NICE: A Developing AI Story

Summary

- CXOs in every board room are willing to take the bet on AI without understanding what the real deal with AI is.

- NICE has the potential to ride the AI-wave, as one of the niche conversational AI plays in the market.

- We, however, remain cautious of the challenges the company could face on the profitability and receivables front.

imaginima

Summary

We previously wrote about NICE (NASDAQ:NICE) in Sep 2022. Since then, the stock hasn’t moved much.

The remarkable bit about the almost negligible movement in NICE’s stock price is the lack of movement despite the company being a torchbearer for conversational AI! And, thanks to ChatGPT, right now AI is hot!

As we detail out below, AI has its own set of challenges and the ability of a prompt window to answer user queries, does not readily translate into cash flows!

Given the lack of clarity around some of the company’s financials (especially around how growth in AI will impact margins), we think it is best to stay neutral on NICE stock, unless the urge to ride the AI wave gets the better of readers.

What is conversational AI and why does it play to NICE’s strength

Per Microsoft, AI can be understood as follows:

Using math and logic, a computer system simulates the reasoning that humans use to learn from new information and make decisions.

An artificially intelligent computer system makes predictions or takes actions based on patterns in existing data and can then learn from its errors to increase its accuracy.

Barak Eilam, CEO of NICE thinks:

To become an AI leader, software companies must have three key assets: a Cloud platform that has been widely adopted, massive amounts of historical data and industry-specific domain expertise. NICE is the only one in our industry with these three assets. We have spent the last several years building and deploying ENLIGHTEN, fully embedded in CXone, transforming it from a software platform to an AI platform and creating an unbridgeable gap in our AI leadership. Just a few weeks ago, we were the first to release a groundbreaking integration between ENLIGHTEN AI and ChatGPT pioneering human-like interactions in CX conversational AI, demonstrating our unparalleled innovation.

Source: Q4 2022 NICE Earnings Call from Seeking Alpha

For clarity, Enlighten is a custom AI engine for customer experience or CX.

Our custom-built AI engine for CX, Enlighten is embedded across our entire platform and suite of applications. It uses historical data to understand CX needs, behaviors and different types of characteristics, analyzes every interaction and allows proactive identification of needs and the ability to act on them in real time. Enlighten AI also leverages conversational data from employee-assisted interactions to discover automation opportunities for self-service. It guides agents in real-time to reduce friction, keeping them informed and prepared, connects people on a personal level to optimize outcomes, and redefines the quality and coaching process to be based on agents’ soft skill behaviors measured on all interactions.

Source: NICE 20-F 2022

CXone refers to NICE’s cloud-based customer engagement platform.

CXone, the global leading unified cloud customer engagement platform that combines guided journey orchestration for voice and digital channels, and comprises of tightly integrated IVR, advance digital capabilities, self-service, bots, proactive conversational AI, knowledge management, agent assist tools, customer journey analytics, leading Workforce Engagement Management and automation solutions.

Source: NICE 20-F 2022

Essentially, one of NICE’s key customer management solutions is called CXone. Within the CXone, Enlighten is offered as a conversational AI system that has been trained on the data NICE has access to.

Before we talk more about NICE, it is worth digressing to ChatGPT.

Understanding ChatGPT

ChatGPT is an OpenAI initiative. The efficacy of ChatGPT’s human-like responses to prompts has led many to assert how it can potentially help generate efficiencies in mundane jobs (read: eliminate grunt work).

ChatGPT’s popularity and instant adoption has also spurred a flurry of AI tools, with Open AI’s valuation jumping to $29 billion with a total investment exposure from Microsoft at $13 billion.

While Elon Musk had created OpenAI to be a not-for-profit entity, the recent valuation developments, and revenue forecast of $200 million in 2023 and $1 billion in 2024 have changed the expectations quite a bit.

While Sam Altman, the founder, claimed that the running cost is probably single-digits cents per chat, the subsidized rates from Azure due to Microsoft make it difficult to ascertain the actual unit economics.

Estimating the economics of running ChatGPT

ChatGPT had crossed a million users within 5 days of launch and one hundred million within Jan 23.

At $200 million in revenue, the expectation is of one million paying users (ChatGPT charges $20 per month or $240 per year). While the overall user base is likely to explode to closer to a billion users (author’s estimate based on the current interest in ChatGPT, dampened by launch of other competing AI tools and adoption in knowledge economies of Asia etc.), a 0.1% share of paying users or a million users is reasonable.

