Medical Properties Trust: The Verdict (Rating Upgrade)

Summary

- REITs are generally boring investments. They collect rents, and investors collect dividends. That’s one reason we all love them.

- Medical Properties Trust has been anything but dull. A myriad of issues have driven the stock down 50% in the past year. Other healthcare REITs have struggled as well.

- Management has decided to test short sellers' confidence and claims in court. We won’t focus on that here, but it’s a sign of how rough things have become.

- Medical Properties Trust Q1 results included many key data points about this REIT's future, including the 13%+ dividend yield that was just confirmed for at least one more quarter.

- Let's take an objective look at Medical Properties Trust now that we have Q1's earnings and 2023's guidance at our disposal.

- This idea was discussed in more depth with members of my private investing community, iREIT on Alpha. Learn More »

olaser

This article was published on iREIT on Alpha on Monday, May 1, 2023. The article was coproduced with Williams Equity Research ("WER").

As many of you know, Medical Properties Trust, Inc. (NYSE:MPW) has become a battleground real estate investment trust, or REIT; the last MPW article I published in March had over 374 comments.

Seeking Alpha

Most must know by now that Medical Properties Trust, Inc. has been the subject of short attacks that has led to enhanced volatility. With a current dividend yield of 13.2%, many investors are wondering whether or not the MPW dividend will be cut.

As for me, I've been strategically dollar-cost-averaging shares as a means to lower my cost basis and more quickly get into a profitable position. Of course, this practice is advisable only if you're certain that stock was cheap when bought originally.

With more clarity (Q1-23 earnings results), we decided to provide an update in which we title this article: The Verdict. We look forward to your comments.

Company Profile

Medical Properties Trust, Inc. owns 444 properties containing ~45,000 licensed beds. The portfolio is diversified across 10 countries and has 54 tenant relationships.

Like most REITs of its type, MPW doesn't manage the day-to-day activities at its properties. Instead, it engages in leases with tenants who have those responsibilities. We'll discuss exactly what those properties are in the next section.

If MPW's tenants are performing well, it's easier to increase rents, and therefore cash flow. If those tenants are defaulting on their lease commitments due to financial trouble, the opposite occurs.

Most REITs, even those outside of the healthcare sector, always face a combination of strong and weak performing tenants.

MPW and many of its healthcare REIT peers, however, have faced unusually high tenant issues. Much of this stems from the unusual challenges and circumstances of the pandemic. These were magnified by labor shortages, increased regulatory costs, and now tighter credit markets.

For those reasons, we'll be taking a careful look at MPW's portfolio, tenant health, cash flow, and balance sheet. With a strong grasp on these subjects, we'll be able to reliably gauge the company's cash flow, and subsequently value as an entity (e.g., a reasonable share price) going forward.

Portfolio & Recent Activity

Cash flow for most REITs is derived from rent payments. These rent payments are tied to leases. REITs like MPW face two risks involving leases.

The first is people breaking lease terms. That's when they owe MPW rent money but don't pay. Lease payments to property owners are powerful legal obligations. In fact, with few exceptions, a tenant can only escape this obligation by declaring bankruptcy. This is a structural advantage all REITs enjoy.

The other risk is when leases naturally terminate.

Once that happens, the REIT can either negotiate a new lease with the existing tenant or find a new one. For these reasons, it's ideal for a REIT to avoid a lot of leases expiring in the near term.

For Simon Property Group (SPG), for example, this is a top priority. It owns higher end mall and outlet centers. Tenants can easily move to a new location when their lease expires because there isn't infrastructure or anything else tying them to any individual property/location.

For MPW, things are different.

A tenant operating a healthcare facility has key client and partner (e.g., local hospital) relationships that often take years to develop. The buildings may be specially fitted for the exact services the operator provides. Rebuilding this infrastructure somewhere else is no small task.

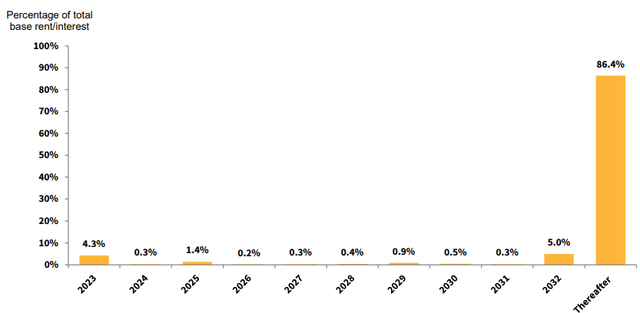

MPW Q1-23 Supplemental

MPW's lease schedule is shown above. 4.3% expire in 2023 and less than 1% expire each year from 2024 to 2031. 86.4% of leases (measured as a percentage of total rent owed, which is what matters) don't expire until 2033 or later.

