Get Paid Handsomely With EOG Resources

Summary

- In this article, I start by explaining my long-term view on oil prices and my desire to invest in companies that let investors benefit through high (special) dividends.

- EOG Resources checks all boxes, as it has high reserves, efficient production, a healthy balance sheet, and a focus on high shareholder returns.

- I expect that EOG will provide investors with high dividends and outperforming capital gains on a long-term basis.

mysticenergy

Introduction

Last month, I wrote an article covering my oil bull case and the fact that I'm increasingly looking for oil stocks that let shareholders benefit through high (special) dividends.

One stock I would have included if the article had covered four stocks is EOG Resources (NYSE:EOG), a fantastic no-nonsense stock that checks all boxes for people who want to benefit from both capital gains and high income.

The company has (among other benefits):

- A large footprint in American onshore operations.

- High inventories.

- Efficient operations.

- A fantastic balance sheet.

- A focus on shareholder returns.

So, without further ado, let's dive into the details!

It's Time To Buy High-Quality Income & Outperformance

As I wrote in the article mentioned in the introduction, I believe in a bright bull case for oil based on steady long-term demand growth and subdued production growth.

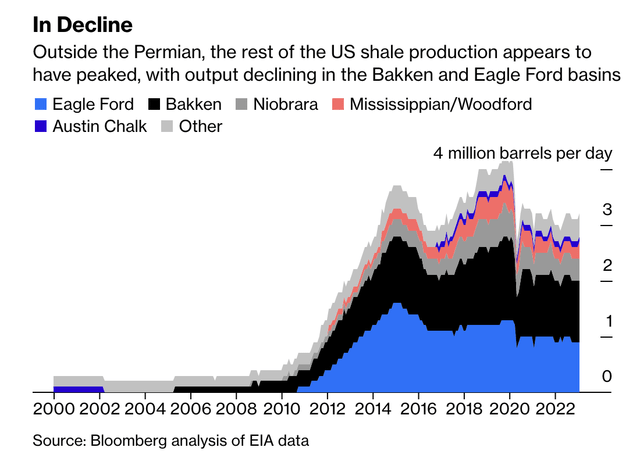

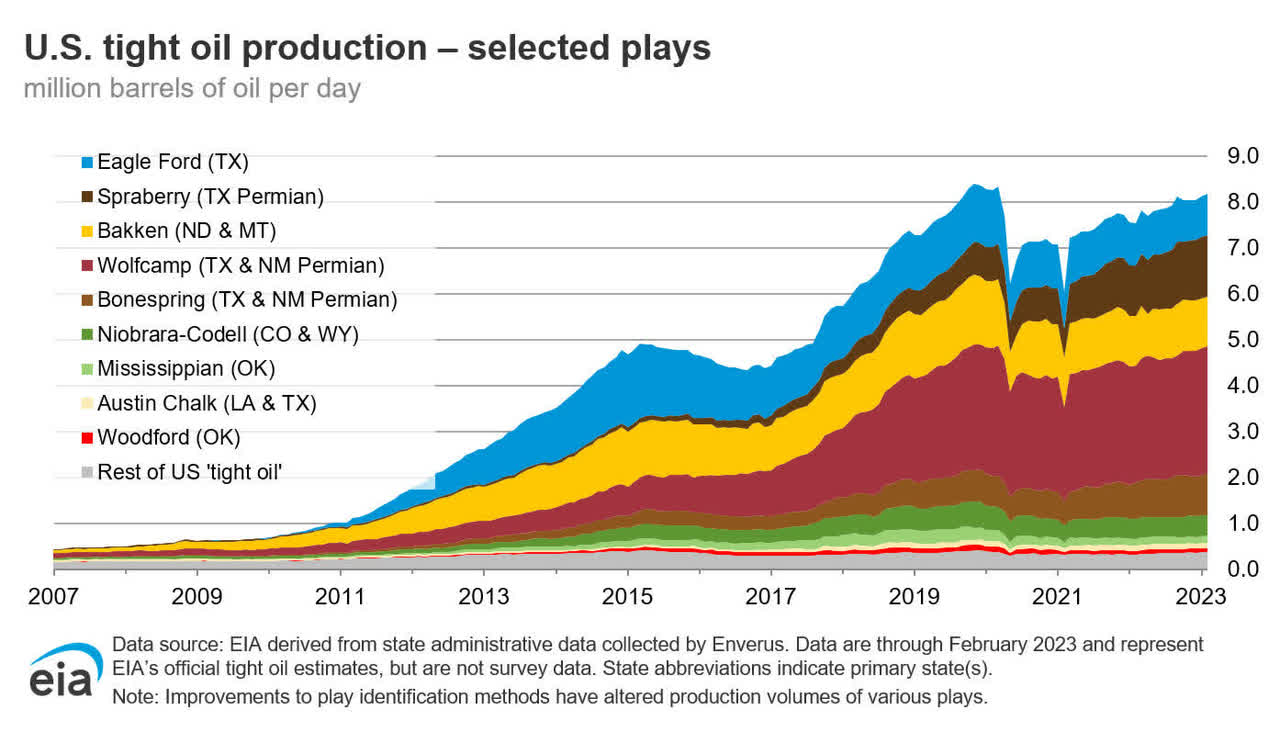

The US was the engine of supply growth after the Great Financial Crisis. Unconventional oil production rise from roughly 500 thousand barrels of oil in 2007 to more than 8 million barrels in 2020.

Energy Information Administration

Now, it's facing a severe slowdown in production, as only the Permian basin is seeing positive (longer-term) production growth.

This is what non-Permian production looks like:

This is, to a large extent, caused by companies that are unwilling to boost output due to the global energy transition and what this could mean for future funding. By reducing oil supply growth, companies prevent another oil price implosion, as we witnessed in 2015 and 2020 when high supply growth met slowing demand.

This is an important quote I used in the article mentioned in the introduction (emphasis added):

