AMD Dips On Weak Q2 Guidance

Summary

- Advanced Micro Devices, Inc. Q1 results beat estimates on top and bottom lines.

- AMD Q2 revenue guidance, however, calls for a sequential decline.

- AMD inventory continues to rise a bit.

David Becker

After the bell on Tuesday, we received first quarter results from chipmaker Advanced Micro Devices, Inc. (NASDAQ:AMD). The company has seen its shares rebound about 40% so far this year as investors look towards the end of a rough patch in the semiconductor space. While the Q1 results weren't as bad as feared, management's sales forecast for the current quarter was a bit light, leading to a pullback in shares after the bell.

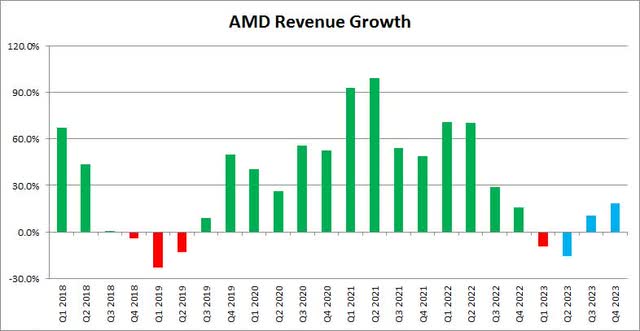

The first quarter of 2023 is where AMD started to face a much higher bar for year-ago periods thanks to the lapping of the Xilinx acquisition anniversary. After a major revenue warning last year, expectations had certainly dropped, and guidance for the Q1 period was not exactly tremendous. AMD was calling for a roughly 10% decline in revenues, with the market hoping that Q2 would be the worst of times in year-over-year percentage terms. We've seen these sales peaks and valleys before as the chart below shows, and the blue bars represent Street estimates as of Tuesday.

AMD Revenue Growth (Seeking Alpha)

As it turned out, AMD came in a little better than expected, with total revenues of $5.35 billion beating the street by a little more than $40 million. Data Center revenues were up just slightly over the year ago period. Embedded segment revenues soared as expected, up over 162% primarily thanks to Xilinx, while the Client segment took a major hit down 65%. Gaming revenues were down more than 6%, leading to an overall revenue decline just over 9% as compared to Q1 2022.

If we look at margins, AMD came in at just short of 50% on a non-GAAP basis, basically what management was looking for. Adjusted operating expenses were up in the high teens, leading to a 10 percentage point drop in operating margins. While earnings per share dropped by almost half, partially due to the rise in share count due to the stock-based nature of the Xilinx deal, non-GAAP EPS of $0.60 did beat the street by four cents. AMD is buying back stock, however, so the major EPS tailwind is about to become a slight tailwind in the coming quarters.

When it comes to guidance, AMD fell short of expectations. Management is calling for a revenue guidance midpoint of $5.3 billion. Not only does that imply a sequential decline over Q1 levels, but it is quite a bit short of the $5.51 billion the street was looking for. This implies about a 19% decline year-over-year, and interestingly enough, AMD didn't point out this percentage change in the guidance section like it has done so many times previously. Non-GAAP margins are forecast to be 50% again, so roughly no change as revenues aren't expected to change much quarter to quarter.

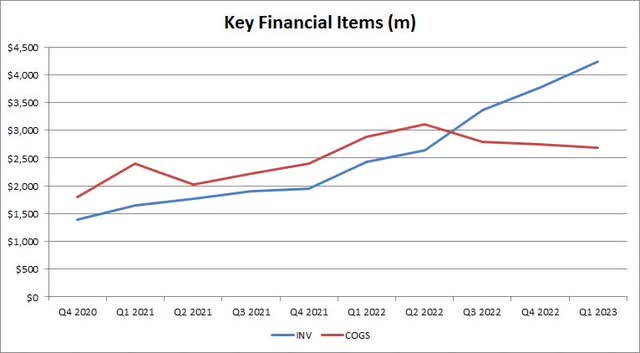

One of the other items I was watching closely was inventory. A few years ago, we had a major chip shortage that was costing names like AMD on the sales line. Recently, the situation has been reversed, with chip names having too much inventory that's resulted in lower margins and weaker cash flow. Unfortunately, inventory continues to rise as the chart below shows, finishing the March period at 1.57 times the Q1 cost of goods sold ("COGS"), almost double the ratio seen a year earlier.

AMD Inventory vs. COGS (Company Earnings Releases)

As for AMD shares, the street has seen them as undervalued for most of the past two years. Going into the report, the average price target on the street was just under $100, implying about 10% upside from Tuesday's close. The stock went into earnings trading just about a dollar above its 50-day moving average. In the after-hours session, shares lost more than 3%, and dipped below that key technical line. If the stock doesn't rebound in the coming days, the 50-day could start headed lower and add a little extra selling pressure.

In the end, AMD's results here were a bit disappointing. The chipmaker's Q2 guidance implied revenues pressures are getting worse in the near term. While Q1 beat on the top and bottom line, AMD investors wanted to see a sales rebound moving forward. While Q2 should be the worst of the top line declines on a percentage basis, it seems future revenue estimates need to come down a bit, and the continued surge inventory is not welcome. With shares up so much into this report during 2023, an AMD pullback is not a surprise here.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.