PGF: Preferred Shares From Mega-Cap Financial Services Companies

Summary

- The Invesco Financial Preferred ETF is a fixed-income exchange-traded fund.

- The fund focuses on fixed rate preferred shares issued by 'mega-cap' financial institutions.

- The vehicle had a very poor performance in 2022 due to the sharp rise in risk-free rates.

- This ETF is not a true buy-and-hold vehicle, but a cyclical play on rates and credit spreads.

courtneyk

Thesis

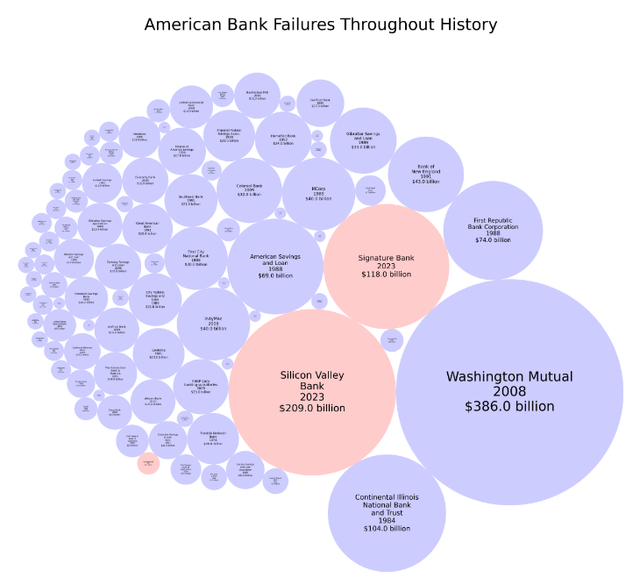

The Invesco Financial Preferred ETF (NYSEARCA:PGF) is a fixed income exchange traded fund. The vehicle focuses on fixed rate preferred shares issued by financial services companies. This is a sector which has been in the news as of late, the market having experienced some of the largest bank defaults since the Great Financial Crisis of 2008-2009:

Bank Failures (Edmonton Capital)

The defaults have resulted in the complete wipe-out of the existing capital structure, including preferred equity and senior notes for the impacted banks. We believe these events have had the following consequences:

- on one hand they have structurally increased spreads in the financials preferred equity sectors

- secondly, they have offered better pricing for the 'too big to fail' mega-banks

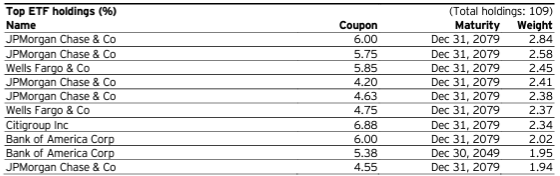

PGF focuses on fixed rate preferred equities, and its top holdings come solely from the largest financial institutions:

The Invesco Financial Preferred ETF is based on the ICE Exchange-Listed Fixed Rate Financial Preferred Securities Index (Index). The Fund generally will invest at least 90% of its total assets in fixed rate U.S. dollar preferred securities issued in the U.S. domestic market by financial companies. The Index is designed to track the performance of exchange-listed fixed rate U.S. dollar preferred securities, and securities that the Index Provider believes are functionally equivalent to preferred securities issued by US financial companies, such as banking, brokerage, finance, investment and insurance . The Fund and the Index are rebalanced monthly.

The fund is therefore subject to both interest rate risk as well as credit spread risk. The fund mitigates some of its credit riskiness by being overweight the most systemically important U.S. financial institutions, namely JP Morgan, Wells Fargo, Citigroup and Bank of America. When passing through the portfolio we noticed the vast majority of the names there fall in the 'mega cap' space. Think about PGF as an alternative to just buying outright an individual preferred issuance from the likes of JPMorgan or Bank of America, with the added benefit of diversification.

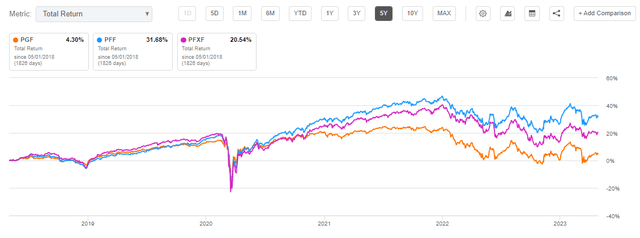

When looking at its performance the fund does not qualify as a viable long term buy and hold instrument. On a 5-year basis its total return is extremely modest, especially compared to its peers. This vehicle is a play on a recovery driven by lower rates, rather something to buy and hold for prolonged periods of time. We can see the poor long term performance also reflected in the fund analytics, with a high standard deviation of 13.7% and a negative Sharpe ratio.

Analytics

- AUM: $1.1 bil.

- Sharpe Ratio: -0.14 (3Y).

- Std. Deviation: 13.7 (3Y).

- Yield: 5.8%

- Premium/Discount to NAV: %

- Z-Stat: n/a

- Leverage Ratio: 0%

- Composition: Fixed Income - Preferred Shares Financials

- Duration: 4.4 yrs

Holdings

Its top holdings come solely from the largest, most systemically important U.S. financial institutions:

Top Holding (Fund Fact Sheet)

The top holdings account for over 23% of the fund and represent the cornerstones of American banking.

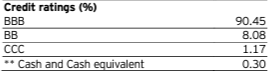

The fund tends to focus on investment grade securities:

Ratings (Fund Fact Sheet)

Some of the underlying securities have split ratings (meaning they are rated investment grade by one of the rating agencies but not the other). The portfolio nonetheless can be considered very high grade when compared to other funds.

Performance

This fund is impacted by both rates and credit spreads, and it tends to outperform post-recessionary periods:

We can see the fund having a high positive performance in 2019 when the Fed started lowering rates substantially. The fund had a horrendous 2022, mainly driven by the violent increase in rates.

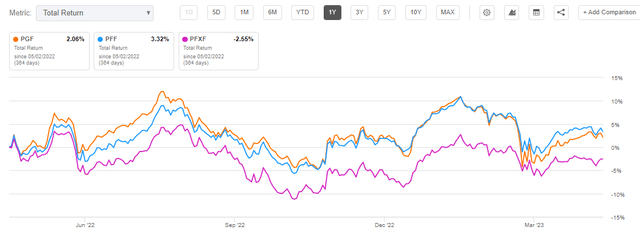

The fund has done very well in the past year versus its peers:

1-Year Total Return (Seeking Alpha)

However, the vehicle is not a true long term buy and hold instrument:

We can see that on a 5-year time-frame the fund is flat from a total return perspective. That is a very poor performance.

Conclusion

PGF is a fund focused on fixed rate preferred equities. The vehicle invests exclusively in the financial services sector and has an overweight position in investment grade securities which account for over 90% of the portfolio. This fund tends to focus on the 'mega-caps' in the financial services space. The top holdings account for over 23% of the fund and represent issuances from JPMorgan, Bank of America, Citigroup, and Wells Fargo. The rest of the portfolio looks similar in terms of the market value of the issuing entities.

Via its composition, the vehicle is subject to both interest rate and credit spread risk. The fund was highly impacted by rising rates in 2022, accounting for a large part of its -19% performance. Long term this fund is not an appropriate buy and hold vehicle, exhibiting a mediocre performance when compared to its peers. The best way to use this instrument is represented by a play on lower rates and credit spreads. We think the current yield (30-day SEC yield) for the fund is too low. We would buy when it goes above 6% and hold until the end of 2024, targeting a total return exceeding 12%. We are on Hold until then.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.