AMLP: Declining Oil And Gas Demand, Production May Soon Hamper Dividends

Summary

- As anticipated, the past year has been markedly stable for oil and gas infrastructure companies as fuel commodities remain at profitable prices.

- The sharp rise in risk-free interest rates increases the "fair value" dividend rate for riskier investments such as energy infrastructure MLPs.

- The popular infrastructure ETF AMLP could face some difficulties this year as the oil and gas rig counts decline in response to oil and gas prices falling below breakeven levels.

- A recessionary decline in crude oil demand could exacerbate strains, although I expect this to be met with an overreaction through reduced oil drilling activity.

- For now, I believe AMLP is best avoided and is likelier to decline. However, it still may be a superior long-term high-dividend investment due to its physical asset ownership (inflation hedge).

pandemin

Last year, I published "AMLP: Midstream Energy Finally Reaches Stability," which detailed my bullish outlook on the midstream energy sector through the Alerian MLP ETF (NYSEARCA:AMLP). At that time, AMLP appeared to pay a very high yield compared to the reduced risk exposure facing the fund's holdings. As expected, AMLP has maintained a stable price over the past year while paying a higher 8% yield. AMLP has held a historically tight trading range of $36-$42 and has not continued to slide in value as it had throughout the 2010s.

Of course, oil prices have declined a bit since then and fluctuated below the "breakeven" level that is highly relevant for midstream fundamentals. Further, the sharp rise in both long-term and short-term interest rates could weigh on the profitability of some of AMLP's holdings and reduce its fair value. With this in mind, I believe it is a proper time to take another close look at AMLP to judge better its risk and reward potential over the coming year.

Shifting Oil and Gas Market Dynamics in 2023

The energy infrastructure companies in AMLP have limited direct exposure to crude oil or natural gas prices. Most companies in the fund are involved in fossil fuel transportation; thus, they require these products' total supply and demand to be relatively constant. Throughout the 2010s, most of these companies struggled as soaring oil and gas production in the US caused significant infrastructure overdevelopment, leading to declining fee rates and volatility in their sales. However, since 2020, the market has become far more stable as the oil and gas industry (from upstream to downstream) shifts away from "growth" toward stability, with a greater emphasis on free cash flows.

The steep losses in the 2010s caused AMLP's holdings to become recognized as "high-risk assets" when in reality, they're generally relatively stable as long as oil production levels are not too volatile. In my view, the fundamentals of the oil market today are not entirely stable due to various internal and geopolitical factors; however, with the "shale boom" ending, that primary source of volatility for midstream oil companies is significantly reduced. Of course, the potential for a recessionary decline in energy consumption could strain AMLP over the next year, mainly if oil prices fall below breakeven levels.

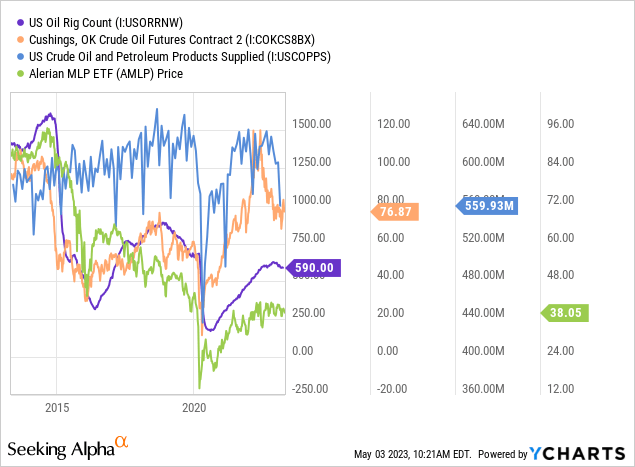

As detailed in my last article on AMLP, revenue and cash-flow levels for energy infrastructure companies should be stable as long as oil and natural gas are above the breakeven levels for newly drilled wells. That figure is around $70/barrel for crude and $3/MMBTU for natural gas, although it is rising due to skilled labor and parts shortages, regulations, depleting reserves, and other factors. When prices fall below that level, we can expect the rig count to decline, hampering the fee revenues for some of AMLP's holdings. This is a potential risk today. See below:

AMLP has a relatively high correlation between the crude oil rig count and the "products supplied" figure, representing oil consumption levels. If the rig count and/or consumption level declines, then less oil will likely flow through the energy transportation industry compared to its capacity, impairing fees and volumes. As crude falls toward that $70 level, the rig count declines slightly as producers reduce investments, negatively impacting future oil supplies and, therefore, midstream profitability. Combined with the negative move in "products supplied" due to slowing fuel demand, many oil energy infrastructure firms could take a hit over the coming months.

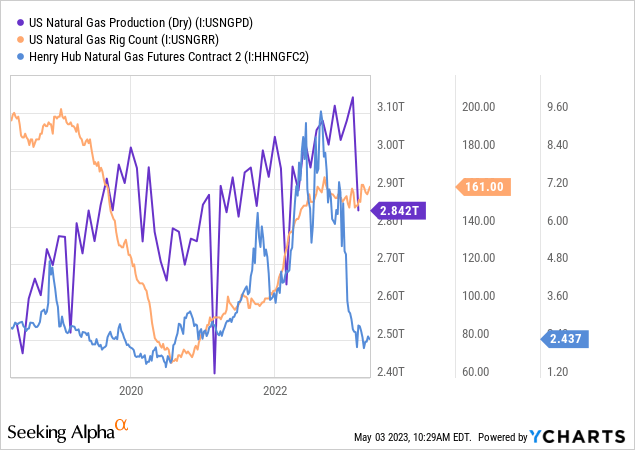

The situation facing natural gas is similar but slightly more drastic. Natural gas is crucial for AMLP as around a third of its holdings are directly involved in gas pipelines or liquefication. The massive decline in natural gas prices over the past six months is likely to hamper natural gas drilling levels over the coming months. See below:

