Verizon: Good Dividend But Deteriorating Business Model

Summary

- The era of strong growth is long gone for Verizon, with revenues barely growing since 2015. Instead, debt levels have kept growing at a sustained rate.

- Slow growth and high capital expenditure will deteriorate the capacity to deliver solid cash flows over time, forcing Verizon to continuously borrow more money.

- Verizon can represent a good investment only for long-term valued investors that buy the company at a decent discount to its intrinsic value.

Bruce Bennett

Investment Thesis

Verizon Communications (NYSE:VZ) is the largest US wireless telecommunication company by revenue, with a whopping $136 billion in 2022, with 115 million mobile subscriptions, meaning a third of the US population is subscribed to one of Verizon’s mobile plans.

Despite its size, the era of strong growth is long gone for Verizon, with revenues barely growing since 2015. Instead, debt levels have kept growing at a sustained rate following the continuous need for capital to maintain the extensive, expensive, wireless network to bring internet connection to its customers.

Verizon has become a big blue-chip company attracting all-time value investors with a chunky dividend of 6%. However, with government bonds yielding a 4% interest rate, the attractiveness of Verizon is fading away.

In today’s analysis we will assess why, despite the stable and consistent earnings generated by Verizon, it does not represent a good investment opportunity at today’s prices.

Business Model

Verizon offers wireless and broadband communications services to the US market under subscription plans which include access to voice, text and internet data with the addition of several perks like the subscriptions to video and music streaming platforms.

Verizon currently owns the 8.5% market share of the entire global telecommunication services industry.

Verizon's business model is divided into two main branches: Consumer services, accounting for 76% of total revenues, and Business services, accounting for the remaining 24%. Consumer connections equal 132 million, counting for both wireless and broadband, while Business connections are 30 million.

Both Consumer and Business connections growth rates have been modest in the past years, not to say flat, with the only exception of 2021 when Verizon acquired Tracfone, a prepaid wireless company, which brought 24 million connections to the core operations of Verizon.

Operating Performance

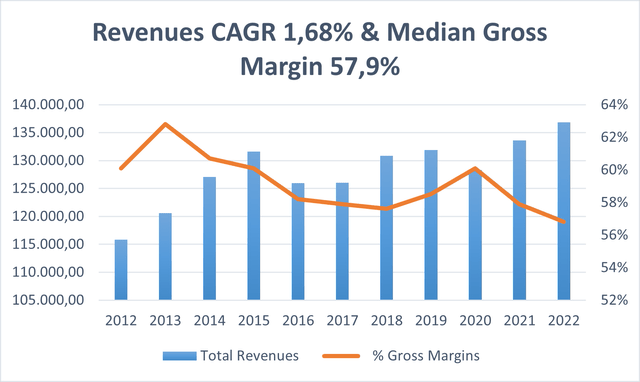

Looking at the past operating performances of the company, in line with what we have seen so far, revenues were basically flat, growing at a compound annual growth rate (CAGR) of 1.68% from 2012 to 2022, with the gross margin slightly decreased from 60% to 56% during the period.

Verizon revenues & gross margin (TIKR Terminal)

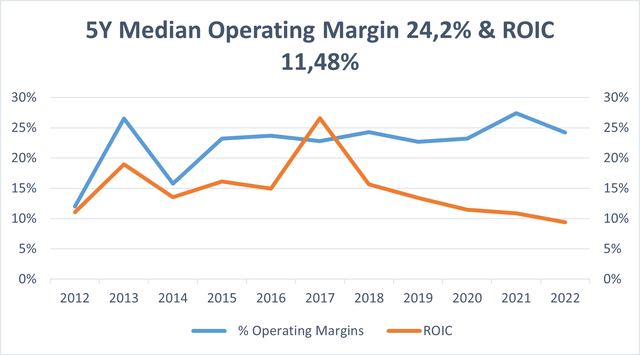

However, the operating margin remained stable around the 5-year median value of 24.2%, while the return on invested capital (ROIC) witnessed major volatility during the period, and despite having a 5-year median value of 11.48%, entered a decreasing trend since 2018 probably due to the considerable investments in capital expenditures to run the wireless network.

