Capital Markets Outlook: Q2 2023

Summary

- Interest rates continue to drive markets, with central banks walking a fine line between taming inflation and avoiding recession.

- The Fed isn’t quite finished with the tightening cycle yet, even as the market remains optimistic that rates will fall sooner.

- Earnings growth has stalled and equity valuations are high, with returns extremely concentrated.

- This raises the stakes on security selection. With growth slowing, we think quality is key, with select opportunities in growth and value. Low-volatility and non-US stocks may also be helpful additions.

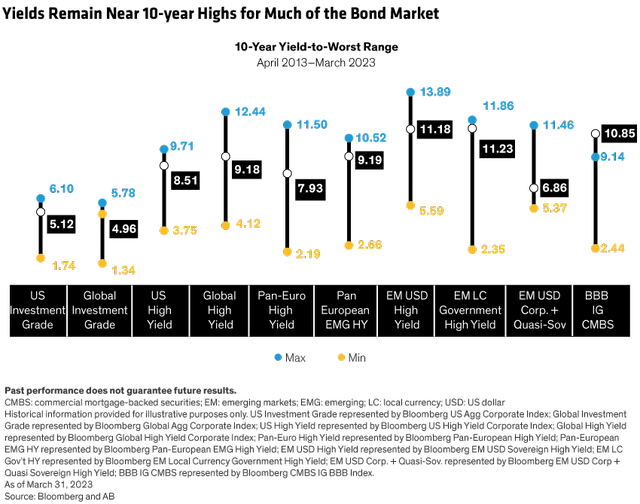

- Bond yields offer appealing entry points for investors after a year of aggressive rate hikes. Despite looming concerns of recession and the need to be selective with credit, corporate and municipal finances are generally healthy, creating potential opportunities for discerning investors.

sankai

What You Need to Know

Markets posted a strong first quarter, though it was a rollercoaster ride. The path forward will likely stay turbulent, with bank turmoil likely tightening credit conditions and the Fed still wrestling with inflation.

Markets, the economy and investment strategies will be unsettled, making research and sound portfolio design keys to avoid overreacting to minutiae and staying focused on navigating the landscape.

An Eventful First Quarter - and Opposing Forces at Play

The first three months of 2023 produced three very different chapters for capital markets. January’s enthusiasm over signs of possible cooling price increases turned into February disappointment. Strong payroll numbers and stubbornly hot inflation readings paved the way for another Fed rate hike… with strong hints of more to come.

March threw an unknown wrench into the works, with the failure of two US regional banks, Silicon Valley Bank and Signature Bank (OTC:SBNY), and the faltering of Credit Suisse (CS).

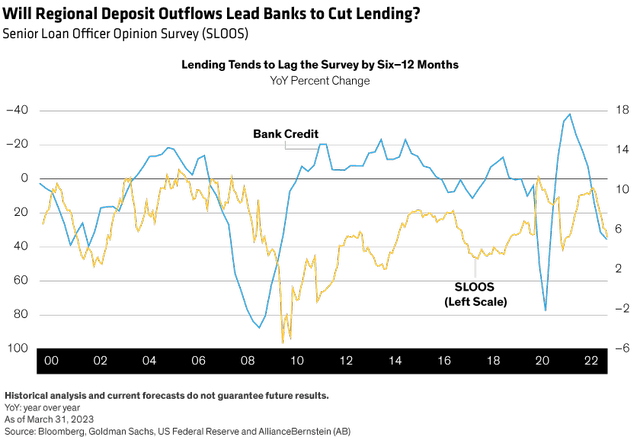

Swift regulatory action helped stem contagion, and investors seemed somewhat reassured that the cause wasn’t systemic problems in banking or financials. Outflows were mostly contained to smaller banks, though the episode could tighten lending conditions (Display).

The Fed stayed the course in raising rates, hiking by another 25 basis points late in the quarter and signaling another likely hike this cycle. The Fed’s approach is essentially expressing optimism that the banking sector can weather this episode, but will keep a watchful eye on bank liquidity to ensure the broader system doesn’t come under stress.