This is an extremely favorable lease maturity schedule in absolute and comparative terms to other REITs. Since that looks solid, let's move on to the next risk.

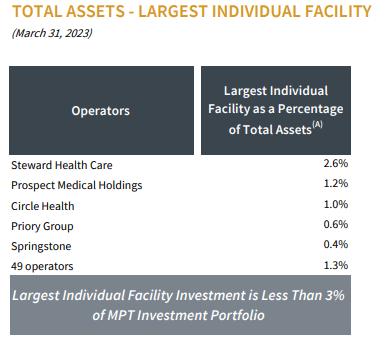

MPW Q1-23 Supplemental

Since MPW's portfolio spans many countries and hundreds of properties, individual facility risk (e.g., a lot of rent being tied to the success of a single operation) is low. The largest facility in the portfolio represents less than 3% of MPW's asset base.

MPW Q1-23 Supplemental

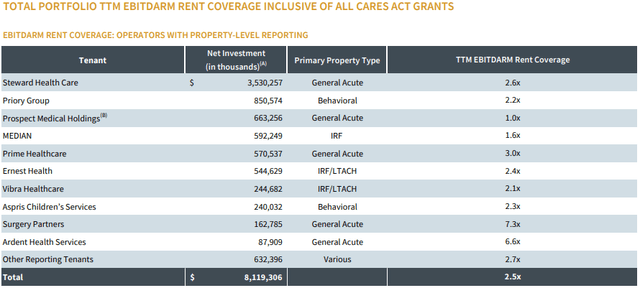

The next risk is operators.

If a large percentage of MPW's rents are tied to a single operator, their financial health becomes MPW's financial health. Steward Health Care is the standout on this list of top operator exposures.

Steward was 29.6% of Q1 2023 revenues. As of mid-February, MPW re-leased its Utah hospital portfolio from Steward to Catholic Health Initiatives Colorado ("CHIC"). CHIC falls under the CommonSpirit Health umbrella. Centura Health will be the new operator.

This is a fairly significant transaction.

I'd call it a big step in a good direction but not a jump all the way to the finish line. It moves 6% of total assets from Steward to a new operator that isn't a concentration risk to MPW.

This won't be fully represented in the REIT's financials until later this year. It'll knock the concentration in Steward from nearly 30% to the low-20% range. In addition, management recently stated that Steward's rent coverage will improve after the transaction (if these properties were especially profitable for Steward, the sale may not actually help MPW at all).

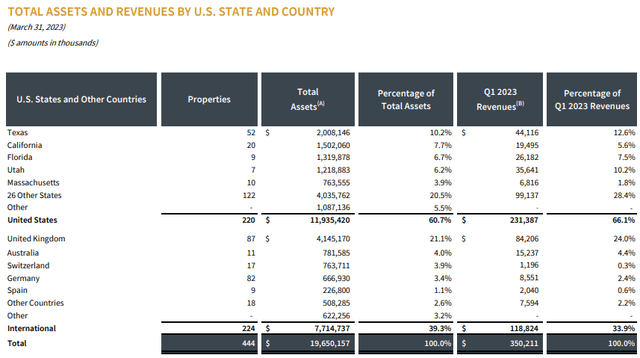

MPW Q1-23 Supplemental

Texas is the largest state market for MPW at 12.6%. Texas is 9-10% of the U.S. population, so MPW is only moderately overweight the state even after considering its international investments. Massachusetts is the state MPW is truly overweight, but at 10.2% of Q1 revenue, it's not extraordinary.

The 33.9% allocated overseas is mostly (24.0%) in the U.K. GDP is still chugging along in positive territory for the U.K. Total health care spending in the U.K. is anticipated to increase by 1.7% in 2023/2024 and 2.6% in 2024/2025 in cash terms. It's flat over that time period after adjusting for inflation. That said, we aren't investing in high-risk, high-reward health care projects that are highly sensitive to small changes in overall spending.

Overall, MPW's geographical allocations provide excellent diversification and don't have any worrisome concentrations.

