IWM: You May Want To Buy This Dip

Summary

- I believe we could be setting up for another leg up in stocks and crypto.

- A Fed pause is likely around the corner, and the economy is surprisingly strong.

- The next rally could be led by higher beta assets. Small-caps and altcoins.

- This idea was discussed in more depth with members of my private investing community, The Pragmatic Investor. Learn More »

DNY59

Thesis Summary

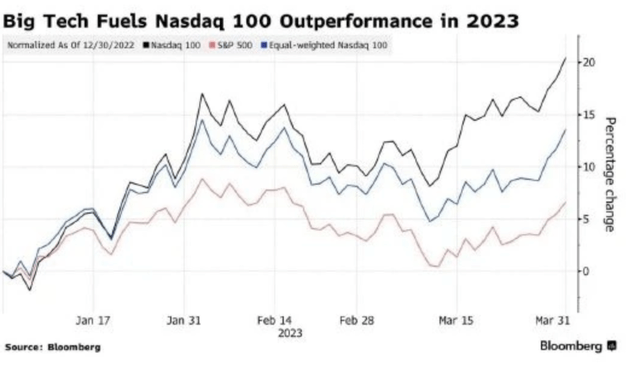

Though some stocks have rallied strongly, much of the market’s gains have been concentrated in mega-cap tech stocks.

This leads me to believe that higher beta assets like small caps, and even altcoins could begin to catch-up.

The Fed is very close to a pause, and the economy is still going stronger than expected.

Now might be a good time to gain exposure to small cap stocks through the iShares Russell 2000 ETF (NYSEARCA:IWM).

Liquidity Outlook

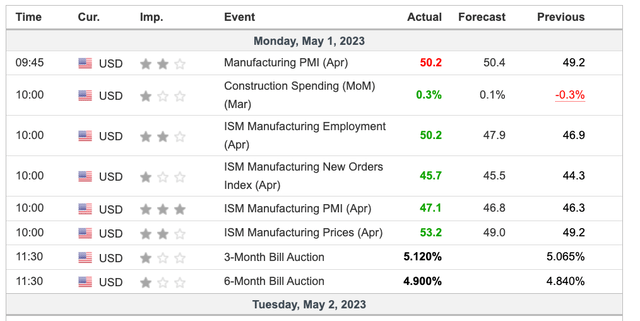

Below we can see the economic calendar for this week.

As I write this, we have already got some important economic data from Monday, with surprises to the upside across the board:

Economic Calendar (Investing.com)

Most notably, the ISM Manufacturing Index and PMI came in above forecast, showing an increase from the previous month. This "recession" is still nowhere to be seen.

In terms of the liquidity outlook, one would still expect to see US liquidity fall in the next couple of months, but the market could counteract these effects if we get a Fed pause.

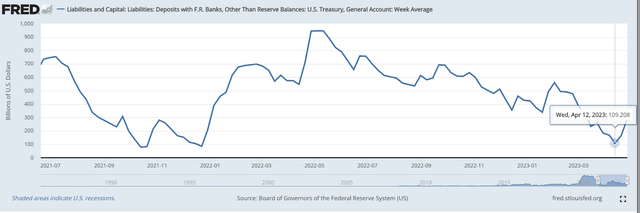

Over the next couple of months, the TGA should be replenished as we enter tax season. In fact, we have already seen this balance pick up.

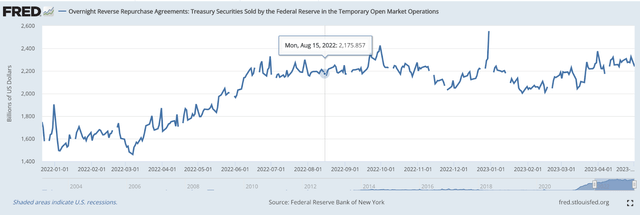

Another element of market liquidity is the usage of the Reverse Repo Facility:

The use of this facility has increased as rates have gone higher, since it makes investment vehicles like Money Market Funds more attractive. However, if the Fed is close to a pause, could the use of the ORR facility be near a long-term peak? This would mean more liquidity could be added back to the market.

Interestingly, the NY Fed recently limited the usage of this facility, saying certain firms might not be eligible:

The bank said that firms that want to use its reverse repo facility should only apply for access if it is consistent with the existing business model of the firm, a move that appears aimed at cutting off access to investment entities set up specifically to take advantage of the tool.

Lastly, the Fed balance sheet, which grew again following the banking crisis, but is now back on its way down.

Though the Fed is expected to keep reducing its balance sheet, we have witnessed just how quickly the Fed is ready to change course. First Republic just got taken over by JPMorgan (JPM) in a deal that includes $50 billion in financing from the Federal Government.

