Debt Ceiling Risk: Getting Long UVXY Through Mid-June

Summary

- The Treasury yield curve suggests risks for a U.S. default jump in early June.

- Volatility has shown signs of life lately, and playing a renewed bout of risk through UVXY may be warranted.

- I outline a trade idea on this short-term volatility ETF, along with identifying important price levels.

wildpixel

We've gotten inklings of a return of volatility. On Tuesday, the CBOE Volatility Index (VIX) surged from under 16 to nearly 20. Settling higher by 1.7 percentage points on the day to 17.78 ahead of the Fed meeting.

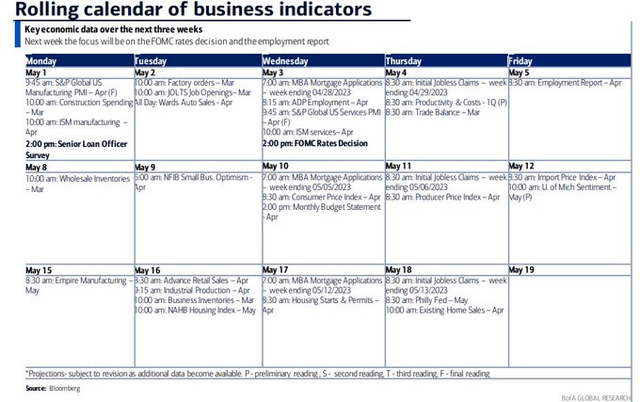

More 'vol' catalysts are on the way with Apple (AAPL) earnings Thursday, the April employment report on Friday, and the next CPI report due out on Wednesday, May 10.

No Shortage of Volatility Catalysts Soon

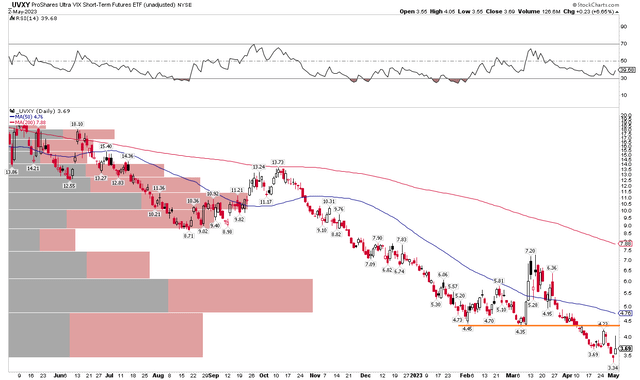

Back in February, I outlined a long play in the popular ProShares Ultra VIX Short-Term Futures ETF (BATS:UVXY), targeting mid-March as the time to take profits. That trade worked out nicely care of the regional banking crisis and volatility around the Credit Suisse (CS) debacle.

I also took a long-volatility stance with a sell rating on SVOL last month. Playing trends in the S&P 500's implied volatility is no easy task, and moves often must be short-term in nature due to the design of so many of these volatility products.

After the rise, then retreat in the VIX, and now with signs that volatility could be re-entering the picture for market participants, I am once again suggesting a buy on UVXY. Let's run through the details and thesis.

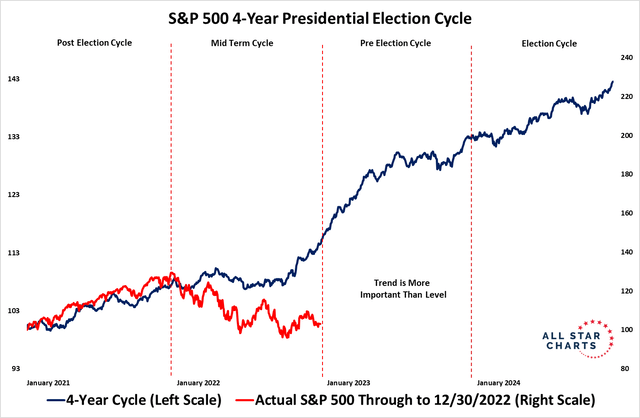

The May through October period is notorious for its bouts of volatility and lack of strong uptrends. The best portion of the election cycle is from November of the mid-term year through April of the pre-election year, and we certainly benefitted from that this go around.

A Strong SPX Run Since October of 2022 (Mid-Term Year), Rockier Stretch Expected

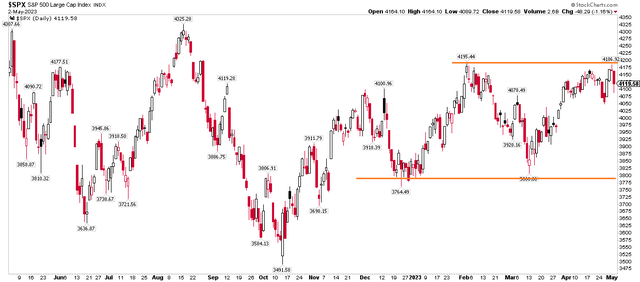

But now we enter a choppier trade, at least according to history. What's more; the S&P 500 has bucked up against resistance from early February just shy of the 4200 level. Taking profits on longs is prudent, but you can also get long volatility to express a cautious view.

SPX Coming off the Upper-End of Its Range

For background, UVXY seeks daily investment results, before fees and expenses, that correspond to one and one-half times (1.5x) the daily performance of the S&P 500 VIX Short-Term Futures Index, according to the issuer. The fund is designed for active investors to profit from increases in the expected volatility of the S&P 500, as measured by the prices of VIX futures contract. Since it rebalances daily, long-term positions in the fund are not advised due to negative compounding effects.

