Can CVS Health maintain earnings beat run amid Q1 seeing M&A focus?

Sundry Photography/iStock Editorial via Getty Images

CVS Health (NYSE:CVS) is scheduled to announce Q1 earnings results on Wednesday, May 3rd, before market open.

The consensus EPS Estimate is $2.09 (-5.9% Y/Y) and the consensus Revenue Estimate is $80.84B (+5.2% Y/Y).

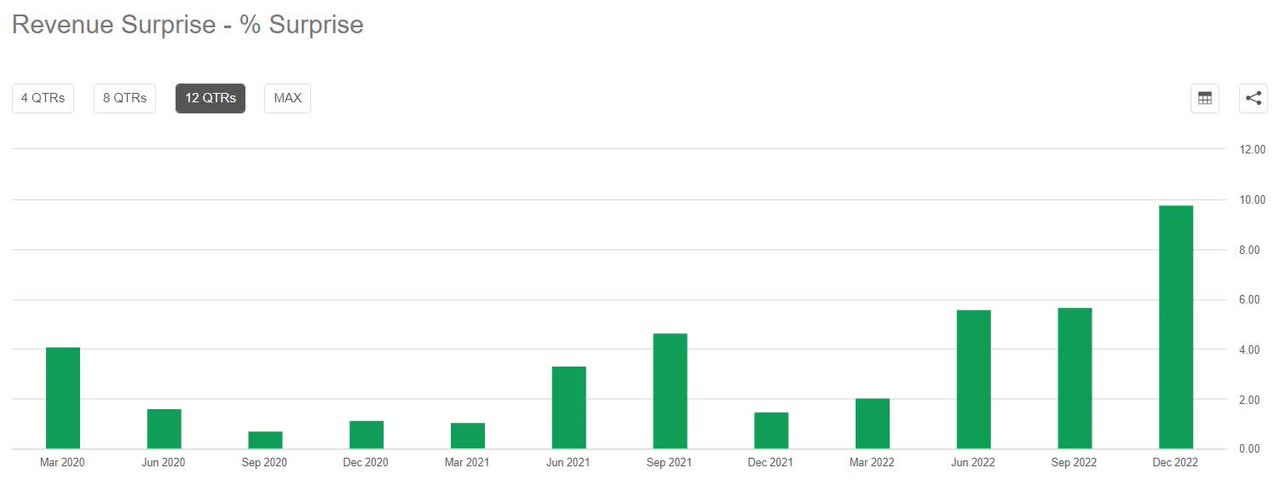

Over the last 2 years, CVS has beaten EPS estimates 100% of the time and has beaten revenue estimates 100% of the time.

Over the last 3 months, EPS estimates have seen 1 upward revision and 12 downward. Revenue estimates have seen 9 upward revisions and 0 downward.

CVS' stock rose +3.47% on Feb. 8 after Q4 results beat estimates and reaffirmed its 2023 adjusted EPS outlook. The day also saw CVS announce the acquisition of Oak Street Health in an all-cash deal, representing an enterprise value of ~$10.6B.

The deal, however, is under a lens as in March, Sen. Elizabeth Warren urged the Federal Trade Commission to closely scrutinize the transaction.

CVS has been busy in the M&A arena and the quarter witnessed the company completing the acquisition of home-healthcare provider Signify Health.

The drug retailer was among the companies, including Walgreens and Rite Aid, which came under lawmaker scrutiny over the retail distribution of mifepristone. However, the U.S. Supreme Court's decision to continue to allow access to mifepristone for the time being.

The decision gave more clarity on the drug's access after a Texas federal judge's ruling, which would have halted the sales of the medicine.

YTD, CVS' stock has taken a hit and has lost ~22%, see chart here. The SA Quant Rating on CVS is Hold, but the average Wall Street Analysts' Rating differs with a Buy rating.