SolarEdge Q1 Preview: The Market Has Braced Itself

Summary

- SolarEdge Technologies, Inc. will report its Q1 2023 results tomorrow, after hours.

- I believe that SolarEdge's Q2 results have the potential to disappoint investors.

- I make the case that SolarEdge's Q2 revenue growth rates will probably decelerate to around 35- 38% CAGR. A meaningful slowdown from the exit rates in 2022.

- Why investors should stick with the stock, even if the SolarEdge Technologies, Inc. outlook disappoints.

- Looking for more investing ideas like this one? Get them exclusively at Deep Value Returns. Learn More »

Paul Bradbury

Investment Thesis

SolarEdge Technologies, Inc. (NASDAQ:SEDG) is about to report Q1 2023 results tomorrow, May 3, after hours. So far, its peers have reported disappointing results, which naturally means that SolarEdge is also likely to disappoint.

That being said, I argue that even if in the very near-term SolarEdge's prospects don't live up to consensus expectations, investors should not abandon the stock.

First Solar and Enphase Primed the Market

The bad news is this: SolarEdge's Q1 2023 results are quite likely to disappoint investors. More concretely, I believe that SolarEdge's guidance will show that demand for solar end markets, including small utility-scale solar installations, commercial, and residential, has normalized.

Indeed, I previously made the case that SolarEdge is well-positioned to participate in the rapid uptake of the need to monitor and maintain photovoltaic systems.

However, on the back of recent results from First Solar, Inc. (FSLR) and Enphase Energy, Inc. (ENPH) recent results, I now believe that I may have been too bullish on SolarEdge.

What's more, I also believe that analysts following this stock may also have been too bullish as we headed into this earnings season.

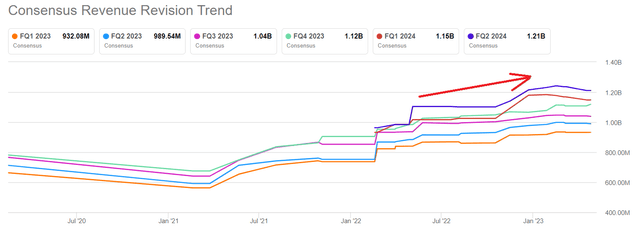

What you see above is that since the start of 2023, analysts have been steadily increasing SolarEdge's consensus revenue estimates. But having gone through both Enphase's and First Solar's recent results, I now believe that when SolarEdge guides for Q2 2023, SolarEdge's revenues will guide for less than $1 billion in revenues.

More concretely, I believe that SolarEdge guides for Q2 2023, investors will see a company that has gone from growing at around just under 60% CAGR in 2022, to probably growing at around 35%-38% CAGR in Q2 2023.

Put another way, I don't believe that investors are expecting this level of revenue growth rate deceleration for Q2 2023.

That could mean, that in the very near term, investors' expectations that SolarEdge is growing in the high 30s% CAGR will be misaligned with reality.

Next, let's discuss the good news.

The SolarEdge Long-Term Narrative Remains Intact

I'm now utterly convinced that the trend toward renewable energy will continue to gain traction. But let me be even more specific. I declare that Future Energy will continue to gain momentum, but it will come not through a linear increase in renewable energy sources but on the back of a step function.

researchgate.net

A step function is when the rate of adoption jumps. You can think about electricity and all the ramifications that came from it. Or you can think about the iPhone or cloud computing and electric vehicles ("EVs").

A step function is when things are happening at a constant rate, and then the pace of innovation suddenly jumps.

Much of the world already runs on electricity. Increasing electricity’s share of total energy through the adoption of electric vehicles and heat pumps will require a ramp-up in renewable energy supply. While at the same time, the world is actively seeking to decarbonize.

From nuclear prospects to solar panel manufacturers, energy security is no longer a buzzword. It's the vital backbone of our societies.

However, for a step function to take place, often times supply chains in the physical world need to be aligned. And from the commentary coming from First Solar, in particular, I'm not convinced that in the very near term SolarEdge will thrive.

That being said, the push to generate power in a carbon-free manner continues to gain momentum. And even if in the very near term, there's a slight slowdown in the trajectory for SolarEdge, I assert that investors shouldn't abandon the stock.

The Bottom Line

In the past week, SolarEdge Technologies, Inc. stock has already come down more than 10%. Meaning, that investor expectations have already to a substantial extent been de-risked.

Furthermore, compared with First Solar, SolarEdge's stock hasn't gone anywhere fast in the past couple of years. Meaning that investors' hope and expectations are not too high towards SolarEdge.

So, there's even less impetus to drop the stock if Q2's guidance isn't alluring since investors haven't been paying a premium for a story stock.

In conclusion, I argue that SolarEdge Technologies, Inc. is an attractive stock with around $1 billion of net cash.

While at the same time, I recognize that SolarEdge's capex requirements will mean that the bulk of its non-GAAP operating profits needs to be plowed back into the business. Thus, if SolarEdge's capex levels were to rapidly outgrow SolarEdge's revenue guidance, that could be something that could lead me to become less bullish on this stock, as SolarEdge's return on investment are not quite as compelling as their recent returns on investment.

However, for now, I'm bullish on SolarEdge Technologies, Inc. and suggest you stay bullish too.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities - stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

- Deep Value Returns' Marketplace continues to rapidly grow.

- Check out members' reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.

This article was written by

DEEP VALUE RETURNS: The only Marketplace with real performance. No gimmicks. I provide a hand-holding service. Plus regular stock updates.

We are all working together to compound returns.

WARNING: Any stocks that you feel like buying after discussions with me are your responsibility.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.