UVXY has a 0.95% annual expense ratio with a median 30-day bid/ask spread of 0.25% - so using limit order is often wise. The ETF typically holds the next two months of VIX futures contracts.

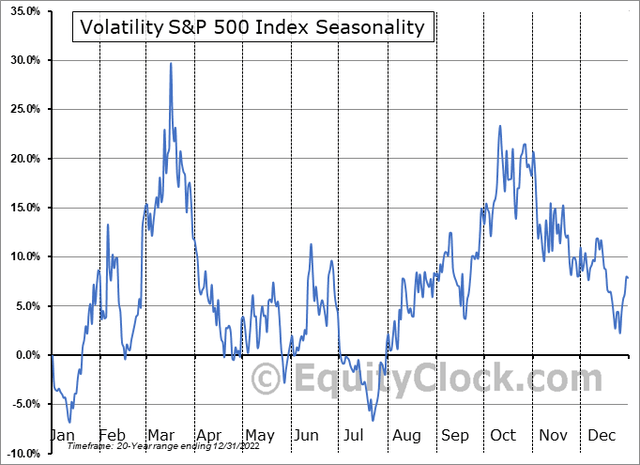

Seasonally, the VIX does not do a ton now through late June, but then a pronounced uptick sometimes takes place in Q3 through early October, according to data from Equity Clock. That is beyond the period investors should hold UVXY, so seasonality is not as much of a part of the thesis this time. Rather, it's more about how the SPX is near the top-end of its range and the VIX is just now starting to show signs of life.

VIX Seasonality: Neutral Through Early June

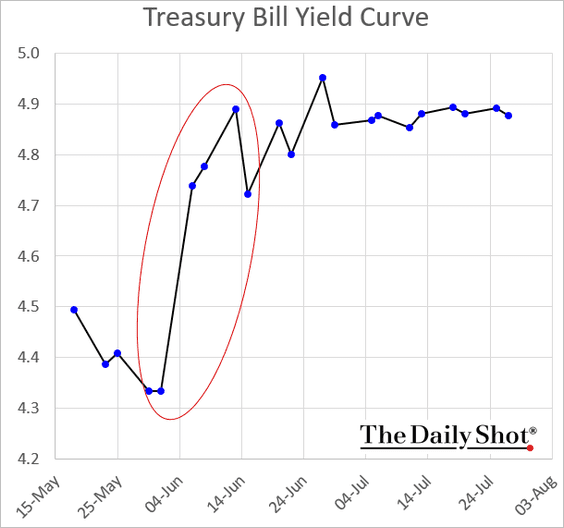

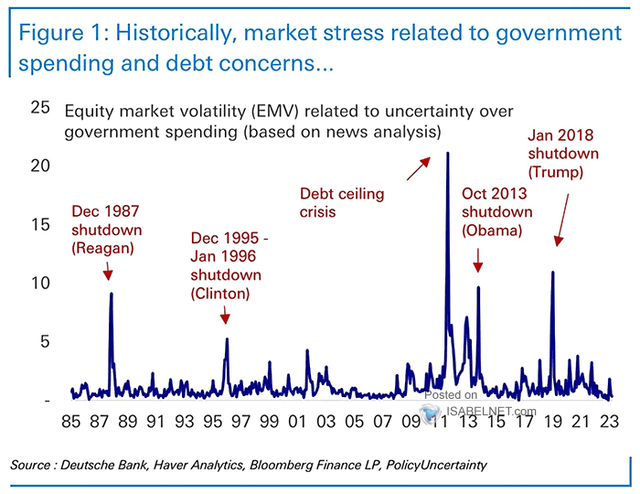

Another fundamental volatility catalyst is, of course, the debt ceiling battle. As it stands, the market has priced in early June to be the make-or-break moment. Treasury yields are much higher, looking out about 5 weeks versus T-bill maturities late this month. So, going long UVXY with a timeframe no longer than mid-June is the idea.

Risk Seen in Treasury Yields: Early June X-Date?

The Daily Shot

Previous VIX Upticks Around Debt Ceiling Events

Deutsche Bank

The Technical Take

UVXY bounced hard off its low on Monday. I see upside potential to $4.50 in the near term, and that might correspond to a VIX level near 25 - which is well within reach. We would not need a financial calamity, rather, just a garden variety pullback in the market to stir up fear. I would exit the trade on a move under Monday's low. Once again, prudence is key with UVXY as its design generally leads to long-term underperformance compared with the VIX.

UVXY: Eyeing $4.50 in the Coming Weeks

The Bottom Line

I have a buy rating on UVXY based on the S&P 500 being near the upper end of its trading range and the looming debt ceiling crisis that could peak in early June if it strikes. The technical chart suggests taking profits near $4.50, but knowing when to cut losses is also smart with this product.

Please be advised of various industry warnings about the unique risks due to negatively compounding returns of leveraged ETFs. Products such as UVXY are not designed to be held long-term but rather as short-term trading vehicles as described in the article.

1) The Lowdown on Leveraged and Inverse Exchange-Traded Products (FINRA)

2) Leveraged and Inverse ETFs: Specialized Products with Extra Risks for Buy-and-Hold Investors (SEC)

3) FINRA's Reminder on sales practices for Leveraged and Inverse ETFs (FINRA)

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.