Fortinet: An Undervalued Cybersecurity Leader

Summary

- Fortinet delivered stellar financial performance over the last decade, which for me suggests that the management is strong and able to capture market share growth.

- The company has a solid position to benefit from the trend of a significant pace of growth for the cybersecurity industry given the secular shift toward digitalization.

- My valuation analysis suggests FTNT stock is substantially undervalued.

Sundry Photography

Investment thesis

Fortinet (NASDAQ:FTNT) has an impressive track revenue of consistent revenue growth and innovative product development, enabling the company to maintain and expand profitability margins. The cybersecurity market is expected to keep double-digit growth despite current severe headwinds in the macro environment, and FTNT is expected to outpace the level of industry growth. Valuation suggests the stock is undervalued, and I have high conviction that the cybersecurity industry is a safe harbor in the technology sector. All these factors together, in my opinion, suggest the stock is a compelling investment opportunity.

Company information

Fortinet is one of the largest global cybersecurity companies, offering a wide range of products and services to help clients protect their digital assets. The company was founded in 2000 and headquartered in Sunnyvale, California. Fortinet operates in more than 100 countries worldwide.

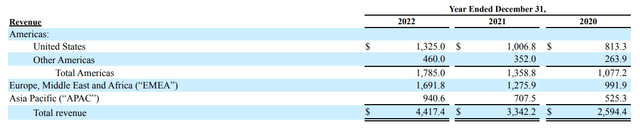

Fortinet 10-K

The company's flagship product is the FortiGate security tool which provides a unified threat management platform that includes a firewall, VPN, antivirus, intrusion prevention, and application control capabilities.

The company's fiscal year ends in December; FTNT operates and reports in one operating segment.

Financials

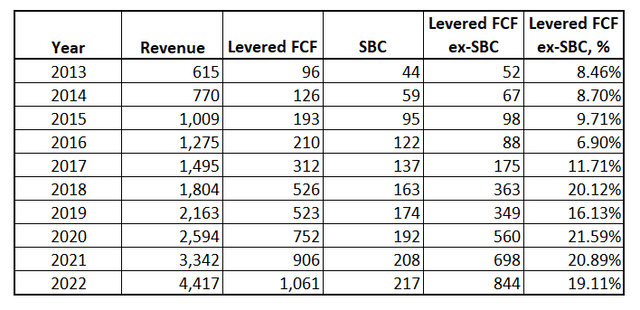

The company's financial performance has been nothing but stellar over the last decade. Revenue increased from $615 million in FY 2013 to $4.4 billion in FY 2022, representing an impressive CAGR of about 22%.

The company also demonstrated awe-inspiring profitability growth. Both gross and operating margins also showed substantial expansion during the last ten years. Gross profit margin increased from about 71% in FY 2013 to almost 76% in FY 2022. Operating margin nearly doubled over the decade - from 12% to 22%, which I believe is impressive.

Cash flow also matters a lot for me when I evaluate the investment opportunity. From this perspective, FTNT also delivered a stellar performance with a free cash flow [FCF] margin expanding significantly over the decade. Please notice that for FCF margin calculation purposes, I eliminated stock-based compensation [FCF].

Author's calculations

Narrowing down to the latest reported quarter, which was announced on February 7, the company slightly missed on revenue and delivered a slight EPS beat of consensus estimates. Despite a little miss in revenue, I believe that quarterly sales were solid since YoY growth comprised 33.15%. Sequential revenue growth was 11.3%, which I consider decent given the challenging macro environment. I will not dig more profound into the Q4 2022 earnings because the company is expected to announce its first-quarter financials very soon, on May 4.

Therefore, I would prefer to discuss upcoming earnings in more detail. Consensus estimates forecast $1.2 billion in sales for Q1 2023, which means a 25.6% YoY growth. It indicates a notable deceleration in revenue growth, but I still believe the growth pace is impressive. What is also important here is the fact that there will be a sequential 6% drop in revenue and about 35% decrease in EPS on QoQ basis. According to the latest earnings call, management also expects a dip in the backlog. For the full year 2023, the company expects a 22% revenue increase. Keith Jensen, the CFO, also reiterated the company's long-term financial goals to achieve $8 billion in sales in FY 2025 with a free cash flow margin of 35%.

I share the optimism of the company's management. While it is evident that cybersecurity is not bulletproof against the current challenging macro environment, the expected earnings dynamic suggests that the industry is a relatively safe harbor in the Technology sector. According to csoonline.com, 65% of responded organizations plan to increase cybersecurity spending in 2023 while in terms of broader IT spending a lower 53% plan to increase spending. This research was conducted in late 2022 when respondents were well aware of the economic headwinds and built appropriate assumptions into their budget planning. These figures suggest that cybersecurity is the top priority in corporate IT structures.

Also, I would like to highlight that according to Canalys' latest cybersecurity forecasts, total global cybersecurity spending will increase by 13.2% in 2023. The fact that FTNT revenue is highly likely to outpace the overall cybersecurity global market growth substantially means that the company is expected to increase its market share, which is a robust fundamental signal for long-term investors.

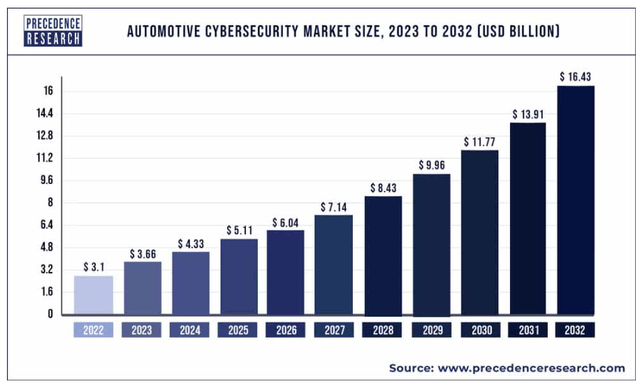

If we look at the cybersecurity industry growth perspectives over the longer term, Precedence Research suggests that the industry is expected to grow at an 18% CAGR between 2023 and 2032. This means that achieving an $8 billion revenue for the company by FY 2025 is doable given the fact that FTNT outpaces the broad industry growth rate.

