MGM Resorts: A Clear Buy Given The Macau Surge Plus All Engines Firing At Once

Summary

- MGM Resorts International's Q1 2023 results were early stage indicators of a surge to come.

- Post-covid recovery on the way in Vegas and U.S. regionals. Add gains in sports betting and now Macau and future earnings beats loom.

- Chronically undervalued for several reasons linked to past managements, MGM Resorts International is now coherent in its goals and executions of plans.

- Looking for a portfolio of ideas like this one? Members of The House Edge get exclusive access to our subscriber-only portfolios. Learn More »

atosan

Investment thesis: After you plow through the oceans of numbers, navigate the endless metrics, read the analysis of many professionals, you still face buy/sell or hold decisions that can prove dead wrong as often as they can prove on target right. While all this poring over numbers and clicking away at this algorithm or that surely contributes to enhancing your sense of direction, in the end, the market tends to keep its secrets. Mr. Market dares you to beat him.

That in part is why wise old Charlie Munger recently said, "many money managers are little more than fortune tellers or astrologists…." Not ALL, money managers for sure. But of the legions of those who are have mushroomed over the past twenty years many are products of data massing-not well educated observers of sector businesses.

The guru population of Wall Street has risen in direct relation to the masses of metrics and data that have been dumped into the process by seductive technologies. And as they have, too many investors have become addicted to the metric drug some gurus prescribe as part of the bacillus of intellectual loafing rife in the process. The difference between guessing and really knowing is where the line is drawn for best odds on being right. You can't hide behind some numbers forever.

It is all part of a larger cultural fog that has settled down over the nation in general. It is the hunger for instant gratification, the quick fix, the zero attention span approach to education. And that is why Mr. Market continues to guard his secrets. He knows that the Greater Fool Theory didn't die with the 17th century Dutch Tulip madness. It is alive and well today---unless you are willing to commit the time to educate yourself about the business of a company beside its stock metrics.

Some stocks demand an educated investor because they are often undervalued or overvalued based on misleading, surface metrics of projected sector growth. Or one of the tricks of one of the self-invented gurus Charlie Munger was referring to in the above quote. What counts is a willingness to put in the time and have the patience to learn. And as Charlie suggested, never stop learning if you want to make money in the market.

Our take on MGM includes a management report card

Infallibility has no place here. We don't imply we have anything other than our 35 years inside the gaming c-suite enhanced by persistent, common sense takes (we hope-it sometimes eludes us as well) on what we see going forward of the shares of gaming sector stocks. Specifically here, on MGM Resorts International (NYSE:MGM). We have never stopped learning. Even during those years when we were mentoring executives who later became CEOs. We sat and listened to learn.

We did constant listening sessions with customers. Not the easy way, with focus groups or highly structured consumer research studies alone. But in the main, meandering around the casino floor, standing in line at buffets, talking and listening. For example, when listening to a given beef, I often tracked it backward to the employee or the policy and beyond that to the c-suite policy maker who fathered the idea. Through that constant process, knowledge bases were built and in the end, had their impact on corporate performance. I had my share of miscues and still do, but my batting average is way up over time and that is all you can ask of Mr. Market.

So, there is no better laboratory to learn than that of the MGM progress from where it was, to where it is and where best guesses forward, it will be. Then examine management. That learning in our view, sets the stage for our successive Price Targets, or PTs, on the stock over the past five years that overall have been more bullish than analyst sentiment.

That is our basis for once again, now, calling a PT on the shares significantly ahead of consensus. And we add only that it represents a compound of basic metrics for certain. But more critically, it's our best take on the ability of MGM management to execute their ambitious goals ahead. I'm voting-agree or disagree, understood-that they can and that their efforts will result in a $72 stock by 3Q23.

Anatomy of an evolving management

Our personal view here is informed from back in the day In 1998.The then CEO of MGM, was my former boss at Caesars Entertainment, Inc. (CZR), J. Terrence Lanni (d.2011). Terry's CFO at that time was former Morgan banker James J. Murren. He had come to the company after being part of the banker's team that advised the company on a refinancing project.

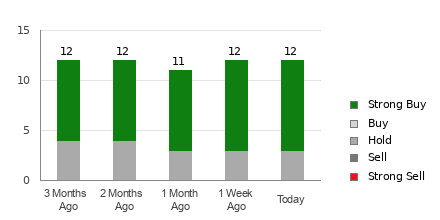

Below: Growing analyst bull scenario finally penetrating to reality.

google

When the need for a change at the COO level became apparent, Terry reached for Murren and gave him the job. I was curious as to why he chose a guy who was not a gut-level gaming guy given the huge footprint of MGM across so many diverse properties. I posed the question at a lunch we always had while I was in Vegas on business.