The go-slow is a business reality. Over the last decade, the US shale industry had become a byword for capital destruction. Shale investors recovered about 50 cents for each dollar they invested during the 2010-2020 period. After riding out the pandemic, the industry is under increasing pressure from impatient stakeholders on Wall Street - the actual embodiment of the financial system, not Midland's mock version. Shale pioneers once put growth over profit, burning billions of dollars in the process; today, they are focused making money for their shareholders.

On top of that, companies are running out of high-quality inventory, which is another important reason to reduce production growth.

Even the mighty Permian is seeing slower growth.

On March 8, the Wall Street Journal reported that frackers are hitting fewer big gushers in the Permian Basin. Major operators are running out of good wells.

Oil production from the best 10% of wells drilled in the Delaware portion of the Permian was 15% lower last year, on average, than top 2017 wells, according to data from analytics firm FLOW Partners LLC. Meanwhile, the average well put out 6% less oil than the prior year, according to an analysis of data from analytics firm Novi Labs.

So, to benefit from what I believe will be a long-term bull case for oil, companies need to meet a few requirements.

As discussed in the introduction, I want companies with a lot of high-quality inventory to prevent forced M&A in the next few years. M&A comes with risks, and it could temporarily lower dividends. Moreover, I want efficient drillers with low breakeven prices. This lowers risks and paves the road for high free cash flow at elevated oil prices. I also want players with healthy balance sheets that do not need to prioritize debt reduction over shareholder returns. Related to that, I want companies that prioritize their shareholder, distributing most of their cash to owners through (special) dividends. Buybacks are good too, but I prefer dividends, as I see energy companies as cash cows, not necessarily total return stocks (although that may sound a bit vague).

That's where EOG comes in.

Why EOG Is A Good Oil Play

With a market cap of roughly $70 billion, EOG is the second-largest oil and gas exploration and production company in the United States. This excludes Exxon Mobil (XOM) and Chevron (CVX), which are integrated oil companies.

