The upward journey of the market continued for the sixth consecutive session on the Nifty50 on May 2, driven by technology, metal, oil & gas, auto, and select bank stocks. The broader markets performed better than front liners as the Nifty Midcap 100 index gained 1 percent and the Smallcap 100 index rose 0.7 percent on positive breadth.

The BSE Sensex rallied 242 points to 61,355, while the Nifty50 jumped 83 points to 18,148, and formed small bodied bullish candlestick pattern on the daily charts.

"The Nifty is trading near a crucial resistance of 18,200 and once surpassed will witness further short covering towards the 18,400 level," Kunal Shah, Senior Technical & Derivative Analyst at LKP Securities said.

He feels the downside support is at 18,000 where aggressive Put writing is visible. The undertone remains bullish and one should keep a buy-on-dip approach, he advised.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data and not just the current month.

Key support and resistance levels on Nifty

The pivot charts indicate that the Nifty may get support at 18,113 followed by 18,095 and 18,065. If the index advances, 18,173 is the initial key resistance level to watch out for followed by 18,192 and 18,222.

The Bank Nifty climbed 118 points to 43,352, continuing the uptrend for the sixth straight session. The index has formed small bodied bearish candlestick pattern on the daily timeframe. It has been making higher tops formation for six days in a row.

The index witnessed a stellar outperformance in the previous week and is now trading at a critical resistance zone of 43,500. The index needs to surpass this level on a closing basis to continue the momentum to a time-high level, Kunal Shah of LKP Securities said.

He feels the downside support is visible at the 43,000-42,800 zone and any dip towards this support zone will be an ideal opportunity to create fresh long positions.

As per the pivot point calculator, the Bank Nifty may take support at 43,287, followed by 43,236 and 43,154. Key resistance levels are expected to be 43,450, along with 43,501 and 43,583.

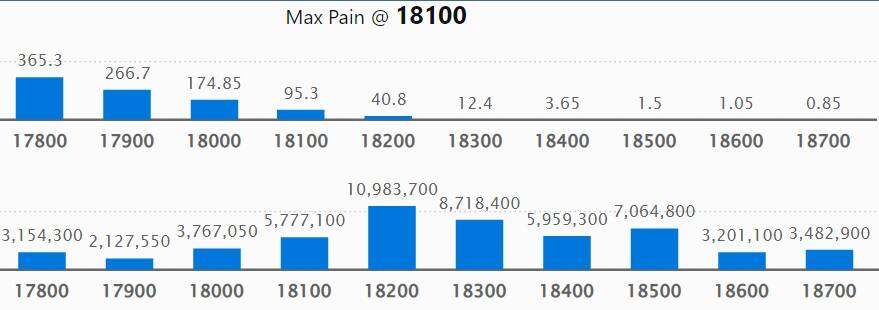

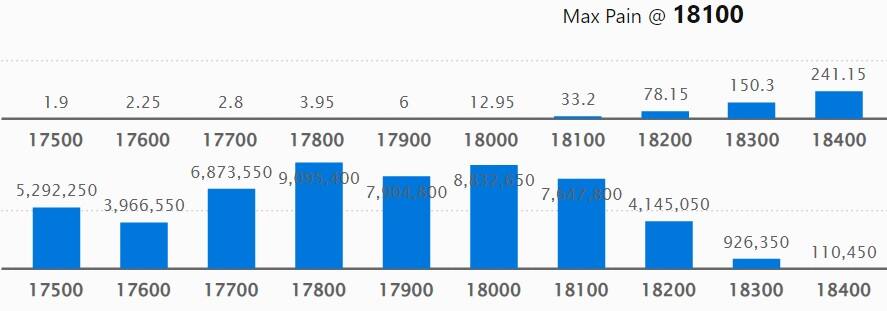

On the weekly options front, the maximum Call open interest (OI) was at 18,200 strikes, with 1.09 crore contracts, which is expected to be a crucial level for the Nifty in the coming sessions.

This was followed by 18,300 strikes, comprising 87.18 lakh contracts, and 18,500 strikes, with more than 70.64 lakh contracts.

Call writing was seen at 18,200 strikes, which added 47.84 lakh contracts, followed by 18,400 & 19,000 strikes, which accumulated 27.14 lakh contracts each, and 18,300 strikes which added 25.98 lakh contracts.

Call unwinding was at 18,000 strikes, which shed 24.42 lakh contracts, followed by 17,900 strikes, which shed 8.01 lakh contracts, and 17,800 strikes, which shed 3.42 lakh contracts.

The maximum Put open interest was at 17,800 strikes with 90.95 lakh contracts, which is expected to act as support in the coming sessions.

This was followed by the 18,000 strikes, comprising 88.32 lakh contracts, and the 17,900 strikes where there were 79.04 lakh contracts.

Put writing was seen at 18,100 strikes, which added 55.8 lakh contracts, followed by 18,200 strikes, which added 35.41 lakh contracts, and 17,800 strikes, which added 10.36 lakh contracts.