But what about the cost per query – assuming an average of ten queries per user per day (the current run rate), we are looking at around two hundred billion queries for the year (sum of queries from all the users growing from one hundred million to one billion). Even at a cost of $0.01 per query (based on Sam Altman’s inputs), we are looking at a $2 billion running cost! Of course, as the data stored grows, the cost to store and compute increases exponentially for large language models such as ChatGPT.

So from an operating perspective ChatGPT could end up with a revenue of $200 million against a cost of $2 billion or an operating loss of $1.8 billion.

Notwithstanding any increases in cost, per the analysis shown above, GPT, which is backed by Microsoft is unlikely to be profitable in the next couple of years.

How then is NICE expected to do?

NICE has been embracing AI for a while.

The company had started talking to the investor community about involving AI in their products as far back as 2017.

In the Q1 2017 earnings report, the CEO says:

The strong financial performance this quarter is the result of the good progress that we are seeing in our four strategic pillars: cloud, omni channel, analytics and artificial intelligence. As a result, we experienced particular strength for our analytics solutions, where we have seen a high volume of very large deals. Additionally, we are very pleased with progress of the integration of inContact, and we are witnessing accelerated momentum in our cloud business.

Source: Q1 2017 Earnings release

Before we jump into the numbers, the same CEO made another very interesting statement earlier this year.

So Cloud is almost, if you would like, a prerequisite in order to really enjoy the full benefit of AI

Source: Q4 2022 NICE Earnings Call from Seeking Alpha

While free (mostly) conversational AI usage backed by cloud is unlikely to be profitable, how does a paid play such as NICE do?

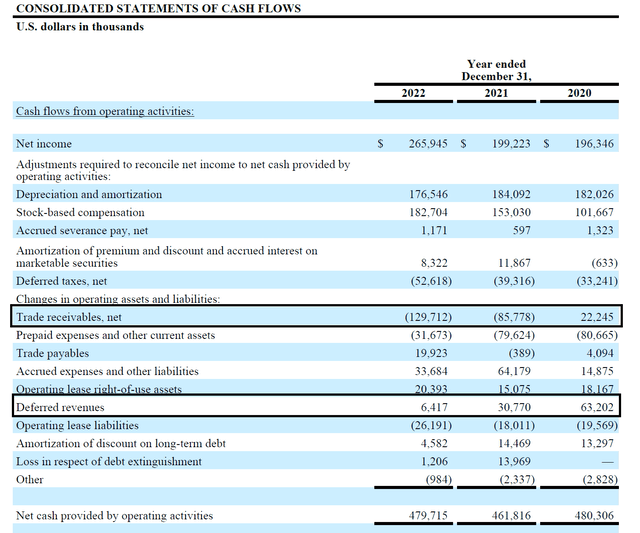

NICE's Gross Margins

Seeking Alpha

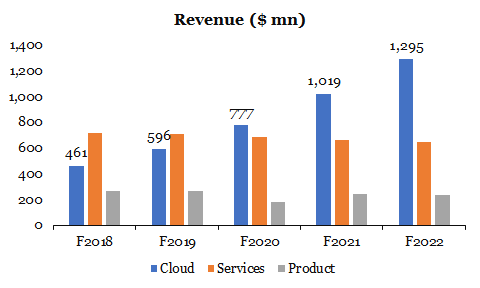

NICE’s gross margins have been on an upward trajectory. It is worth highlighting that the company is actively focused on moving customers away from the on-prem product onto the cloud and hence the volatility in the product margins.

Our expanding Cloud gross margin is a testament to the efficiency of our Cloud infrastructure, coupled with increasing enterprise adoption of our high-margin portfolio of Cloud software solutions.

Source: Q4 2022 NICE Earnings Call from Seeking Alpha

Although the improvement in the cloud business is notable, the starting point was much lower than the product side. This can be expected given on-prem customers were given sizeable discounts to make the move to the cloud.

For NICE, AI expands the deal size (revenue) by way of enabling a few contact center agents to have a much larger digital footprint. However, the impact to margins is not clear.

The improving trajectory of cloud margins is most likely due to the annual increments baked in the cloud contracts, which started at a much lower price versus the on-prem versions.

To understand more about how AI impacts margins, a bit of commentary from Microsoft (MSFT) can help.

Amy Hood, the CFO of Microsoft noted:

..to focus on investing in AI, which I talked about, will increase COGS growth..

..staying focused on gross margin improvements where we can. Some of them will come in AI over time, given our commitment to the build-out.

