Pembina Preferred Shares Remain Undervalued With 8% Plus Yields

Summary

- We have covered the Pembina Preferred Share Yields previously.

- On our last take, we looked at how the upcoming calls would be handled based on prevailing interest rates.

- We examine the setups today and tell you why the preferred shares about to reset are very cheap.

- Conservative Income Portfolio members get exclusive access to our real-world portfolio. See all our investments here »

Don White/iStock via Getty Images

All amounts discussed are in Canadian Dollars and all preferred share prices are referenced on the TSX.

On our last coverage of Pembina Pipeline Corporation (NYSE:PBA) we recognized that the common shares were beaten down enough and upgraded them to a Buy. But the focus of our work was on the announced redemption of the Series 23 ("Series 23 Shares") shares and opportunities that existed in the PBA preferred line-up. We follow up on that area and look at the current offerings and upcoming reset dates to tell you our picks.

PBA From A Credit Perspective

PBA has a BBB:High Rating from DBRS and a BBB rating for S&P. While those ratings are excellent by themselves, there is more to the PBA story. That extra comes from the most disciplined approach amongst the Canadian pipeline industry. We saw that during the last two years as PBA lived within its cash flow. In fact total cash flow was a positive $1 million over 2021 and 2022. So cash provided from operations funded the dividends and the capex. That discipline remains unmatched in this sphere. At present trends, PBA's debt to EBITDA will be down to 3.3X at year end 2023. So while the ratings are giving PBA due credit, we think they are actually underestimating what is happening here. One final point here for comparison is TC Energy Corporation (TRP) which was recently downgraded to BBB+ by Fitch. TRP is still rated at BBB+ by S&P, one notch higher than PBA, although with a negative outlook. TRP is running near 6.0X debt to EBITDA and over all expected timeframes will be over 5.5X on that metric. So our point here is that PBA has shown the discipline and capital allocation to be rated at least to BBB+, and perhaps A- over the next few years.

PBA Preferreds

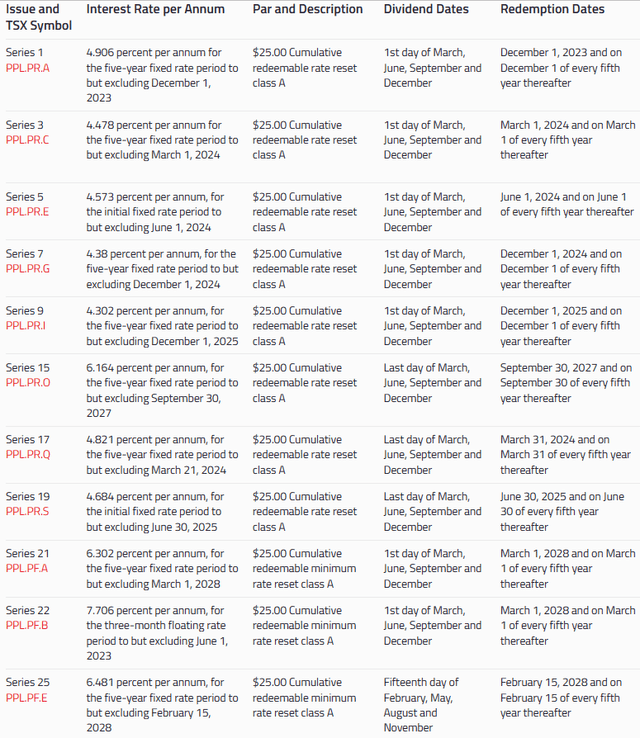

PBA has a wide swath of preferred shares and covering each one in detail is beyond the scope of this article.

PBA Website

What we will do though, is look at them in two major sets and then tell you which ones we like at present. These two sets can broadly be shown as the fixed resets and fixed resets with a floor yield. The fixed resets are the ones circled below.

PBA Website

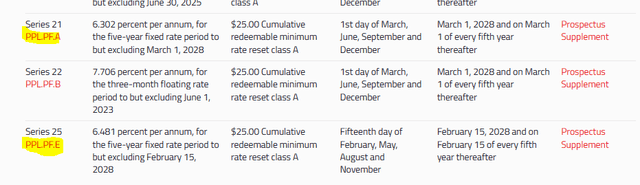

The fixed resets with a floor yield are highlighted next.