We have seen Put unwinding at 17,200 strikes, which shed 10.64 lakh contracts, followed by 17,400 strikes, which shed 7.51 lakh contracts, and 17,300 strikes, which shed 6.81 lakh contracts.

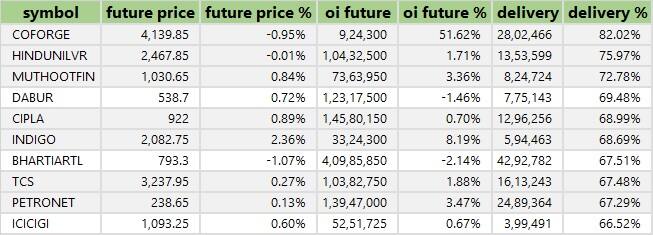

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. The highest delivery was seen in Coforge, Hindustan Unilever, Muthoot Finance, Dabur India and Cipla among others.

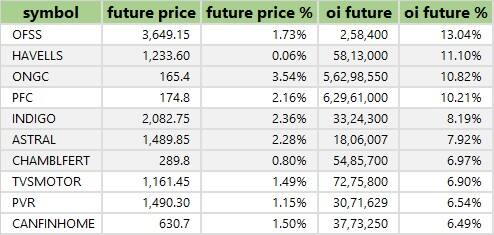

An increase in open interest (OI) and price typically indicates a build-up of long positions. Based on the OI percentage, 91 stocks, including Oracle Financial, Havells India, ONGC, PFC and InterGlobe Aviation saw long build-ups.

A decline in OI and price generally indicates a long unwinding. Based on the OI percentage, 13 stocks, including Page Industries, Ashok Leyland, Adani Enterprises, Ipca Laboratories and Bharti Airtel saw a long unwinding.

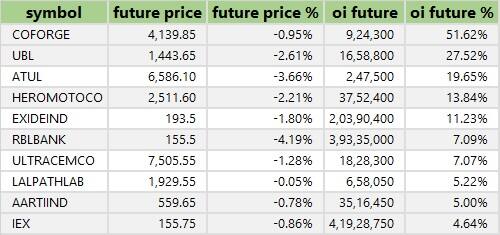

32 stocks see a short build-up

An increase in OI along with a price decrease indicates a build-up of short positions. Based on the OI percentage, 32 stocks, including Coforge, United Breweries, Atul, Hero MotoCorp and Exide Industries saw a short buildup.

A decrease in OI along with a price increase is an indication of short-covering. Based on the OI percentage, 54 stocks were on the short-covering list. These included SBI Card, Axis Bank, Indian Hotels, Max Financial Services and Godrej Consumer Products.

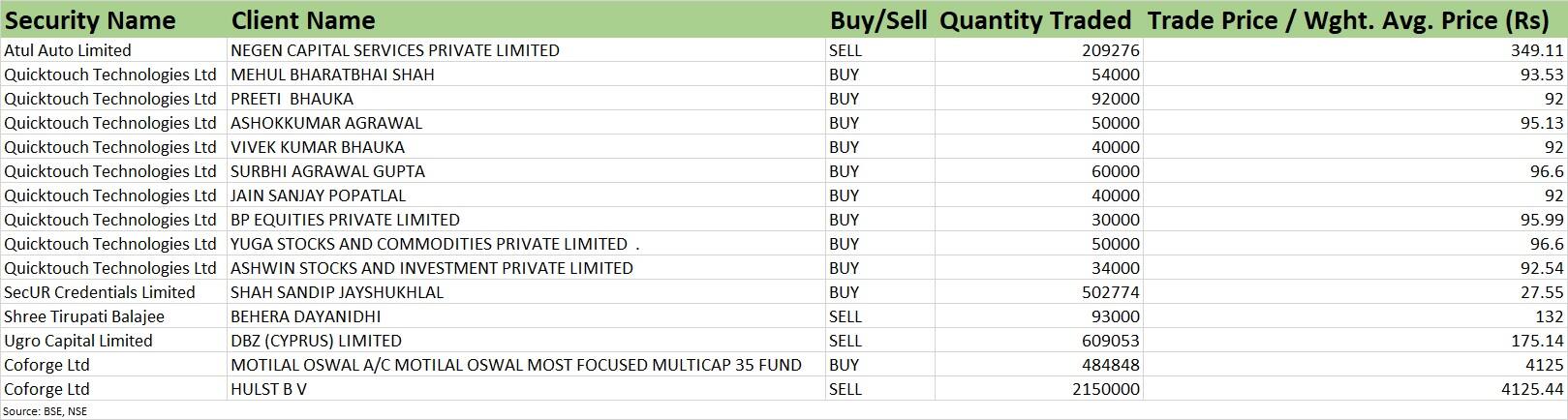

Ugro Capital: DBZ (Cyprus) sold 6.09 lakh equity shares in the company via open market transactions at an average price of Rs 175.14 per share.

