POTX: The Weed Barge Is Sinking, So Consider Abandoning Ship

Summary

- POTX invests mainly in healthcare and real estate institutions that are focused on cannabis.

- The demand for and spending towards cannabis is increasing, but many dispensaries and cannabis-focused institutions are still struggling to pull in sufficient cash.

- Relevant companies’ profits are impeded by their inaccessibility to traditional banking services, strict governmental regulation, and social stigma around marijuana products.

- I rate POTX a Sell, as the cannabis industry is likely to struggle in the coming periods, amid high interest rates and other business-related hurdles.

Morsa Images

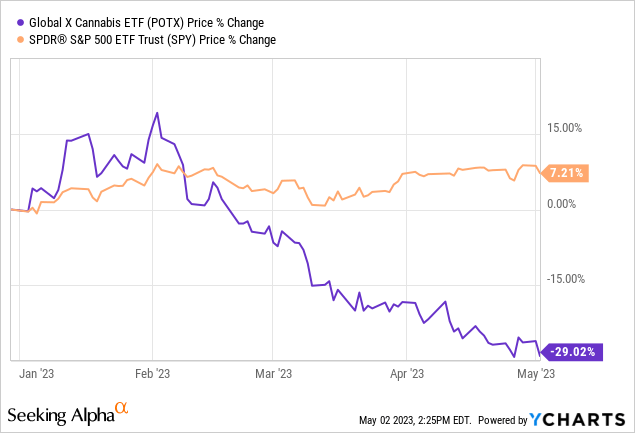

Demand for cannabis is likely to increase for time to come, but that doesn’t indicate smooth sailing for the cannabis market. In fact, I think this marijuana ship is actually quite far from smooth sailing and much closer to submerging. From their limited access to traditional banking services to the stigma surrounding marijuana legalization and everyday use, the cannabis industry faces many barriers to profitability. This especially appears as the case when looking at the lackluster performance of the Global X Cannabis ETF (NASDAQ:POTX). Therefore, I rate POTX a Sell.

This ETF’s price has declined without respite for over two years at this point, and various regulatory measures targeting cannabis companies and products is unlikely to improve this situation. For example, cannabis companies are often subject to over-taxation, fierce competition, and supply chain issues. Supply chain issues in particular often revolve around material shortages, poor planning, and outdated inventory management.

POTX is a prominent example of the fact that increasing revenue within an industry does not necessarily mean greater returns for investors. That being said, I believe cannabis businesses could struggle significantly as they fall victim to rate hikes and strict regulatory scrutiny. Furthermore, POTX’s top heaviness and general exposure to unprofitable companies is likely to weigh it down in the future. This may even test the patience of those who are highly-bullish towards the cannabis market.

Strategy

This ETF tracks the Cannabis NR USD Index and uses a representative sampling technique. This index contains solely cannabis companies, whose eligibility is determined by how much cash they derive from the cannabis market. In specific, such companies must generate at least half of their revenue, operating income, or assets from the cannabis industry. This industry includes but is not limited to companies involved in the legal production, growth, and distribution of marijuana or hemp, as well as pharmaceutical companies and financial services dedicated specifically to cannabis.

Companies in the designated index are required to have a market capitalization of at least $100mm, as well as a minimum average daily turnover for the last three and/or six months of at least $2mm.

Holdings Analysis

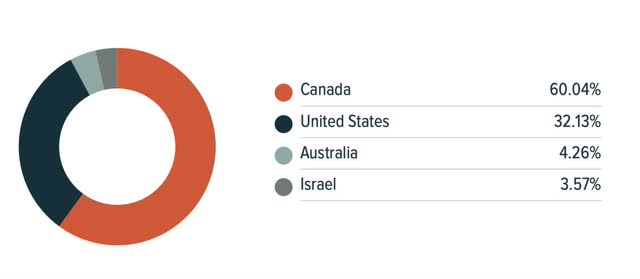

POTX holds stocks located primarily within Canada, while sparing just over a third of geographical allocation to the United States, Australia, and Israel.

This ETF contains securities primarily within the field of healthcare, with roughly a third of holdings identifying as companies focused on industrials or technology.

The top 10 holdings in this ETF account for 80% of the whole portfolio, which consists of just 17 stocks. Furthermore, the top three holdings come just short of taking up half of the entire fund. With this in mind, concentration risk is an outstanding issue for POTX.

