CenterPoint Energy: Incrementalist Strategy Yields Security And Growth Amid Macro Volatility

Summary

- CenterPoint Energy has experienced superior 1Y performance (+1.52%) to both the market (SPY: +0.25%) as well as the general utilities index (-2.03%).

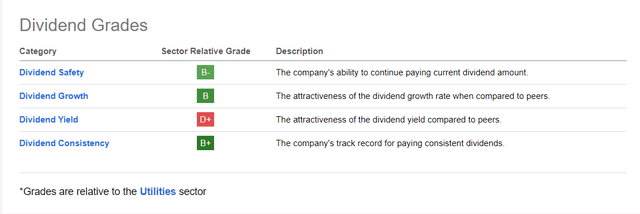

- This comes alongside a 2.49% dividend yield, complete with safety, consistency, and dividend growth built-in.

- As a utilities company, CenterPoint experiences lower implied volatility than the rest of the market.

- The company's growth comes from annual price hikes in addition to incremental improvements to both the company infrastructure and its offerings.

- Due to a relative undervaluation, the company's ability to return capital to shareholders in a stable fashion, and prospective long-term growth, I rate the company a 'buy'.

Brandon Bell

CenterPoint Energy (NYSE:CNP) is an American Fortune 500 electric and natural gas utility serving the states of Indiana, Ohio, Louisiana, Minnesota, Mississippi, and Texas.

In the TTM period, the company has recorded $9.34bn in sales, up 11.60% from 2021, alongside a TTM EBITDA of $2.92bn.

Introduction

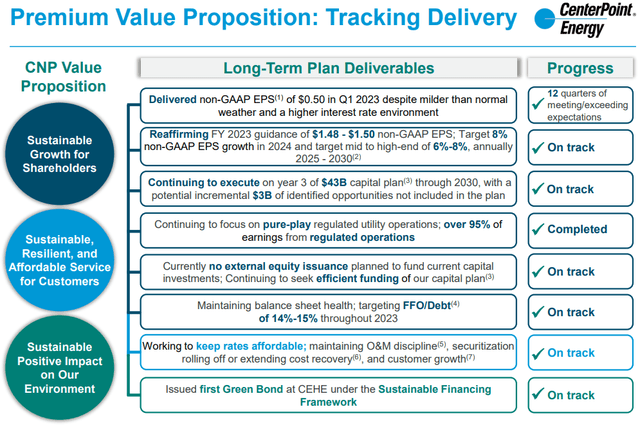

CNP's value proposition is broken down into three primary end goals; Sustainable Growth for Shareholders; Sustainable, Resilient and Affordable services for consumers; and Sustainable Positive Impacts on the Environment.

The company's broad strategy puts much focus on gradual growth, shying away from large capex spending and moving towards sustainable financial spending which then enables superior returns and long-term financial stability to support superior service.

Valuation & Financials

General Overview

Although the company has outperformed both the general market (SPY) and peer companies (XLU), as a utility company its price movement has been minimal.

CNP (Dark Blue) vs Industry & Market (TradingView)

Again, though CNP is a utility, I believe this minimal movement allows the company to grow more aggressively in the coming years, with further value provided by potential income opportunities.

