The Federal Reserve Continues To Put Inflation First

Summary

- The Federal Reserve voted today to raise its benchmark rate 25 basis points to 5-5.25%, a move it has been telegraphing for months.

- Fed Fund futures, which are trader projections of future Fed funds rate, have continued to fall away from the Fed's projections.

- The inflation fight remains the priority, making the new few inflation reports and the June Fed meeting critical.

DNY59

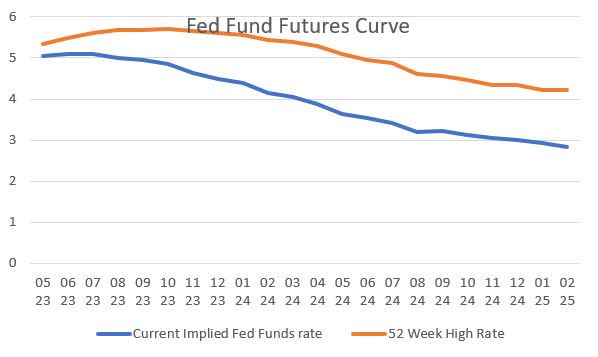

The Federal Reserve decided earlier today to raise their benchmark Fed funds rate by 25 basis points to a range of 5.00 to 5.25%. While many believe the Fed is done with further rate hikes after this meeting, it's important to note that the Fed mentioned its desire to attain 2% inflation multiple times in today’s statement. I believe the Fed is prioritizing price stability over regional banking concerns and that further rate hikes are not off the table.

Federal Reserve

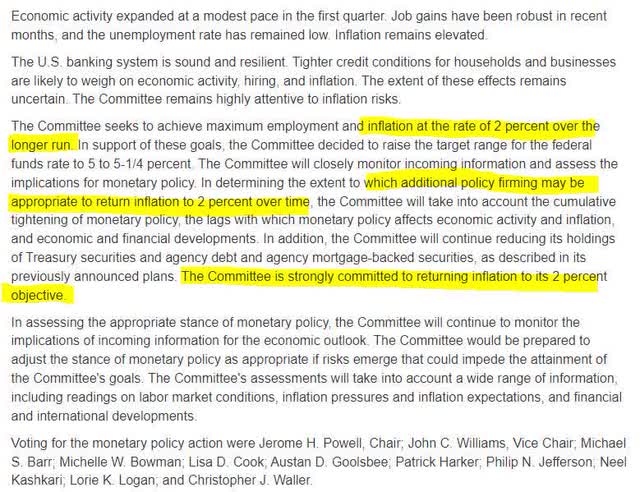

The market continues to be overly optimistic that the Fed will be easing or cutting rates in the near future. Even in the course of trading today, Fed fund futures for late 2023 through mid-2024 moved notably lower while late 2024 rate projections eased modestly. Fed fund futures for the fourth quarter of 2024 moved almost 25 basis points lower today, implying the market believes an additional cut will occur over the next 20 months, with a total of 200 basis points in rate reductions between now and the end of next year.

