The Fed's May Rate Hike Will Likely Not Be Its Last

Summary

- The March 2023 FOMC statement mimics the policy path of 2006.

- If that continues to play out, then May will not be the last rate hike of this cycle.

- The economic data suggest that more rate hikes will be needed.

- Looking for a helping hand in the market? Members of Reading The Markets get exclusive ideas and guidance to navigate any climate. Learn More »

Alex Wong/Getty Images News

The Federal Open Market Committee (FOMC) meeting on May 3 is highly significant. Many investors expect it to be the final rate hike of one of history's most aggressive rate-hiking cycles. Starting from Wednesday, every economic data point will take on added significance. Despite inflation cooling down, the real challenge begins now.

This is where the Federal Reserve and the market may diverge in their outlooks. On the one hand, the market believes that the Fed will be cutting rates aggressively in the latter half of 2023, while on the other hand, the Fed has repeatedly stated that it does not plan to cut rates in 2023.

The market is currently giving the Fed the green light to raise rates in May, with the Fed Funds Futures market indicating a more than 80% rate hike probability. However, it is uncertain what will happen after that, as the market is pricing in a low likelihood of another rate hike in June.

More Rates Hikes May Be Coming

As a result, investors will closely scrutinize the FOMC statement for any clues about the Fed's plans as well as Powell's press conference. If the statement remains unchanged, it will leave the door open for further rate hikes if the economic data warrants such action.

The critical language in the FOMC statement investors will hone in on will be the phrase:

The Committee anticipates that some additional policy firming may be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time.

The interesting thing about this language is it has been used before, under Alan Greenspan during the mid-2000 hiking cycle, but it didn't signal the end of the rate hiking cycle. In the December 2005 statement, there was the language that read:

The Committee judges that some further measured policy firming is likely to be needed to keep the risks to the attainment of both sustainable economic growth and price stability roughly in balance.

The December 2005 language was changed from the November 2005 statement, which read:

With underlying inflation expected to be contained, the Committee believes that policy accommodation can be removed at a pace that is likely to be measured.

That November 2005 language was the critical messaging the Fed used throughout several prior meetings as the Fed continued to raise rates. Then after raising rates again by another 25 bps in January 2006 following the December language change, the language changed just a bit again, with the word "likely" being changed to "may" and the removal of the word measured.

The Committee judges that some further policy firming may be needed to keep the risks to the attainment of both sustainable economic growth and price stability roughly in balance.

The Fed raised rates by 25 bps in March 2006, May 2006, and June 2006. The June 2006 rate hike was the last of the cycle, and the Fed signaled that the June 2006 hike was the last hike by changing the wording in the statement to read:

The extent and timing of any additional firming that may be needed to address these risks will depend on the evolution of the outlook for both inflation and economic growth, as implied by incoming information.

Statement Is Not Likely To Change

It is probably not by chance that the language used in the March 2023 statement, "the Committee anticipates that some additional policy firming may be appropriate," is almost identical to the 2006 rate hiking cycle; "the Committee judges that some further policy firming may be needed," and should serve as a warning to investors that May, may not be the last rate hike of this cycle. If the language doesn't change in the May 2023 statement, the likelihood of another rate hike in June is probably greater than what the market is currently discounting.

Tighter Lending Standards

The market has been betting that the Silicon Valley and Signature Bank failures, and now potentially First Republic, will work to tighten lending standards, forcing the Fed to cut rates later in 2023. But some signs suggest that lending hasn't slowed very much.

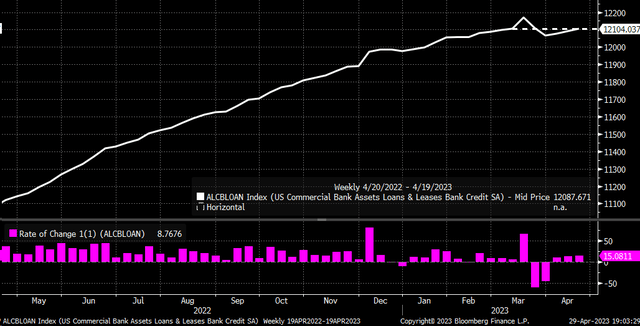

US commercial bank assets, loans, and lease data show that activity has rebounded and is now back to where they were on March 8 and is again trending higher. Not to mention that the week of March 15 saw a huge surge before the slight decline following the SVB failure.

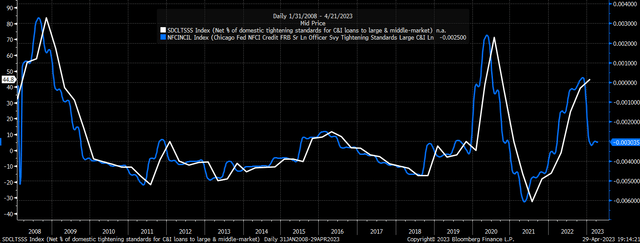

Additionally, the senior loan officer survey is a closely watched indicator for many investors. It provides insight into changes in lending standards for commercial and industrial loans to large and mid-sized companies. The January survey showed a tightening of lending standards, with 44.8% of respondents indicating that they were tightening their standards. However, the Chicago Fed National Financial Conditions Index, which tracks weekly changes in the FRB Senior Loan Officer Survey, has shown that standards for those tightening large C&I loans have significantly relaxed and haven't changed materially since the SVB failure.

If that is the case, then the tightening of lending standards some are waiting to see hasn't happened yet. Of course, just because the Chicago Fed measure has been a good predictor of the FRB senior loan officers survey due in a couple of weeks doesn't mean it has to continue to work. But given the evidence, it seems those lending standards have not tightened and have been easier, while commercial bank data shows that loans and leases are again rising.