Now, it's time to move on to the specifics of what MPW owns.

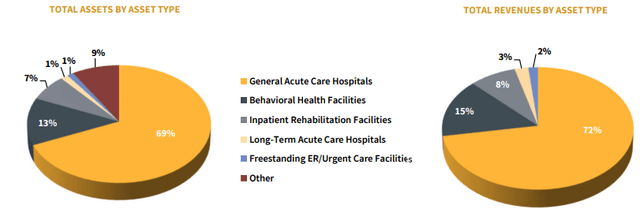

General acute hospitals are the core of the portfolio. Unsurprisingly, that's also Steward's main business, which is MPW's #1 operator. The REIT also has a significant 15% exposure (by revenue) to behavioral health facilities with the next three categories totaling 13% of revenues in Q1.

MPW Q1-23 Supplemental MPW Q1-23 Supplemental

Rent coverage is the most popular metric to determine if a tenant can pay. A rent coverage of 1.0x means there is no margin of error. If the company's profits decline, or rent goes up, the tenant will not be able to pay in full.

Ideal rent coverage depends heavily on the type of business the operator is engaged in. Steward's aggregate rent coverage over the past 12 months was 2.6x. That's measured as EBITDA plus rent and management fees. Now when you see EBITDARM, you'll know exactly what it means. This does not necessarily capture rent paying capacity perfectly, but it's a reasonably good metric.

What jumps out in the most recent chart is Prospect Medical Holdings' 1.0x rent coverage and the median rent coverage of 1.6x. Without any other research, I'd automatically expect issues with Prospect. And that's exactly what we've seen in the past.

Management provided significant context on these challenges in the Q4 earnings call. Prospect is aggressively cutting costs and strategically selling properties to shore up its balance sheet. MPW has written off rents associated with underperforming Prospect properties. Since that's already been done, I don't anticipate much downside risk to cash flow from this operator in the near to medium-term.

Overall, context matters.

We can consider Ventas, Inc. (VTR) numbers as one resource. This top-tier healthcare REIT's post-acute rent coverage is 1.00-1.19x, with almost all the properties sat or below 1.09x. Is post-acute the same as general acute?

No, hence the different names. But there are many similarities, and it also demonstrates that rent coverage close to 1.0x is not unusual or unsustainable.

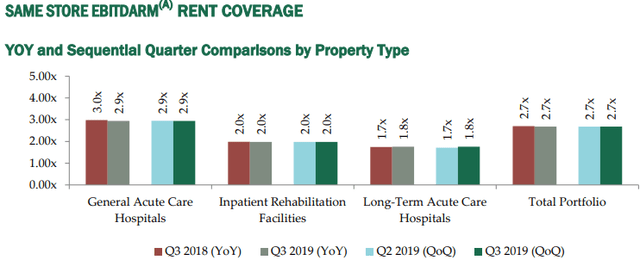

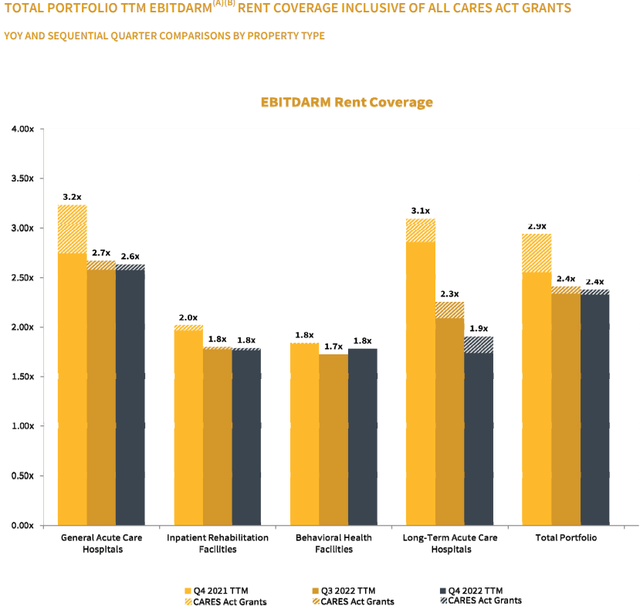

MPW Q4-19 Supplemental

During the time period this supplemental filing covered, MPW's share price averaged $20. The portfolio is not a perfect apples-to-apples to today but note that general acute hospitals rent coverage was 2.9x. That's not materially different than today.

MPW Q1-23 Supplemental

You can compare the numbers yourself.

