Merlin Properties: Idiosyncratic Office Exposure Pulls It Through

Summary

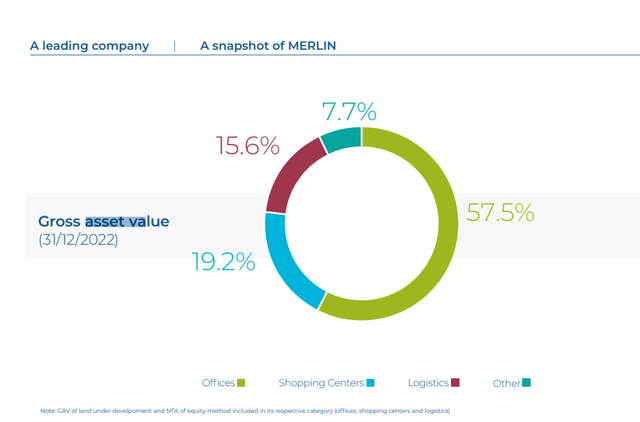

- More than 50% of MERLIN Properties SOCIMI, S.A. exposure is in office real estate, the rest is in logistics and shopping centers.

- The office exposure managed to grow organically thanks to improving occupancy rates, and that is owed to idiosyncratic dynamics in certain growing European business clusters.

- Reopening has been supporting the shopping center business, and in general, while somewhat exposed to a recession, Merlin has a lot going for them.

- They also have an IX angle which is good since there are winner-take-all dynamics and they are first.

- Looking for a helping hand in the market? Members of The Value Lab get exclusive ideas and guidance to navigate any climate. Learn More »

Adam Smigielski/iStock via Getty Images

MERLIN Properties SOCIMI, S.A. (OTCPK:MRPRF) is a real estate investment trust, or REIT, in Europe. This isn't such a big asset class in Europe, and it shows in that it's immediately better valued than anything we've seen in the U.S. in our pretty wide REIT ETF (exchange-traded fund) coverage.

Merlin is exposed to offices, but in the best possible way that you can be exposed to the office space. Otherwise, its exposures are relatively solid as far as real estate goes, with logistics and shopping centers. Financial discipline is excellent, with long-dated maturities at low rates, and ultimately it bucks every trend that we've come to know from U.S. REITs but at a lower valuation. A very compelling proposition, and better than any REIT we've seen in U.S. ETFs, certainly any that focuses on commercial real estate. Clear buy.

Notes on Merlin Exposure

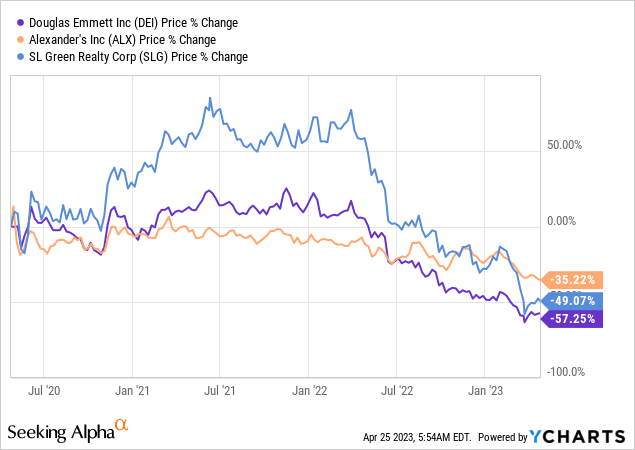

Merlin's primary exposure is to office real estate. This is usually a disqualifying factor for a REIT in the U.S., since vacancy rates are rising in a lot of even premium properties, and the hybrid/WFH risks are being taken very seriously by markets, and probably for good reason. Consider the performance of marquee NYC real estate, or of REITs that track real estate in employment clusters around industries like tech with L.A, particularly since COVID-19 2020 weakness.

Merlin was not immune from similar declines, but they are markedly less steep, and dividends have been earned in the meantime.

Merlin Doesn't Decline as Much (SeekingAlpha.com)

As said, Merlin's exposure is focused on office, but offices performed well with organic growth in rents and plenty of new leases and renewals confirmed as of the 4Q '22. Renewals are happening, and WAULTs are still at 3 years, which is pretty solid and confirms some visibility. Renewals must be happening at higher rents for there to have been organic growth, so demand is clearly staying strong in these markets - we propose a couple of structural reasons that should not be ignored.