PBA Website

Let's talk about these two first.

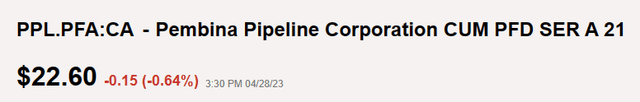

They were both reset recently and offer investors the certainty of fixed income over the next 5 years. The Series 21 (TSX:PPL.PFA:CA) trades at $22.60 and yields 6.302% on par. This works out to a 6.97% yield on current price till March 2028.

Seeking Alpha

After that the reset will be at Government of Canada (GOC) 5 year bond yield plus 3.26%, with a minimum yield of 4.90%. Since you are buying below par, your minimum yield is 5.4%. While that is not the most amazing yield, it offers a reasonably good set of outcomes over the next decade.

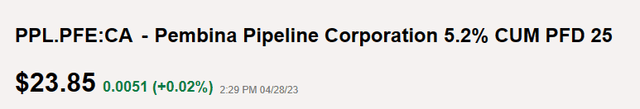

The Series 25 (TSX:PPL.PFE:CA) yield 6.481% on par and run a tad more expensive. They yield 6.79% currently.

Seeking Alpha

After that the reset will be at GOC 5 year bond yield plus 3.65%, with a minimum of 5.25%. This is the reason they trade more expensive as you get a wider reset spread and higher floor. Both are very safe choices for inflationary and deflationary environments.

The Plays We Like

While those are defensive options, the preferred shares without a floor yield look incredibly cheap in comparison.

The Series 1 (TSX:PPL.PRA:CA) come up for reset soon and currently yield 7.15% (price at $17.20). The reset in December 2023 will be at GOC 5 year bond yield plus 2.47%. With the GOC 5 year current yield of 3.09% this works out to a 5.56% yield on par or 8.08% yield on current price. That would be locked for 5 years.

Similarly the Series 3 (TSX:PPL.PRC:CA) yields 6.7% currently and the reset is in March 2024 at GOC 5 year bond yield plus 2.60%. If bond yields stay static, the reset would give you 8.55% at the current price.

Ok, so we won't run through this exercise with all the remaining. The key points here are that you are being paid a lot higher rate if you choose to forego the floor rate. You are being paid for the uncertainty of what happens between now and the reset. One intriguing aspect here is that the Bank Of Canada's policy rate is at 4.5%. So the GOC 5 year bond yield at 3.09% already prices in some good interest rate cuts. So if inflation stays stubborn and Bank Of Canada stays moderately firm, there is upside to the GOC 5 year yield and these resets.

Conclusion

At the heart of the matter is that these yields represent a very low risk play to get more money than GICs in Canada. They also yield a lot more than 5-10 year investment grade bonds in Canada which average around 4.75%. PBA's bonds also yield 4.67% for 7 years out.

CIBC May 1, 2023

The preferred shares also carry a dividend tax credit which makes their after tax yield far juicer. So the current spread makes these quite desirable for Canadian investors, especially in non-tax deferred accounts. One final way to look at these is to compare the reset yields to what was originally setup. The Series 1 will set reset to about 8.08%. This one was setup with a GOC 5 year plus 2.47%. Yet it is going to generate (assuming yields stay static), GOC 5 year yield plus 4.99% (difference between 8.08% and the current 3.09% GOC 5 year yield). That is a phenomenal spread for a company that has actually become stronger in the last decade and shown resilience and discipline. We own some of these and will be adding more over time.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Are you looking for Real Yields which reduce portfolio volatility? Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.

Give us a try and as a bonus check out our Fixed Income Portfolios.

Explore our method & why options may be right for your retirement goals.

This article was written by

Conservative Income Portfolio is designed for investors who want reliable income with the lowest volatility.

High Valuations have distorted the investing landscape and investors are poised for exceptionally low forward returns. Using cash secured puts and covered calls to harvest income off value income stocks is the best way forward. We "lock-in" high yields when volatility is high and capture multiple years of dividends in advance to reach the goal of producing 7-9% yields with the lowest volatility.

Preferred Stock Trader is Comanager of Conservative Income Portfolio and shares research and resources with author. He manages our fixed income side looking for opportunistic investments with 12% plus potential returns.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

We are long multiple PBA and TRP preferreds. We are TRP with covered calls.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.