CEF Weekly Review: Bank Wobble Drives Deleveraging In Some Preferreds CEFs

Summary

- We review CEF market valuation and performance through the third week of April and highlight recent market action.

- The CEF market was mostly down as interest rates and credit spreads rose over the week.

- A number of preferred CEFs deleveraged in March on the back of the bank tantrum.

- Systematic Income members get exclusive access to our real-world portfolio. See all our investments here »

Darren415

This article was first released to Systematic Income subscribers and free trials on Apr. 23

Welcome to another installment of our CEF Market Weekly Review where we discuss closed-end fund ("CEF") market activity from both the bottom-up - highlighting individual fund news and events - as well as the top-down - providing an overview of the broader market. We also try to provide some historical context as well as the relevant themes that look to be driving markets or that investors ought to be mindful of.

This update covers the period through the third week of April. Be sure to check out our other weekly updates covering the business development company ("BDC") as well as the preferreds/baby bond markets for perspectives across the broader income space.

Market Action

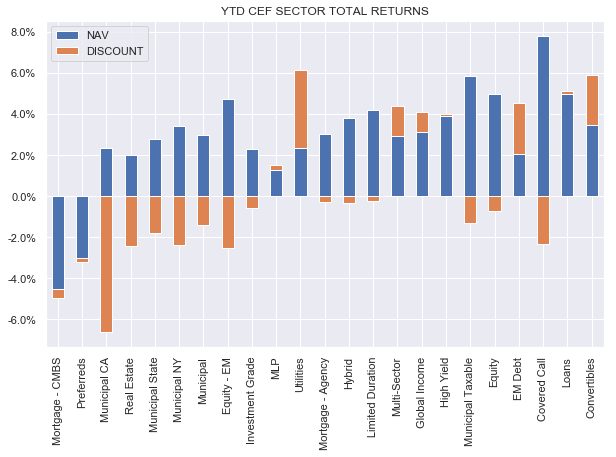

The CEF market was down nearly across the board, as interest rates and credit spreads rose over the week, with only the unloved CMBS sector eking out a positive return. The year-to-date picture remains pretty strong, however, with most sectors in the green.

Systematic Income

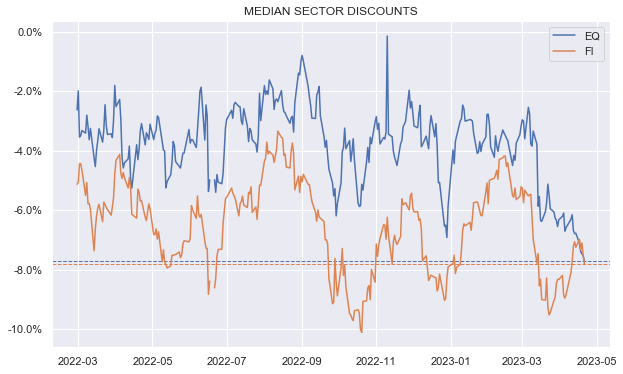

Equity CEF sector discounts continued to widen and now stand at the same level as their fixed-income CEF sector counterparts.

Systematic Income

Over the longer-term, CEF valuations are on the cheaper end, as we would expect, given performance since 2022, however they are not blindingly cheap. A double-digit level on a median sector basis would be more compelling for new capital allocations.

Systematic Income

Market Themes

The recent bank tantrum caused some deleveraging in the preferreds CEF sector. This is a pattern that we saw in 2020 as well as in 2022. A number of funds in the sector have strict leverage caps which means they need to sell assets when prices of holdings fall since this mechanically causes leverage to rise near the caps.

This deleveraging is typically not in investor interest because of the mean reversion that we tend to see in the sector. Selling when prices fall and buying back when they are higher obviously locks in economic losses.

