Vermilion Energy: Promising Market Outlook, Financials, And Risks

Summary

- Due to higher demand from China, oil prices in the second half of 2023 can be higher than in the first half.

- For the increasing exports of LNG from North America to the European Union and higher domestic consumption in the electricity sector, Henry Hub's natural gas prices can increase to $3/MMBtu.

- In 2022, the company used its high amount of FCF to fund some strategic acquisitions and reduced its net debt level.

- The improvement of VET’s interest coverage ratio indicates that the company can easily pay back interest on its outstanding debt and cover its obligations.

pandemin

Introduction

Vermilion Energy (NYSE:VET) faced challenges such as windfall tax and a milder winter in 2022, leading to a difficult period for investors. Despite this, the company performed well financially in the previous year. Although there was a decrease in free cash flow and FFO due to the one-time windfall tax in Europe, VET generated sufficient cash flow to fund strategic acquisitions and reduce net debt levels. The ongoing war in Ukraine and preparations for the winter season suggest increased demand for natural gas imports, which could boost VET's international FFO in 2H 2023. Additionally, crude oil production is increasing in the United States and Canada due to changing trade patterns following the war in Ukraine. EIA estimates that US and Canada's crude oil production will increase by 4.7% YoY and 4.2% YoY respectively in 2023. In my opinion, VET has significant upside potential and will experience more favorable conditions going forward. Therefore, I recommend buying this stock.

The market outlook

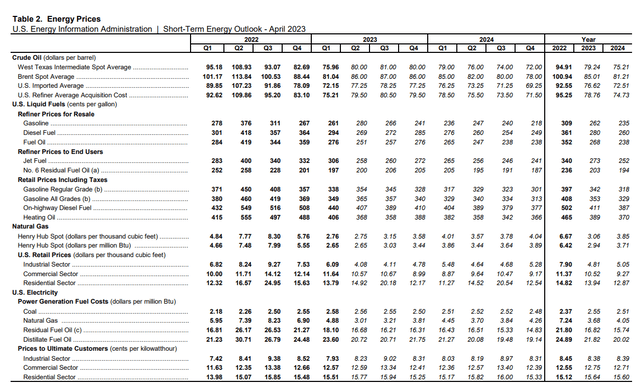

According to IEA April 2023 oil market report, world oil demand can increase to 101.9 mb/d in 2023. This estimation is higher than IEA estimations a few months ago. For example, in its October 2022 report, IEA estimated the world oil demand in 2023 to be 101.3 mb/d. The reopening of China supports the higher estimation of world crude oil demand. However, crude oil prices are now lower than six months ago, and due to the relative stability in the market, are not expected to remain flat in the near future. EIA expects Brent crude oil price to be about $86 per barrel in 2Q 2023, 3Q 2023, and 4Q 2023, which is slightly higher than in 1Q 2023 (see Figure 1). Higher oil prices in the second half of the year are supported by less global production, driven by OPEC+ production cuts. However, the recent issues in the banking sector and high interest rates to combat inflation can have a negative effect on global oil consumption., and offset the higher demand from China.

Furthermore, due to the mild winter in 1Q 2023, natural gas prices dropped significantly. Natural gas inventories are estimated to end the injection season (April-October) at 3.8 trillion cubic feet, 6% higher than the five-year average. However, due to rising demand for feed gas from Freeport LNG, and higher natural gas consumption in the electric power sector, natural gas prices in the second half of 2023, can be higher than in the first half. EIA expects Henry Hub's natural gas price to increase to more than $3.00/MMBtu in the second half of the year.

It is important to know that due to increasing natural gas demand from European Union (as a result of the continuing war in Ukraine), natural gas exports from North America to European counties are expected to increase in 2023 and 2024. EU's efforts to increase its natural gas storage (to get prepared for the winter season), can increase European Union natural gas import prices in the second half of the year. Thus, VET's international FFO in 2H 2023 can be stronger than in 1H 2023.