Comparable Companies

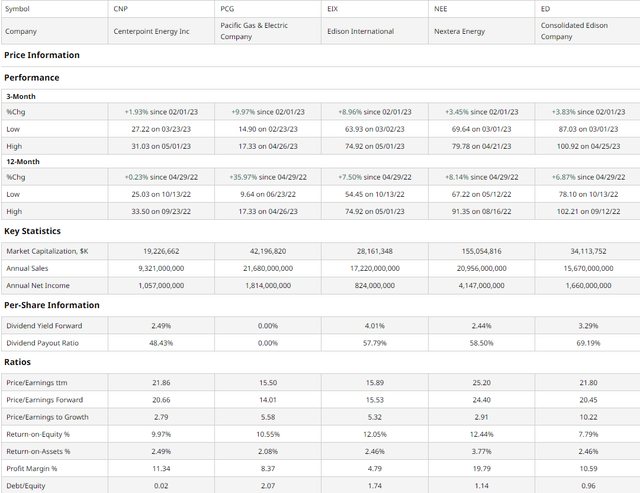

In contrast to the relatively regulated nature of utilities in the rest of the country, Texas, and its surrounding states, enable a unique environment for the provider to operate within, with CNP, for instance, controlling both generation, delivery, and infrastructure. That said, there exists a range of utilities which, while not directly competing with CNP, do operate with similar principles and objectives; Pacific Gas and Electric (PCG.PD) is the largest publicly owned utility in the US, primarily servicing California and Oregon; Edison International (EIX) also services California, primarily the Southern region; NextEra Energy (NEE) is among the most highly-valued utilities, with a focus on renewables; and Consolidated Edison (ED) is a highly vertically integrated firm operating out of New York.

As illustrated above, although CNP maintains similar multiples and returns to peers- and in spite of their overperformance to indices and the market- the company has experienced poorer price action relative to similar firms.

I believe this is a combined response to both CNPs' unwillingness to make large capital investments in addition to general fiscal stability, such that its price did not fall as much in the first place (due to extraneous macro stressors) in contrast to peers. This is well-reflected in their significantly lower debt/equity ratio.

While this fiscal conservatism may not support short-term growth, I believe it enables long-term flexibility and is a strength rather than a fault. CNP's conservative attitude is further emphasized through a relatively lower PEG ratio.

Valuation

According to my discounted cash flow analysis, CNP's fair value, at its base case, is $35.77, up from its current price of $30.68, meaning the stock is undervalued by 14%.

The model is estimated over 5 years, without growth in perpetuity. My DCF assumes a more liberal discount rate of 7% due to the company's low cost of capital (as seen with their debt-light cap structure), alongside net margins within current bounds from 11-12%.

AlphaSpread

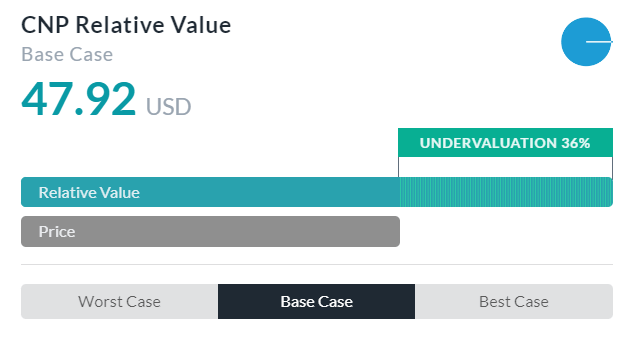

My calculation of undervaluation is further corroborated by AlphaSpread's multiples-based relative valuation tool. The tool estimates that CNP is undervalued by 36%, with a fair value of $47.92.

Therefore, by using a mean-based approach, I estimate the company's fair value to be ~$41.85, currently undervalued by 25%.

Incrementalism Offers a Bulwark Against Macro Volatility

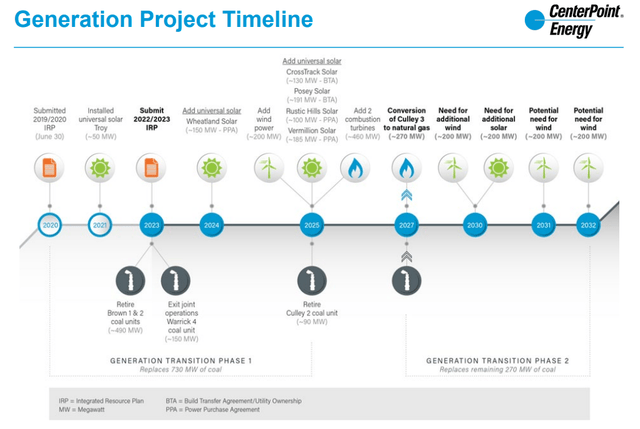

As mentioned multiple times, incremental growth is a consistent theme across the business. This remains true for capital expenditures as well. In 2022, the company completed $4.4bn in new projects, including $1.3bn in the core utility business, expanded its renewables footprint, and conversion of coal units to natural gas. The company has additionally outlined $26bn over 10 years in the electric business to enhance transmission and distribution, support reliability and resiliency, and prepare for accelerated electrification. In conjunction with this, CNP will continue executing on their $16bn natural gas capital investment plan, supporting pipeline modernization, smart metering, and climate footprint reductions.

