Amazon: Could Be A Coiled Spring If Certain Trends Continue (Rating Upgrade)

Summary

- Roughly 10 seconds of commentary derailed the after-hours rally after earnings were released, and I feel the market got fixated on the wrong things.

- I have been very critical of Amazon going from very bullish to neutral, but Q1 2023 showed a lot of promise, and AMZN's profitability is in a better place.

- AWS is no longer the only business line driving operating profits, and North America is back in the black.

- I wouldn't be surprised if shares rally to $150 in 2024 if the trends of cash from operations and FCF continue upward.

- I think AMZN is getting to the point where they have pulled so much CapEx forward that they can flip a switch and increase FCF by tens of billions when they want to.

HJBC

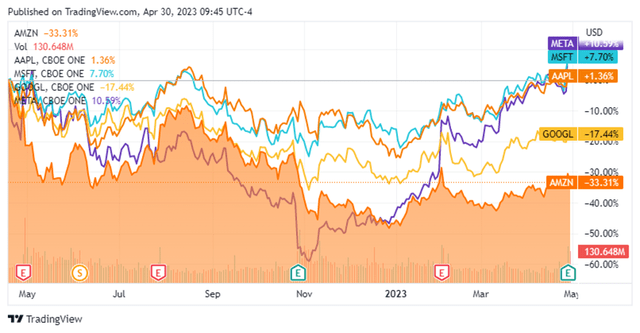

Shares of Amazon (NASDAQ:AMZN) have been disappointing recently. For roughly 20 months, shares of AMZN spent minimal time under the $150 level between 7/7/20 thru 4/19/22. Since 4/19/22, shares have declined -33.3% to $105.45, and at one point, they were down -48.5% as shares reached a 52-week low of $81.43. AMZN has now replaced Meta Platforms (META) as the worst-performing big tech company since the $150 barrier was breached. Sentiment on AMZN has been mixed on Seeking Alpha after earnings with two buy, three sell, and two hold articles. Q1 2023 wasn't the greatest quarter, but it wasn't the disaster that some have made it out to be. There is a lot to be excited about regarding AMZN's future. I think shares could retest the $100 or even fall below it, but the long-term thesis looks good, and too much focus has been placed on the slowing of growth with AWS. Looking at the numbers, I think AMZN could be a coiled spring later and explode to the upside if things go well.

The devil is in the details, and AWS ended up overshadowing the bigger picture

So what exactly happened after hours when AMZN reported Q1 2023 earnings? AMZN delivered a double beat, delivering $0.31 in EPS, which was a beat of $0.11, and generating $127.4 billion in revenue, which was a beat of $2.85 billion. Shares skyrocketed in after-hours trading by almost 12%, only to give up all of the gains and end down -2%. On the surface, AMZN was moving on revenue growth, profits, and a state of efficiency, then the conference call took place, and the market negatively reacted to commentary from AMZN's CFO Brian Olsavsky. Mr. Olsavsky stated:

Customers continue to evaluate ways to optimize their cloud spending in response to these tough economic conditions in the first quarter, and we are seeing these optimizations continue into the second quarter with April revenue growth rates about 500 basis points lower than what we saw in Q1."

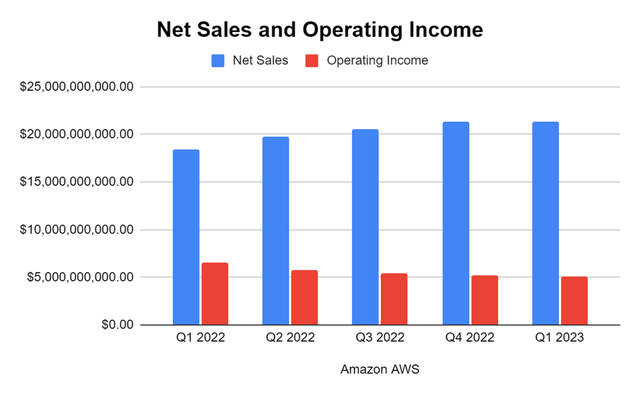

Upon these comments, shares of AMZN gave back all their gains and then some. Investors realized the reality that AWS is continuing to see reduced growth rates on the top line, profits in AWS are declining, and margins are compressing. Growth on the top line has stalled, and AWS saw a QoQ revenue decline of -$24 million. The more concerning aspect is that the operating income generated by AWS has declined by -21.4% (-$1.4 billion), and its operating margin has been reduced by -11.35% YoY. In Q1 of 2022, AWS generated $18.44 billion in revenue, and $6.52 billion in operating income, placing its operating margin at 35.35%. In the most recent quarter, AWS generated $21.35 billion in revenue but only produced $5.12 billion of operating income at an operating margin of 23.99%. For some time, AWS was the only segment driving operating income to the bottom line, as the main business lines operated in the red.