Figure 1 - Energy prices

VET performance and 2023 outlook

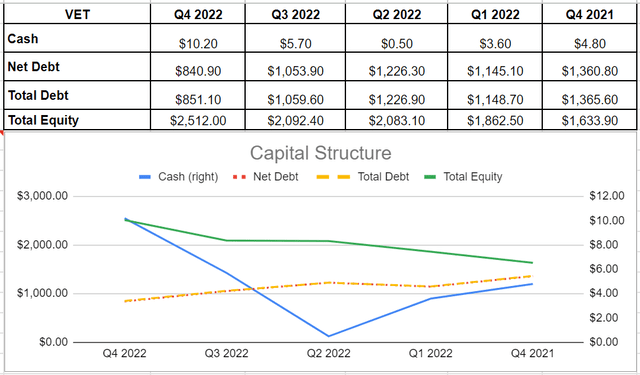

In the fourth quarter of 2022, E&D capital expenditures amounted to $169 million, resulting in a free cash flow of $115 million. However, if not for the temporary windfall tax, FCF would have been $338 million, slightly higher than the previous quarter. Despite being impacted by windfall taxes and hedging losses, the company generated a significant FCF of $1.1 billion in 2022, which was significantly higher than the previous year's $545 million. This allowed Vermilion to fund strategic acquisitions and reduce its net debt level from over $1.3 billion in 4Q 2021 to $841 million at the end of 2022 (see Figure 2).Furthermore, Vermilion allocated 11% of its FCF towards dividends and share buybacks, declaring $46 million in dividends and repurchasing 1.1 million shares in the first month of this year. The company plans to increase its dividend expenditures by 25% to $0.10 compared to the prior quarterly dividends. These actions demonstrate how actively management is working towards bringing returns to shareholders. Regarding the planned acquisitions, the Corrib acquisition is expected to contribute approximately 7000 boe/d of European gas production to the company's existing production by March 2023. This increased production, along with other sales agreements such as southeast Saskatchewan, will be used to reduce debt. As a result, Vermilion is projected to achieve its targeted net debt of $1.0 billion in 2023. Lowering debt levels will improve leverage conditions and enable more capital returns to shareholders.

Figure 2 - VET's capital structure

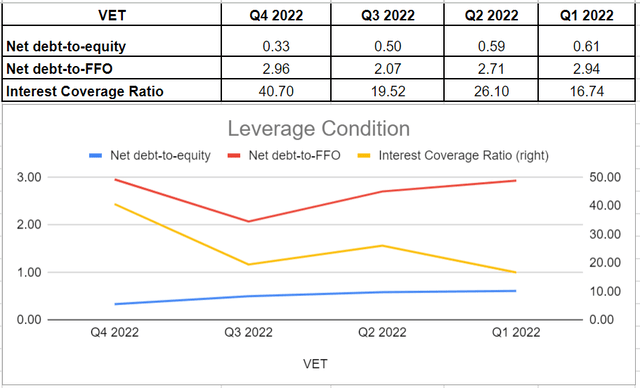

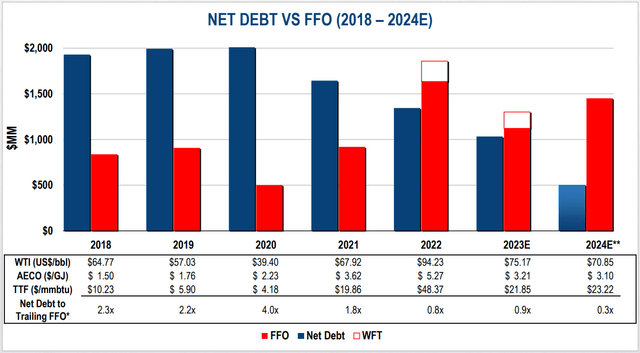

In order to achieve the company's goal of reducing debt levels, it is important to assess its leverage condition. In the fourth quarter of 2022, Vermilion Energy reported an FFO of $284 million, which was impacted by a European windfall tax of $223 million. However, if this tax had not been imposed, the company's FFO would have been consistent with the previous quarter at $507 million. While fluctuations in oil and gas prices can be unpredictable, analyzing VET's balance sheet structure suggests that reducing debt levels would be an effective way for management to improve leverage condition. Over the past year, Vermilion Energy has made progress in decreasing its leverage ratios. Figure 4 shows that the company aims to achieve a net debt-to-FFO ratio of 0.9x and 0.3x in 2023 and 2024 respectively. Additionally, other leverage ratios indicate that Vermilion Energy's condition has improved. Also, the interest coverage ratio reached its highest level of 40.7x in Q4, indicating that the company can easily pay back interest on outstanding debt and has no current liquidity issues. Finally, equity levels surged by over 53% to $2512 million in 2022, resulting in a drop in net debt-to-equity ratio to 0.33x. Overall, reducing debt levels appears to be an effective strategy for improving Vermilion Energy's leverage condition and achieving its financial goals. (see Figure 3).

Figure 3 - VET's leverage condition

Figure 4 - Net debt-to-FFO

VET's presentation as of April 2023

Risks

As an energy producer, Vermilion Energy is exposed to various risks that may impact its operations and financial performance. One of the primary risks is associated with higher operating costs and lower production levels, which may affect the company's profitability. Moreover, the oil and gas industry is constantly evolving, and Vermilion needs to keep up with technological advancements to remain competitive. However, implementing new technologies requires significant financial resources, which may put pressure on the company's finances. Another significant risk for Vermilion is related to regulations and politics. As the company operates in multiple countries, it may be subject to different government legislation concerning the oil and gas industry. For instance, Europe's windfall taxes on profits have affected Vermilion's operating cash flow considerably. The European Union has indicated a minimum tax rate of 33% on taxable profits above a 20% increase in average yearly taxable profits from 2018 to 2021. It remains uncertain whether this tax will continue through 2023 or whether similar regulations will be enforced in other countries where Vermilion operates. Furthermore, fluctuations in commodity prices, foreign exchange rates, interest rates, and production volumes may impact Vermilion's ability to pay dividends and buy back shares. Therefore, the company needs to manage these risks effectively to ensure sustainable growth and profitability in the long run.

Conclusion

Through this analysis, I have examined Vermilion Energy's financial performance over the past year and projected its financial conditions for 2023. Despite the inherent volatility of the oil and gas industry, the company has made efforts to enhance its solvency and leverage conditions by reducing its debt level. By aiming for a net debt level of $1.0 billion by the end of 2023, shareholders can expect higher capital returns. Based on Vermilion Energy's impressive financial performance in the previous year, I strongly recommend buying this stock.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.