VICI Properties: Strong Outlook, Attractive Price

Summary

- VICI is strongly positioned as a gaming and entertainment REIT with well-known properties such as Caesars Palace, Harrah's, The Venetian, and the like.

- First quarter results were strong, quarterly revenues were up 111%, and AFFO up 19% year over year.

- However, due to the size of the debt, I do not expect any significant acquisitions in the coming years.

- For the near future, we see debt maturities of $1 billion next year and $2 billion in 2025. Both will have to be refinanced at higher interest rates at the expense of earnings.

- For 2023, VICI came with a guidance of 9.8% year-on-year growth in AFFO per diluted share.

RudyBalasko

Introduction

VICI Properties (NYSE:VICI) is a REIT that specializes in leasing gaming and entertainment properties. It has a portfolio of well-known properties such as Caesars Palace, Harrah's, and The Venetian in Las Vegas. So VICI is very strongly positioned in a niche market with great allure. First quarter results were strong due to acquisitions and growth from rent escalators, and VICI's strong balance sheet is also very attractive. Also, excellent growth is expected in the coming years.

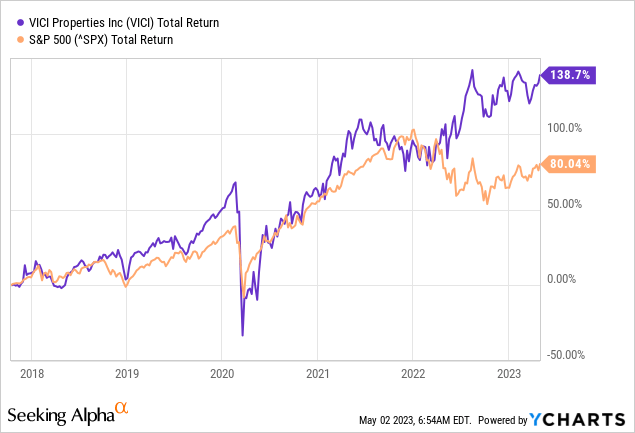

VICI has even overtaken the S&P500 in terms of total return, with an average return of 19.1% per year over the past 5 years.

First Quarter 2023 Earnings

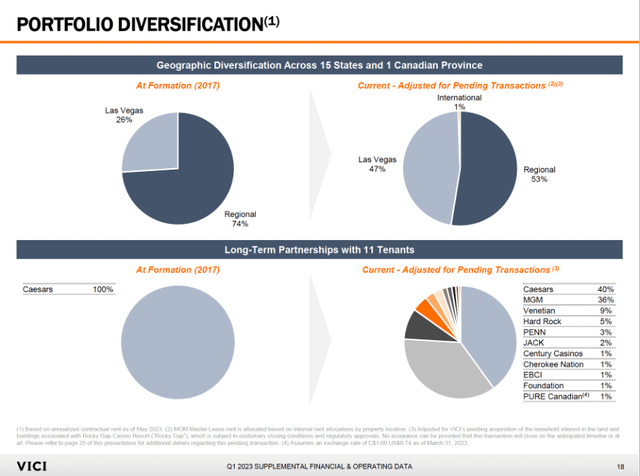

Portfolio Diversification (VICI's First Quarter earnings presentation)

With the acquisition of the Venetian Las Vegas in 2022 for $4 billion, VICI has acquired a magnificent property. The lease of initially $250 million benefits consolidated earnings and will increase by escalators of 2% to the level of CPI (up to a maximum of 3%). The acquisition also significantly increased the net debt on their balance sheet to $16.4 billion. With funds from operations of $1.1 billion (in 2022) and interest coverage of 3.5x, this seems on the high side. Cash and marketable securities of $248 million provide adequate liquidity, and the debt-to-equity ratio of 0.70 is fine. I do not expect any further major acquisitions, I expect VICI to grow strongly organically over the next few years due to rent escalations and minor acquisitions.

First quarter figures came in on May 1 and VICI delivered stunning results with 111% revenue growth, 116% growth in net income and 48% growth in net income per share. FFO reached $0.35 per share and AFFO increased 19% year over year to $0.44.

This strong growth was primarily characterized by acquisitions and the acquisition of the remaining 49.9% interest in the MGM Grand/Mandalay Bay, giving VICI control of the two most economically productive assets on the Las Vegas Strip. VICI also entered into a new partnership with Pure Canadian Gaming and invested in 4 Canadian casinos. In addition, VICI entered into a loan with Great Wolf to develop a resort adjacent to the Foxwoods Resort Casino. VICI is rapidly expanding and has an international foothold in the entertainment and gaming market.

In 2024, roughly $1 billion will be repaid, followed by $2 billion in 2025. Net income and FFO will take a hit as these are refinanced at higher interest rates. Its debt maturity schedule is spread out evenly over the next few years, with no single year having more than $2 billion in dues.