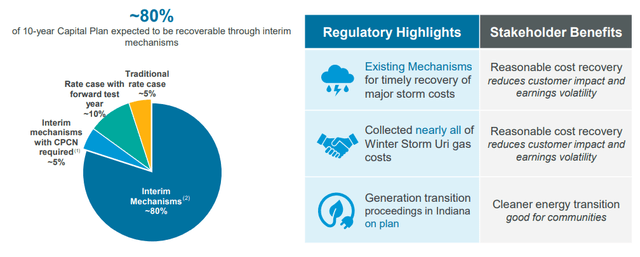

Therefore, despite focusing on stability above all else, CNP does want to increase its consumer footprint by ~2% per year while concurrently supporting operational efficiencies, ultimately gradually leading to scale and margin expansion. Due to the company's focus on consumer affordability- compounding their ability to attract consumers- CNP has ensured a <1% average annual increase in household rates over the past decade. The utility, beyond its ability to afford cheaper debt, also maintains interim mechanisms in case of black swan events, allowing it to sidestep much of the instability which plagued other utilities during extreme weather- this is outlined below.

Another technique the company applies to fulfill its tripartite goals is to leverage the newer instrument of utility securitization, enabling investors to earn constant returns from utility contracts in exchange for upfront value; this runs in parallel with CNP's growing 2.49% dividend, with a payout ratio of 48.43%, well lower than the industry average.

Wall Street Consensus

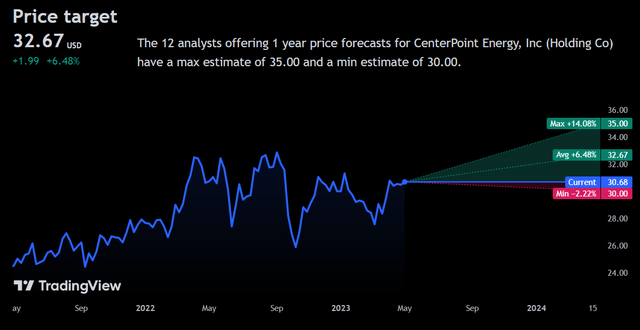

Analysts support my positive view on the company, projecting an average 1Y price increase of +6.48%, to a price of $32.67.

Even at the lowest projected price, analysts only project a dip of -2.22%, well recovered by the annual dividend yield and in line with the stability narrative of the utility.

Risks

Power Generation Inadequacy

As demonstrated by power outages due to the 2021 polar vortex in Texas, CNP's failure to adequately supply energy to consumers can have serious consequences. Among these was a loss of trust in the company, increased regulatory pressures, and, while the company recovered from financial losses this time, poorer power generation and delivery can materially affect the company.

Capital Intensive Transition Plans

Although CNP maintains a more conservative role than its peers, its respective $26bn and $16bn capital investment plans are nonetheless expensive. They may lead to CNP's quality cap structure and its advantage being tarnished. Additionally, any potentially costly investments which do not live up to cash flow expectations may lead to reduced profitability.

Suppressive Regulatory Structure

As inherently centralized and traditionally government-run institutions, utilities are constantly under increased regulatory scrutiny. With power outages caused by extreme weather events, these pressures have increased, with potential price caps, increased resiliency measures, etc. imposed, increasing opex and reducing profitability.

Conclusion

In the short term, I expect investors to price in the stability of the company and a reversion to the average multiple prices of peers.

In the long-term, I project CNP's incrementalism will put it in a superior position to deliver value to investors and maintain a high level of capex and opex.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.