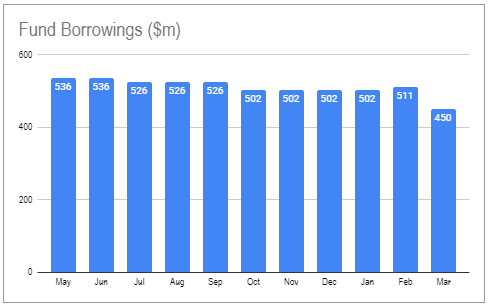

Nuveen and First Trust preferred CEFs deleveraged in March. We don’t know exactly where they sold assets. The NAV of JPS fell around 18% to the trough on March 20th and since then has rallied about 10%. We have to see the next time the funds add borrowings (i.e. buy back assets) but it’s very likely to be above the level where they sold.

Systematic Income

We can see how this happened with JPC as its borrowings fell to $450m from $511m.

Systematic Income CEF Tool

This frequent deleveraging pattern makes holding these funds as perpetual CEF options not super attractive. Another Nuveen Preferred CEF - (JPI) which is in some of our Income Portfolios, has a term structure whose benefits exceed the drag from this dynamic. JPI has outperformed the sector since 2021 (and since it was topped up in June of that year).

Market Commentary

Speaking of Nuveen preferred CEFs, Nuveen has proposed a merger of 3 of the funds: JPS, JPT and JPC. This continues the trend of CEF mergers that we saw over the last couple of years. This was particularly evident in the tax-exempt Muni sector.

The idea makes sense. There are often several funds from the same issuer particularly in the larger sectors and the funds tend to be run very similarly to each other. The mergers are themselves an admission that the managers tend to run multiple funds using pretty much the same strategy.

The preferreds sector is not particularly large but it has several managers with multiple funds. Nuveen has 4, Flaherty has 5, Cohen has 3, John Hancock has 3 (CEFConnect lists PDT in the preferreds sector but that’s wrong - preferreds are less than a quarter of the fund, rest being common shares and bonds). First Trust is the only issuer with a single fund.

JPI is left out of the merger as it’s a term fund. It may get absorbed eventually if it survives the tender offer which is likely to come around its termination date (mirroring what happened to JPT).

Stance And Takeaways

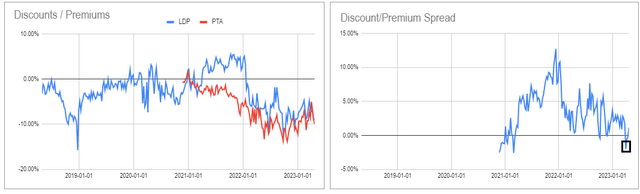

The recent Cohen & Steers preferreds CEF LDP / PTA relative valuation has corrected and LDP is back trading at a tighter discount than PTA. The differential is still less than 1% however (9.3% for LDP vs. 10.1% for PTA as of this writing) so we expect the differential to move closer to 2-3% i.e. further relative strength for LDP.

This also means that investors in taxable accounts who are concerned about the wash sale rule don't need to rush back to PTA. The pair spends most of its time with LDP trading at a tighter discount so there should be plenty of opportunity to swap back to LDP. It is the more unusual situation where PTA moves out to a tighter discount that demands more immediate action on the part of investors looking to monetize this relative value opportunity.

Check out Systematic Income and explore our Income Portfolios, engineered with both yield and risk management considerations.

Use our powerful Interactive Investor Tools to navigate the BDC, CEF, OEF, preferred and baby bond markets.

Read our Investor Guides: to CEFs, Preferreds and PIMCO CEFs.

Check us out on a no-risk basis - sign up for a 2-week free trial!

This article was written by

At Systematic Income our aim is to build robust Income Portfolios with mid-to-high single digit yields and provide investors with unique Interactive Tools to cut through the wealth of different investment options across BDCs, CEFs, ETFs, mutual funds, preferred stocks and more. Join us on our Marketplace service Systematic Income.

Our background is in research and trading at several bulge-bracket global investment banks along with technical savvy which helps to round out our service.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LDP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.