Highwoods Properties: Nearly 9% Dividend And Over 30% Upside Potential

Summary

- Highwoods Properties is a beaten-down office REIT that operates primarily in top Sunbelt operating markets.

- Though occupancy levels have declined, their portfolio continues to track well ahead of other competitors within their submarkets.

- Their sizeable liquidity position and a recently reaffirmed investment-grade rated balance sheet provide a notable buffer against refinancing-related risks.

- At current trading levels, I continue to remain bullish on the stock and maintain the view that shares are overdue for a course correction higher.

Walter Bibikow/DigitalVision via Getty Images

Highwoods Properties (NYSE:HIW) is an office-focused real estate investment trust ("REIT") that operates primarily in the nation's best business districts ("BBDs").

Their top three operating markets include Raleigh, Nashville, and Atlanta. Collectively, these markets account for about 60% of their net operating income ("NOI").

Similar to other office operators, shares have continued declining over the past year. And since my last update, shares have declined 19%. The broader S&P (SPY), on the other hand, is up 5% over the same period.

Seeking Alpha - Basic Trading Data Of HIW Over Past 1-YR

Despite the perennial weakness in the stock, I continue to remain bullish. In my view, the downside risks are overly priced in. While the company does face the same operating threats as others, I view HIW as better positioned to weather the challenges. Positive leasing activity, a sizeable liquidity position with recently reaffirmed investment-grade ratings, and their overall valuation are a few factors that reinforce my conviction in the stock.

Lower Occupancy But Still Better Than Others In Their Submarkets

At the end of the first fiscal quarter, consolidated occupancy landed at 89.6%. This was lower than in prior periods due in part to a large known move-out in their Nashville market, one that has already been backfilled.

Despite the lower occupancy levels, their portfolio continues to outperform their competition. The occupancy gap between HIW and their peers within their submarkets, for example, presently stands at about 600 basis points ("bps"). This is up from 490bps since the start of the COVID-19 pandemic.

Leasing Activity Remains Healthy

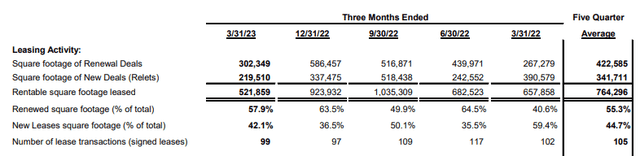

Total leasing volume amounted to 520K SF during the quarter, 220K of which was related to new leases. Rent spreads were up 2% on a cash basis and average rental rates were 3% higher than they were a year ago.

While their total leasing volume was lower than in prior periods and their five-quarter average, the overall number of leases signed remained stable at about 100. This is promising, considering that the number of leases signed is typically lower in the first quarter of the year due to the rush of signings that typically occur prior to year end.

Q1FY23 Investor Supplement - Summary Of Leasing Activity By Quarter

HIW is also continuing to see strong interest from smaller and medium-sized organizations. Also notable is that the number of expansions outpaced contractions by a 5:1 ratio.

Active Developments Remain On Target

On the development front, HIW's +$518M development pipeline is progressing as expected, with all projects on time and on budget. Collectively, these projects are 22% pre-leased, with about two years until projected stabilization across their more speculative projects.

Overall, HIW expects these projects to generate +$40M in NOI upon stabilization.

Their next delivery is their 2827 Peachtree project in Atlanta, which is expected to come online in the third quarter, with projected stabilization in the first quarter of fiscal 2025. At present, the project is 88% pre-leased. This is up from 75% at year end.

Supportive Balance Sheet And Liquidity Position

From a funding standpoint, there is +$320M left to fund in their pipeline of developments. Given their current liquidity position, which presently stands in the +$700M range, there is more than enough to fund their remaining commitments for their active developments.

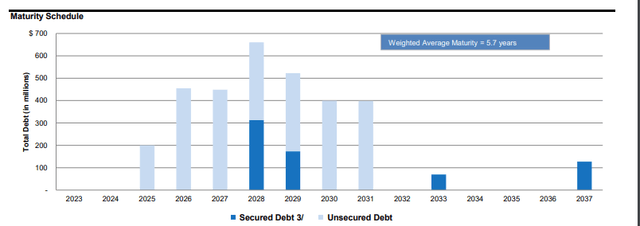

A well laddered maturity schedule, with no near-term maturities, provides further confidence of their ability to meet their reoccurring obligations.

Q1FY23 Investor Supplement - Debt Maturity Schedule

At the end of the quarter, HIW sported a net debt to EBITDA multiple of 5.9x, which is flat from year end, despite continued commitments on their development pipeline and no meaningful disposition proceeds.