Barchart

Barchart Yesterday vs Today

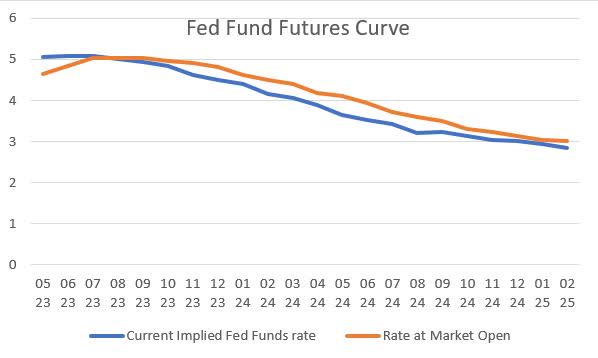

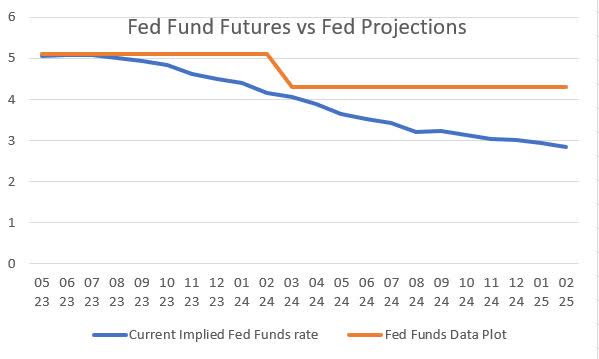

Fed fund futures for late 2024 are now 125 basis points lower than the projections provided by the Federal Reserve in March. The same differential exists when examining the Fed fund futures curve against its 52-week high. When examining December 2023 and December 2024 Fed fund futures history, the cause becomes abundantly clear. The failure of Silicon Valley Bank and Signature Bank created a dovish sentiment among traders that remains 100 to 125 basis points lower now than before the crisis.

Barchart and Federal Reserve Projections

Barchart

Barchart

Barchart

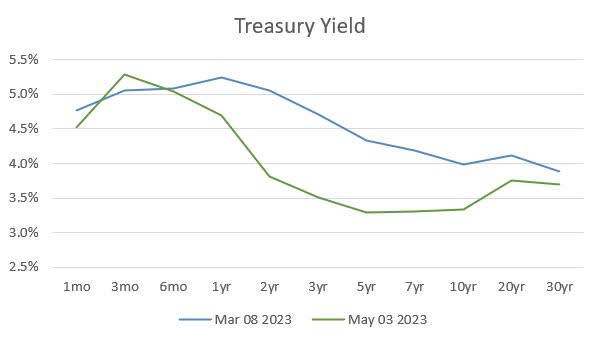

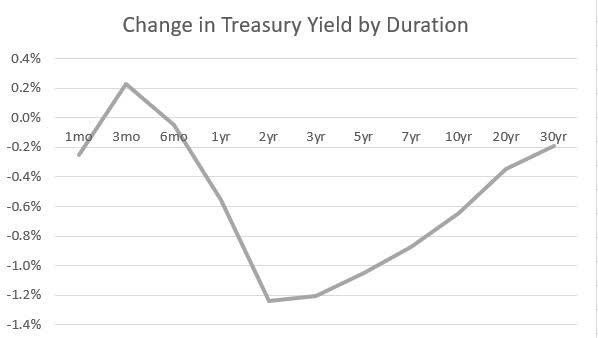

The Treasury markets are in lockstep with Fed fund futures. The Treasury yield curve inversion has continued its dramatic downward steepening since March 8, with the two and three-year Treasuries falling more than 120 basis points while three-month yields have risen. The market has priced in cuts so clearly that I’m concerned we may see interest rate and stock market volatility if the Fed maintains a pause on rates over the next six months.

Federal Reserve

Federal Reserve

Since the next Fed meeting is right around the corner (June 14), I don’t see enough changing for the Fed to do anything different from what they've projected (a rate pause), but that meeting will be paramount considering new economic and rate projections will be released. Additionally, there will be a few inflation reports between now and the July meeting that will be paramount to where Fed policy will go.

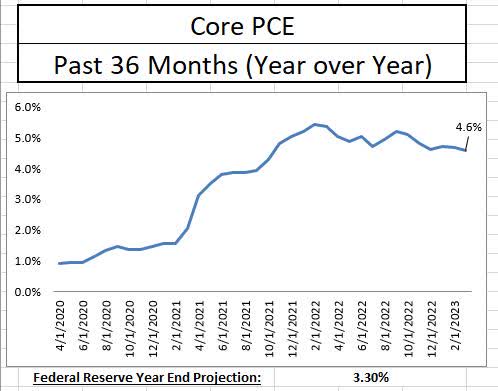

Everyone agrees that inflation has moved away from its peak, but opinions are mixed regarding whether it has moderated enough. The data suggests we have a long way to go. For example, core PCE, which is the Fed’s current preferred measure of inflation, is at 4.6%. While that level is down from the peak of 5.4% in February of 2022, it is a far cry from the 3.3% projection made by the Fed for 2023 or the 2% long-term goal.

Federal Reserve

While I believe the economy is headed toward recession, the Fed cannot throw in the towel and give up on price stability before the mission is completed. Abandoning the fight against inflation now would create a set of conditions far more painful than our current situation and require even higher interest rates to alleviate.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.