Precedence Research

Overall, I am very positive about the company's financials. The company may experience some short-term headwinds in the nearest couple of quarters, but over the longer term, increasing their cybersecurity spending seems inevitable for businesses. Increased digitalization and more remote work mean increased cyber threats for businesses. The cost of cyber-attacks can be substantial, including not only financial losses but also reputational damage and litigation risks. Investing in cybersecurity measures is relatively small compared to the potential cost of a cyber-attack.

Valuation

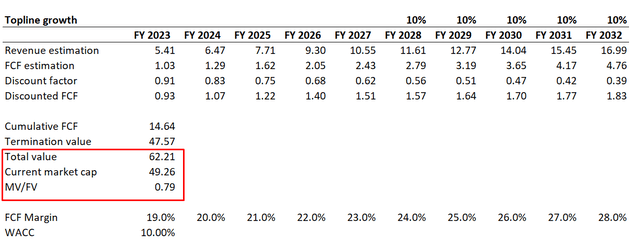

FTNT is a growth stock that does not pay dividends, so for valuation, I use discounted cash flow [DCF] approach together with historical multiples analysis.

For DCF, I need to project the company's future cash flows which will be discounted. For the discount rate I use WACC, which is provided by GuruFocus, and round it up to 10%. For future cash flows, I have consensus revenue estimates up to FY 2027, I implement a conservative decelerated revenue growth of 10% between FY 2028 and 2032. To derive future cash flows, revenues are multiplied by the FCF margin which I expect in 2023 to be at 19% level and expand by 1 percentage point every year.

Author's calculations

Incorporating all these assumptions into my DCF calculation template gives me a fair company's business valued at $62 billion, which is about 20% higher than the current market cap, suggesting substantial undervaluation.

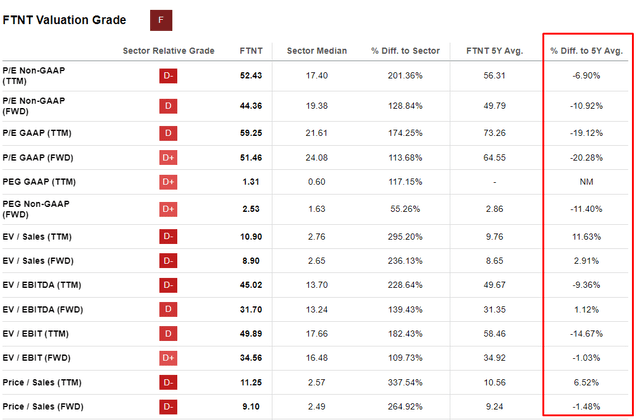

Seeking Alpha Quant assigned FTNT stock the lowest possible valuation grade of "F", which is due to much higher multiples of the company than the sector median demonstrates. But FTNT is a leading company with a unique product proposition to the market, so I believe we should compare FTNT with its historical averages, which are currently mostly below historicals across the board.

Seeking Alpha

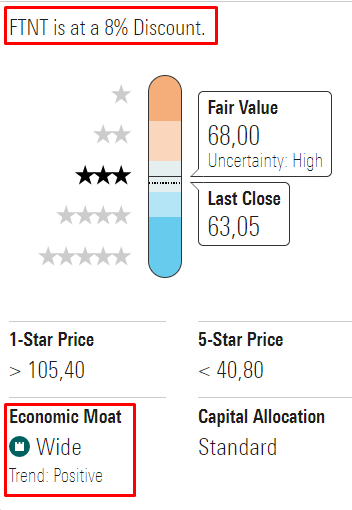

Last but not least, to cross-check myself I refer to Morningstar Premium. According to Morningstar fair value estimations, the stock is currently traded at an 8% discount with a wide economic moat trended positively.

Morningstar Premium

To sum up valuation, I believe that FTNT stock is attractively valued with a solid margin of safety.

Risks to consider

While FTNT looks attractive, potential investors should evaluate risks before buying the company's stocks.

First of all, cyber breaches, which Fortinet's software will not prevent will lead to a significant loss of reputation. While the company invests heavily in its own cybersecurity measures, there is always a risk of a successful attack that could result in substantial financial losses or reputational damage.

Second, the company faces fierce competition with other strong companies like Cisco Systems (CSCO), Palo Alto Networks (PANW) or Check Point Software (CHKP). Increased competition affects the company in two ways. With intense competition, the company's pricing is under pressure which can affect profitability. Also, fierce competition means that the company cannot afford to fall behind competitors regarding technological advantages. If the company fails to keep up with technological trends it will inevitably compromise the quality of its cybersecurity solutions.

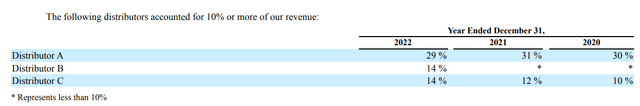

Third, the company relies heavily on a few large distributors, which means a concentration risk. Any of these distributors switching to a competitor could significantly impact financial performance. According to the company's latest 10-K, just three distributors represented 57% of FTNT total sales.

Fortinet 10-K

Bottom line

To conclude, I believe that FTNT stock is a buy. I am highly convinced because the management has a proven track record of delivering solid results and capturing market share. The cybersecurity industry is expected to grow substantially over the next decade, and the stock is undervalued at the moment, which is suggested by my valuation analysis.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.