Strengths

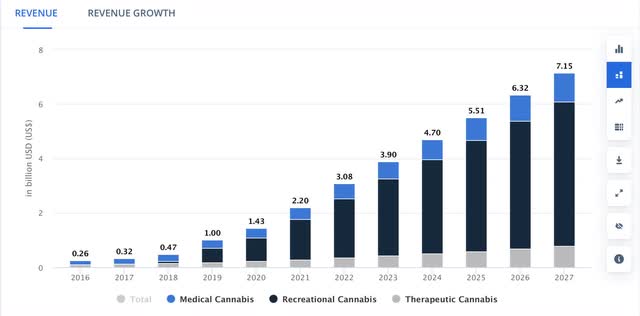

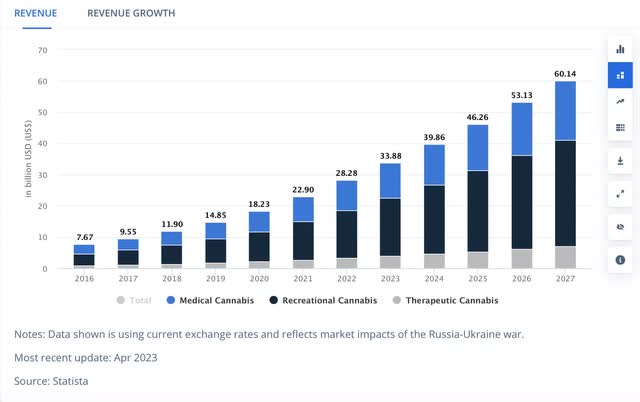

The global cannabis market is still very much in its infant stages, and this ETF could be well positioned for growth in the long term as demand for recreational marijuana rises. Below is the growth forecast for the cannabis market in Canada, being the most represented country in this ETF. Keep in mind, recreational marijuana has generally been legal in Canada for almost five years now, but this still might vary by province or territory.

Cannabis industry growth forecast (Canada) (Statista)

The cannabis market in the United States is similarly positioned for growth, as seen in the chart below. Despite being less represented in POTX, the United States marijuana market could reach heights much greater than that in Canada, hence why legalization in the United States has been such a salient topic this year. On this same note, industry expansion in the United States could potentially move POTX in the right direction with time.

Cannabis industry growth forecast (United States) (Statista)

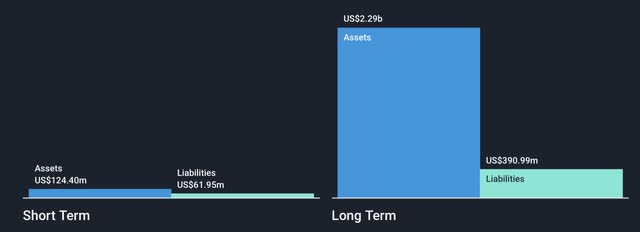

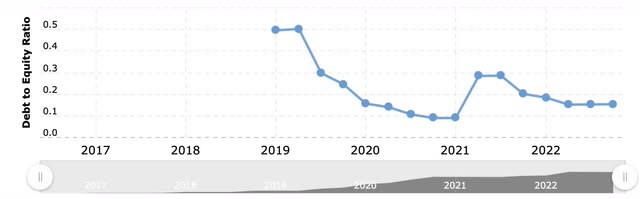

Innovative Industrial Properties (IIPR) as the top holding in POTX could also serve as a silver lining down the road as more cannabis-oriented businesses emerge and become in need of real estate. IIPR has a diverse tenant base which spans across the United States. While legalization progresses, IIPR could see an increase in potential tenants, which to this institution means more potentially profitable assets. As this REIT’s assets are already transcending its debt, I think IIPR could become quite profitable in the long term as the cannabis industry expands.

IIPR Financial Position Analysis (Simply Wall St.) Macrotrends

Weaknesses

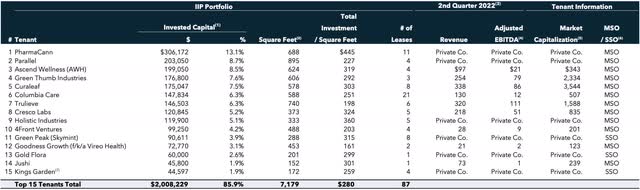

Concentration risk on multiple levels could bring this ETF down in the future, even if the future brings more demand for recreational marijuana. By “multiple levels”, I’m indicating that POTX is both highly-concentrated from its holdings, while IIPR simultaneously devotes a hefty 86% to just its top 15 tenants.

