begin to increase prices.

In fact, volumes have increased a lot compared to Q1 2022, and the CFO stated that in the next 3 quarters an organic price increase is expected.

Here again, segment income as a percentage of net sales is up compared to Q1 2022.

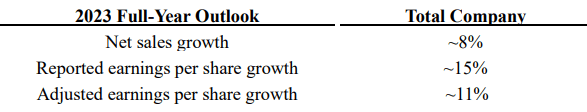

Finally, to conclude this article, here is the company's guidance for FY2023.

The Hershey Company Q1 2023

Net sales up 8% and EPS up double digits. So, according to the company's expectations, Hershey's golden period will continue throughout FY2023.

With such EPS growth in this economic environment, it is not surprising that the momentum of this company will continue.

Final Thoughts

The Hershey Company has once again beat estimates, and what the market likes the most is that it is likely to continue to surprise. The guidance alludes to a successful year, which can obviously be risky if expectations are not met. After all, we are still at the beginning of this year and anything can change, but the company is fully aware of this and the CFO's words prove it:

I think the biggest factor is it is still early in the year, so have a lot to play out. We’re certainly taking stock of the upside that we saw in the first quarter, but we’re still being cautious, also, on what is to come. The world’s changed a lot over these quarters and still a lot of volatility potentially ahead, and so we’re factoring that in. Then, also, as we go forward, particularly in Q4, the laps get tougher, and so that’s the other factor weighing in the guidance.

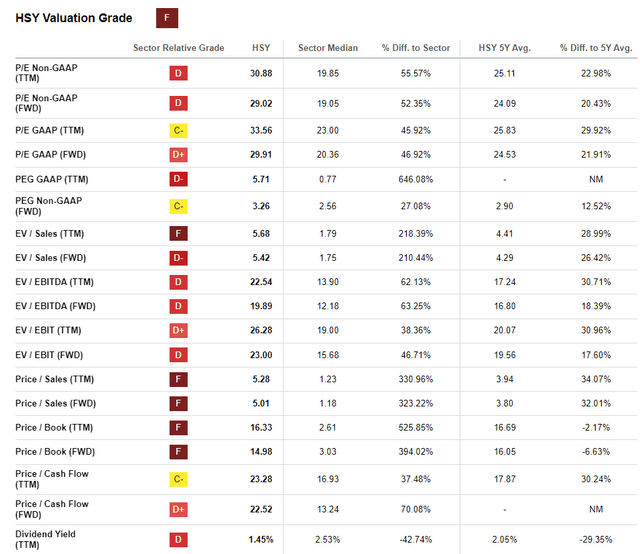

Personally, I value this company and would like to start buying it, but at the moment I prefer to wait.

Valuation multiples are still too high, both comparing them to competitors and to their historical average. I prefer to wait for a slight drop first.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Not a financial advice, just my opinion.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.