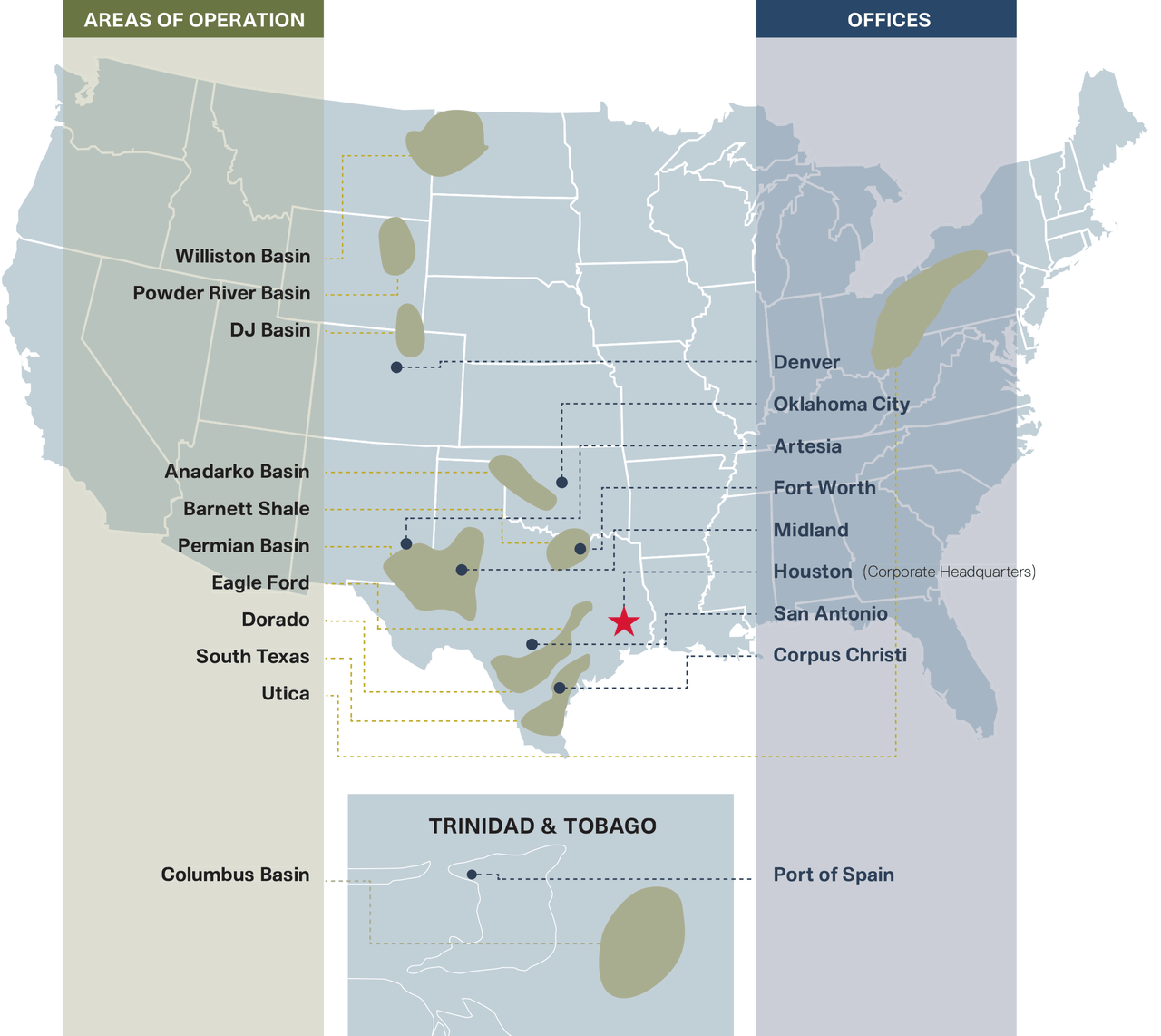

The company specializes in exploring, developing, producing, and marketing crude oil, natural gas liquids, and natural gas, primarily in major producing basins in the United States, Trinidad and Tobago, and select other international areas.

As of December 31, 2022, EOG's total estimated net proved reserves were 4,238 million barrels of oil equivalent, with approximately 99% located in the United States and 1% in Trinidad, which goes to show that it's basically a pure-play US driller.

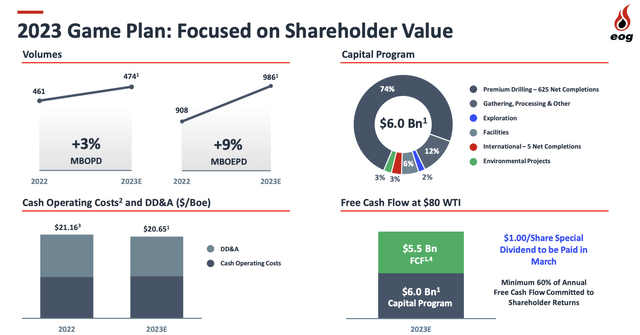

In 2023, the company aims to produce 986 thousand barrels of oil equivalent per day, an increase of 9% versus 2022. Roughly half of that (474 thousand barrels) consists of oil.

Based on these numbers, the company is sitting on 12 years' worth of high-quality reserves.