IIPR: November Investor Presentation (Innovative Industrial Properties)

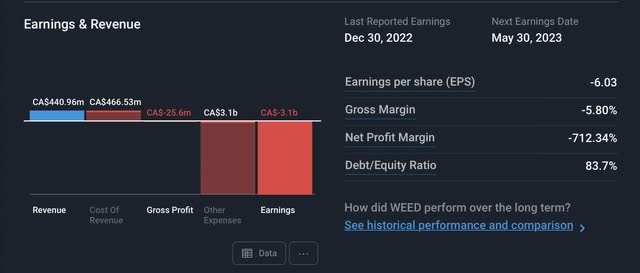

Furthermore, though IIPR may be relatively stable compared to Tilray Brands (TLRY) and Canopy Growth Corporation (WEED:CA), these two latter stocks could still seriously drag this ETF down in the future. Both of these companies have struggled to produce positive earnings within the past few months, which raises red flags, especially as the United States economy is likely due for more rate hikes in the future.

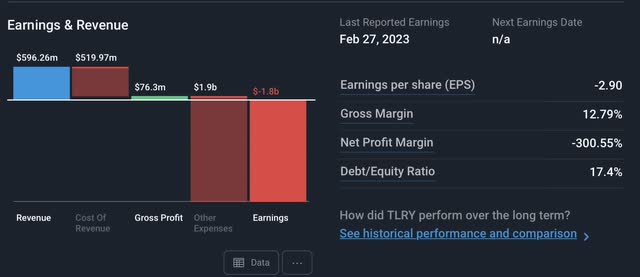

Below is the earnings and revenue statistics for TLRY.

TLRY Earnings & Revenue (Simply Wall St.)

Below is the earnings and revenue statistics for WEED.

As seen in the visuals above, these companies may have a limited ability to rake in cash, which is likely to hurt the returns of this ETF for time to come.

When covering ETFs, I don’t usually dive this deep into individual holdings, but POTX is so top-heavy that just a few specific holdings are ultimately responsible for moving the needle in this fund.

Opportunities

POTX’s identity as a small-cap fund tracking an emerging industry could make it quite attractive in the coming periods. Historically, small-cap assets have come to light amid market turnaround. Future economic downturn is likely in store for both the United States and Canada, however, I don’t believe small cap growth during an eventual market turnaround is necessarily beyond the current scope.

Ongoing legalization of marijuana in the United States could be a primary catalyst in reducing the stigma surrounding marijuana and also proliferating its acceptance by society and federal regulators. This could ultimately result in regulatory changes that could grant cannabis businesses access to traditional, better banking services. This could then provide them with profits sufficient enough to better compensate their investors. Attempts towards such changes have already taken place, such as the Secure and Fair Enforcement (SAFE) Banking Act in 2019. The objective of this bill was to protect certain banks that could work with cannabis companies, which would allow these companies to receive quality funding without putting said banks at risk of federal persecution. This bill was not passed, however, future developments in the recreational marijuana space could cause similar bills to emerge, only this time with more luck.

Threats

The tight federal regulation over the interstate trade of cannabis could threaten marijuana companies in the coming periods. Though legalization could increase demand within the specific states where the legalization is occurring, this demand could hit a wall if goods aren’t allowed to cross state borders. Evidently, until interstate sales are more widely permitted, the recreational marijuana market could be stuck with too much supply and not enough demand. This may be good for consumers, but it is just the opposite for companies. Therefore, this trend could keep POTX from gaining the right momentum down the road.

In general, several states’ thoughts on marijuana legalization are still somewhat mixed. Until this trend picks a more definite direction, I think cannabis institutions could struggle significantly in terms of gaining adequate support from congress as well as banks.

Conclusion

The cannabis industry is one which might still have yet to unleash its full potential and could become a profitable investment vehicle with time. However, the market for cannabis, especially the recreational kind, still faces many barriers to profitability. This is likely to hinder this ETF’s momentum in the future, which is why I believe POTX is not a worthy investment for the time being. Until marijuana businesses gain more support from government executives and the general population alike, it is hard to see this ETF going anywhere for a little while. On this note, POTX ETF is a Sell for now.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.