Leggett & Platt Q1 Earnings: Don't Worry, Just A Little Nervous

Summary

- Leggett & Platt, the diversified manufacturer of consumer durable and industrial products, reported its first quarter results yesterday, May 01, 2023.

- In this update, I review the company's results and provide an update on its balance sheet and liquidity position.

- The article focuses on cash flow. Recall that 2021 was the first year in the last 34 years that the dividend was not covered by free cash flow.

- Finally, I will assess the safety of the dividend and show how Leggett & Platt management has already hinted at the 52nd dividend increase back in February.

Akhmad Bayuri/iStock via Getty Images

Introduction

Arguably, there have been easier times for a company like Leggett & Platt, Incorporated (NYSE:LEG), which is largely exposed to durable consumer goods and industrial components. Coming out of the pandemic, same as many other companies, Leggett was significantly impacted by supply chain disruptions and a challenging labor market. Combined with the effects of high inflation and deteriorating consumer sentiment, it's no wonder Leggett & Platt stock is trading near its 52-week low.

The company, best known for its bedding products, reported its first-quarter results yesterday, May 01, 2023. Investors reacted positively to the results, despite the fact that sales fell 8% year-over-year and earnings per share were down 41% compared to the first quarter of 2022.

In this update, I will highlight possible reasons for the improved investor sentiment, taking a look at earnings and especially cash flow. Recall that 2021 was the first year Leggett & Platt failed to cover its dividend with free cash flow. I will also briefly discuss the company's updated balance sheet and liquidity situation, and conclude with my expectations for Leggett & Platt's dividend going forward.

Leggett & Platt Q1 Earnings - Were Analysts Too Conservative?

Prior to the Q1 earnings announcement, I noticed that analysts were increasingly negative about the company's 2023 outlook (Figure 1). Six months ago, analysts were expecting first-quarter earnings per share (EPS) of approximately double the most recent estimate of $0.26 on a non-GAAP basis. The company beat that arguably conservative figure handily, reporting EPS of $0.39 without the need for any non-GAAP adjustments. The 41% year-over-year decline in EPS was primarily due to an 8% decline in sales (-11% excluding recent acquisitions) and a 221 basis point contraction in gross margin.

Recall from my previous articles, such as the March 2022 deep dive into Leggett's performance since 1999, that the company has never had a particularly high gross margin, but it maintains solid profitability through tight control of selling, general and administrative (SG&A) expenses. As such, this magnitude of decline may be considered worrisome, even as Leggett displayed solid pricing power not too long ago (see my Q2 2022 earnings review).

However, I think it's important to understand that Leggett's steel rod business acted as a counterweight last year, and steel rebar prices have been under quite a bit of pressure lately. In fact, the company attributed 3% of its sales decline to raw material-related price declines. Finally, it should not be forgotten that Leggett reported an even weaker gross margin of just 17.6% for the fourth quarter of 2022 in February.

Figure 1: Earnings estimate revisions for Leggett & Platt, Inc's [LEG] Q1 2023 earnings (obtained from Seeking Alpha's Premium Service)![Earnings estimate revisions for Leggett & Platt's [LEG] Q1 2023 earnings](https://static.seekingalpha.com/uploads/2023/5/2/49694823-16830390287182944.png)

In terms of sales, Leggett's Bedding Products (BP) segment was the worst performer, down 17% year-over-year. Given deteriorating consumer sentiment, high inflation, and management's cautious comments in previous earnings calls, this was largely to be expected. Furniture, Flooring & Textile Products (FFTP) also experienced a significant decline (-13% year-over-year). As these two segments accounted for 74% of sales in the first quarter, Leggett's Specialized Products (SP) segment, which is mainly comprised of car seat supports, motors, actuators, tubing for aerospace products and hydraulic cylinders, was understandably unable to offset the decline. The segment continues to perform well (sales and volumes increased 21% and 11%, respectively), confirming the ongoing recovery in the aerospace industry and solid demand from commercial customers in the hydraulic cylinder segment. Operating margins in the BP and FFTP segments contracted significantly (-560 and -240 basis points, respectively), due in part to lower metal margins in the Steel Rods sub-segment, while the SP segment reported a slight margin expansion to 8.9% from 7.8% in the year-ago quarter.

Overall, Leggett's operating margin declined 300 basis points and 160 basis points to 7.8% compared to the first quarter and full year 2022, respectively, due not only to commodity-related price declines, currency and timing issues, and difficulty passing on price increases, but also to higher SG&A expenses (+4% year-over-year). This trend was already evident in Q4 2022, when SG&A expenses increased by 10% year-over-year (p. 6, Q4 2022 earnings press release). As a company with good reviews on Glassdoor, I suspect that even in times of high inflation, management emphasizes retaining talent through appropriate compensation, so it will take some time for the company to fully absorb the rising costs. Nonetheless, confirming once again Leggett management's tendency to under-promise and over-deliver, first-quarter operating profitability was better than previously expected and therefore contributed to the earnings beat.