Tighter financial conditions would likely help the Fed tamp down inflation. Some price measures, including headline inflation, are painting a rosier picture, but certain services categories are still stubbornly hot. The Fed’s top priority remains bringing a more “natural” balance to the labor market, and this requires weakening overall demand.

Economic growth has indeed come down, and we expect it to be challenged in 2023, Our forecasts call for US gross domestic product (GDP) to decline slightly by –0.1% this year, with global growth muted - China is the notable exception. For 2024, we expect US growth to recover to 1.8%, accompanied by inflation roughly in line with a higher long-run structural level of 2.0%.

Equity Earnings Growth Stalls, with Valuations Still High

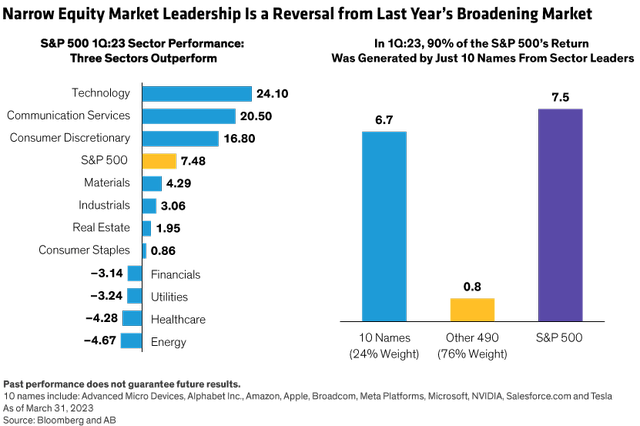

With growth fading, corporate earnings estimates are bottoming out and forward guidance remains mostly negative. Yet the S&P 500 still posted a blistering 7.5% first-quarter return, leaving valuations hovering near a ceiling that’s only been breached during the dot-com bubble and post-COVID-19 period.

A look under the hood reveals the disconnect (Display). Only three sectors beat the index, and 90% of the S&P 500 return came from only 10 stocks - mostly tech giants. With winners limited to only 24% of the index’s market cap, investors should be wary of a concentrated market.

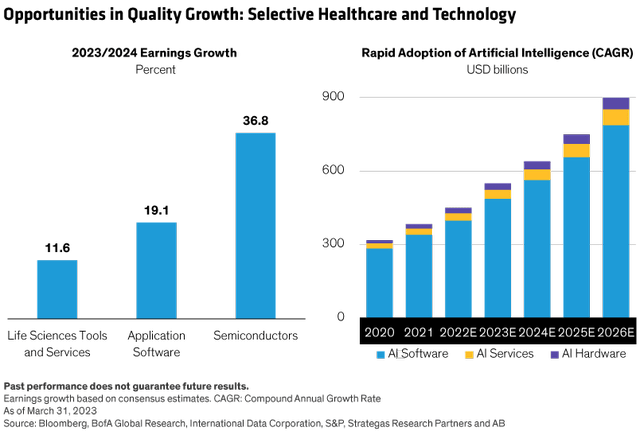

Select growth stocks in healthcare and technology segments such as life sciences tools and services, application software and semiconductors, seem to fit the bill. And the rapid adoption of artificial intelligence (AI) has growth implications for widespread technology applications, with the global AI market expected to grow at a 19% compound annual growth rate (Display).

Managing Fixed Income When the Yield Curve Is Inverted

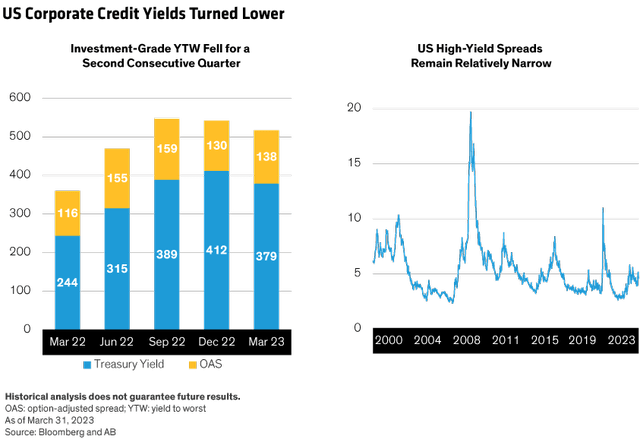

Following a painful 2022 that saw aggressive Fed rate hikes, bonds delivered solid returns in the first quarter of 2023. The key driver was a rapid decline in the market’s interest-rate expectations, pushing yields down across bond sectors (Display). With the Fed and other central banks continuing to tighten policy, growth worries remain - along with concerns that credit spreads could rise further.

