CubeSmart: A Sleep Well At Night Self-Storage Buy

Summary

- CubeSmart’s first quarter results demonstrate its resilience amidst economic adversity.

- It has a strong, sticky customer base and a strong balance sheet.

- The stock remains attractive priced with a respectable dividend yield for potentially strong long-term returns.

- Looking for a portfolio of ideas like this one? Members of Hoya Capital Income Builder get exclusive access to our subscriber-only portfolios. Learn More »

ansonsaw

Market timing can be hard, and I don't know anyone who's been able to do it successfully over time. That's why a better strategy may be to layer into attractively priced stocks at regular intervals rather than waiting for a crash that may never come.

This brings me to CubeSmart (NYSE:CUBE), which I last covered here back in December, highlighting its well-located portfolio and attractive valuation. The stock has given investors a respectable 6.5% total return since then, nearly double the 2.9% rise in the S&P 500 (SPY) over the same timeframe.

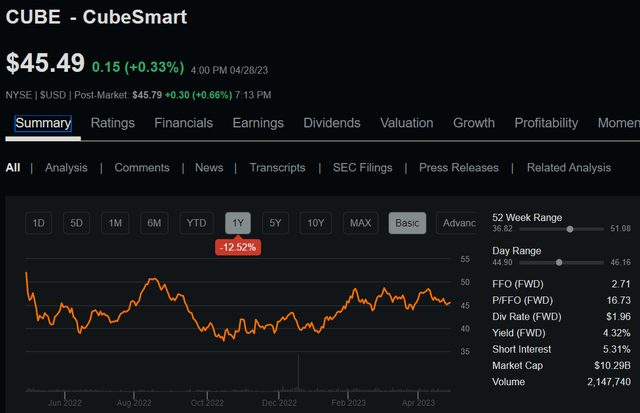

It still remains attractive, though, considering its dip for the near-$50 level in early April and remains down by 13% over the past 12 months, as shown below. In this article, I highlight recent developments and discuss why it's attractive for income and potentially strong long-term returns, so let's get started.

Why CUBE?

CubeSmart is one of the top 3 self-storage REITs in the U.S. with 1,279 properties. What sets CUBE apart from other self-storage REITs is the fact that it also has a 3rd party management platform, through which it manages properties for private owners, thereby resulting in a steady source of fee revenue.

CUBE is diversified across 39 states, operating in 153 markets, and 89% of its owned stores are located in the Top 40 metropolitan statistical areas in the U.S. It has 712K customers and no single tenant or cohort represents a material segment of CUBE's rent roll.

Meanwhile, CUBE continues to demonstrate strong results, with same store net operating income growing by an impressive 9.1% YoY during the first quarter. This was driven by positive operating leverage in which revenue growth of 7% far outpaced the 1% growth in operating expenses. CUBE also added 25 stores to its third party management platform during the quarter, bringing its total 3rd party managed store count to 676.

Notably, CUBE is enjoying a sticky existing customer base, as vacates during Q1 were down by 3.3% from the prior year period, and down even further by 9.5% when comparing to the pre-pandemic first quarter of 2019. 48% of CUBE's customers has been with them for over two years, up 230 basis points from the same period last year, and same store occupancy also remained strong at 91.9% as of March 31st. This gives management a stronger base on which it can raise rents.

Potential headwinds to CUBE include the below average growth in some markets such as Washington D.C., Virginia, Maryland, and Arizona, where COVID-induced migration has waned. This was offset by above average growth in Florida, Texas, and Southern California. However, management is being cautiously optimistic, as the demand momentum it saw in the first two months of the year slowed in March, only to kick back into gear in April.

Meanwhile, management is also being disciplined with external growth opportunities in the current environment, with deal volume that's down by 30% compared to the same prior year period. This is due to unattractive pricing with not as many high quality opportunities as it saw over the past couple of years.

Nonetheless, CUBE maintains a strong balance sheet, making it well-positioned to pursue opportunities when bid-ask spreads on property acquisitions improve. This is reflected by its BBB credit rating and low debt to EBITDA ratio of 4.4x. 98% of CUBE's debt is fixed rate and it has an average debt maturity of 6 years.

The investment grade credit rating and low leverage should enable CUBE to secure favorable pricing on debt as it matures compared to lower-graded borrowers. Plus, the market now expects just a quarter point hike at the Fed's next meeting with potential for 50 bps in rate cuts by the end of the year, which would reduce the cost of borrowing for REITs (VNQ) such as CUBE.

Importantly for income investors, CUBE pays a respectable 4.3% yield and the dividend is well covered by a 75% FFO payout ratio. It also comes with an impressive 5-year dividend CAGR of 10% and 12 years of consecutive growth.

Lastly, while CUBE is no longer cheap at the current price of $45.49 and forward P/FFO of 16.8, it's not expensive either, as this sits below its normal P/FFO of 18.7. This is also considering CUBE's 12% YoY FFO per share growth during the recently closed quarter and its strong balance sheet with potential for accretive growth over the long run. Analysts have a consensus Buy rating on the stock with an average price target of $52, implying potential 19% total return over the next 12 months.

Investor Takeaway

In summary, CubeSmart's impressive first quarter results are indicative of its resilience amidst economic adversity and demonstrates why it is an attractive REIT for income and growth investors alike. Its long-term growth prospects remain solid despite the headwinds in some markets while the strong balance sheet gives management flexibility to pursue external growth opportunities when attractive opportunities arise. Meanwhile, it pays a respectable yield and remains attractively priced for potentially strong total returns over the long run.

Gen Alpha Teams Up With Income Builder

Gen Alpha has teamed up with Hoya Capital to launch the premier income-focused investing service on Seeking Alpha. Members receive complete early access to our articles along with exclusive income-focused model portfolios and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%.

Whether your focus is High Yield or Dividend Growth, we’ve got you covered with actionable investment research focusing on real income-producing asset classes that offer potential diversification, monthly income, capital appreciation, and inflation hedging. Start A Free 2-Week Trial Today!

This article was written by

I'm a U.S. based financial writer with an MBA in Finance. I have over 14 years of investment experience, and generally focus on stocks that are more defensive in nature, with a medium to long-term horizon. My goal is to share useful and insightful knowledge and analysis with readers. Contributing author for Hoya Capital Income Builder.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not an investment advisor. This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.