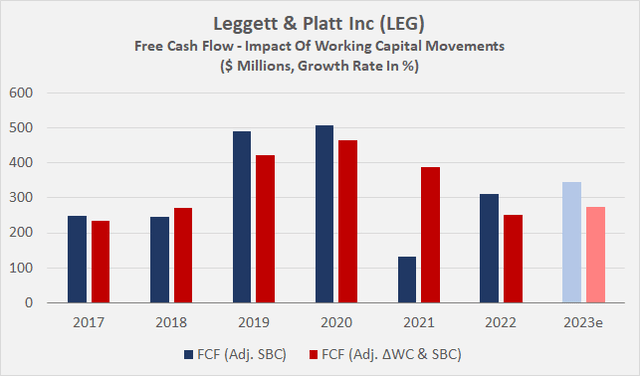

Compared to 2021, which was significantly impacted by working capital issues, operating cash flow recovered in 2022, up 63% to over $440 million. For 2023, management expects a further improvement to $475 million. However, Leggett's expected free cash flow (FCF) is still well below pre-pandemic levels. Figure 2 compares conventionally determined FCF after adjusting for stock-based compensation (SBC) to FCF after normalizing for the impact of working capital (three-year rolling average) and adjusting for SBC. So far in 2023, additions to working capital have been modest ($20 million vs. $114 million a year ago). Nonetheless, Leggett still suffers from an overhang of working capital, but the situation has improved to the point where the company's rather generous dividend is once again fully covered (see below).

Figure 2: Leggett & Platt, Inc's free cash flow, adjusted for stock-based compensation (blue) and in addition normalized with respect to working capital movements (red) (own work, based on the company's 2015 to 2022 10-Ks, the first quarter 2023 earnings press release and own estimates)

Management affirmed its previously issued EPS guidance of $1.50 to $1.90 against the backdrop of sales expected between $4.8 billion and $5.2 billion (down 7% to up 1% year-over-year). Considering that 2021 was a record year for Leggett in terms of sales, I am quite positive on the guidance, although the range underscores the high uncertainties and Leggett's cyclical nature, as well as the volatile demand situation.

Is Leggett & Platt's Balance Sheet Still Holding Up?

As I mentioned in my September 2022 article, Leggett has amended its debt covenants in 2020 and 2021 to allow for more flexibility. The updated covenants allow for a debt-to-EBITDA ratio of 3.5x net debt to EBTIDA (previously 2.5x and a gross debt perspective). At the end of Q1 2023, Leggett's leverage ratio was 2.88x adjusted trailing twelve-month EBTIDA, which represents still adequate headroom (Figure 3). The company has no significant debt maturities until 2024, and liquidity was ample as well, but has been declining since the first quarter of 2022 (Figure 4). While it is important to keep an eye on the company's liquidity, I would argue that Leggett & Platt's management has a multi-decade track record of dealing with challenging environments. It should also be remembered that operating cash flow was relatively weak in the first quarter of 2023 ($97 million) and additional cash inflows of $350 million to $400 million are expected for the remainder of the year.

In addition, it is worth noting that Moody's has so far seen no reason to put Leggett's credit rating on watch for potential downgrade. In fact, since the downgrade from Baa1 in April 2020, the company's credit rating has been maintained at Baa2 (BBB S&P equivalent) with a stable outlook.

Figure 3: Leggett & Platt, Inc's [LEG] leverage in terms of net debt to trailing twelve-month adjusted EBITDA (own work, based on the company's quarterly and full year earnings press releases) Figure 4: Leggett & Platt, Inc's [LEG] liquidity at the end of each quarter (own work, based on the company's quarterly and full year earnings press releases)![Leggett & Platt, Inc's [LEG] leverage in terms of net debt to trailing twelve-month adjusted EBITDA](https://static.seekingalpha.com/uploads/2023/5/2/49694823-16830435567784584.png)

![Leggett & Platt, Inc's [LEG] liquidity at the end of each quarter](https://static.seekingalpha.com/uploads/2023/5/2/49694823-16830435818743732.png)

LEG Stock Dividend

For Leggett & Platt, 2022 marked the 51st consecutive year of dividend increases. This ignores the fact that the company did not increase its dividend in May 2020, but in my view, this is entirely understandable given the prevailing uncertainties during the height of the pandemic and Leggett's exposure to the leisure and office sectors. It definitely takes a lot to achieve such a track record, especially considering the cyclicality of the underlying business. In my view, Leggett's unwavering commitment to growing dividends while maintaining a solid balance sheet underscores management's forward-thinking and conservative, yet shareholder-friendly, attitude.