Not only is the core segment's rent coverage about the same, so is the total portfolio's. It was 2.7x in 2019 versus 2.5x today (Prospect’s recently excluded rent would bridge most of that gap anyways).

Given all that we've covered so far, nothing warrants MPW's ~63% decline from its 2019 peak. That leaves two possibilities. Cash flow or balance sheet problems.

Balance Sheet & Liquidity

Let's do balance sheet first.

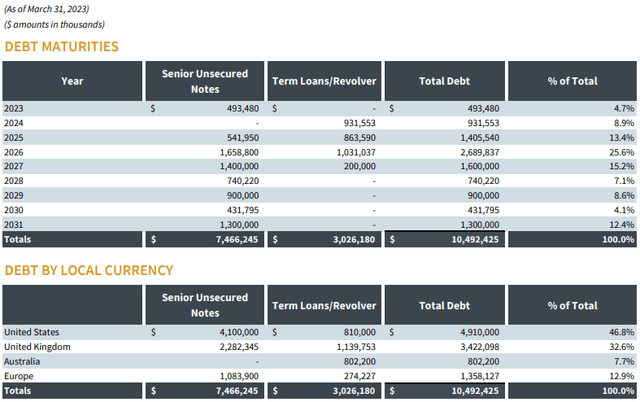

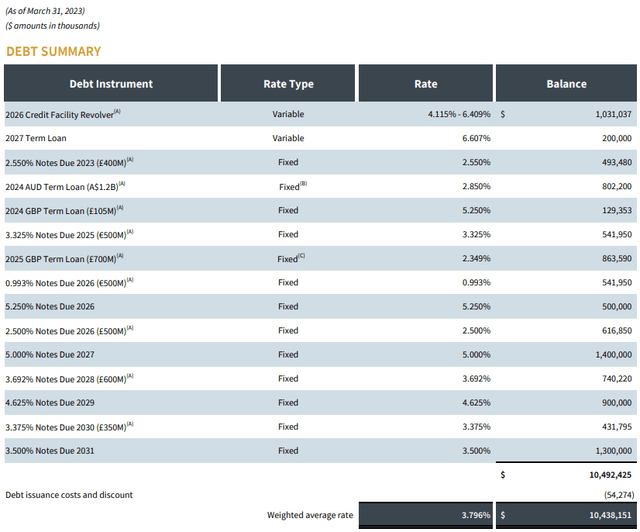

We are focused on three topics.

The first is the debt maturity schedule. Just like with leases, we don't want too many liabilities occurring all at once. That's especially the case today because rates are much higher than at any other point in the past 10 years. All maturing debt will cost more in this interest rate environment versus the near-zero landscape since 2009. Greater interest expense means less cash flow, all other things equal.

MPW Q1-23 Supplemental

Debt maturing in 2023 is only 4.7% of the total. That's no issue. The same with 2024's 8.9%. Even in a complete disaster scenario, MPW could repay that debt simply by redirecting the common dividend to debt service. It could also sell assets or take other measures without damaging the core business.

2025 through 2027 isn't a debacle, but the story does change. With roughly 55% of all outstanding debt maturing in those three years, MPW would suffer if current rates were still applicable in 2025-2027. Those bonds were issued with coupons of 5.250% to 6.375%.

Those same bonds now trade with yields of 9.1% to 9.8%. The market is telling us that, like with all companies that issued debt in the low/zero interest rate environment, it would cost more to issue those bonds today.

In MPW's case, it would be ~400 basis points/4% more expensive on average. That assumes rates stay elevated where they are today and do not dip at any point between now and 2027. MPW (and everyone else) would refinance when that occurred. They wouldn't wait until maturity.

In summary, MPW's debt maturity schedule won't cause any major issues for at least the next two years. At the same time, it could if interest rates stay elevated through 2027.

Even if rates did stay that high, MPW could absorb the higher interest expense at current levels of leverage without much trouble. The issue is the dividend would have to be reduced, and perhaps by as much as 50% in a worst-case situation. That ignores the reality that MPW’s leases are tied to inflation rates, and would adjust upward at the same time.

MPW Q1-23 Supplemental

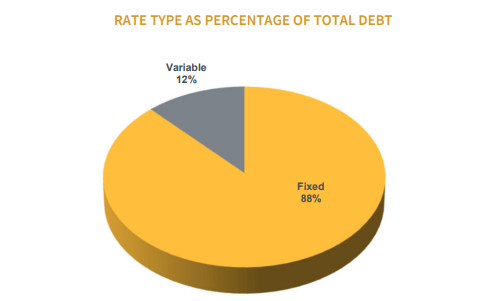

The next balance sheet topic is interest rate sensitivity.

