Kirby: Profitability Likely To Be Dampened, Avoid

Summary

- Although the company returned to profitability in 2022, the level of profitability was still about $160 million lower than it was 8 years prior.

- The company will be rolling 32% of its debt this year. If you've been paying attention, you know interest rates are relatively high at the moment. This will dampen profitability.

- In spite of all of this, the market is paying a premium for this low-growth business. This is a bad combination in my view.

Sjo/E+ via Getty Images

It's been about 8 ½ months since I wrote yet another cautious note about Kirby Corporation (NYSE:KEX), and in that time, the shares are up about 7.5% against a loss of about .8% for the S&P 500. The company has reported earnings yet again, and they were quite good in many ways, so I thought I'd review the name yet again. I'll decide whether it makes sense to buy at $72.25, when I couldn't see my way to buying at $67. This will obviously be dependent on the valuation. I missed out on some great gains previously, and it's time to see whether or not it makes sense to bite the bullet and finally rejoin this party.

I'm busy, and you're busy. Thus, we may not have time to wade through an entire article. This is particularly so with some of my articles. Anyway, since I'm obsessed with saving you time, I offer a "thesis statement" paragraph in each of my articles that gives you the "gist" of my thinking up front. This allows you to get the "gist" of my thinking immediately, so you can then decide whether or not you want to continue to wade deeper into the article or "get while the gettin's good." You're welcome. I'm of the view that Kirby shares remain a poor investment at current levels, in spite of the huge uptick in profits from last year to this. While I'm very impressed by the fact that the company moved from a loss to a positive profit, I feel a need to remind investors that profits last year were about $160 million lower than they were in 2014. This is not a "growth" business, which is why it doesn't deserve a PE of 29 in my view. In the relativistic game of investing, we're constantly on the lookout for risk adjusted returns. In my view, Kirby stock offers poor returns at high risk, and thus should be eschewed. Thus ends the "thesis statement" portion of our programming.

Financial Snapshot

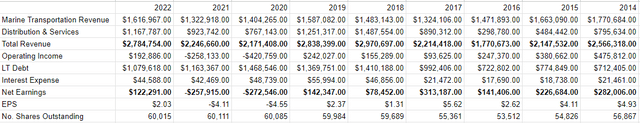

I'd say that the financial performance here has been quite good. Both of the "Marine Transportation" and "Distribution & Services" groups did very well, with revenue up by 22.23% and 26.4%, respectively. Additionally, the company seems to have come out of the losing slump it was on over the past two years, with net income up by about $380 million from a loss of $258 million in 2021 to a positive $122.3 million last year. Performance has been quite good relative to the previous two years.

Those who know me best, though, know that I'm a bit of a "downer." This explains the state of my social life. If something's going great, I'm the guy who insists on pointing out the problems. Because, as the song says, I "gotta be me", I'm going to point out some problems here. First, interest expense has crept up again by about 5% from last year to this. Average interest expense has been creeping up for years, actually, as it was 3.1% in 2020, 3.2% in 2021, and was 3.8% in 2022.

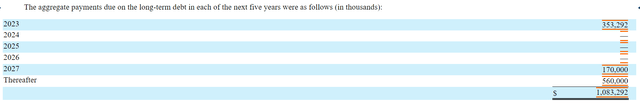

I've plucked the following table from page 61 of the latest 10-K for your viewing pleasure. It shows that about 32% of long term debt is going to be rolled this year. Given where interest rates are this year relative to the past five, I expect average interest expenses to continue to climb higher.

Kirby Debt Repayment Schedule (Kirby 2022 10-K)

Interest expense was about 36% of net earnings in 2021, and I anticipate that figure going higher.

In spite of this, I think it fair to say that this is a reasonably solid business that has returned to profitability. I'd be very happy to buy at the right price.

Kirby Financials (Kirby investor relations)

The Stock

One of the most important, and most painful, lessons I ever learned is that a company is different from the stock that supposedly represents it. The stock is, in fact, often a poor proxy for the underlying business. I've told and written this story a few times, but I think it's worth repeating because it highlights a mistake that less experienced investors often make. It was the late 1990s, I had bought an irresponsibly large amount of Nokia because I knew the company was going to report rapid growth. They did as I expected, and the stock dropped about 9% in early trading hours. The company delivered very good results, but the market expected very, very good results. Since the company didn't meet the market's expectations, the stock was punished. I learned more from this painful, expensive lesson than I did from every one of my accounting and finance classes in business school. It's not about how the company does, it's about the extent to which the company meets, exceeds, or falls short of expectations.

Just because a company delivers great financial results doesn't mean that the stock will go up. If there was that tight a relationship between the two, investing well would be much, much simpler. Ever since this incident, I've drawn a distinction between "stock" and "company" and have realized that a great company can be a terrible investment if you buy it for the wrong price.

The company may sell vital marine transportation services and is affected by the dynamics of that business. The stock, on the other hand, is a piece of virtual traded paper that gets passed around, and rises and falls in price depending on the crowd's ever changing views about the health of the business. Additionally, the stock may get taken along for the ride when the crowd becomes more or less enamoured of "stocks" as an asset class. Given the above, I want to only ever buy a stock when it's cheap, because doing so insulates me as much as possible against the vagaries described above.