Coforge: Motilal Oswal A/C Motilal Oswal Most Focused Multicap 35 Fund acquired 4.84 lakh equity shares in the IT services company at an average price of Rs 4,125 per share, however, promoter Hulst B V sold 21.5 lakh shares at an average price of Rs 4,125.44 per share.

(For more bulk deals, click here)

Titan Company, ABB India, Tata Chemicals, Petronet LNG, AAVAS Financiers, Anupam Rasayan India, Adani Wilmar, Bajaj Consumer Care, Cholamandalam Investment and Finance Company, Godrej Properties, Havells India, Jyothy Labs, KEC International, Mold-Tek Packaging, MRF, R Systems International, SIS, Sona BLW Precision Forgings and Sula Vineyards will be in focus ahead of quarterly and full-year earnings on May 3.

Stocks in the news

Tata Steel: The Tata Group steel company has recorded 84 percent year-on-year decline in consolidated profit at Rs 1,566.2 crore for the quarter ended March FY23, impacted by weak operating performance and lower topline. Revenue from operations declined 9.2 percent to Rs 62,961.5 crore compared to the year-ago period. On the operating front, EBITDA plunged 52 percent YoY to Rs 7,219.2 crore with the margin falling 1,022 bps to 11.46 percent for the quarter, but overall numbers above analysts' estimates. The board announced a dividend of Rs 3.6 per share for FY23.

Ambuja Cements: The cement maker has reported a standalone profit of Rs 502.4 crore for the March FY23 quarter, a 1.6 percent growth YoY, supported by topline and other income. However, the profitability was impacted by weak operating performance and restructuring costs (Rs 80.71 crore). Revenue grew by 8.4 percent year-on-year to Rs 4,256.3 crore, with sales volumes increasing by 8 percent YoY to 8.1 million tonnes. At the operating level, EBITDA at Rs 788.3 crore for Q4FY23 declined 0.6 percent YoY, with margin falling 170 bps to 18.5 percent.

Bharti Airtel: The telecom operator, Dialog Axiata Plc, and Axiata Group Berhad have entered into a binding term sheet to combine operations of Bharti Airtel Lanka (Airtel's wholly-owned subsidiary with Dialog, a subsidiary of Axiata Group Berhad). Discussions with respect to the proposed transaction are ongoing between the parties and also with the relevant regulatory authorities.

BL Kashyap and Sons: The civil engineering and construction company has secured new order worth Rs 238 crore, from Embassy Construction. The said contract is expected to be executed within 28 months. The total order book as on date stands at Rs 2,518 crore.

Godrej Consumer Products: The FMCG company said the board members will be meeting on May 10 to consider approval for raising funds amounting to Rs 5,000 crore via non-convertible debentures (NCDs) in one or more tranches.

Mukand: The company has completed the sale and transfer of 25.71 lakh equity shares or a 5.51 percent stake in Mukand Sumi Special Steel to Jamnalal Sons, at Rs 574 per share, and received the entire amount of Rs 147.58 crore. Mukand Sumi Special Steel is a joint venture of Bajaj Group, and Jamnalal Sons is a promoter group entity of Mukand.

Mahindra & Mahindra Financial Services: The non-banking finance company has recorded overall disbursement at Rs 3,775 crore in April this year, growing 39 percent over a year ago month. Healthy disbursement trends have led to business assets at approximately Rs 83,900 crore in April, a growth of 1.4 percent over March 2023. The collection efficiency was at 92 percent for April against 90 percent YoY. The company continued to maintain a comfortable liquidity chest of about 3-month's requirement.

Fund Flow

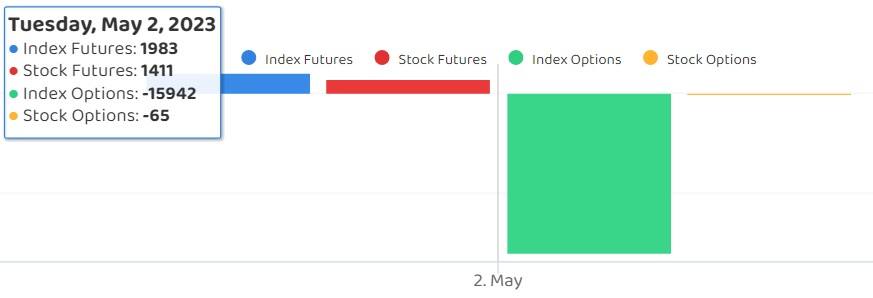

Foreign institutional investors (FII) bought shares worth Rs 1,997.35 crore, whereas domestic institutional investors (DII) sold shares worth Rs 394.05 crore on May 2, provisional data from the National Stock Exchange showed.

Stocks under F&O ban on NSE

The National Stock Exchange has not added any stock to its F&O ban list for May 3. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.