Enagas Is Finally Delivering

Summary

- Positive implication from TAP and from Enagás regasification facilities.

- Asset rotation in place with a net capital gain of €40 million on the Gasoducto de Morelos sale.

- Q1 results are on track to meet the annual financial target. Our valuation is then confirmed.

Lucia Gajdosikova/iStock Editorial via Getty Images

Here at the Lab, we analyzed Enagás (OTCPK:ENGGF, OTCPK:ENGGY) in the latest years and before commenting on the company's recent Q1 results, it is important to follow up on two publications.

Starting with the oldest one titled Enagas Is Playing A Crucial Role In The Energy Crisis released in early May 2022, we emphasized how the Spanish pipeline company "could manage 40% of the total capacity in continental Europe thanks to its 6 regasification plants and plays a central role in EU energy diversification". In October, we also analyzed the French market hostility; and despite the negative political sentiment, we forecasted an increase in capacity on the existing Euskadour pipeline. According to our estimates, Enagás could deliver 1.5 bcm of gas to Europe.

Looking at the recent release, we have been way upfront in our indication. But, in Q1, Enagás delivered 8 TWh of natural gas to France (a record) with an increase of more than 104%. In addition, as already anticipated, 43% of the total European LNG has been stored & regassed in Enagás regasification facilities. Following the Nord Stream collapse, gas vessels number increased by 124% compared to Q1 2022. This was well in line with our previous indication and we are not surprised to see a positive stock price appreciation since our last update.

Mare Evidence Lab's previous publication

Secondly, there was a change in the TAP shareholding structure. The Trans Adriatic Pipeline entered into operation in 2020 end and has now become crucial to offset the Russian gas volume drop. As of 31 December 2022, the company that owns the TAP pipeline was still owned by six shareholders. In January 2023 end, Axpo Trading decided to exit and sell the entire stake, dividing it between Enagas (4%) and Fluxys (1%). The agreed amount was €210 million, of which €168 was to be paid by Enagas and the other €42 million by Fluxys. This transaction gives TAP a valuation of €4.2 billion.

TAP will have 5 shareholders of equal weight because Fluxys and Enagas will also rise with a 20% equity stake. Nothing should change in governance relationships. In detail, none of TAP's shareholders can exercise control over the company, not even jointly. Having analyzed Snam's 2022 financial report, TAP value investment moved from €310 to €450 million. This means that 10% of Enagás' market cap is related to TAP.

Operationally speaking, over 19 billion gas cubic meters have so far arrived in Italy through the pipeline. This data were updated on 14 April 2023 and was a record in volumes versus 2022. Gas imports increased by 2.6 billion cubic meters with a growth of approximately 15% thanks to operations optimization. As already mentioned in our 'Positive News Ahead' note, these flows are destined to grow further, up to double the current annual capacity. To support this thesis, REPowerEu, which is the plan presented in 2022 by the European Commission to end Russian fossil fuels dependence, agreed to a capacity expansion. Currently, the TAP dividend contributed to €70 million to Enagás accounts. In 5 years, this number could double.

Q1 Results and Conclusion

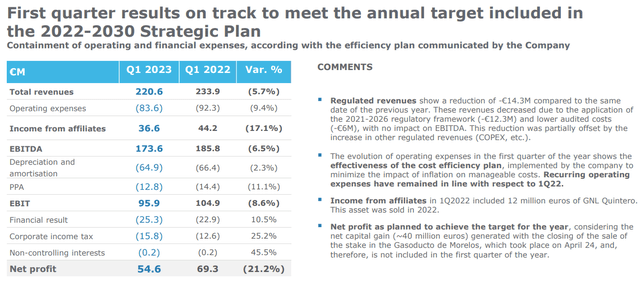

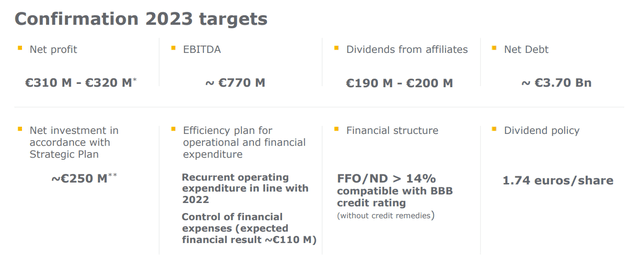

As expected, given the regulatory framework application, Enagás regulated revenues decreased by €14.3 million (Fig 1). Enagás' strategic plan is advancing, and operating expenses reduction was higher than revenue loss. Despite that, the company was not able to limit its earnings reduction. This was also due to a lower income from affiliates. As a reminder, in Q1 2022 GNL Quintero contributed €12 million. In 2022, the asset was sold. On a positive note, Enagás is moving on with its asset rotation plan. Aside from the TAP agreement, the company completed the Gasoducto de Morelos sale. There is a capital gain of approximately €40 million that follows a deal closed for €87 million. Excluding this positive one-off, Enagás' net income reached €54.6 million and was in line with the company's financial target (Fig 2).

Therefore, no changes in our estimates. The dividend was once again confirmed and so is our valuation. Our buy target rating is supported by our previous analysis and valuing Enagás with a DDM model with a fixed dividend per share set at €1.74 (and a discount and growth rate of 8% and 1% respectively), we still derive a buy rating price of €24 per share ($12.5 in ADR).

Source: Enagás Q1 results presentation - Fig 1

Fig 2

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ENGGF, ENGGY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.