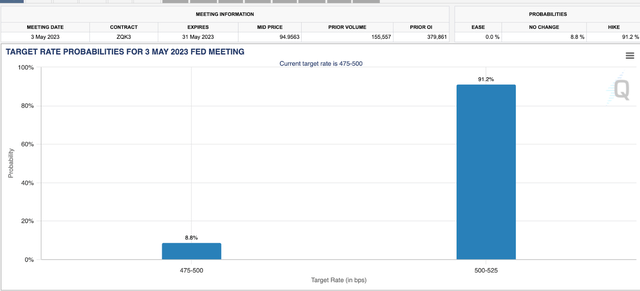

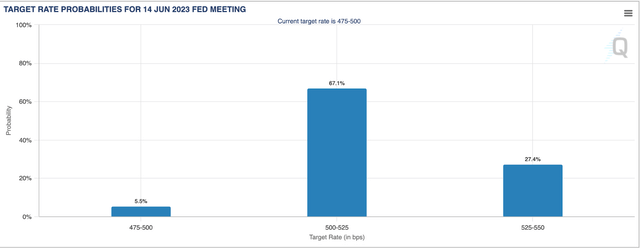

Looking at tomorrow’s Fed meeting, most investors are pricing in a 25 bps hike, and if we look at the forecast for the next meeting, this could be the last hike:

Rate hike expectations (CME watch) Rate hike expectations (CMEWatch)

As I’ve mentioned before, a Fed pause (not cut) on the back-drop of a stronger-than-expected economy could set us up for some bullishness.

Buy the dip In IWM

From a technical perspective, this is supported by the charts. If we are getting ready for a next leg up, then I believe that the higher beta assets could outperform moving forward. i.e. small caps and altcoins.

Nasdaq outperformance (Bloomberg)

Most of the gains in the Nasdaq have been driven by large cap tech companies. However, I believe we could now see small caps, (IWM) and Altcoins play catch-up.

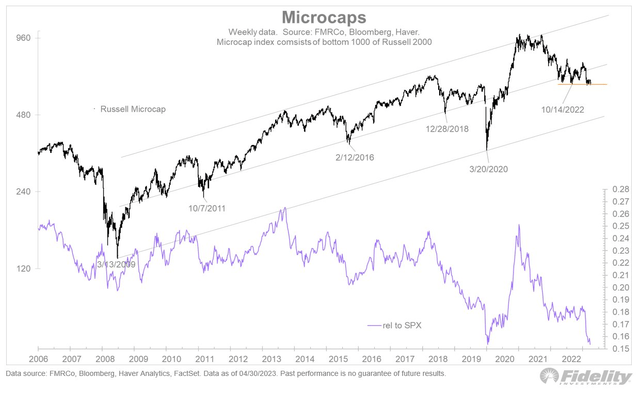

We can also see that microcap performance is at an all-time low compared to the SPX. In the past, this has been a pretty reliable signal of market bottoms followed by strong reversals.

Now, let’s look at the IWM chart

The IWM is still consolidating at the 50% retracement of its wave 3 rally. As we can see, it has barely moved though in the last 6 months. This offers us a good risk-reward entry in my opinion.

As long as we can hold the recent low, this rally could take us into the 267-290 region, which is the 1.272-1.618 ext of the wave 4.

Bonus: Buy The Dip In Altcoins

An altcoin refers to any cryptocurrency that is not Bitcoin (BTC-USD). In the crypto space, periods where altcoins outperform Bitcoin are known as “Altseason”.

The last few months, however, have been dominated by Bitcoin, which has outperformed a lot of the altcoins.

Blockchaincenter has an altseason index, and it is showing very clearly that Bitcoin is the coin to own, for now.

Altcoins season index (blockchaincenter)

The altcoins season signal is at 12, indicating a strong dominance of Bitcoin. However, we are arguably getting to a point where, historically, the market has reversed, and alts have begun to outperform.

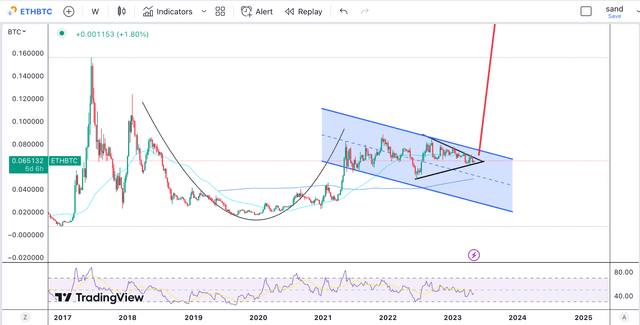

The telltale sign would be a breakout in the ETH/BTC chart:

Alt season usually begins with liquidity moving into ETH, which means Ethereum outperforming Bitcoin. If we look at the ETHBTC chart, we have been grinding down over the last few months, forming a triangle, from which we could break-out.

There’s actually a larger cup and handle pattern at play, which could suggest a breakout to the upside.

Final Thoughts

Small-cap stocks and altcoins are similar to the extent that they often undergo more volatile moves (higher beta). They also share the characteristic that they require a shift in liquidity dynamics. This is something we could see happen in the next few months. Though there are some short-term headwinds for liquidity, the outlook now is for a Fed pause. For this reason, I believe any sell-off in the coming weeks should be used as an opportunity to gain exposure to these high-beta assets.

This is just one of many exciting stocks you can buy right now! The environment is ripe for outsized gains in this asset class.

Join The Pragmatic Investor to stay ahead of the latest news and trends in the space and gain:

- Access to our Stock Portfolio; commodities, international equities, crypto and more.

- Deep dive reports on select stocks

- Weekly macro-focused newsletter.

This article was written by

James Foord is an economist and financial writer with over five years of experience writing about stocks and crypto. His lifelong interest in monetary policy and innovative technologies led him to specialize in macroeconomics, crypto and technology. Given the current macro outlook, he is focused on commodities, real assets, international equities and value stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of IWM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.