Most natural gas producers cannot profit at current prices unless they have significant hedged positions from last year. Since many do, and the expectation of higher European LNG natural gas demand, the natural gas rig count and production level have remained high despite low prices. Considering the enormous natural gas storage shock over winter (due to warm weather) and Europe's largely successful efforts to find other natural gas sources, I believe natural gas has few shortage catalysts today. Eventually, reducing production levels could push the market back toward normalization, creating a bullish opportunity in natural gas. Still, AMLP's constituents may struggle for some time as production levels must falter first.

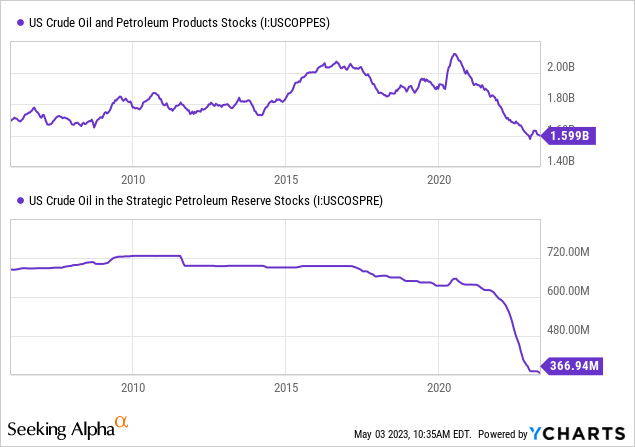

Unfortunately, the outlook for the fossil fuels industry in 2023 is not very bullish for AMLP compared to my perspective last year. Fundamentally, demand levels have fallen slightly while global supplies have grown, pushing prices lower, likely negatively impacting driller investment levels. The situation facing natural gas midstream companies is probably more critical for AMLP because gas prices are so low that there could be a more rapid race away from drilling activity. The falling economic outlook is negatively impacting crude oil. Still, the end of the SPR release and the low oil storage inventory level could easily cause its price to rebound after the market rebalances. See storage levels below:

Unlike natural gas, domestic crude oil production never returned to pre-COVID levels. When demand was too far above supply last year, the Biden administration oversaw a mass release of oil from the Strategic Petroleum Reserve that greatly aided domestic supplies and lowered prices by artificially fixing the supply-demand gap. This also benefited AMLP by maintaining a more constant supply level. However, the SPR release has since ended, leaving total oil inventories at much lower levels and the SPR essentially drained. The end of the SPR release early this year has been met with a recessionary decline in crude oil consumption; thus, no shortage has formed despite the decrease in supplies.

I expect that situation to remain the same as oil demand continues to sour. Eventually, as production levels decline and OPEC pursues its cuts in response to near-breakeven prices, we could see the oil market quickly shift back toward a shortage. Problematically, a return of the oil shortage could cause energy prices to soar due to the severely low oil storage inventories today. At this point, the SPR lacks sufficient capacity to release oil in such a scenario as doing so would leave the US with no emergency supplies. With this in mind, I believe crude oil is more likely to rise in value over the coming year, even if a recession continues to hamper demand levels. That said, falling production is not bullish for AMLP as the total volume of crude flowing through the transportation sector seems likely to decline over the coming months.

What is AMLP Worth Today?

Last year, I had a positive outlook on AMLP due to the improved stability of energy supply, demand, and pricing and the fund's elevated yield compared to its reduced risk profile. Today, my outlook on AMLP is slightly bearish from a short-term perspective because oil and natural gas prices are too low to sustain today's production levels. Further, slowing economic activity worldwide appears to hamper the oil demand outlook, potentially straining the situation. Although low oil inventories and overreaction in oil and gas producers could cause prices to rebound much higher eventually, I believe most energy infrastructure firms in AMLP will see a slightly negative shift in volumes and fee levels throughout 2023.

AMLP's dividend of 8% of relatively attractive today, but it is not as alluring since interest rates are much higher. The "risk-free" return rate on T-Bills is around 5% today, making AMLP's yield premium much lower than last year. Of course, AMLP's dividend has superior inflation sensitivity since fees should rise with inflation (in the long run), so its yield premium may be better compared to real interest rates, which are closer to 1-1.5% today. Still, most companies in AMLP operate at a financial debt-to-assets of around 50%, so their distributable cash flows could fall as long as interest rates rise. As these firms refinance debt, they're likely paying much higher costs, particularly given the recent tightening of bank lending standards and bank avoidance of "fossil-fuel financing."

Considering these factors, I believe AMLP could decline in value over the coming months. For now, I would not be bullish on the fund until its yield is closer to the 10-12% level, requiring a 20-33% reduction in its price to the $25 - $30.5 range. In my view, that yield would better offset the risks of a decline in its dividend associated with falling fuel supply volumes, potentially lower fees, and higher interest rates. While that may seem like a significant decline, the low-end of my range outlook is still considerably above AMLP's lows in 2020 of $15-$20. Of course, I am not so bearish on AMLP ETF that it appears to be a short opportunity. In the long run, I still believe AMLP is preferable to most other high-dividend assets as AMLP's ultimately a strong inflation hedge due to its considerable physical asset exposure.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.