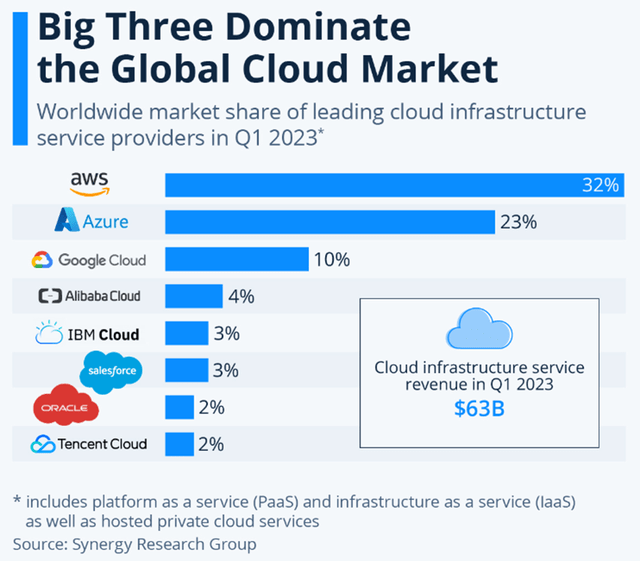

Synergy Research Group has compiled data from the global cloud market, and after Q1 2023, AWS still has 32% of the market, while Azure controls 23%. AWS, Azure from Microsoft (MSFT), and Google Cloud from Alphabet (GOOGL) control 65% of the global cloud market. If you have ever been a part of migrating to the cloud, you will understand exactly why these numbers are so important. Once a company undergoes a digital transformation, it's unlikely they are going to switch from AWS to Azure or Azure to AWS. Many got hung up on the commentary regarding April revenue growth rates being roughly 500 basis points lower than what they saw in Q1, but they didn't take what was said next into consideration. So far, top-line growth in AWS doesn't look great for Q2, but AMZN has been clear they are not looking at this on a quarter-by-quarter basis, and they have a long-term outlook. Their priority is building customer relationships and helping customers optimize their AWS spending to forge a long-lasting business.

The cloud computing market is expected to reach $1.55 trillion by 2030, which is a CAGR of roughly 14.1%. Infrastructure as a Service ((IaaS)) is projected to have the highest CAGR through 2030, which will be fueled by the growing need to simplify IT complexities and lower the costs associated with deploying data centers. The short-term revenue growth and compressing margins shouldn't be a deterrent in an investment thesis for AMZN. Today, AMZN's AWS is the dominant IaaS provider, and AMZN is putting its customers first, which I feel will pay off in spades. AWS has generated $83 billion in net sales in the trailing twelve months (TTM). If the CAGR in IaaS is 14%, AMZN could add $27.93 billion or 33.64% to its TTM revenue number in Q1 of 2030, placing the TTM revenue at $110.94 billion. At an operating margin of 25%, that would be an annualized operating profit of $27.73 billion or $6.93 billion quarterly. If AMZN can get its margin back to Q1 2022 levels of 35.35%, this would increase its TTM operating profit to $39.22 billion or $9.8 billion quarterly. There is still a lot of business to be captured, and AMZN is positioning itself to continue being the dominant force in cloud infrastructure.

Investors should focus on the big picture and not get hung up on comments about AWS

In many ways, the market is reactionary, and one sentence derailed the after-hours pop even though April is just one month in Q2. AMZN is still growing, and its profitability is improving in key metrics. Overall revenue increased 9% to $127.4 billion YoY while North America grew 11%, International grew 1%, and AWS grew 16%. AMZN's total operating income grew by $1.1 billion to $4.8 billion YoY in Q1, and its net income came in at $3.2 billion compared to -$3.8 billion in Q1 of 2022. There are three numbers that stand out to me within the earnings report. North America was profitable again after showing significant losses in prior quarters, operating cash flow increased 38% to $54.3 billion in the TTM compared to Q1 of 2022, and FCF outflows improved to -$3.3 billion.

In Q1, AMZN's $127.4 billion revenue was comprised of $76.88 billion from North America, $29.12 billion from International, and $21.35 billion from AWS. North America, which is their largest business segment, is no longer losing money. North America went from losing -$1.57 billion in Q1 2022 to making $898 million in Q1 2023. This is huge because AWS is no longer subsidizing losses from the rest of the business. Throughout 2022, every dollar of operating profit came from AWS, that is no longer the case, and it should have positive ramifications going forward. As inflation continues to decline and as the macro environment eases, North America should continue to improve its margins adding operating profit to the bottom line. On the International side, AMZN generated -$1.25 billion in operating income, and while it was still a loss, it was the narrowest loss in over a year.