While investors were somewhat shocked by the abrupt decline of cash flow in 2021, and some even thought the dividend would be cut, management stood by its commitment. With working capital recovering and cash flow conversion returning to more normal levels, I think it is reasonable to expect another dividend increase in two weeks. In fact, management hinted at an increase back in February when it issued 2023 guidance. Management anticipates a $240 million dividend payout and likely no material share repurchases, which equates to a 4% to 5% dividend increase, depending on the number of shares outstanding (i.e., dilution via performance shares). Figure 5 shows Leggett's dividend costs since 2017 in absolute dollar amounts, which serves as a fairly good proxy for dividend growth based on expected full-year costs. Note that cash spent on share repurchases is shown to illustrate the effect of a more or less significant reduction in the number of shares outstanding. In 2018, for example, dividend costs increased by 4.4%, while dividends per share increased by 5.9% - the company bought back a significant number of its own shares in the previous year. As an aside, the increase in dividend costs in 2020 (LEG did not increase its dividend in that year) is due to the timing of dividend increases (usually in mid-May, while the fiscal year ends on December 31) and a slightly higher number of outstanding shares entitled to dividends.

Figure 5: Leggett & Platt, Inc's [LEG] cash dividends in absolute numbers and cash flow related to share buybacks, netted with proceeds from share issuances (own work, based on the company's 2017 to 2022 10-Ks and the first quarter 2023 earnings presentation)![Leggett & Platt, Inc's [LEG] cash dividends in absolute numbers and cash flow related to share buybacks, netted with proceeds from share issuances](https://static.seekingalpha.com/uploads/2023/5/2/49694823-16830393183373299.png)

With this in mind, and given that Leggett's cash earnings improved significantly in 2022 compared to 2021 and should continue to recover throughout the remainder of 2023, I see no reason for the company to skip its expected dividend increase in two weeks, or worse, cut its dividend. However, if the widely expected recession proves to be prolonged, with severe effects on consumer disposable income, I think Leggett will have to cut its dividend at some point. Nevertheless, and I have already discussed this at length in previous articles, Leggett & Platt's management is one of the most shareholder-focused and candid I know, and I am confident that management would not cut the dividend lightly.

Concluding Remarks

All in all, I think Leggett & Platt, Incorporated continues to manage this difficult environment well. The challenges are obvious and have been transparently communicated to shareholders over the past several quarters. As I have highlighted in my previous articles, the candor and transparency of Leggett's management is a key reason why I am confident as a shareholder.

Cash flow recovered as expected in 2022 and will continue to recover in 2023, although I believe it will take a few years for Leggett to return to pre-pandemic cash flow levels - after all, it is a cyclical company with a high proportion of big-ticket items that can be deferred. In addition, earnings are indirectly impacted by higher interest rates via higher mortgage rates as well as a weakening housing market.

Against this backdrop, Leggett's results were actually quite solid, in my opinion. As I've pointed out in the past, I'm a big proponent of management's decision to vertically integrate its Bedding Products division, even if the synergies aren't really visible yet. At the risk of sounding like someone who views the world through rose-colored glasses, I think the period following the Elite Comfort Solutions (ECS) acquisition has been and continues to be very difficult for Leggett. Therefore, to dismiss the transaction as a failure without considering the past and ongoing challenges is unfair, in my opinion.

Given the strong rebound in free cash flow in 2022 and the expected continued recovery in 2023, as well as the adequate liquidity position, I view the Leggett & Platt dividend as safe and expect the company to announce its 52nd increase in about two weeks. In fact, management already hinted at the increase when it issued its 2023 guidance in February. With another expected $0.08 annualized increase, investors buying LEG shares today can lock in a forward dividend yield of 5.8% based on today's (May 02, 2023) share price of about $32. This is well above the stock's five-year average dividend yield of 4.04%.

In conclusion, I continue to sleep very well with my position in Leggett & Platt, Incorporated, which currently accounts for 0.9% of my portfolio. However, given the cyclical nature of the company, I do not intend to increase the position to more than 1.0% to 1.2%.

As always, please consider this article only as a first step in your own due diligence. Thank you for taking the time to read my latest article. Whether you agree or disagree with my conclusions, I always welcome your opinion and feedback in the comments below. And if there is anything I should improve or expand on in future articles, drop me a line as well.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LEG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The contents of this article and my comments are for informational purposes only and may not be considered investment and/or tax advice. I am neither a licensed investment advisor nor a licensed tax advisor. Furthermore, I am not an expert on taxes and related laws - neither in relation to the U.S. nor other geographies/jurisdictions. It is not my intention to give financial and/or tax advice and I am in no way qualified to do so. I cannot be held responsible and accept no liability whatsoever for any errors, omissions, or for consequences resulting from the enclosed information. The writing reflects my personal opinion at the time of writing. If you intend to invest in the stocks or other investment vehicles mentioned in this article – or in any form of investment vehicle generally – please consult your licensed investment advisor. If uncertain about tax-related implications, please consult your licensed tax advisor.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.