Sapiens: High-Quality Vertical Software Company, Trading For Trough 15x P/E, Estimates Rising

Summary

- Sapiens sells insurance software for policy, billing, and claims, which is sold to P&C, life, reinsurance, and workers comp insurers.

- The software is very sticky and customers become more profitable, the longer they have been a Sapiens customer, creating a secular profit margin tailwind.

- Management and board are well aligned, with Sapiens chairman controlling Formula Systems which owns 40% of Sapiens.

- History of strong capital allocation, averaging one acquisition per year, which has been highly value-accretive. Management are value buyers - buying vertical software at 1-2x rev and 6-10x operating profit.

- The company has grown revenue by 20% and operating profit by 21% since the current chairman took over in 2009. I expect them to return to that cadence over the next 5 years.

I going to make a greatest artwork as I can, by my head, my hand and by my mind.

Sapiens Thesis

Sapiens (NASDAQ:SPNS) has a strong business and management with a long track record of profitable growth. Revenue has grown at a +20% CAGR and operating income at +21% CAGR since the current chairman and management team took over in 2009. This is due to operating in vertical software market with very sticky customer relationships and a good execution by management. Sapiens has a dominant market position in European markets, which is difficult for competitors to break into because of the regional differences in regulations and customer preferences. Sapiens has superior growth + GAAP profitability metrics vs its industry peers, due to management's focus on profitable growth. The industry is highly attractive to private equity because of its extremely sticky customer relationships and ability to increase pricing and profit margins over time. Sapiens' software and recurring managed services revenues are higher margin and growing faster than its implementation services revenue, providing a long-term tailwind to profit margins and improving revenue quality over time.

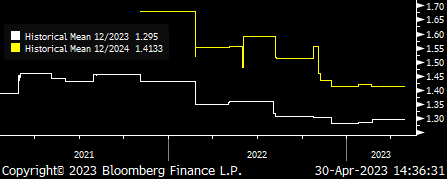

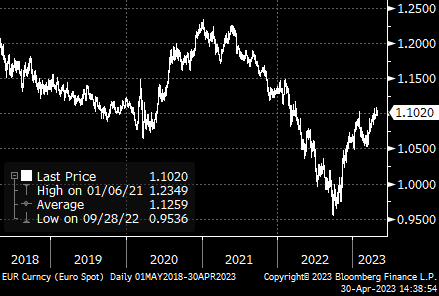

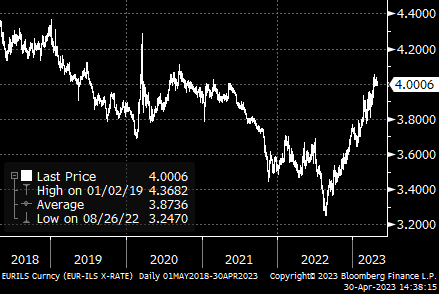

Street estimates are too low and will likely rise through 2023. At the same, the P/E multiple is at a 10-year low, giving the potential for earnings upgrade cycle and re-rating in the valuation multiple. I estimate that 2023 revenue growth of 6.5% plus 2% from fx tailwinds, driving a 2.2% beat to consensus revenue estimates. Because nearly half of Sapiens' revenue is in Euros and only ~25% of costs are in Euros (with the rest in ILS, INR, and USD), operating margin, profits, and EPS are even more exposed to the Euro. I estimate Sapiens will do $1.34 EPS in 2023 (+3% beat vs consensus) and $1.51 in 2024 (+7% beat vs consensus). Further, the company has historically made one acquisition per year, which has generally created value for shareholders. However, it has been 2 years since the last acquisition because valuations were too high for targets. Given the stress in venture capital funding including in insuretech and Sapiens' strong balance sheet, I expect the company to return to its historical acquisition cadence of one per year, which drives further revenue and earnings upgrades from my estimates (which are only organic).

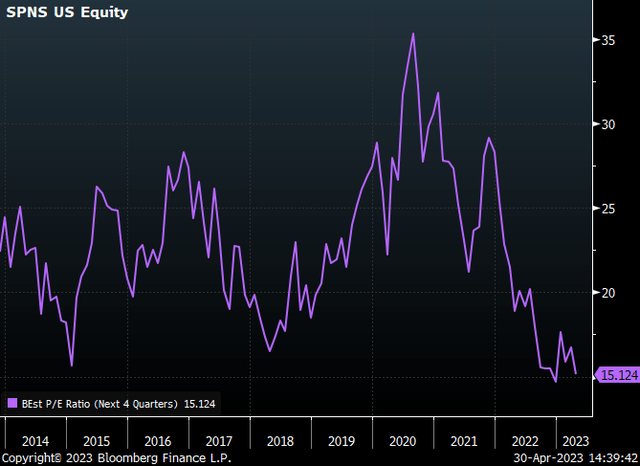

Sapiens is valued at just 15.1x 2023 consensus P/E, vs 10-year history of 15-30x and an average of 23x. I think this is because 2022 was a year of EPS downgrades, due to fx headwinds (which will reverse in 2023) and a large European deal slipping into 2023 (which may contribute meaningful revenue in 2H23). Exiting 2023, SPNS could be worth $1.51 2024 EPS x 23x P/E = $34.73, providing potential for meaningful outperformance.

The long-term value creation algorithm for the business is compelling, with 8-11% organic revenue growth, ~50 bps margin expansion, and ~5% growth from acquisitions, driving 20% per year growth in EPS over the long-term. Long-term consensus numbers are far below, creating the potential for multi-year upgrade cycle to revenue and EPS. In 2028, I estimate EPS of $3.15/share at 23x historical P/E = $72.45/share, a +29% CAGR over 5 years.

Finally, I think that profitable software companies are unusually well-positioned, given the changes that are happening in the world. MSFT, ORCL, SAP, CSU CN are all performing well. I think profitable software businesses will find it easier to attract and retain talent, reducing their cost pressure and aiding margin expansion. Further, faster growing and venture-backed companies are paring back, reducing competitive threats to these businesses, strengthening the competitive position of profitable software companies and potentially even improving the organic growth rate, as competitors cannot spend as aggressively on sales and marketing. Finally, there will likely be opportunities to acquire certain of these companies at improved valuations, as they run out of funding. I think Sapiens falls into this category of software companies and will be appreciated once they start delivering beats/raises.

Sapiens EPS estimates fell throughout 2022 from a weak Euro and one deal that slipped into 2023. With new customer wins in early 2023 and fx now shifting in their favor, I think SPNS EPS estimates will be upgraded over the coming 12 months.

SPNS historical EPS estimates (Bloomberg )

SPNS forward P/E ratio is at 10-year lows and I think forward EPS for 2023, 2024, and 2025 will rise over time.

SPNS hist P/E ratio (Bloomberg )

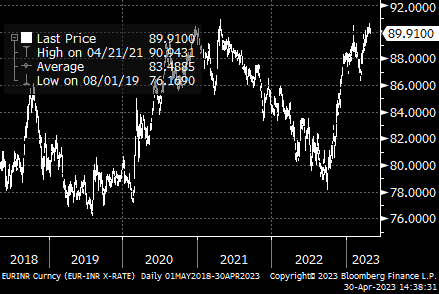

Currency pairs are all very favorable for SPNS, starting in 2Q23 and very favorable in 3Q23 and 4Q23.

EURUSD pair

EURUSD (Bloomberg)

EURILS pair - directional proxy for profit margins

EURILS pair (Bloomberg)

EURINR pair - directional proxy for profit margins

EURINR pair (Bloomberg)

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SPNS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.