The Bottom Fishing Club: Tyson Foods

Summary

- Tyson's price downtrend over the past year has opened an intelligent cyclical valuation buy proposition.

- Stable food demand trends and a return to long-term margins during 2024 should support a 25%+ total return over the next 12 months.

- Underlying bullish momentum on the trading chart may be telegraphing extra reward vs. risk potential now exists for investors.

Joe Raedle/Getty Images News

If you are searching for a stable, leading food business for your portfolio that pays a high dividend yield, likely to rise nicely over time on a better-than-normal coverage from earnings, the easy pick might be Tyson Foods (NYSE:TSN). The stock quote declined -40% from 2022's peak into March, but is showing signs of a turnaround. The good news for investors is a sound valuation can be grabbed during the 2023 hiccup in profit margins coming off COVID's boom demand for at-home food choices. In fact, the current Tyson price may prove a bargain looking back in 2024, assuming normalized margins on sales return in 12-18 months.

Tyson is one of the top U.S. producers/sellers of frozen and cold meats, especially its main focus on chicken, found at your local grocer. Popular items include Tyson fresh and frozen chicken cuts, Hillshire Farm sliced/processed meats, Jimmy Dean breakfast sausages, Ball Park franks/hot dogs, Sara Lee premium deli meats, aidells sausages, and Fast Fixin' frozen ready to heat and eat meats, just to list a few.

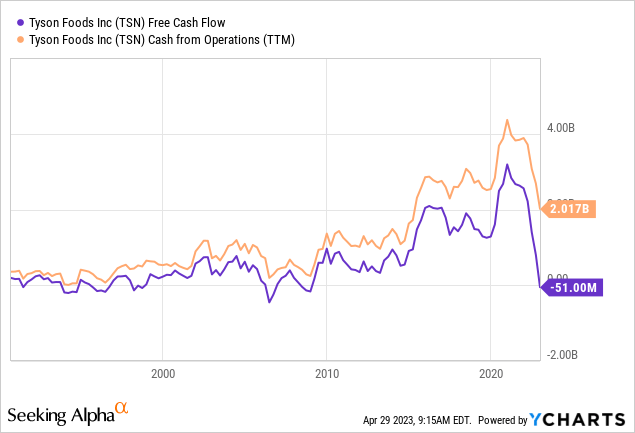

The company has steadily grown over the decades to a point where cash flow since 2015 has bounced between $2 and $4 billion annually. To reach its current size, reinvestment in the business through the acquisition of new brands and capital spending on plant & equipment has kept "free" cash flow more limited. Going forward and because of its large size, I expect management to continue following its latest focus on the return of capital to shareholders (through dividend raises and potential future share buybacks). Based on the company reaction to super-sized free cash flow achieved during the pandemic boom in demand for its products, cash flow generation could be sent to owners at increasing rates into 2025.

YCharts - Tyson Foods, Cash Flow Stats, Since 1991

Bullish Valuation Story

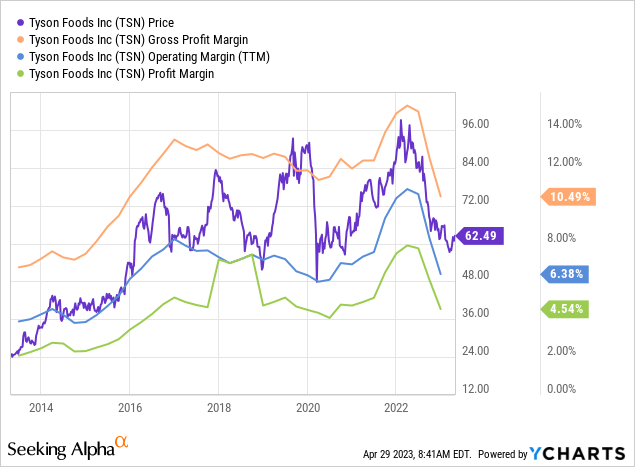

The first thing you will notice when researching Tyson is its stock price is HIGHLY correlated with the prevailing rates of profit margin on sales. The main excuse for the -40% dump in its share price has been a pivot in margins from excessive to below average this year. To a degree, the meat industry goes through cycles like other businesses. The stretched COVID-related margins of 2020-22 have encouraged new entrants and supply to appear. So, we are in the down part of the cycle for Tyson. Today's margins are the lowest since early 2016.