MPW Q1-23 Supplemental

88% of MPW's debt is fixed rate. 12% has already increased in cost due to higher interest rates. That's enough to show up in the financials, but not enough to cause noticeable problems.

I'll demonstrate.

Total interest expense in the most recent reporting period was $97.7 million on total debt of $10.5 billion. In Q1 2021, which is before rates moved, total interest expense was $87.0 million on total debt of $9.2 billion. Q1 2021 EBITDA was $365.6 million for context. The delta in interest expense since rates have moved dramatically isn't significant, and that's partly because MPW's debt was 96.2% fixed rate back in early 2021.

Last is leverage.

Back in early 2021, pro forma net debt/annualized adjusted EBITDA (a rough measure of cash flow available to pay interest) was 6.3x. That was up from 6.0x in late 2019. It now stands at 6.5x after adjusting for ongoing M&A.

For context, top health care REIT Ventas, Inc's was 6.9x last quarter. And it's rated BBB+ (3 notches into investment grade) compared to MPW's BB+ (one notch below investment grade). Realty Income Corporation (O) was at 5.2x, down from 5.6x in Q4 2021. Realty Income is tied with the highest-rated REITs at A-.

MPW's leverage is higher than the top-rated REITs, but it's actually lower than one of the highest rated health care REITs. Its interest coverage of 2.9x can't compete with Realty Income's ~6x, but once again that's similar to many healthcare REIT peers and isn't alarmingly or unusually weak.

It's true that MPW should improve these metrics at least marginally if it wants to obtain investment grade status. But it's also true that there is nothing here to justify the kind of decline and current valuation MPW is experiencing.

As noted in the recent Q1 conference call, there are a few levers management is pulling to improve the balance sheet. One involves Prospect.

They stated there are two transactions totaling $900 million in cash proceeds that they'll use to repay debt. If that were to occur, leverage would be lower than it was in 2021. Since those transactions are "likely," accounting rules require them to flow through to the income statement. In these specific circumstances, it's a net negative from an accounting (not cash) perspective.

Time for the cash flow analysis.

Cash Flow & Dividend

In Q1 2022, MPW generated $0.37 in adjusted funds from operations ("AFFO"). AFFO adds back stock-based compensation ("SBC") but subtracts straight-line rent revenue and other items.

AFFO was $0.30 for Q1 2023 with FFO coming in at $0.37. Management guided for $1.50-$1.61 in normalized FFO per share. The quarterly figures for the next two quarters may be volatile since there is pending M&A. Investors should take that into account before reacting too strongly to medium-term earnings announcements.

Q1 2023 revenues were $350.2 million on total assets of $19.7 billion.

Let's compare these figures to early 2021 when sentiment and the stock was much higher. Q1 2021 FFO/AFFO was $0.43/$0.34. Both were ~15% higher than last quarter.

Q1 2021 revenues were $362.8 million, or about 3% higher than last quarter.

There isn't a single major driver to blame. Instead, costs were modestly higher, revenues were down slightly (~3.4%), and that adds up to a bottom line that's ~15% weaker than two years ago.

The dividend is currently set at $0.29 quarterly. We know that's effectively a 1.0x distribution coverage ratio for the most recent quarter. If management's expectations about 2023 come to fruition, that'll improve to ~1.3x coverage ratio for the year.

These year-over-year comparisons are also flawed because Prospect's rent income is no longer included. Leverage ratios and various rental income metrics are slightly less favorable than reality because of this. Although minor, that closes the gap between a lot of the numbers of 2021 compared to last quarter.

This is related to another important topic that I do not see mentioned very often. Most of MPW's leases are structured with inflation clauses that reset annually. We talked about the impact of higher rates on the future of the balance sheet, so I won't rehash that hear.

But the fact MPW's leases are structured with a natural hedge against rising rates matters. A large percentage (>50%) of incremental interest expense should be offset by higher rents due to the inflation clauses. And remember, most of the leases do not expire for many, many years. The tenants are not escaping those terms.

Valuation & Conclusion

Medical Properties Trust, Inc. has supported its operators with capital in various forms, but usually through loans. This has understandably spooked the market. Many REITs, including Simon Property Group, have taken similar measures. And the market hasn't liked any of it as far as I can tell.

