DNB Bank Hits The Middle-Ground Of Rate Hike Benefits

Summary

- DNB Bank benefits from the fact that the Bank of Norway is going lighter on the hikes, meaning there's the higher net interest income without the deposit beta issues.

- Spreads are rising, and so are loan books, even organically when considering the merger of Sbanken into DNB.

- We think the personal loan dynamics should remain strong, and there is quite a lot of opportunity in the Norwegian corporate space as well.

- As far as banks go, DNB is our top pick. They own a major share in Vipps, which was merged some years ago with BankID and now with MobilePay, and is a veritable payments giant.

- The PE is low, and the Vipps valuation could cover about 5% of the market cap and provides pretty meaningful scope for earnings growth. The 7.3% yield makes it a high-conviction all-rounder of value and income.

- Looking for a helping hand in the market? Members of The Value Lab get exclusive ideas and guidance to navigate any climate. Learn More »

Roland Magnusson

Published on the Value Lab 04/30/23

DNB Bank (OTCPK:DNBBY) is a top pick among everything in the global banking panorama. It's not going to have issues like we've seen in the US due to Norway's lighter rate hikes, which are giving them a boost on the net income margin side. Key markets like real estate are supported by S/D fundamentals, so personal loans should rise. On the corporate side, strength in key markets like oil and gas are a good thing for corporate development, as well as plentiful credit from the other institutions too, keeps the environment healthy and primed for further loan growth. Finally, DNB has an edge in being a major owner of Vipps, a Norwegian payments app, that is merging with peers in other Nordic geographies. We estimate the valuation of Vipps could cover about 5% of DNB's market cap as of today, and is a latent source of earnings growth since it only just became profitable in recent quarters. With yields above 7% and a low PE, this is a top pick for income and value investors.

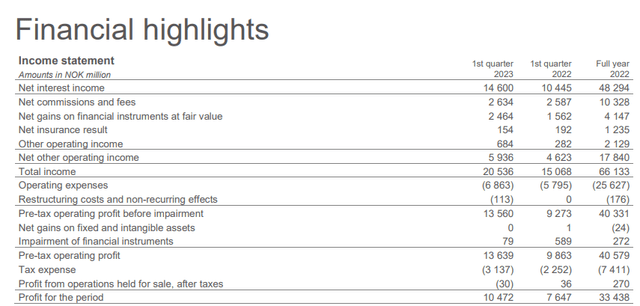

Q1 Breakdown

The headline figures are as follows, but they are exaggerated slightly by the merger with Sbanken late last year. While NII grew by 40% on a headline basis. Around 30% growth was achieved organically, and this is owed to continued double-digit growth in loan volumes but also increases in spreads on loans and deposits relative to last year thanks to the continued hiking, but rather slow hiking in 25 bps increments, of the Bank of Norway. The contributes of Sbanken to commission and fee income would be about 2%, and not very meaningful.

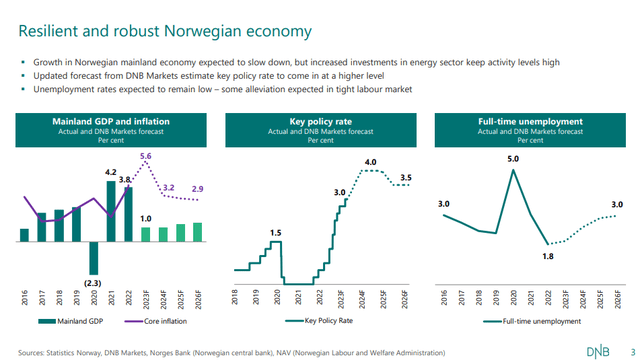

Key Macro Metrics (Q1 2023 Pres)

IS (Q1 2023 PR)

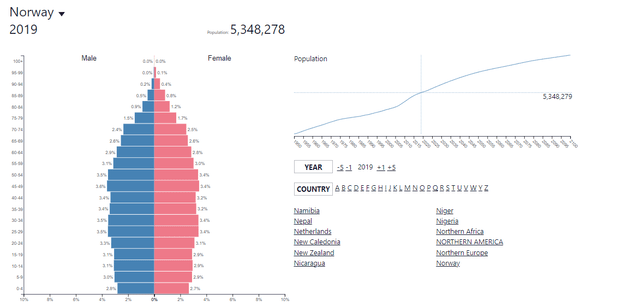

While both corporate and personal segments grew meaningfully in NII YoY, but personal grew in the mix with a more pronounce growth figure. Average loans grew by 14% in the personal segment, with loans in mortgages matching thanks to healthy trends in Norwegian real estate. The real estate market in Norway is still benefiting from relatively early stages of high-degree urbanisation, and relative to other western countries, Norwegian demographics are very strong. The S/D dynamics are strong in residential real estate, also helped by a tight labour market. The corporate income was being driven by solid loan growth and strong corporate conditions. Slow rate hiking keeps credit plentiful in Norway, and strong conditions in Norway's primary industry of oil and gas keeps major actors healthy.

