CHIQ: Ideal Way To Play The Chinese Economic Reopening

Summary

- CHIQ is a concentrated way to play the return of the Chinese consumer in 2023.

- The ETF has outperformed the wider Chinese market over the past 3 and 5 year periods.

- Chinese data has been coming in strong in the past 2 months plus the ETF is well off its highs from January 2023.

Chalffy/E+ via Getty Images

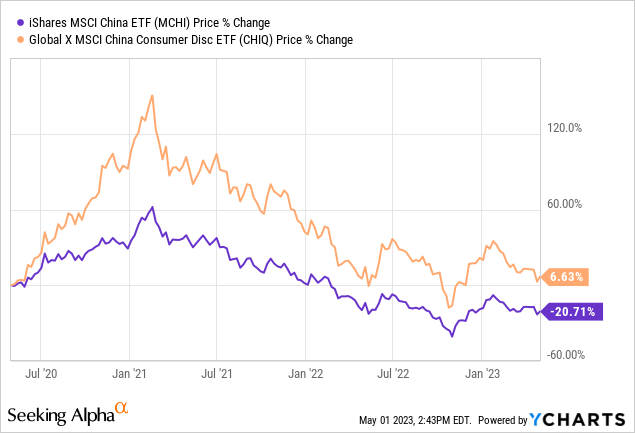

China is experiencing another wave of growth at the moment, as a green light from the government leads increased consumer activity. While manufacturing data continues to come in quite mixed in China, the consumer has been cooped up much like in the United States and is ready to spend. At the moment the best way to play China now that valuations have reverted to a reasonable area is through a consumer focused ETF. This reduces your single stock risk holding something like Alibaba (BABA) or Tencent which have seen weakness in the past 2 years from ongoing political pressure. At these valuation levels the MSCI China Consumer Discretionary ETF (NYSEARCA:CHIQ) is a great option for investors looking for targeted Chinese exposure. As you can see below, CHIQ has outperformed the wider Chinese stock universe in the longer term with significant Alpha on the 3 and 5 year basis. In the 3 year period it has beaten the wider Chinese region by over 27% with a positive period return. As Chinese stocks remain depressed, it gives an excellent buying opportunity for patient investors that have a long term outlook.

The ETF

The ETF maintains a bent towards large cap companies at over $50 Billion average size, as well as a smaller number of companies with 75 total holdings. Expense ratio is a bit high in 2023 at 0.65%, but it is the best option for this focused consumer play without being a specific internet option. Chinese internet focused ETF's such as KWEB or CQQQ are riskier and have the full brunt of political risk built into them making CHIQ a solid middle of the road option. It also pays a very small yield of 0.28% as of 2022, which could be smaller or larger in 2023 - not a reason to consider this option. It holds both mainland Chinese stocks as well as Hong Kong listings as well - anything in the MSCI universe focused on the Chinese consumer. It has a solid beta of 0.45 against the S&P 500, being less correlated to the remainder of your US portfolio. The ETF trades at a solid forward P/E for 2023 of 18.09 and a Price to Book of 1.96. Considering potential growth and rebound of the economy, these are intriguing valuations for those that can look through the political noise. The ETF is off its highs from late January, as optimism around the reopening reached a fever pitch among institutional investors. At that point CHIQ traded as high as $24 with the current price of $18.50 providing a great entry point for the long term with the same underlying fundamentals.

The Data

Chinese retail sales data has seen a tremendous move up the several months, from 0% growth y/y in January 2023, to 10.6% in March 2023. This was the best mark since June 2021 when the ETF was above $33 compared to just $18.50 today. The strength has been in areas such as clothing, cosmetics and personal care items showing a preference for smaller purchases. Auto sales have rebounded as well from low levels in March 2022, with some carmaker exposure in the ETF at just under 20% which should benefit. A large portion of the ETF are consumer plays such as the Chinese internet giants (25% of holdings) and consumer products companies (13%) that are in the sweet spot based on the recent data. GDP growth was 4.5% in Q1, and with a goal of 5% for the full year look for continued acceleration into Q2 as things are fully reopened in the economy. The unemployment rate has also ticked down in recent months to 5.3%, showing no imminent recession with momentum to a further strengthening of the economy. Exports have also rebounded strongly, from down 6.8% in February to up 14.8% y/y in March 2023. The data continues to be supportive of at least average valuations, but valuations remain at trough levels. April's first data release of non-manufacturing PMI was a bit below expectation but still strongly expansionary at 56.4 for the month. Sentiment was strong at 62.5 as well, albeit a bit lower than March as businesses are reasonably excited about the prospects for 2023.

Long-term buy

CHIQ remains a long term buy and one of the best ways to play a potential outperformance in the Chinese economy this year. A 3-5% weighting to your overall portfolio, along with adding other developed market ETF's is prudent with global stocks still cheap compared to the United States S&P 500. Now is the time when solid diversification is paying dividends, with other developed markets outperforming significantly the past 6 months. Emerging markets may be the next to perform well as inflation gets under control and reopenings in the Asian region accelerate into the summer.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CHIQ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.