If History Is Any Guide - These Are Your Dos And Don'ts

Summary

- "Sell in May and Go Away"? Not so quickly, although the next few months, during a pre-election year, don't look too promising.

- Looking at the S&P 500 - neither valuation measures nor YTD performance + drawdown look tempting.

- While growth and large-cap stocks are the least attractive bonds and non-U.S. stocks are the most attractive asset classes.

- Looking for a helping hand in the market? Members of Macro Trading Factory get exclusive ideas and guidance to navigate any climate. Learn More »

natasaadzic

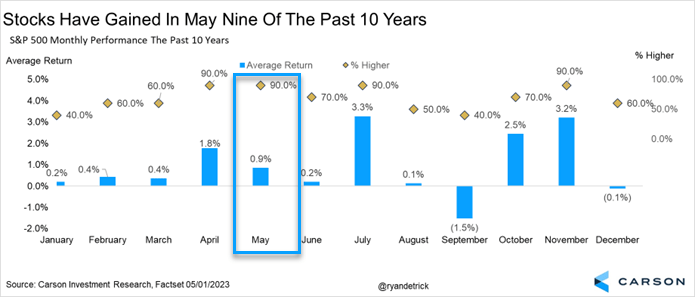

"Sell in May and Go Away"? Not so quickly.

The good news: Over the past decade, the S&P 500 (SP500) closed higher in 90% of Mays.

The bad news: The single negative May happened in 2019 - a pre-election year just like the one we're currently at - and it was a rough one (-6%).

Carson

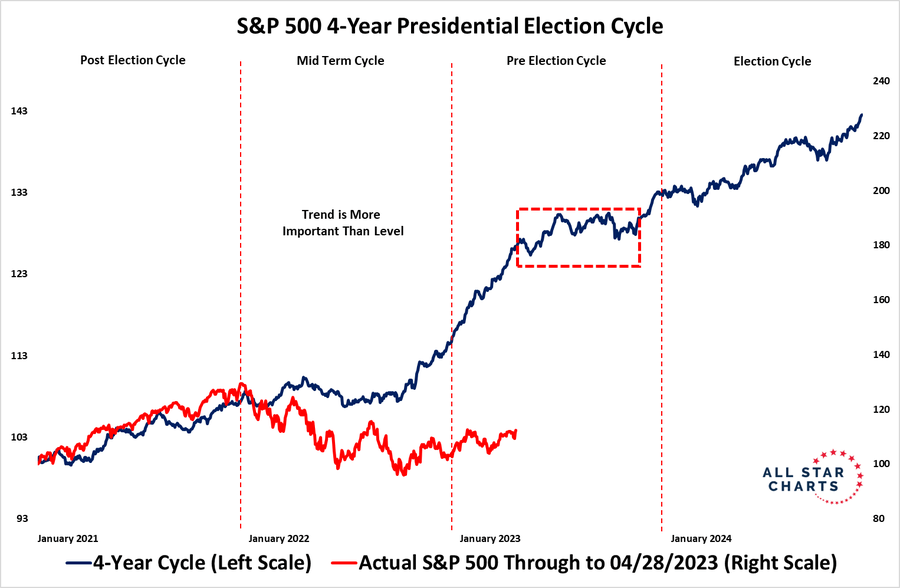

The neutral news: mid-year of a pre-election cycle usually treads water.

