SEBI had received complaints that alleged that CARE’s managing director were interfering in the rating process and took bribes to grant AAA ratings to clients.

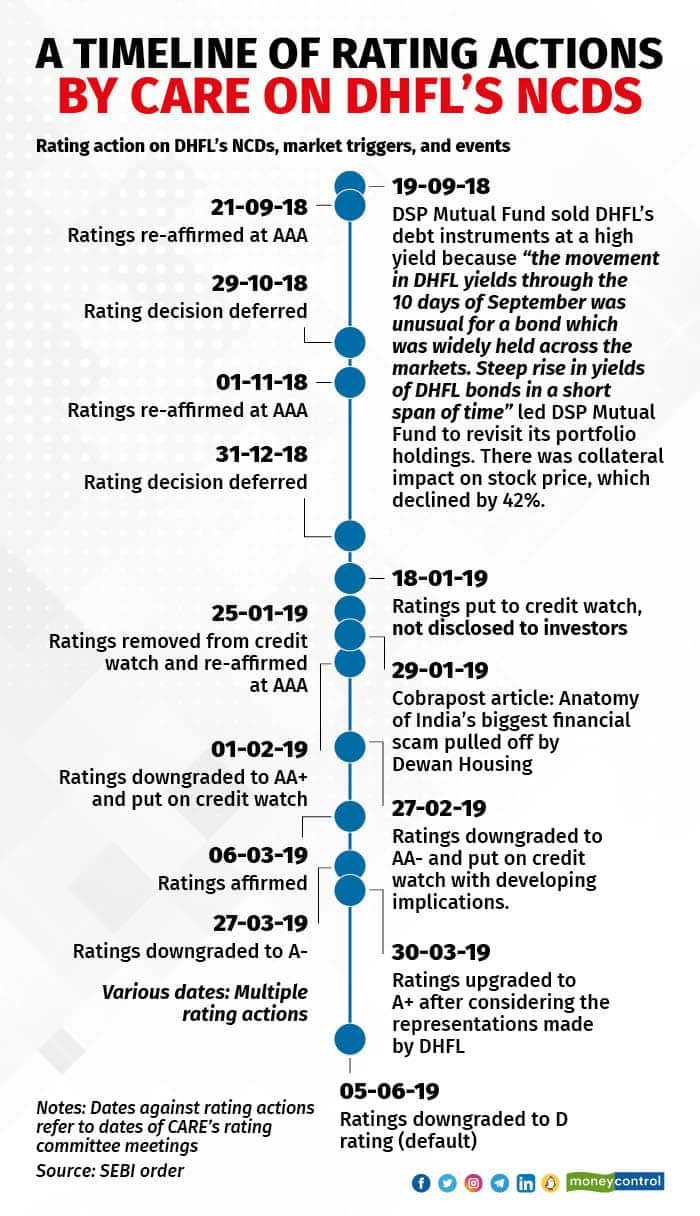

On April 20, 2023, the Securities and Exchange Board of India (SEBI) banned Rajesh Mokashi, the erstwhile managing director of CARE Ratings Limited (CARE), from being “associated with any SEBI registered intermediary, directly or indirectly, in any manner whatsoever, for a period of two years”. SEBI’s order concluded that Rajesh Mokashi had influenced the rating process for Dewan Housing Finance Limited (DHFL), because of which, purportedly, rating actions were delayed, and in one instance, not disclosed to investors. SEBI was unable to establish if he had interfered in the rating processes for Yes Bank, IL&FS, Patanjali and Cox & Kings. SEBI did not take any action against SB Mainak, CARE’s non-executive chairperson.

SEBI had received eight whistle-blower complaints between December 2018 and July 2019 that alleged that CARE’s managing director and its non-executive chairperson “were interfering in the rating process at CARE and granting AAA ratings to clients paying higher fee”. SEBI asked CARE to undertake an investigation. CARE’s first action, in February 2019, was to appoint its internal auditor as the investigator, which SEBI did not accept citing concerns over the independence of the process. CARE then appointed another chartered accountant firm, Borkar and Muzumdar in March 2019 to undertake the investigation, which gave CARE a clean chit. SEBI did not accept this report because, among other things, “phone records and e-mails of the relevant persons were not examined”, and “some of the employees/ officials of CARE whose statements were included in the B&R Report independently confirmed to SEBI that they had not been interviewed by the auditor”.