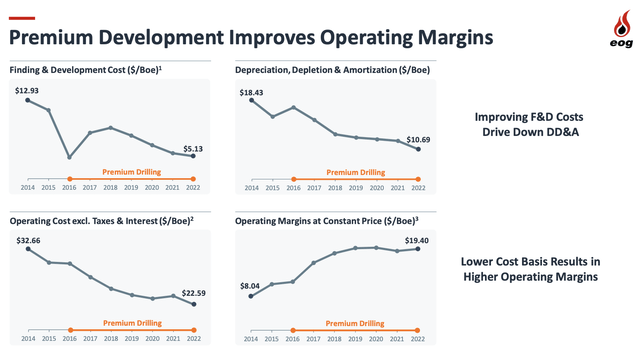

However, there's more to it. The company isn't going out of business after 12 years. It is constantly finding new reserves. In 2022, the company found new reserves worth 244% of its annual production. This means that total reserves rose. Also, these reserves can be exploited at a finding and development cost of $5.13 per barrel, meaning this isn't inventory that will cause operating costs to skyrocket in the future.

The company is also operating efficiently. According to the company (emphasis added):

Now as far as breakevens on our capital program this year, it definitely is up a little bit year-over-year. As Billy mentioned, there's some inflation in there. But also, we're obviously seeing the opportunity to invest in our multi-basin portfolio and increase the CapEx. So, our CapEx program this year is at $44 WTI price with a $3.25 gas price.

Related to this, the company has seen significant improvements in operating costs. F&D, depreciation, and other operating costs are all in a long-term downtrend.

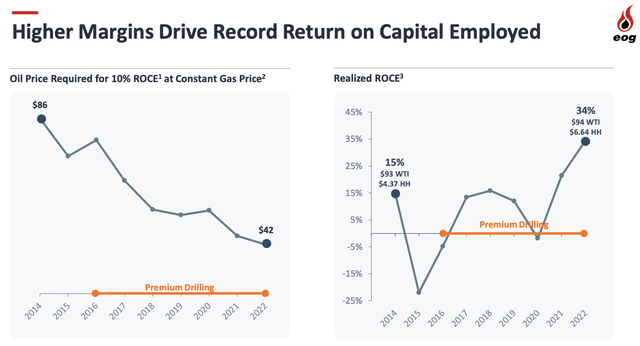

While oil isn't at $94 anymore, the company showed that its return on capital is 34% at these levels. In 2014, that number was 15% at the same oil price (yet slightly lower natural gas prices).

Even at $42 WTI, the company has a 10% ROCE.

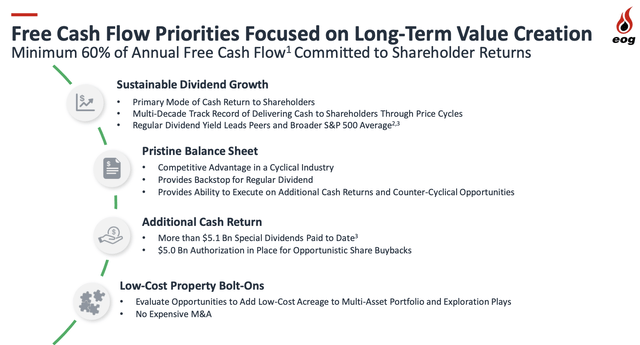

Moreover, the company has a healthy balance sheet. It's so healthy that it is now not its largest free cash flow priority anymore. Its biggest priority is now sustainable dividend growth.

The company ended 2022 with negative net debt of $900 million, which means it had more cash than gross debt. Its net leverage ratio was -0.1x EBITDA, well below the E&P peer average of 0.7 (which is also very low). The company's cash was 8.6% of its market cap, which is twice the S&P 500 median.

In 2023, EOG plans to grow oil volumes by 3% and total production on a BOE basis by 9%, as I already briefly mentioned. By doing so, it expects to generate about $5.5 billion of free cash flow at $80 WTI and $3.25 Henry Hub.

While natural gas is now lower, we can assess how much cash the company can generate at elevated oil prices. In this case, $5.5 billion translates to a free cash flow yield of roughly 8.0%.

The good news for investors is that thanks to the healthy balance sheet and the related capital priorities, the company is in a fantastic position to distribute a big part of its cash to shareholders.

According to the company:

[...] our commitment to return a minimum of 60% of free cash flow considers the full year, not a single quarter in isolation. The special dividend reflects the confidence in our plan and our constructive outlook on oil and gas prices. We will continue to evaluate the amount of cash return as we go through the year with an eye on, once again, meeting or exceeding our full year minimum cash return commitment of 60% of free cash flow.