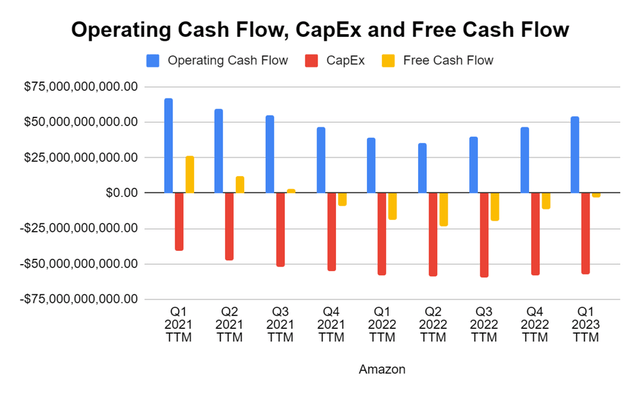

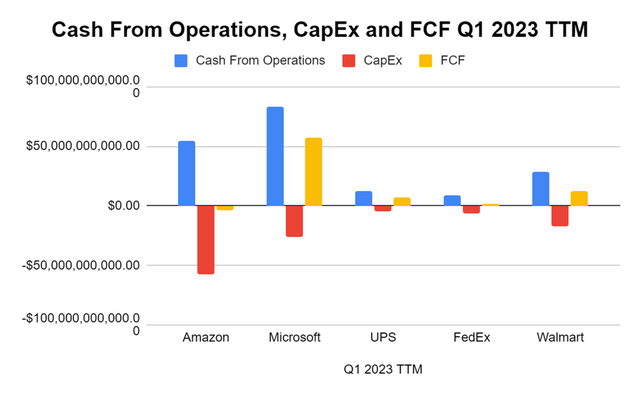

What could be the most important aspect of Q1 2023 is the metrics surrounding AMZN's operating cash flow, CapEx, and FCF. I compiled the data on a TTM basis over the nine quarters to show the trends in these areas. AMZN hasn't generated positive FCF on a TTM basis since Q3 of 2021, and at its worst point, produced -$23.49 billion of FCF on a TTM basis in Q2 of 2022. This was also AMZN's lowest amount of operating cash flow generated on a TTM basis. Over the past three quarters, on a TTM basis, AMZN has increased the amount of operating cash flow its businesses generate by $18.76 billion (52.72%) and narrowed its negative FCF by $20.17 billion. Over the past 12 quarters, AMZN has generated $160.87 billion in cash from operations, allocated $156.4 billion to CapEx, and produced $4.46 billion in FCF.

These numbers are encouraging for several reasons. AMZN's cash from operations and FCF have increased QoQ for the previous three quarters. AMZN has continued to allocate steady amounts of capital toward CapEx while driving additional cash from operations. Based on this trend, AMZN should return to FCF profitability next quarter on a TTM basis. The real story is in the bigger picture. AMZN has allocated $156.4 billion toward CapEx over the past three years and has outspent the competition. AMZN has spared no expense in building out its warehouses, fleet, and operations. When AMZN is in a position to scale back its CapEx to 2021 TTM levels or less, its FCF should jump by tens of billions. To put how much AMZN spends in CapEx into perspective, MSFT, United States Parcel (UPS), FedEx (FDX), and Walmart (WMT) have collectively spent $54.53 billion in CapEx over the TTM. AMZN has spent $57.65 billion. AMZN has been outspending these four companies for several years now on an annual basis. I believe that with all of the capital AMZN has allocated to CapEx over the past several years, there will become a point where they could reduce their annual CapEx to around $27 billion, which would be half of what MSFT, UPS, FDX, and WMT spends to maintain their infrastructure and add tens of billions in annual FCF.

Seeking Alpha, Steven Fiorillo

Conclusion

I am changing my stance again on AMZN, and I think it's a strong buy at these levels. I am basing my investment thesis on improving profitability and future growth. Instead of focusing on a few quarters of slower revenue growth in AWS and compressed margins, I think the focus should be on overall business improvements. What is AMZN worth when it's in a position to allocate considerably less in CapEx and generate an additional $20-$30 billion in FCF annually? AMZN has been in a position to aggressively spend on building its infrastructure, and I believe it can flip the profit switch a lot sooner than the market is giving them credit for. AMZN could sell off further, but from a long-term perspective, I think now is an opportunistic time to be bullish on AMZN. I wouldn't be surprised if shares of AMZN exceed $150 sometime in 2024, as all we need is a string of solid quarterly reports that show an improved operating profit, cash from operations, and FCF.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, AAPL, META, GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.