YCharts - Tyson Foods, Stock Price vs. Profit Margins, 10 Years

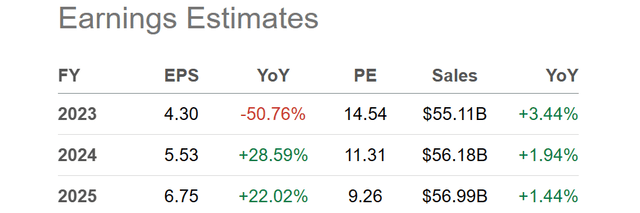

The bullish view is the company remains wildly profitable, and the return of normalized margins in 2024-25 should jump EPS back into the $5-6 range. Wall Street forecasters are expecting such a scenario.

Seeking Alpha Table - Tyson Foods, Analyst Estimates for 2023-25, Made on April 28th, 2023

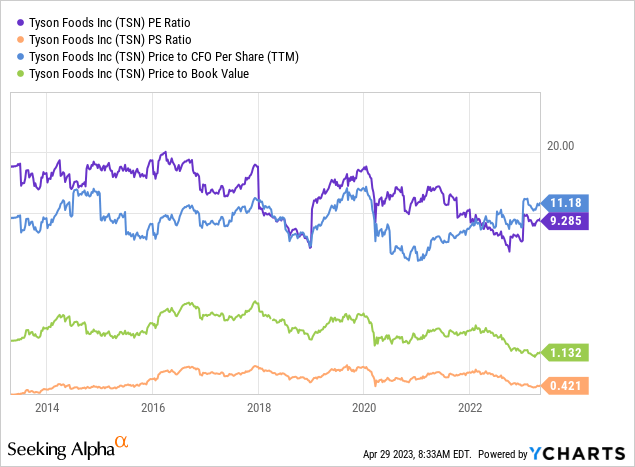

In terms of the stock's basic fundamental ratio valuation on trailing earnings, sales, cash flow, and book value, Tyson is trading at a lower than 10-year average position right now. If you look only at sales and book value, it is closer to a decade low.

Seeking Alpha Table - Tyson Foods, Basic Trailing Valuation Ratios, 10 Years

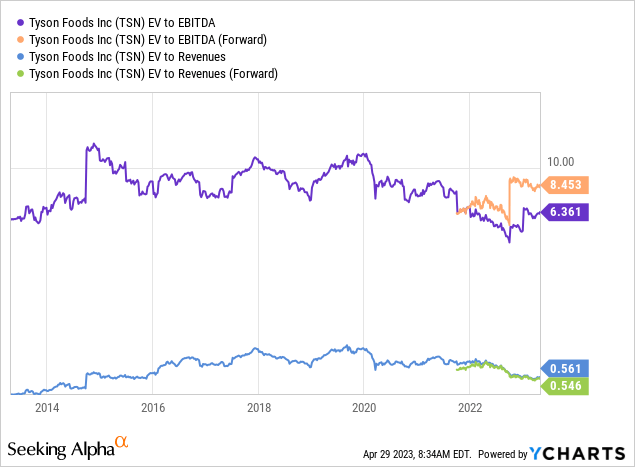

When we include debt and subtract cash holdings, the enterprise value picture does not change the underlying story much. You will note that lower margins and EBITDA are forecast for 2023.