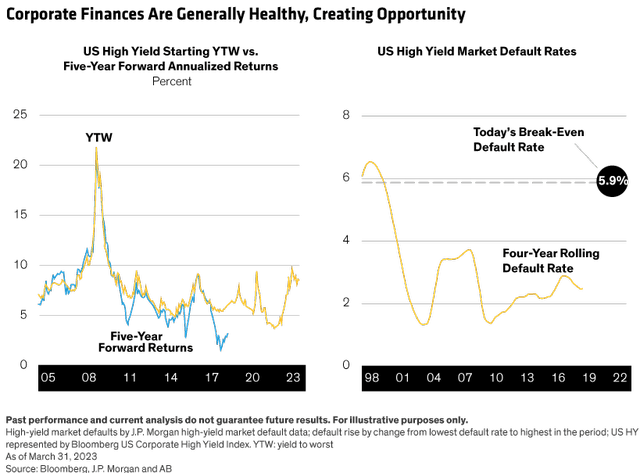

Defaults will likely rise from their very low 1.3%, but the break-even default rate is comfortably higher at almost 6.0%. And US high yield’s yield to worst (YTW)—historically a good indicator of five-year returns ahead—is roughly 8.5% (Display). This seems like an attractive entry point for high-yield exposure.

In the roughly 40-year history of Bloomberg’s US Corporate High Yield Index, the average annualized total return has been 7.7%. Missing the best month in each of those years would have cut that return to only 3.5%. Missing the two best months of each year would have slashed it to only 0.99%.

Municipal Bonds: Strong Fundamentals… and Technical Conditions

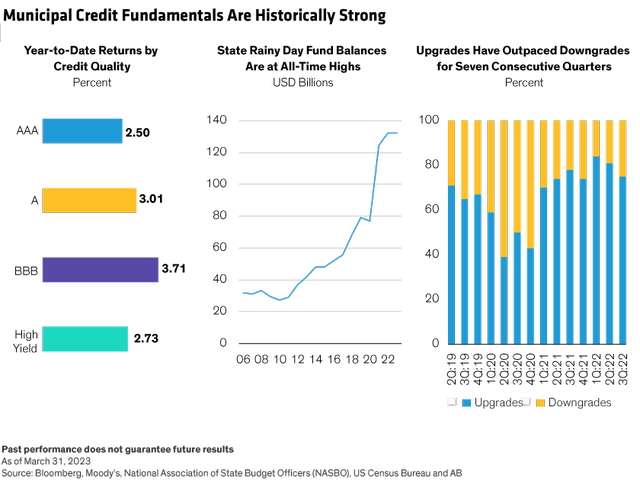

Despite the first quarter roller-coaster ride, municipal bonds delivered a 2.8% return, and we think there’s a fair amount of opportunity left. Fundamentals are historically strong, with states’ rainy-day fund balances in better shape than at any time in the recent past, and with credit-rating upgrades continuing to outpace downgrades (Display).

But active management is key, including positioning along the inverted yield curve - an uncommon state for the muni market. We think an intermediate overall duration exposure seems prudent, but investors might consider working around the inverted middle of the curve - roughly two through 11 years to maturity. We think a barbell structure that combines short-term and longer-term bonds makes sense.

Credit opportunities also seem appealing in the A, BBB and high-yield ratings. But the US economy is slowing, so credit also requires care and caution. More defensive sectors seem to make sense, including charter schools, affordable housing and toll roads. Credit research is crucial, as more pro-growth sectors such as land deals and senior-living facilities may face headwinds.

The bottom line? We believe 2023 is a year of transition - full of known and unknown hazards. To do more than muddle through, we think thorough research that uncovers long-term quality investment opportunities is the key to preparing for more normalized conditions in 2024.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time.

This article was written by