Population Pyramid (populationpyramid.net)

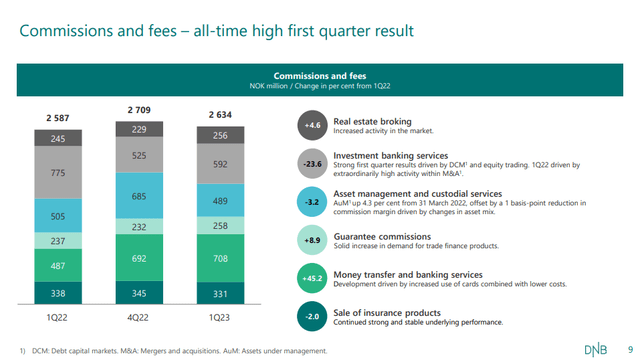

The commission and fee income grew but it was limited by headwinds to investment banking revenue and the asset management business. IB and AM is around 40% of fee and commission income, down from being 50% last year. Growth in card revenues offset these declines with large increases in money transfer and banking services.

Fee and Commissions (Q1 2023 Pres)

Vipps

The core business grew as you'd expect with loan growth combined with higher rates that aren't triggering deposit beta effects. What is more unique to DNB is their substantial, almost 50% holding of Vipps, which is a Norwegian payments app also combined some years ago with BankID, which is Norway's digital ID and signature app used to access state platforms and banking. DNB are the parent company of Vipps.

Now Vipps has merged with MobilePay which is the Danish Vipps equivalent, backed by Danske Bank (OTCPK:DNSKF). This will broaden its Nordic appeal but also prep it for becoming a more broadly used European app. DNB owns a little bit less than 50% of Vipps, and it will own about 33% of the new combined entity.

Vipps became profitable in 2022, but since we lack financial data, we need to value it on a cursory basis using customer number figures. The combined Vipps and MobilePay entity has about a third of the customers of Revolut, so a third of the valuation would put it at around $11 billion. Let's assume that Revolut was overvalued at its last fundraising, so bring it down to a $5 billion valuation for Vipps + MobilePay, and DNB owns about a third, so let's call it $1.7 billion in DNB's hands.

Vipps Customer Number (2022 AR)

This is a pretty conservative figure that can stand behind. The current earnings could also be used for valuing it with Wise (OTCPK:WPLCF) as a relatively close peer, which would value Vipps at around $700 million. Since the earnings have much more scope to grow than Wise, having just become a profitable entity, the $1.7 billion seems more fair.

Bottom Line

The current Vipps valuation is around 5% of the market cap and the earnings are growing quickly. There are other equity-accounted investments too in Fremtind and Luminor. Together they could probably cover about 10% of the market cap conservatively, where Fremtind and Luminor are also profitable, but Fremtind, which is an insurance company, had taken an earnings hit.

Otherwise, the DNB PE is low at below 8x, and the yield is above 7% and well covered. Trading in line with other European banking peers, but in much better shape and with some really nice equity-accounted exposures, we think that DNB is the better pick, certainly when stacked against companies like ING Groep (ING) and other European banks focused on deposits and lending activities. We see none of the risks in DNB that have hit other geographies in banking, and we remain bullish on the overall state of the Norwegian economy.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We've done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it's for you.

This article was written by

Formerly Bocconi's Valkyrie Trading Society, seeks to provide a consistent and honest voice through this blog and our Marketplace Service, the Value Lab, with a focus on high conviction and obscure developed market ideas.

DISCLOSURE: All of our articles and communications, including on the Value Lab, are only opinions and should not be treated as investment advice. We are not investment advisors. Consult an investment professional and take care to do your own due diligence.

DISCLOSURE: Some of Valkyrie's former and/or current members also have contributed individually or through shared accounts on Seeking Alpha. Currently: Guney Kaya contributes on his own now, and members have contributed on Mare Evidence Lab.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.