In addition, they remained active in the capital markets, securing a +$200M, 5-year interest-only secured mortgage with a 5.69% interest rate.

Despite the secured nature of this debt raise, which was primarily related to the better economics in relation to the unsecured alternative, their overall asset pool remains largely unencumbered. In addition, their investment-grade ratings were recently reaffirmed by both their rating agencies with stable outlooks.

While it was a quieter quarter overall on the transactional front, HIW does expect activity to pick up later in the year, particularly in asset dispositions, which could potentially reach +$400M. It's acknowledged, however, that this upper boundary could be out of reach, given the current capital markets.

Positive Results And Favorable Revisions To Guidance

In the first fiscal quarter of the year, HIW generated funds from operations ("FFO") of $0.98/share. And same-property cash NOI grew 0.8%. This is despite lower occupancy levels.

And looking ahead, HIW sees full year FFO at $3.75/share. This would be up about a penny at the midpoint since their initial outlook in February. Same-property cash NOI was also revised upwards, up 25bps at the midpoint to ($0.75)/share.

Why HIW Is A Buy

HIW is not immune from the multitude of threats facing the broader office sector. But they remain better positioned than most.

Current consolidated leased rates, for example, are down 170bps YOY and 160bps sequentially. Yet this still outperforms their submarkets by nearly 600bps. And compared to the national average, it outperforms by 750bps.

Aside from occupancy levels, an incoming wall of maturities is another concern on the minds of many. And this is a valid concern. In fact, just this week, it was reported that a large Los Angeles office owner operated by Brookfield Asset Management (BAM) is currently facing the risk of foreclosure on five of their office buildings. This is according to reporting by The Wall Street Journal.

And looking ahead, with office values on the decline, it's more likely than not that many operators will simply walk away from their properties. This could, consequently, create headwinds for those in the sector looking to refinance in the nearer term.

Highwoods, however, has time on their side. Their debt ladder is skewed heavily towards later periods. And their next maturity is not until fiscal year 2025. They also have sufficient liquidity to meet all their reoccurring obligations, including their dividend payout, in the interim.

The current payout yields about 8.75%, and I view it as safe, considering its conservative payout ratio of about 53% of FFO. Additionally, financial statement net income is currently tracking ahead of last year's run rate.

And while this is not the same as taxable income, it still provides an indicator of where taxable income may end up for the year, which is important since the payout could be reduced or suspended for tax purposes, as was the case for Vornado (VNO). Given that there hasn't been a notable decline in financial statement net income, however, I don't view taxable income being an issue for HIW.

As an overall protective measure, HIW's total portfolio is also more diversified across tenants and industries. In addition, management conveyed that current leasing activity and interest is greater among small and medium-sized organizations, which is notable for two reasons.

First, smaller/medium-sized tenants are the ones most likely to prefer in-person work due simply to their more limited resources in accommodating hybrid requests.

And second, HIW is more likely to be the party with greater negotiating power due to advantages afforded to them by their scale and size. This, therefore, provides a protective buffer against declining rent spreads.

True, net effective rents after their capital and operating expenditures did decline on a sequential basis, but they were still up YOY.

The failure of their sizeable development pipeline to lease up as expected is one potential risk that could cause shares to underperform in future periods. Two projects set to deliver in the current fiscal year, for example, are currently less than 20% pre-leased.

In addition, HIW could experience continued weakness in renewals in the periods ahead. As one example, in their most recent quarterly filing, it was disclosed that Georgia's Department of Revenue, which currently occupies 255K SF of space in one of their Atlanta properties, would reduce their spacing needs by approximately 60% upon expiration of their current lease. Additionally, a complete nonrenewal was also listed as a distinct possibility.

The impending future vacancy now leaves HIW in the difficult position of backfilling the space, which presently is non-core, older, and need of renovation. They could potentially convert it to multi-family or outright sell it, but there's no guarantee that either would fully offset or mitigate their losses.

All considered, I continue to view HIW favorably. Declines over the past year have left shares down nearly 50%. And I believe much of the downside is already priced in, if not overly so.

Consistent with my prior view on the stock, I continue to believe shares are overdue for a course correction higher. Even a modest revision higher in their forward multiple to the 8x range would suggest upside potential of over 30%. And even then, shares would still trade at an implied cap rate of about 9%, which is still too high in relation to their higher-quality portfolio of assets. As such, I am maintaining a bullish view on HIW following recently released results.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of HIW, VNO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.