Seeking Alpha Table - Tyson Foods, Enterprise Valuation Ratios, 10 Years

Dividend Income Buy Logic

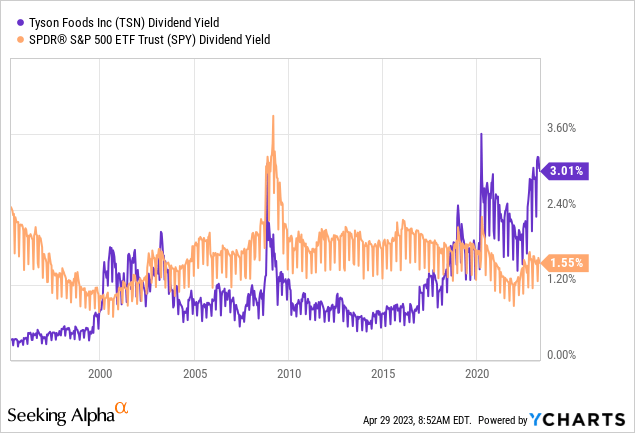

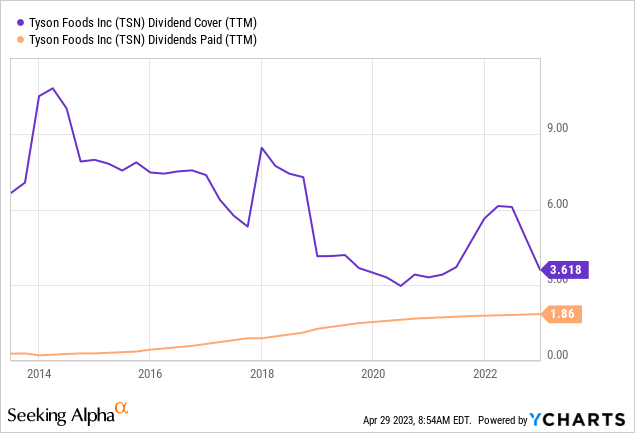

An even stronger ownership argument may come from the rising dividend payout trend from the company each year, plus its higher current yield available now after the stock selloff into April. Today's 3%+ yield is double the S&P 500 rate (sitting at the largest relative spread ever), with an easily covered from earnings rate of 3.8x compared to 2x to 2.5x from the typical S&P 500 blue-chip business.

YCharts - Tyson Foods vs. S&P 500 ETF, Trailing Dividend Yield, Since 1995 YCharts - Tyson Foods, Dividend Cover Ratio from Earnings, Rising Dividend Payout, 10 Years

The terrific news for Tyson owners is management could increase the dividend payout rate by 50% to 100%, and still be in a conservative zone vs. other companies (given normal profit margins and some sales growth takes place in 2024). In other words, Tyson could afford a 5% to 6% dividend yield payout at today's share price of $62. And, it would still retain enough earnings and cash flow generation to move operations in a growth direction, creating capital appreciation through share quote gains over time. [Warren Buffett and Berkshire Hathaway may want to kick the tires and dig deeper into this idea, in my opinion.]

Technical Trading Momentum

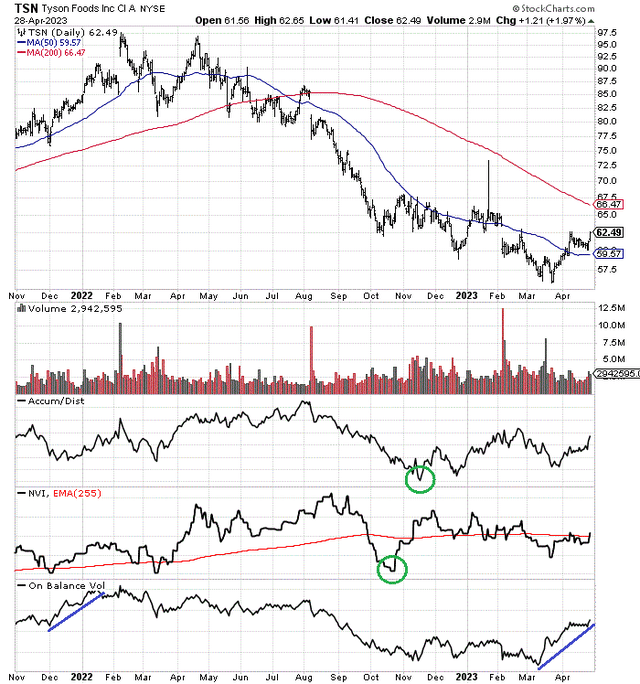

Another reason to consider purchasing a Tyson position is a turnaround in stock trading momentum may be taking place right now, from aggressive sellers having the upper hand to buyers taking control.