Nominal Growth Is Still Too Strong

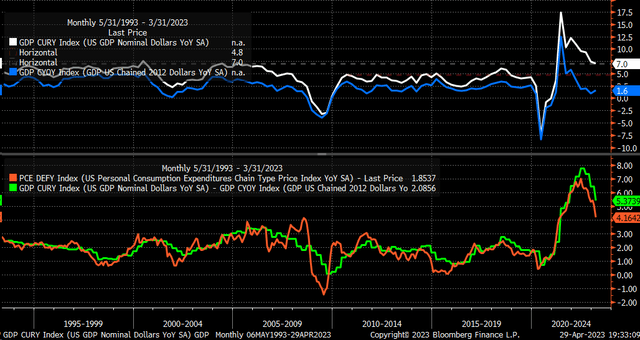

So once again, the idea that the Fed is going to be forced to cut rates by the end of 2023 doesn't seem to be materializing. This may be especially true when nominal GDP is still growing at a 7% year-over-year rate and is on par with the economies of the late 1990s and mid-2000s and during the inflationary years of the 1970s and 1980s. To get inflation back to that 2% rate the Fed desires, the nominal GDP growth rate will probably need to drop to under 5%, assuming a 2% inflation and a 3% real growth rate.

But currently, the real first quarter 2023 GDP increased by 1.6% year-over-year versus the nominal 7% growth. That difference is essentially the inflation rate, around 5.3% in the first quarter on a year-over-year basis, which is not the same as the reported seasonal adjusted annualized rate.

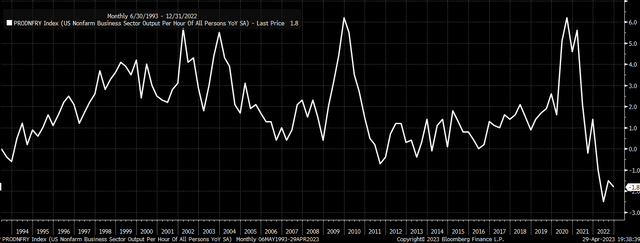

So, the Fed, in essence, to get inflation down to its target, needs to target nominal GDP growth. Considering in nominal terms, the US economy is growing at its fastest pace in decades; the Fed still has a lot of work to do because it needs to get that nominal GDP growth to fall more or somehow increase productivity, and non-farm productivity has fallen dramatically in recent quarters, and fell by 1.8% y/y in December, and has been trending lower for many quarters.

So, while a 25 bps rate hike in May seems to be a given at this point, based on market pricing, what happens next will be dependent on the economic data and, more importantly, the April Job report and the inflation data that come mid-May.

Given that the Fed knew about the increased risk of bank failures at the February FOMC meeting and still chose to go ahead with raising rates by 25 bps at that meeting and again in March, it should tell investors a lot about how the Fed plans to deal with financial stability and inflation in very different manner.

Unless the language in the statement changes or Powell explicitly says the Fed is pausing, the data suggest that more rate hikes are coming because inflation is still extremely high. There needs to be more work done to bring inflation back under control.

Join Reading The Markets Risk-Free With A Two-Week Trial!

(*The Free Trial offer is not available in the App store)

Find out why Reading The Markets was one of the fastest-growing SA marketplace services in 2022. Try it for free.

The market is more complex than ever, and Reading The Markets is here to help you cut through all the noise and to help you better understand what is driving trading and where the market is likely heading, both short and long-term.

Check out my newsletter if you want to start with something less intensive.

This article was written by

I am Michael Kramer, the founder of Mott Capital Management and creator of Reading The Markets, an SA Marketplace service. I focus on long-only macro themes and trends, look for long-term thematic growth investments, and use options data to find unusual activity.

I use my over 25 years of experience as a buy-side trader, analyst, and portfolio manager, to explain the twists and turns of the stock market and where it may be heading next. Additionally, I use data from top vendors to formulate my analysis, including sell-side analyst estimates and research, newsfeeds, in-depth options data, and gamma levels.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Charts used with the permission of Bloomberg Finance L.P. This report contains independent commentary to be used for informational and educational purposes only. Michael Kramer is a member and investment adviser representative with Mott Capital Management. Mr. Kramer is not affiliated with this company and does not serve on the board of any related company that issued this stock. All opinions and analyses presented by Michael Kramer in this analysis or market report are solely Michael Kramer's views. Readers should not treat any opinion, viewpoint, or prediction expressed by Michael Kramer as a specific solicitation or recommendation to buy or sell a particular security or follow a particular strategy. Michael Kramer's analyses are based upon information and independent research that he considers reliable, but neither Michael Kramer nor Mott Capital Management guarantees its completeness or accuracy, and it should not be relied upon as such. Michael Kramer is not under any obligation to update or correct any information presented in his analyses. Mr. Kramer's statements, guidance, and opinions are subject to change without notice. Past performance is not indicative of future results. Neither Michael Kramer nor Mott Capital Management guarantees any specific outcome or profit. You should be aware of the real risk of loss in following any strategy or investment commentary presented in this analysis. Strategies or investments discussed may fluctuate in price or value. Investments or strategies mentioned in this analysis may not be suitable for you. This material does not consider your particular investment objectives, financial situation, or needs and is not intended as a recommendation appropriate for you. You must make an independent decision regarding investments or strategies in this analysis. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Before acting on information in this analysis, you should consider whether it is suitable for your circumstances and strongly consider seeking advice from your own financial or investment adviser to determine the suitability of any investment.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.