Terry first reminded me that he, too, had been a finance guy (the old E.F. Hutton brokerage) before he had joined Caesars in the mid-70s. He agreed Jim would have a learning curve about the operational challenges of the business but that he would absorb all he needed to run the place. "This business is hard to understand at the outset, but as we both know, the customers are your ultimate teachers. After that you own it."

Even after I left the c-suite in the early 2000s to focus on my consulting business and analysis work, I kept abreast of MGM along with all the companies I follow. My appraisal over time was that Murren had mixed track record. A few bad expansion moves, a response to criticism for not unlocking shareholder value by creating a corporate REIT rather than rationalizing the portfolio among them. A few good moves, a few bad ones. He proved unable to escape the bred to the bone transactional mentality that had served him during his investment banking years. In brief, I saw MGM run more like a hedge fund engaged in buying, selling and REIT de facto refinancing.

Grade C+

Murren surprised Wall Street when, in February 2020, at the cusp of the covid disaster, he resigned to pursue his interests working in the public service/health sector. The MGM he left behind was a bewildering blend of some good, some bad, but a company with a huge overload of debt. It was among the reasons the stock at the time was trading way below Mr. Market's valuation. Murren had his fans on Wall Street.

I was not one of them. His had been a transactional deal mentality management style in a business that in its gut was all about cost-efficient operational savvy. Gaming is inherently a business of waste. That in our view was not what MGM needed ahead. I believed-right or wrong - that the company demanded a bred to the bone gaming chief executive.

Enter Bill Hornbuckle

Murren's sudden exit had provoked speculation among Vegas veterans that the MGM board would reach for another financial type given its diffused, erratic real estate investment trust ("REIT") moves. His announced strategy of converting company goals to an "asset light" approach was founded on the idea that owning its own realty was just holding too much dead money. There was sentiment either way, as the REIT refocus did have some promise in rebuilding a more viable balance sheet ahead.

Yet there had been bungles and fumbles like the move to charge for Vegas parking, which remains questionable till this day. And our view that his taking the bronze medal as it were in the race for Massachusetts gaming licenses with a project in Springfield was a bad decision. (Steve Wynn won the gold with the casino license for metro Boston).

My own take was that the natural move was to promote Bill Hornbuckle, a veteran, solid operational hands on leader whose career began as a bartender, moving on to a job as a room service attendant at the Flamingo Hilton as he completed his degree at UNLV. From that point on he rose to management jobs at Golden Nugget (under the learn or burn tutelage of Steve Wynn), Mirage, lastly Caesars Palace. This led him to MGM by 1998, where he'd held a number of c-suite positions actually running day-to-day properties like the massive MGM Grand. He was, above all, a grinder, a hands on operator.

Upon Murren's departure, he was named temporary CEO at the edge of covid in 2020 and later confirmed in 2019 as the permanent top gun. Apologies for the mini-resume rehash here. It's only to make a point, namely that the top management mentality of MGM has moved from the transactional mentality of Murren, to an operational one.

I saw that as being very bullish for the shares. Hornbuckle made changes in the c-suite, instituted a better take on the company's MLife rewards program, oversaw the entry of BetMGM's online sports betting business and moved to keep initiatives like the Japanese IR project alive when most everyone else in the bidding had left.

Hornbuckle's tenure has transformed MGM into a global player as well as building more strength at its Vegas fortress. His track record so far is very sound. The company has endured covid as well as any peer. The field of play, so long stalled and buffeted by macro headwinds, has cleared. But valuation of the shares, while inching up, does not yet in our view represent its real value for those seeking yield and strong returns.

Grade: B+

Tracking price action on the stock leaves the impression to us at least that Mr. Market continues to see the stock as foundering within a confined trading range. I do not yet see evidence that there is breakthrough point north in the making. Yet to me, evidence supports the premise that it may not be far off.

Clearly price alone is no way to guide a buy decision on a stock. Yet when we see a long term pattern with a company clearly past immense headwinds sprouting green shoots all over the place, a history of price action is warranted as a beginning.

Price at writing: $45.95

Price when Hornbuckle took permanent CEO job 2019: $28.50

Price February 2022 when Vegas looked a bit better but Macau was still buried in zero covid Beijing prison: $44.29

June 2022: $28.95 results showed uncertain path out of covid and other factors.

Our calls:

Prices at our article dates

July 2022: $32.44

Feb 8th 2023: $41.68 OUR PT $58.

DCF value according to alpha spread formula: $55.10

Intrinsic value at writing: $66.74

Analyst consensus PT: $56.38

Our revised PT based on trends we saw in 1Q23 results: $67.54 by the end of 2Q23 to early 3Q23.