In Q1, for example, Prospect drew down another $50 million in financing from MPW. Within the next few months, ongoing M&A should result in clarity on most of MPW's loans to operators.

Management sees behind the curtain. If it is confident an operator can sell assets to become current on rent obligations, then it makes sense for MPW to float them capital in the interim. It also comes with risks, and the stock market clearly dislikes this strategy.

MPW has creatively solved tenant problems in the past, and its track record in this area is 20 years long and generally very strong. But that's no guarantee it'll solve the current set of problems. And the dividend wasn't 13-14% in the past.

Last month, MPW hit a 52-week low of $7.10. The declaration of the $0.29 dividend (unchanged) and generally favorable Q1 2023 earnings release helped move the stock back toward $9. The dividend yield is now 13.2% and short interest is reportedly 19.5%.

Omega Healthcare Investors, Inc. (OHI) has experienced a similar crisis of confidence and yields 10% with 9.7% short interest. MPW isn't completely alone.

OHI trades at 10x forward FFO estimates. The other health care REITs trade at 11.6x (National Health Investors (NHI)) to 16.1x for VTR. The whole sector is still a little beat up by the pandemic.

So, what about MPW? 5.6x. You read that correctly. This REIT trades at less than six times forward FFO estimates.

That can make sense if cash flows are falling off a cliff and or there are major solvency issues. As we've discussed, neither of those are objectively the case. Instead, a bearish view on MPW would assume a ~30% dividend cut, all current M&A failing to meet expectations, and an 8-9x FFO multiple. That's still $12-$13.50 per share.

A middle-of-the-road perspective might be no dividend cut or a smaller 15% reduction coupled with some of the M&A working out and a 9-10x FFO multiple. That's $13.50-$15 per share. The upper end of that represents a ~70% capital gain from current trading levels.

For the slightly more optimistic, the dividend is never reduced, most of the M&A works out, and those inflation clauses start to show up better in the financials for an FFO multiple of 11-12x within a year or so. That's $16-$18 per share (~90% capital gain) and a $1.16 dividend per year (13% yield on cost) while you wait.

If bearish investors want to call it quits around $12-$13 per share, that's understandable.

But selling MPW stock at current levels below $10 a share makes no sense to me.

Shorting it makes even less sense for a variety of reasons. Buying MPW bonds with their nearly 10% yield-to-maturity is also an attractive option for some investors. That's not far off holding the common stock if you think capital gains isn't likely in the years to come. And the bonds are ~95% less risky (from a principal loss perspective) than the common stock in my opinion.

Author's note: Brad Thomas is a Wall Street writer, which means he's not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Get My New Book For Free!

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREIT, Preferreds, BDCs, MLPs, ETFs, and we recently added Prop Tech SPACs to the lineup. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus my FREE book.

This article was written by

Brad Thomas is the CEO of Wide Moat Research ("WMR"), a subscription-based publisher of financial information, serving over 100,000 investors around the world. WMR has a team of experienced multi-disciplined analysts covering all dividend categories, including REITs, MLPs, BDCs, and traditional C-Corps.

The WMR brands include: (1) iREIT on Alpha (Seeking Alpha), and (2) The Dividend Kings (Seeking Alpha), and (3) Wide Moat Research. He is also the editor of The Forbes Real Estate Investor.

Thomas has also been featured in Barron's, Forbes Magazine, Kiplinger’s, US News & World Report, Money, NPR, Institutional Investor, GlobeStreet, CNN, Newsmax, and Fox.

He is the #1 contributing analyst on Seeking Alpha in 2014, 2015, 2016, 2017, 2018, 2019, 2020, 2021, and 2022 (based on page views) and has over 108,000 followers (on Seeking Alpha). Thomas is also the author of The Intelligent REIT Investor Guide (Wiley) and is writing a new book, REITs For Dummies.

Thomas received a Bachelor of Science degree in Business/Economics from Presbyterian College and he is married with 5 wonderful kids. He has over 30 years of real estate investing experience and is one of the most prolific writers on Seeking Alpha. To learn more about Brad visit HERE.Analyst’s Disclosure: I/we have a beneficial long position in the shares of MPW either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

WER: I/we have a beneficial long position in the shares of VTR, NHI, SPG, O, MPW either through stock ownership, options, or other derivatives.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.