Consequently, Ernst and Young (EY) were appointed in August 2019 to undertake a forensic audit. EY’s forensic audit report was submitted to SEBI in February 2020. Although there were no conclusive findings against SB Mainak, CARE’s board advised him to “consider the option of resigning, pursuant to which SB Mainak tendered his resignation on February 11, 2020”. SEBI advised CARE’s board to undertake a full-fledged investigation, following which CARE appointed Retired Justice BN Srikrishna to conduct an inquiry, which also gave CARE a clean chit. Justice Srikrishna’s investigation concluded that “there was no evidence in the forensic audit report to conclude that the rating outcome was affected on account of such interferences” by CARE’s managing director. SEBI, however, concluded, that “the interference irrespective of its ultimate impact on the rating decision would fall foul of the regulatory mandate”.

Questioning The Business Model

Some of the issues highlighted in SEBI’s order must cause market concern. But when rating agencies fail, the first question that gets raised is about their business model. “It is an accepted fact that there exists an inherent conflict of interest in the ‘Issuer pays’ model specifically with the reliance of the rating agency on earnings arising from the fees paid by its clients. In turn, an issuer armed with this leverage would be in a position to get inflated ratings in his favour.” SEBI too recognises that the investor-pays model will have equal challenges, and is not an obvious alternative to the issuer-pays model. When investors pay, there is no obligation from the issuer to provide the rating agency with the necessary information. This will compromise the rating agencies’ analytical depth. Keeping the rating under surveillance will also have its challenges as the debt gets sold from one investor to another. Most importantly, the investor-pay model will keep the bond market at shallow levels – most debt funds invest in AAA and AA-rated paper.

SEBI’s solution to strengthen analytical quality – and possibly the only one it can adopt – is to ask rating agencies to follow stringent processes. “SEBI has sought to address the inherent conflict of interest in the ‘Issuer pays’ model by seeking to insulate the Rating Committee members and analyst from the pressures of business development to mitigate the possibility of the ratings issued being linked to the fees charged. The separation of the business development and rating functions is an important regulatory safeguard. The regulations not only seek to shield officials with rating responsibilities but also prohibits persons with business responsibility functions from interfering in rating functions”.

Maintaining Firewalls

Structurally, this solution is good, but its ability to work is driven by the integrity of the leadership and corporate culture. It is incumbent on the leadership of a rating agency to be able to maintain strong firewalls between the analytical side and business side, and more importantly, not succumb to revenue pressures by compromising the quality of ratings or the rating process. “In the matter of DHFL, the Rating Team and Rating Committees were not allowed act independently and were instead guided by the undeniable pressure exerted” by CARE’s managing director.

In the face of such interference, “the measures adopted by CARE to ensure independence of the rating decisions like independent rating committee, separation of rating and business development, etc. amounted to nothing more than a collective exercise in futility. In other words, the insulation did not afford sufficient protection to the members of the Rating Committee while rating DHFL”. According to the SEBI order, CARE’s managing director “was only paying performative obeisance to this regulatory mandate by not being a part of Rating Committees, but, as noted above, was still interfering in rating decisions.”

When rating agencies fail, the question is not of its business model - but of the strength of its operations, the tone that is set at the top, and its corporate culture. If one considers ratings like any other product, then it is merely the pressures of revenues that drive poor decision-making, independent of where the revenues are sourced from. In effect, it is no better or worse than car manufacturers trying to cheat emission norms and project better fuel efficiency just to sell more cars; or indiscriminate lending by some banks just to show growth. Rating quality could be equally compromised for an investor that regularly pays high fees for an ‘acceptable’ rating.

Ratings are not infallible and rating agencies will fail. This is the nature of the business. How often a rating agency fails, the size and extent of its failures, and the changes it makes from the lessons learnt are important. That is the role of leadership and not a function of the ratings agencies’ business model.

Hetal Dalal is President and Chief Operating Officer at Institutional Investor Advisory Services (IiAS). In her prior role, she worked at a rating agency for over a decade. Twitter: @hetal_dalal. Views are personal and do not represent the stand of this publication.