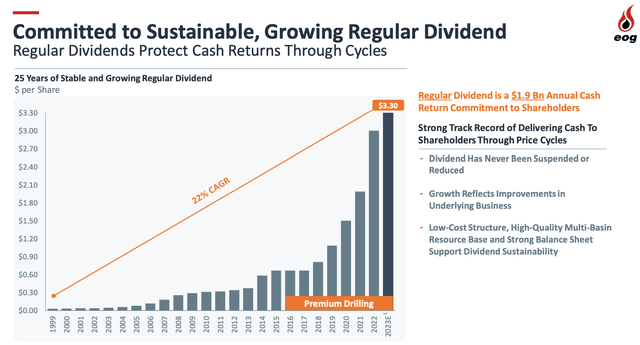

In this case, it is important to mention that EOG distributes a regular quarterly dividend and a special dividend to distribute more cash. Ignoring the special dividend, the regular dividend has grown by 22% per year since 1999, and most of it came after 2019. This regular dividend has never been cut.

On February 23, the company declared a $0.825 regular dividend and a $1.0 special dividend. This translates to an annualized yield of 6.1%.

Please be aware that the special dividend is highly volatile. At $80 WTI, the yield is likely sustainable. At higher oil prices, the company will accelerate its dividend. However, at subdued oil prices, the special dividend will be cut.

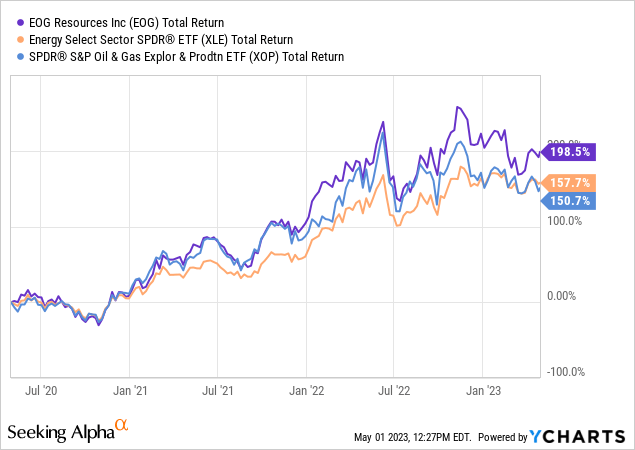

These qualities have also allowed the company to outperform its peers, as shown by the chart below. I expect that to continue both in bull and bear markets.

Furthermore, this week, the company is expected to release earnings.

Upcoming Earnings

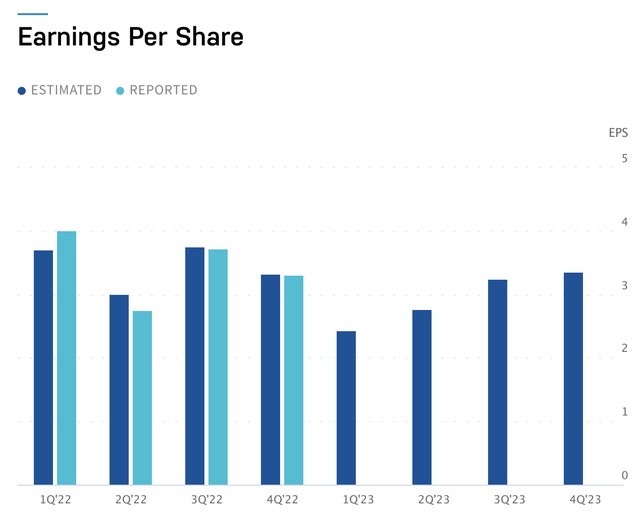

The company is scheduled to release earnings on May 4 after the market closes. EPS is expected to be $2.42, which would be down from $3.69 in the prior-year quarter.

Needless to say, this is the result of lower oil prices.

Over the past four weeks, 1Q23 earnings have received two upgrades and eight downgrades, which shows that a lot has been priced in. In general, it is fair to say that EOG often reports earnings in line with estimates, which is why I do not especially anything spectacular.

That said, investors should carefully watch if anything changes with regard to EOG's production outlook, including its production costs.

Takeaway

In this article, we discussed my long-term view on oil prices, which includes my desire to focus on companies that let shareholders benefit from high regular and special dividends.

One of these companies is EOG Resources. This onshore driller has everything I'm looking for in an energy stock, including high reserves, efficient production, a healthy balance sheet, and the dedication to distributing at least 60% of free cash flow to shareholders.

I believe that it will be a great source of dividends and outperformance for many years to come.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of XOM, CVX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.