All Star Charts

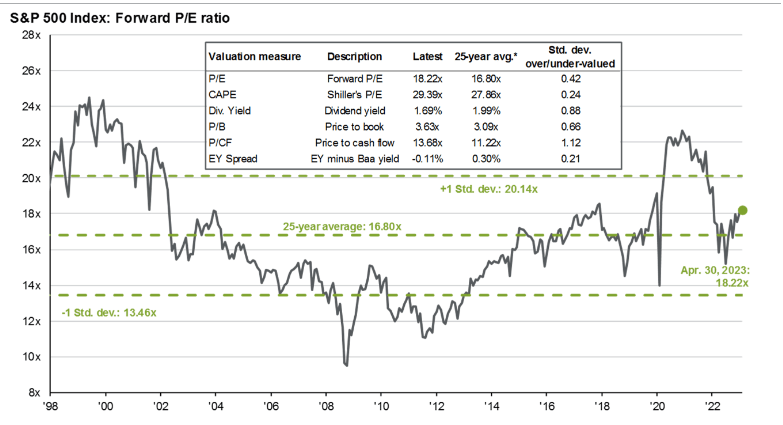

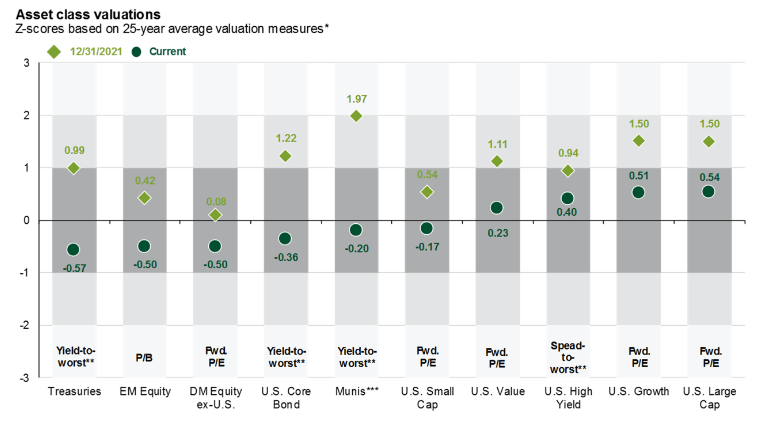

As of April 30, S&P 500 valuation measures suggest that while stocks aren't as expensive as they were in 2021 (or 1998-2000 for that matter) - this isn't a cheap market.

Each and every valuation measure is currently worse than its average over the past 25 years.

JPM

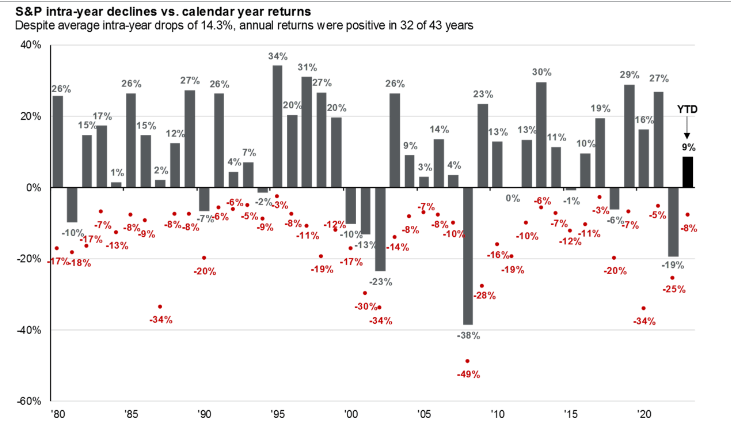

S&P 500 YTD return is already (about) in-line with the long-term average performance. However, the index's YTD drawdown is significantly smaller than the historical norm.

JPM

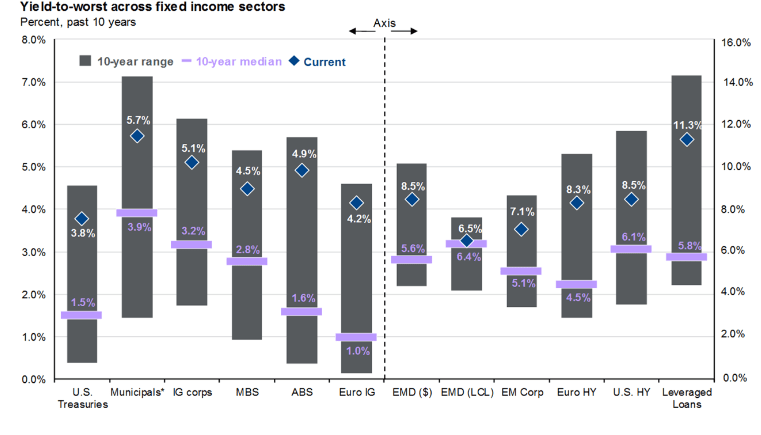

Yields, on the other hand, are looking attractive across the board.

JPM

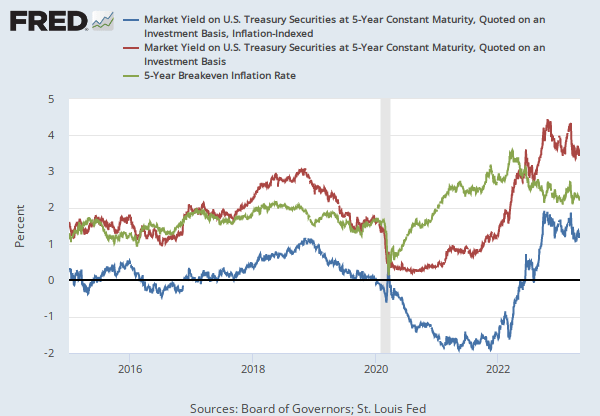

With inflation expectations (as at May 1, 2023) pointing to a breakeven rate of 2.24%, real yields are quite high on both absolute and (surely) relative basis.

Fred

Furthermore, the iShares Core U.S. Aggregate Bond ETF (AGG) - a good indication for bonds - has already suffered (more than) the average drawdown this year.