Rationale: Macau recovery gaining strength monthly. While pent-up demand factor for Vegas will begin to ease over the next sequential quarters, on a net basis it will sustain and exceed baseline 2019 levels. Regional properties will regain strength from return of older demos.

MGM's shot at a successful bid for one of three metro NY gaming licenses bears favorable odds. Its Empire racino (Video Lottery Slots only) in nearby Yonkers NY has long been targeted by management for an upgrade to a full scale integrated casino resort. We believe state officials will tend to favor existing operators like MGM and Genting in issuing licenses. This would be a significant catalyst for the shares going forward because a

change out of the VLT's for standard slots and added table games as soon as legal will supercharge win for the existing property.

1Q23 MGM performance highlights

Earnings: $0.40 vs y/y $0.01

Revenues: Las Vegas segment up 31% y/y to $2.23b

Hotel occupancy: 92% vs 75% y/y

Operating income: $731m vs $106m y/y.

Free cash flow: $566m.

MGM China Ltd: up 14% Y/Y TO $555M.

Adj. Property EBITDA: $168.7M VS $25.7M Y/Y. Reflects reality that we have entered a post covid era saving any black swan events ahead.

Price takeaway: MGM is trading below intrinsic value. Its price history from pre-covid 2019 until today is erratic proving ongoing skepticism about a break through price move continues to elude fair value. This implies a positive margin of safety in our view.

Financial keys

Cash on hand at Hornbuckle's appointment day: $2.330b

Cash on hand as of writing: $5.912b. Whether this is mostly related to property sales to REITs but may or may not include substantial operating cost cuts implemented by the new management teams is secondary. What counts is Its post covid positioning in Macau already is showing an upside move in market share moving from pre-covid high single figures to above low double digit.

(Note: MGM has remained acquisitive. It is little remembered that last year it probed Genting to acquire its Singapore duopoly property, Sentosa, but was rebuffed. It was also rebuffed by an offer to acquire all of its online partner Entain of the UK. It successfully acquired digital gaming operator LeoVegas in 2022 and now adds digital game developer Push Gaming to that subsidiary vertical. It is further evidence of MGM's concentrated effort to acquire companies to expand its digital as well as brick and mortar footprint globally).

Long term debt: $5.912b.

Capital leases (long term liabilities) $25b. These are non-interest bearing obligations. But they do include a 2% escalator clause for rent based on a formula.

Long term debt at writing: $32b.

This is nearly 3X what it was pre-covid and remains an ongoing concern among some investors. The rate at which long term debt is being repaid by MGM tends to gyrate clearly related to erratic free cash flow during the covid and early covid recovery periods in Las Vegas plus.

Current ratio: 2.15 is very slightly above what may be considered strong, but overall remains within the general spectrum of healthy enough to meet all obligations.

Conclusion: Valuing companies like MGM

The impact of sound, above-average corporate management in the casino sector in our view has a positive response to these questions that to me, are crucial for investors to ask:

Does the company have, or is it well on the way to having, a durable competitive advantage?

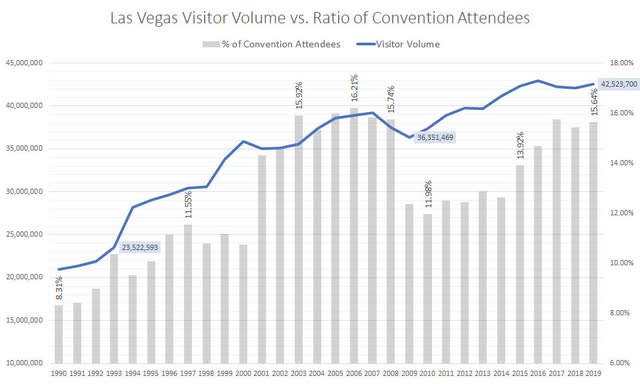

Above: Convention bookings are way up and MGM dominates room availability for those with large attendance rosters.

Our answer: Yes. In a business that appears to be so much me too in adaptation to the realities of servicing tourists and gamblers, MGM stands apart. A competitive advantage is exactly what its management appears to be in the process of sustaining and building upon. The power of its 14 Vegas properties dominates total capacity of the town. The competitive edge that this spread brings is most evident in the tourist and convention business. Here massive arrivals over a set period of days for a convention makes capacity a key driver of revenue. That's when MGM shines above peers.

Is there a margin of safety in the trading range of the stock?

This can be a matter of opinion to some. Our view looks at the differential between intrinsic value and actual price which gets you to ~33%. If you believe in the 15% basis as many do, you are in theory sitting at twice the level of margin of safety if you buy the stock now, at its recent high.

Is it a company in a constant learning process?