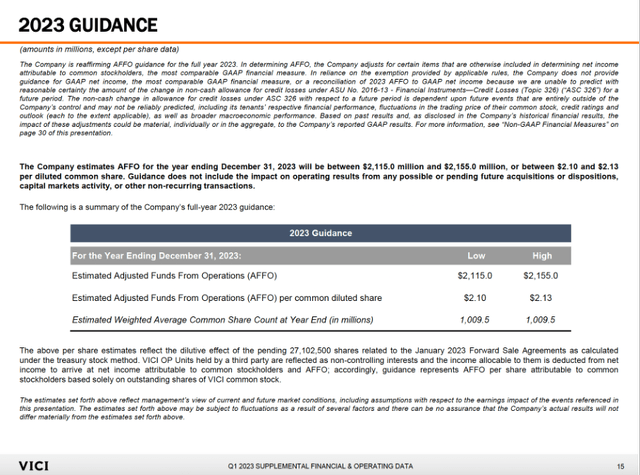

The outlook is fine and VICI came up with a guidance of AFFO per diluted common share of $2.12 at the halfway point, this represented 9.8% year-on-year growth.

2023 Guidance (VICI's first quarter earnings presentation)

Dividends and Share Issuances

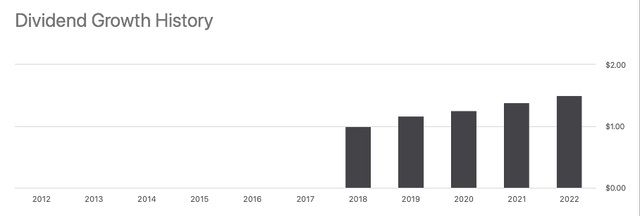

VICI pays a nice dividend of $1.56 per share that represents a dividend yield of 4.6%. From 2018, dividend growth averaged 10.7% per year and analysts forecast 5.6% dividend growth next year. The 2024 forward dividend yield is high at 5% and offers a nice premium over 10-year treasury notes, which currently stand at around 3.5%.

Dividend growth history (VICI's ticker page on Seeking Alpha)

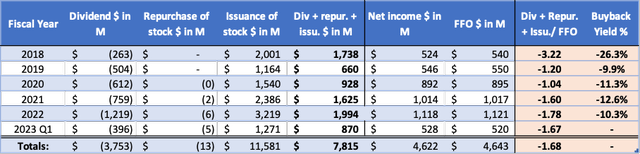

The cash flow statements show that VICI uses equity issuances to finance its properties. These properties ultimately provide rental income, which serves as income to equity investors. FFO averaged 19.4% per year over 4 years, a solid and stable growth rate. Much of this is paid out as dividends, as REITs must distribute at least 90% of their taxable earnings.

VICI's cash flow highlights (Annual reports and author's own calculations)

Favorable Valuation

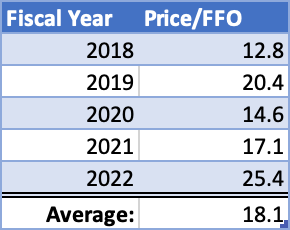

The valuation picture looks favorable, with a price to funds from operations of only 13.6. The average shows a more expensive valuation, making the current valuation look 25% undervalued. However, it must be said that rising interest rates have a huge impact on equity valuations. Its valuation was much higher after the Fed cut interest rates in 2020, while it is now very attractive during this increased interest rate environment.

VICI's price to FFO (Author's own calculations)

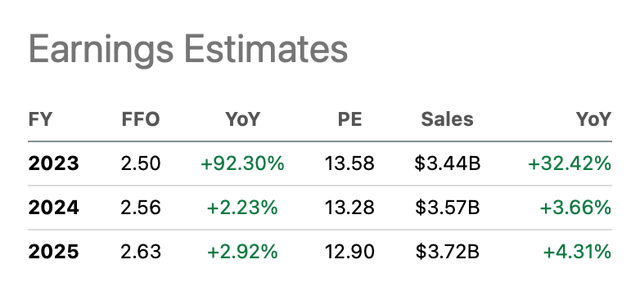

However, analysts are divided on earnings expectations for the coming years. On average, they expect a strong 92% increase in FFO for this year (partly due to growth from acquisitions), while it will rise only 2% to 3% per year in the years thereafter.

Higher interest rates depress profits through higher interest expenses, and this affects the company's growth. Interest rates are expected to peak at 5.1% this year, after which they will fall next year. Then VICI should be able to grow further, and if that's the case, the attractive price level now provides the ideal buying opportunity in my view.

Earnings Estimates (VICI ticker page on Seeking Alpha)

Conclusion

VICI is strongly positioned as a gaming and entertainment REIT with well-known properties such as Caesars Palace, Harrah's, The Venetian, and the like. First quarter results were strong, helped by the acquisition of The Venetian in Las Vegas and the consolidation of their interest in MGM Grand/Mandalay Bay.

Quarterly revenues were up 111% and AFFO was up 19% year over year. The balance sheet is solid with $248 million cash, a debt-to-equity ratio of 0.70, and interest coverage of 3.5x. However, due to the size of the debt, I do not expect any significant acquisitions in the coming years. VICI will continue to grow organically through their rent escalators and minor acquisitions. For the near future, we see debt maturities of $1 billion next year and $2 billion in 2025. Both will have to be refinanced at higher interest rates at the expense of earnings. A positive point to mention is the expected downward interest rate trend from 2024, as many analysts expect interest rates to fall. For 2023, VICI came with a guidance of 9.8% year-on-year growth in AFFO per diluted share.

Its dividends should increase in tandem with its AFFO as the company expands. Analysts predict about 6% dividend growth for next year. The current dividend yield is a solid 4.6%. And even though the share price has risen well, the valuation is still favorable; the stock appears 25% undervalued. The cheap stock valuation, corporate growth and dividend growth, and the quality of the real estate make this stock worth buying.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.