On the 18-month trading chart below, I have drawn several important momentum indicators that are highlighting increased buying trends. The Accumulation/Distribution Line and Negative Volume Index readings bottomed in October-November (circled in green), long before the final price lows of March. The new price declines in December and again in March were not confirmed with selling pressure as aggressive as witnessed between August to November.

Next, buying interest as measured by On Balance Volume has really taken off the last 7 weeks. I have marked with blue lines the current OBV spike alongside the last similar ramp higher in December 2021. From the previous point of reference into April 2022, Tyson strongly outperformed the S&P 500. Essentially, equity markets overall were in serious decline as Russia invaded Ukraine, at the same moment as energy/food commodity shortages were feared.

StockCharts.com - Tyson Foods, Author Reference Points, 18 Months of Daily Price & Volume Changes

Final Thoughts

For bottom-fishing thinkers, Tyson is a blue chip with clear upside arguments. It's a defensive pick in the food industry, with a powerful dividend yield setup for long-term income investors. Margins will be down in the immediate future, but should recover nicely in 12-18 months. If you are willing to hold it for a number of years, I am confident you will be rewarded handsomely. More than likely, Tyson will outperform the U.S. stock market in general as overvaluations remain in the majority of U.S. stocks, especially if a recession in corporate profitability is next.

I rate Tyson a Buy, with a share price target range of $75 to $80 by the middle of 2024. Such a gain would support a total return of +25% to +35%. Not an incredible advance mind you, but if the S&P 500 is flat to lower over the same span, Tyson might be a truly productive idea to consider. An improved margin outlook and a simple 10-year average valuation setup gets you to this gain. Of course, much higher profitability on better-than-expected sales, and an above-average valuation could produce a share quote above $100 in 2024 (all-time highs). Such a scenario would deliver a total return of +65% or higher over 18-24 months.

What are the risks? For starters, Tyson Foods has a spotty trading/operating record during past recessions. The company's worst operating performance arguably occurred between 2007-10, the Great Recession period. Tyson experienced a number of growing pains in operations and stagnate sales during that span. So, a severe recession later in 2023 may hold back the share quote (although I worry other stocks in America could decline even faster in price and value). I do believe downside is rather limited in a continued bear market phase on Wall Street. I have downside projections to $50 in worst-case scenarios (-20% for a total return), absent an all-out stock market crash.

All told, I am projecting Tyson will perform materially better than the S&P 500 the rest of the year, no matter if we get a big rise or decline in stock quotes generally. Buying it on the cheap, with analyst sentiment in the cautious to bearish zone may be the winning strategy from here. In the end, I am taking a contrarian slant vs. conventional wisdom, and forecasting now is a great time to buy a stake, especially on any weakness under $60 a share.

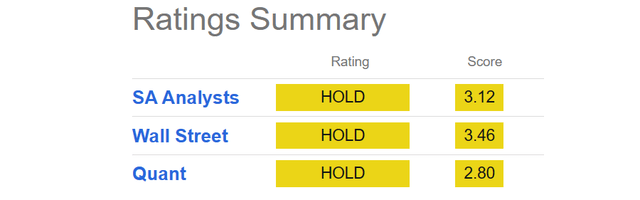

Seeking Alpha Table - Tyson Foods, Ratings Summary, April 29th, 2023

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in TSN over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This writing is for educational and informational purposes only. All opinions expressed herein are not investment recommendations, and are not meant to be relied upon in investment decisions. The author does not provide personalized or individualized investment advice or information that is tailored to the needs of any particular recipient. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. When investing in securities, investors should be able to bear the loss of their entire investment and should make their own determination of whether or not to make any investment based on their own independent evaluation and analysis. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. Any projections, market outlooks, or estimates herein are forward looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. This article is not an investment research report, but the author’s opinion written at a point in time. Opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information, and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein. Any and all opinions, estimates, and conclusions are based on the author's best judgment at the time of publication, and are subject to change without notice. The author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials. Past performance is no guarantee of future returns.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.