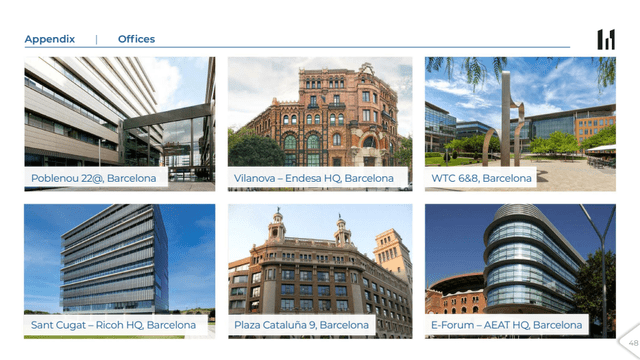

The first is the fact that a lot of the office properties are historical buildings that could easily be reconceived as other types of real estate. These spaces are in higher demand, even if they aren't currently organized for purposes other than being offices. This applies across the geographies of Madrid, Barcelona and Lisbon. Then there's the fact that labor is cheaper in these countries. Labor protection laws are stricter, but also bureaucracy more rigid, which means remote solutions are harder to administrate and these headcounts are prioritized in MNCs. With Madrid and Barcelona attracting tech thanks to more progressive Spanish tax regimes, all these considerations matter in keeping offices relatively relevant.

Some MERLIN Offices (FY 2022 Report)

Besides offices, Merlin's logistics and shopping center segments are both solid, growing somewhat close to 10% each in terms of rents. Shopping centers have the cushion of reopening to counter economic headwinds, and logistics facilities have the benefit of higher capacities and fleets for goods and product production, even though some economic headwinds are to be expected.

Office Performance (FY 2022 Report)

Bottom Line and CRE Comments

Merlin is also getting into the data center market, in particular building colocation centers, leveraging their existing land-bank. We have spoken often about Equinix, Inc. (EQIX) on Seeking Alpha, commenting specifically on the fact that its network effects have been rocketing the company in the market for connectivity, providing massive value by reducing data draw from the backbone. This is a winner-take-all situation, and Merlin is already the "first mover" in the Iberian peninsula.

In general, investors should be concerned with one risk in particular. While less exposed to commercial real estate, or CRE for short, European banks are still quite exposed. There is less leverage in the European system, and there's been more regulation, so the concerns are not systemic, it's just that there are a lot of European geographies where offices in particular are weak. Historical European centers are not exposed due to the more measured cities and the intrinsic value across use-cases of historic buildings. While some buildings are clearly designed by be modern corporate headquarters, not all of them, and it mitigates the overall WFH and hybrid risk.

The conversion ability is especially important because there are other secular reasons why demand would be high for housing in these jurisdictions, one of them being the golden visa in Portugal and also the general outsourcing and cluster formation in cities in Spain, especially around university towns like Barcelona and Madrid, which have become major sinks for European students from all over Europe due to quality of life considerations. Moreover, labor shortages have slowed down housing supply in these countries.

Merlin trades around 14x P/E and 14x FFO (funds from operations), which is in line with marquee U.S. office peers like Alexander's, Inc. (ALX) and SL Green Realty Corp. (SLG). We do not agree that these should be similarly valued businesses as the Merlin performance is showing vigor in its markets. Merlin yields are about half the yields of these competitors, but this is really normal for any EU vs. U.S. yield comparison.

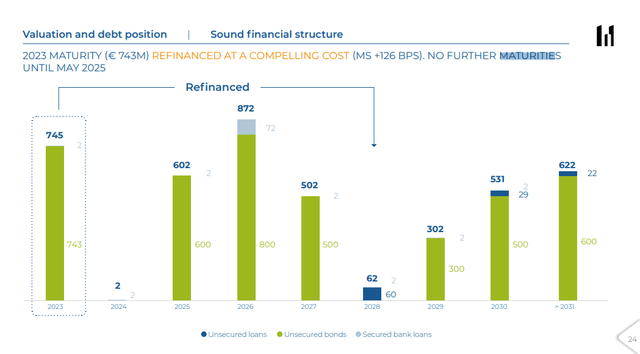

We like MERLIN Properties based on valuation considerations and for an acceptable yield, but we have to point out that weakness in general CRE financing environment is a problem for companies to keep their public market values. If there emerges a scare around banks and their CRE assets, and if there is a camping down on the standards, possibly even exogenously by government, for CRE lending, this is all bad for a company that is sustaining less than a 2% yield on still reasonably long-dates maturities.

Maturity Timeline (FY 2022 Report)

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We've done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it's for you.

This article was written by

Formerly Bocconi's Valkyrie Trading Society, seeks to provide a consistent and honest voice through this blog and our Marketplace Service, the Value Lab, with a focus on high conviction and obscure developed market ideas.

DISCLOSURE: All of our articles and communications, including on the Value Lab, are only opinions and should not be treated as investment advice. We are not investment advisors. Consult an investment professional and take care to do your own due diligence.

DISCLOSURE: Some of Valkyrie's former and/or current members also have contributed individually or through shared accounts on Seeking Alpha. Currently: Guney Kaya contributes on his own now, and members have contributed on Mare Evidence Lab.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in MERLINE PROPERTIES over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.