MGM passes that test. It now says it has a 30% share of the U.S. sports betting market in BetMGM. Its failed bid for ENTAIN was clearly part of a learning process that helped ignite its deal to buy LeoVegas, the Scandinavian online betting site. And recently adding Push Gaming to it suggesting a step by step process by which MGM expects to become a global presence in the digital gaming space.

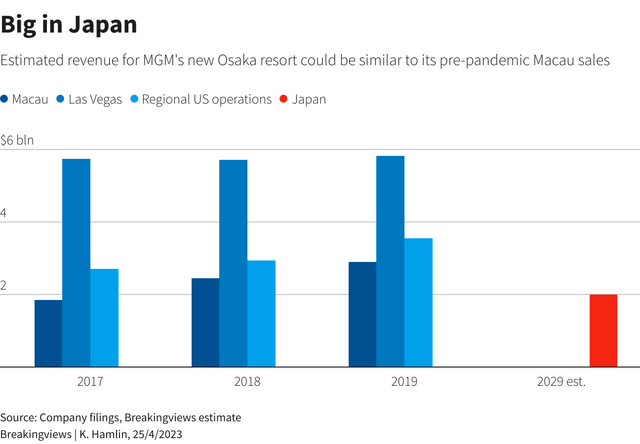

Its decision to move ahead for 50% of the estimated $10b cost for an IR in Japan will give it a long learning curve well before the first shovel digs into the ground at Osaka.

Above: Current look of proposed $10b MGM property for Osaka.

Above If Osaka matches Macau, MGM's estimated $5b investment will be more than vindicated over time.

Our conclusion: Even at its recent post 1Q23 results high, we believe MGM has been a chronically undervalued stock that is nearing break out. The most immediate catalyst will be Macau results, which for April posted a market wide gross gaming revenue of $1.8b. Once the market posts results above $2b as I believe it will added to Vegas and U.S. regional positives and BetMGM, MGM should beat all forward earnings calls.

The company has done two stock repurchase deals that have not in my view resulted in sharp upsides unto themselves. They are nice in that they convey management's sensitivities to investors when dividends are missing. But I do believe after all MGM Resorts International engines are firing at once by mid-year, the restoration of dividends becomes possible. If not, the fundamentals of MGM Resorts International stock are strong and it should reflect in earnings beats that finally uncork the champagne of exponential price gains.

For in-depth and deep dive research on the casino and gaming sector, subscribe to The House Edge. New: Free excerpts from our book in progress "The Smartest ever Guide to Gaming Stocks" - free to existing members and new subscribers.

This article was written by

For 30 years I held senior vp and exec VP positions in major casino hotel operations among them Caesars, Ballys, Trump Taj Mahal and have done extensive consulting assignments for many others in the US, including the native American property Mohegan Sun, in Connecticut. I have also done special projects for Caesars Palace in Las Vegas. I was the founder and publisher of Gaming Business Magazine, first ever publication covering the gaming industry and have written extensively about the industry.

MY INVESTMENT STRATEGY: Due to the necessities of my casino consulting business which encompasses many top gaming companies, I have placed my own gaming portfolio into a blind trust over ten years ago. At that time I instructed my money manager(who is a former industry colleague herself as well as a corporate lawyer and money manager) to follow my gaming investment strategy along these lines.

1. I am a value investor first. Knowing the industry in depth I am able to plumb opportunities and problems others cannot see. Mostly I like to identify price ranges over given periods where I believe the market is asleep and I can buy in at the lowest possible risk. 2. I am a strong believer in management quality. Knowing so many top people in the industry allows me to evaluate which ones I believe have the "right stuff" to move a stock and which are populated by corporate drones. 3. I have instructed my manager never to trade on sugar high spikes in earnings or news per se but use the "string theory" I have developed which in brief, follows a skein of news and earnings releases over set periods of time for each stock and then move in or out. 4. I have instructed her to keep the portfolio diverse with holdings in four basic areas: Casino stocks in Las Vegas, Macau and the regionals, gaming tech stocks with real moats not just cute apps.

I am pleased to announce that as of September 1, 2022 I am expanding my coverage to include entertainment stocks, a sector undergoing a massive revolution on many fronts. This has sprung loose many investment ideas in the space I expect to share with members. The coverage is added at no extra cost.

I have been involved in the entertainment sector as well for decades involved in overseeing show and events in my properties as well as independent productions. I currently sit on the board of privately held Atlas Media Corporation, one of America;s premium non-fiction producers of tv and film programming.

Overall I have done immensely well and share my views with SA readers and more specifically with strong recommendations and gaming stock strategy analysis based on my network of industry contacts for subscribers to my SA Premium Site: THE HOUSE EDGE.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.