Verizon median operating margin & ROIC (TIKR Terminal)

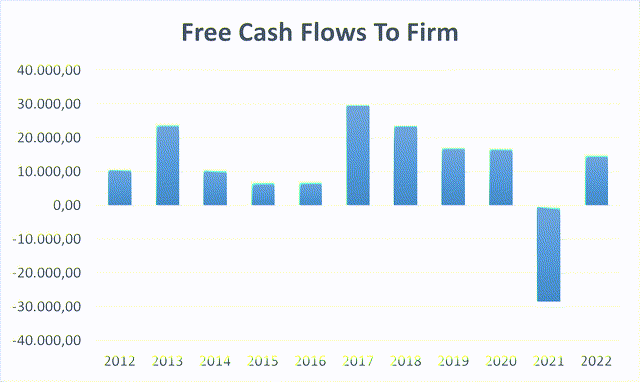

Verizon delivered solid free cash flows to firm (FCFF) through the years, with the only exception of 2021 when FCFF turned negative as Verizon paid more than $40 billion to win the licence auction which enabled the company to operate its wireless network on the US territory.

Verizon FCFF (Personal Data)

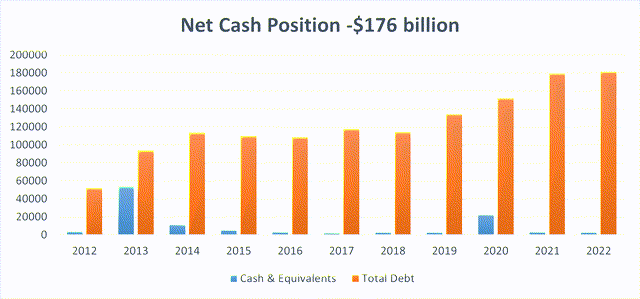

Financially, Verizon presents a considerable amount of debt outstanding, equal to $178 billion as of the end of March 2023. Despite this might seems a critical level of leverage, for wireless operator companies like Verizon, and its two direct competitors T-Mobile (TMUS) and AT&T (T), being highly indebted is part of the game given the considerable costs to deploy and run wireless infrastructures.

Verizon financial position (TIKR Terminal)

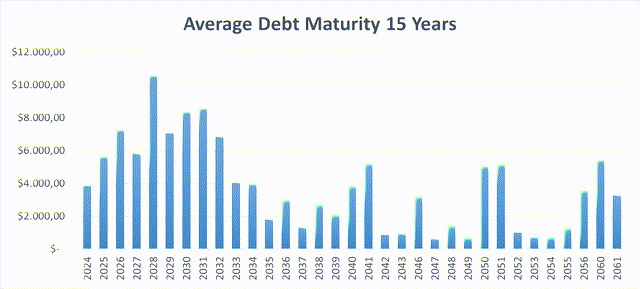

Is worth to be mentioned that Verizon's debt has an average weighted maturity of 15 years, being well spread over 30 years, and with an average fixed interest rate of 3.24%.

Verizon debt maturity (Verizon)

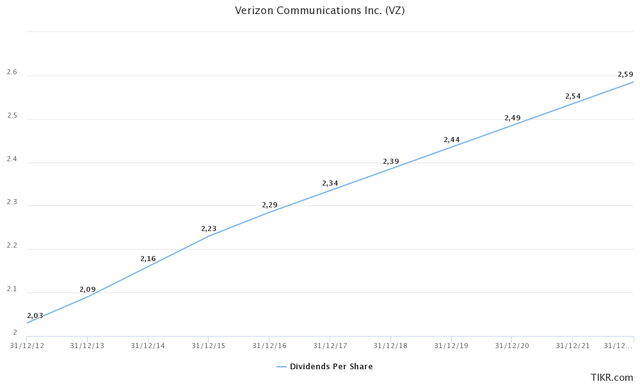

Verizon hasn’t done any significant buyback in the last years, opting instead to distribute a big and consistent dividend which has increased through the years.

Verizon dividend (TIKR Terminal)

Market & Risks

The wireless services industry is highly competitive, however for Verizon, T-Mobile, and AT&T the situation is slightly different. These three companies are so-called Mobile Networks Operators (MNO) and distinguish themselves from the others by directly owning and operating wireless infrastructure like cell towers and spectrum licences.

These three major operators give access to their wireless networks to other smaller prepaid wireless companies, which given the high costs to set up their networks, prefer to rely on already existing ones so they can offer plans at lower prices.

So, while is true that competition is rising in the mobile plans industry, with low-cost companies like Mint Mobile or Visible offering mobile plans at half the price of the big three, it is also true that these competitors need Verizon, T-Mobile, and AT&T to distribute their services.

Even if low-cost companies steal customers from Verizon and the other network operators, those companies are still bounded to pay considerable fees to Verizon to obtain access to their networks.