JPM

Based on Z-scores over the past 25 years, the most attractive assets can be found on the left (U.S. debt and non-U.S. equity) and the least attractive assets can be found on the right (U.S. growth and large cap stocks).

JPM

Macro Trading Factory is a macro-driven service, led by The Macro Teller and RoseNose.

The service offers two portfolios: “Funds Macro Portfolio” and “Rose's Income Garden”; both aim to outperform the SPY on a risk-adjusted basis, in a relaxed manner.

Suitable for those who either have little time/knowledge/desire to manage a portfolio on their own, and/or wish to get exposed to the market in a simple, though more risk-oriented (i.e. less volatile), way.

Each of our portfolios, spanning across all sectors, offers you a hassle-free, easy to understand and execute, solution.

It's Mandatory.

Macro Trading Factory

For an Upward Trajectory!

This article was written by

Welcome to my profile and thanks for stopping by!

First and foremost, let's clarify two important points that you might currently find confusing:

1. "Macro Trading Factory" ("MTF") by "The Macro Teller" ("TMT") is the second service we offer after the "Wheel of FORTUNE" ("WoF") by "The Fortune Teller" ("TFT").

2. TFT and TMT are the same person. It's due to SA policy that we need to open two profiles in order to run two services, but rest assured we don't suffer from schizophrenia (as of yet)...

TMT is an account that represents a business which is mostly focuses on portfolio- and asset- management. The business is run by two principals that (among the two of them) hold BAs in Accounting & Economics, and Computer Sciences, as well as MBAs. One of the two is also a licensed CPA (although many years have gone by since he was practicing), and has/had been a licensed investment adviser in various countries, including the US (Series 7 & 66).

On a combined basis, the two principals lived and worked for at least three years in three other-different countries/continents, holding senior-managerial positions across various industries/activities:

On one hand/principal, IT, R&D, Cloud, AI/ML, Security/Fraud, Scalability, Enterprise Software, Agile Methodologies, and Mobile Applications.

On the other hand/principal, Accounting, Banking, Wealth Management, Portfolio Management and Fund Management.

Currently, they run a business which is mainly focusing on active portfolio/fund/asset management as well as providing consulting/advisory services. The business, co-founded in 2011, is also occasionally getting involved in real estate and early-stage (start-up) investments.

The people who work in and for this business are an integral and essential part of the services that we offer on SA Marketplace platform: Wheel of Fortune, and Market Trading Factory. While TMT (or TFT for that matter) is the single "face" behind these services, it's important for readers/subscribers to know that what they get is not a "one-man-show" rather the end-result of an ongoing, relentless, team effort.

We strongly believe that successful investors must have/perform Discipline, Patience, and Consistency (or "DCP"). We adhere to those rigorously.

The contributor RoseNose is both a contributing and promoting author for Macro Trading Factory.

On a more personal note...

We're advising and consulting to private individuals, mostly (U)HNWI that we had been serving through many years of working within the private banking, wealth management and asset management arenas. This activity focuses on the long run and it's mostly based on a Buy & Hold strategy.

Risk management is part of our DNA and while we normally take LONG-naked positions, we play defense too, by occasionally hedging our positions, in order to protect the downside.

We cover all asset-classes by mostly focusing on cash cows and high dividend paying "machines" that may generate high (total) returns: Interest-sensitive, income-generating, instruments, e.g. Bonds, REITs, BDCs, Preferred Shares, MLPs, etc. combined with a variety of high-risk, growth and value stocks.

We believe in, and invest for, the long run but we're very minded of the short run too. While it's possible to make a massive-quick "kill", here and there, good things usually come in small packages (and over time); so do returns. Therefore, we (hope but) don't expect our investments to double in value over a short period of time. We do, however, aim at outperforming the S&P 500, on a risk adjusted basis, and to deliver positive returns on an absolute basis, i.e. regardless of markets' returns and directions.

Note: "Aim" doesn't equate guarantee!!! We can't, and never will, promise a positive return!!! Everything that we do is on a "best effort" basis, without any assurance that the actual results would meet our good intentions.

Timing is Everything! While investors can't time the market, we believe that this applies only to the long term. In the short-term (a couple of months) one can and should pick the right moment and the right entry point, based on his subjective-personal preferences, risk aversion and goals. Long-term, strategy/macro, investment decisions can't be timed while short-term, implementation/micro, investment decision, can!

When it comes to investments and trading we believe that the most important virtues are healthy common sense, general wisdom, sufficient research, vast experience, strive for excellence, ongoing willingness to learn, minimum ego, maximum patience, ability to withstand (enormous) pressure/s, strict discipline and a lot of luck!...

Analyst’s Disclosure: I/we have a beneficial long position in the shares of FUNDS MACRO PORTFOLIO ("FMP") either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.