Source: Microsoft 3Q 2023 Earnings Call from Seeking Alpha

Yes, Azure is the cloud infrastructure and optimization mechanics at the infrastructure level versus the application layer (where NICE operates) would be different. However, the principle remains the same: look at more data and scenarios, learn and then decide – more the data, more the storage and computational requirements, which in turn will lead to COGS growth.

Hence, we think NICE has its work cut out – transition customers to the cloud while ensuring AI doesn’t eat into the gross margins due to cost. Should this happen, the discussion will move away from NICE’s innovation in AI to the commoditized nature of NICE’s end market.

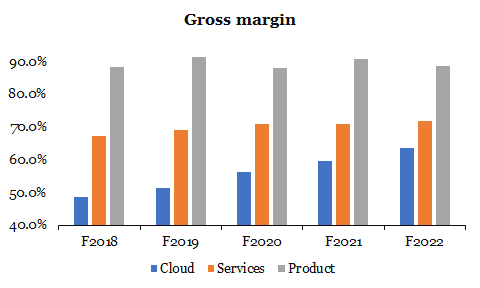

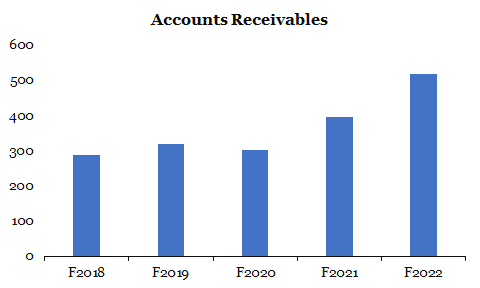

NICE's FCF

Seeking Alpha

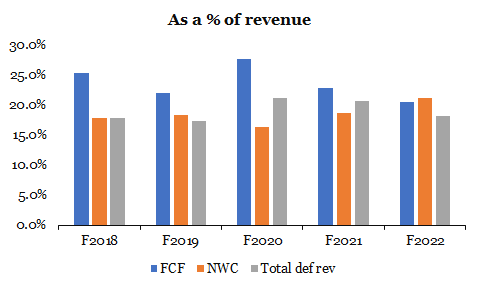

The company's free cash flow or FCF has begun to stagnate, and the reasons appear to be the increasing receivables and weakening deferred revenue growth.

The increase in receivables can implies customers are delaying payments, greater than what they did in 2019 and 2020!

Seeking Alpha

While it is a worrisome trend, the increase in AR can be understood considering we are in an environment of rising interest rates.

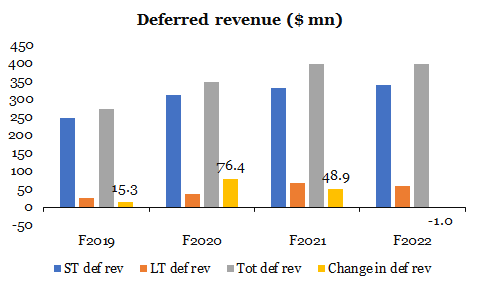

However, what is truly perplexing is the weakness in deferred revenue growth.

Seeking Alpha

While on the one hand cloud (subscription based) revenue (which is typically collected upfront and gives rise to deferred revenue) is growing, on the other hand the deferred revenue is not.

Seeking Alpha

We think that the lack of growth of deferred revenue despite growth in revenue could point to the following possibilities:

- The management has already said that cloud is a pre-requisite for AI and hence either the cloud subscriptions are for less than a year.

- Another option is that revenue is invoiced (or the collection) quarterly / half-yearly.

Either of those two mean that customers still need to be persuaded to adopt the cloud offerings and the strength of demand may be hanging by a thread.

Another challenge that arises is that if these contracts are less than a year in duration, how does the annual escalation in pricing and improvement in gross margin come through?

Clarity of the trends in the net retention rate for the company will help answer these questions.

Risks to our thesis

- Costs of running AI: Should the monetary policy ease faster than expected, the cost of running AI workloads could come down significantly. This in turn would be a tailwind to the margin profile of AI-first companies, including NICE.

- Potential acquisition: NICE's position as a conversational AI specialist could make it an important strategic tool for many large enterprises. Apart from the elevated price a potential offer might bring about, potential synergies from vertical integration (in case the buyer is a hyperscaler or large technology firm) could go against our thesis.

Conclusion

We think NICE has carved out a niche for itself in the conversational AI space. Furthermore, the integration with ChatGPT is likely to get the company a lot of visibility. However, considering profitability aspects of running AI and continued collection related issues warrant a neutral stance until greater clarity emerges.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.