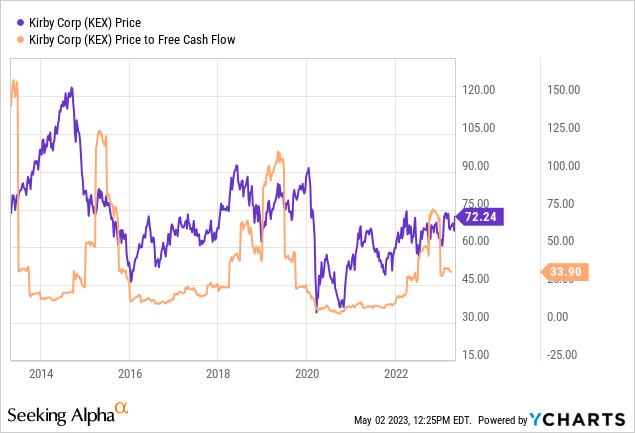

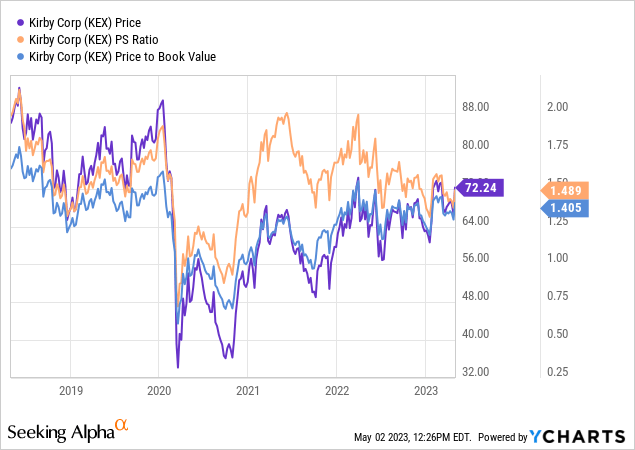

My regular readers know that I measure whether or not a stock is cheap in a few ways, ranging from the simple to the more complex. On the simple side, I look at the ratio of stock price to some measure of economic value, like sales, book value and the like. Ideally, I want to see a stock trading at a discount to both the overall market and its own history. When I last reviewed Kirby, I eschewed the shares because the valuation was very rich in my view. For instance, the price to free cash flow had spiked to over 50, and the market was paying $1.68 for $1 of sales, and $1.37 for $1 of book value. I put those numbers in context by pointing out that I did very well on my Kirby investment when it was trading at a price to free cash flow of about 7 times.

Fast forward to the present, and here's the lay of the land:

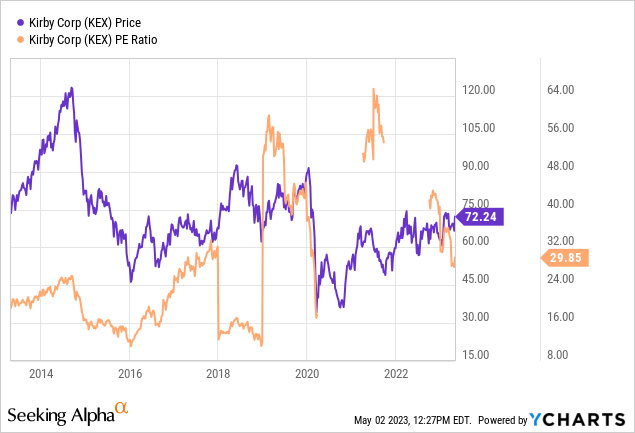

The shares are much cheaper on the price to free cash and a price to sales basis, which is unsurprising given the great performance in 2022. The problem is that "cheaper" is not the same thing as "cheap." Additionally, now that earnings have returned to the equation, we can look at the current PE relative to the past decade. The market is paying a PE of just under 30 times, in spite of the fact that we could reasonably call this a "growth free business." For example, net income in 2014 was $282 million. It was $122.3 million last year.

My regulars know that I think ratios can be instructive, but I want to confirm (or not) what they're "saying" by trying to work out what the market is "thinking" about a given investment. If you read my stuff regularly, you know that the way I do this is by turning to the work of Professor Stephen Penman and his book "Accounting for Value" for this. In this book, Penman walks investors through how they can apply some pretty basic math to a standard finance formula in order to work out what the market is "thinking" about a given company's future growth. This involves isolating the "g" (growth) variable in this formula. In case you find Penman's writing a bit opaque, you might want to try "Expectations Investing" by Mauboussin and Rappaport. These two have also introduced the idea of using the stock price itself as a source of information, and we can infer what the market is currently "expecting" about the future.

Applying this approach to Kirby at the moment suggests the market is assuming that this company will grow earnings at a rate of ~12%, which I consider to be massively optimistic. In my view this is yet another sign of the market's optimism here. While things may work out as perfectly as the crowd seems to believe they will, I am skeptical. I'd rather preserve capital at the moment than shoot for gains, and for that reason, I must continue to recommend avoiding the shares.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.