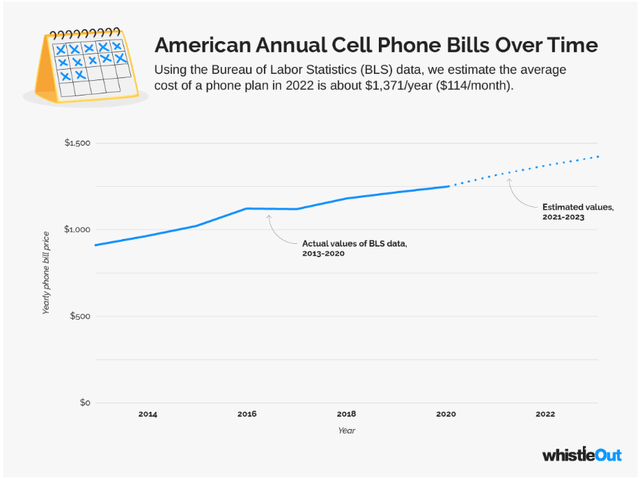

Despite the increasing competition, the average price of phone bills has increased over the past years, and that might have been caused by the numerous perks included in the mobile plan. Despite the cost for cellular gigabytes decreasing over time, companies like Verizon have been adding additional perks into their plans, like subscriptions to streaming platforms like Netflix, and Apple Music, or the possibility to buy smartphones and tablets along with the mobile plans, maintaining the prices around $80 per month.

whistleout

However, even with additional perks included in mobile plans, considering how saturated the market is, high growth rates, in both customer acquisition and revenues, are a distant memory for wireless services companies.

The business model of wireless network operators like Verizon is inexorably characterised by slow or nonexistent growth and high capital expenditures to maintain the network infrastructures and licence rights.

With slow or zero growth and high and constant capital expenditure, the capacity to deliver solid cash flows will deteriorate over time, forcing Verizon and the others to continuously borrow more money to finance their operations and maintain their attractive dividend.

Projections

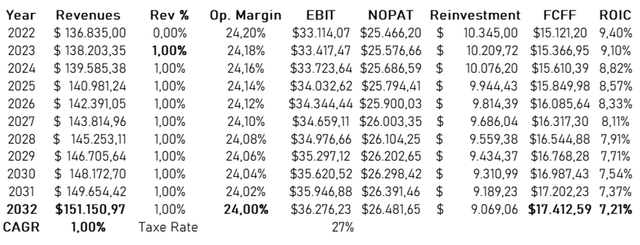

Trying to project Verizon’s future performances, The story we are telling here sees Verizon remain a big blue-chip company, with very small growth, and high margin derived from its dominant position, but lower returns on investments given the high and recurrent reinvestments to operate its wireless network.

Starting with revenues, we can expect them to grow at around 1% as the company enters its steady state, in line with the CAGR of 1.68% registered in the past 10 years. With these assumptions, revenues are expected to be around $150 billion by 2032.

As regards future efficiency, assuming Verizon will maintain its 8.5% market share, we can expect the company to maintain its historical operating margin of 24%.

Moving to future reinvestment needs, the median reinvestment margin of Verizon over the past 10 years is 7%, and we can assume it to remain around 7% to 6% in the years to come as Verizon has to deploy its new 5G network. Given the slow growth in revenues and the high reinvestment needs, Verizon’s ROIC will decrease in the coming years sitting around 7.2% by 2032, in line with the industry average.

With these assumptions, Verizon will keep delivering solid and consistent FCFF expected to be around $17 billion by 2032.

Verizon future projections (Personal Data)

Valuation

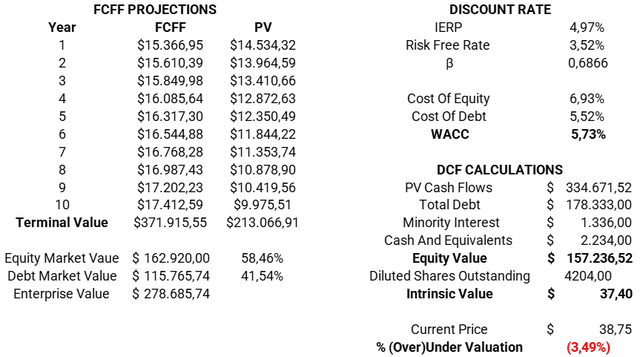

Applying a discount rate of 5.73%, calculated using the WACC, the present value of these cash flows is equal to an equity value of $157 billion or $37.4 per share.

Verizon intrinsic value (Personal Data)

Conclusion

Given my analysis and assumptions, Verizon’s stocks result to be fairly valued at today’s prices.

In my opinion, Verizon can represent a good investment only for long-term valued investors that buy the company at a decent discount to its intrinsic value and enjoy its bulky dividend. However, given the spirals of zero growth, high and recurrent capital expenditures, and continuous borrowings, Verizon’s ability to deliver solid cash flows might be threatened in the future.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.