Project $1M: Q1'23 Brings Welcome Relief

Summary

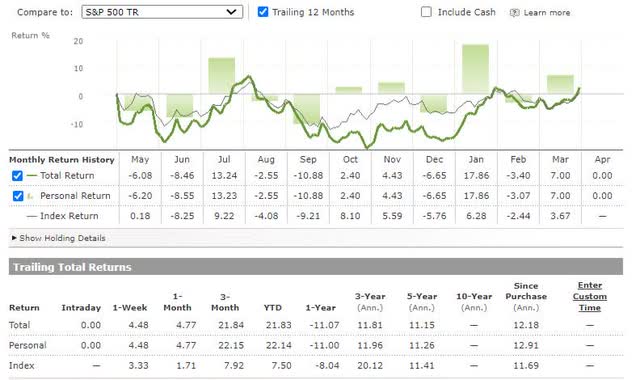

- The Project $1M portfolio continues to grind away, well into its 8th year and is now back above the S&P500 on a cumulative basis once again.

- Strong performances from Meta and MercadoLibre helped power strong returns in Q1.

- I made several changes in Q1, taking a partial axe to Meta Platforms, increasing the Datadog holding and making one new portfolio addition.

- Q1'23 illustrated that nothing goes down forever. Similarly, I don't expect things to suddenly shoot up in a straight line for the rest of the year.

- Looking for a portfolio of ideas like this one? Members of Sustainable Growth get exclusive access to our subscriber-only portfolios. Learn More »

Thibault Renard

The Project $1M portfolio is a long-term buy-and-hold investment portfolio that I started way back in late 2015 with the objective of turning a sum of approximately $275K into $1M within a 10-year period.

The portfolio is primarily invested in high quality rapidly, growing, secular compounders that typically have strong founder involvement, good operating cash flow and capital, and robust returns on capital.

The portfolio has historically run relatively concentrated, with the top five portfolio positions accounting for greater than 50% of the portfolio's invested capital. This continues to remain the case today, with the top five positions accounting for 60% of the portfolio. The bear market's strange path initially pushed Mastercard (MA) and Visa (V) to an overweight position as an inflation hedge.

In Q1, MercadoLibre's (MELI) strong results, plus the untimely fraud of its main competitor in the Brazilian market, has elevated MercadoLibre into the top two positions alongside Mastercard. Both now collectively account for more than 30% of the portfolio weight.

morningstar, author calculations

After a number of years of outperformance of the S&P 500 index, 2022 saw a major reset, with strongly negative performance impacting their portfolio's overall returns. 2023 (so far) has delivered a welcome return back to form. It will be interesting to see just how long this lasts. Q1 saw a return to cumulative outperformance over the S&P 500 since its inception once again and a fairly resounding outperformance of the S&P 500 itself.

Q1 in review

The portfolio enjoyed an excellent performance across the board in the first quarter. Particular strength was seen in those positions which were hit hard last year. Meta Platforms (META) has nearly doubled since the beginning of the year, while a couple of emerging market positions, such as MercadoLibre and Sea (SE) are also well up more than 50% so far this year.

Table created by Author includes Veeva (VEEV), ServiceNow (NOW), Alphabet (GOOGL), Adobe (ADBE), Atlassian (TEAM), Amazon (AMZN), Salesforce (CRM), Nanosonics (OTCPK:NNCSF), ARK Genomic (ARKG), Pro Medicus (OTCPK:PMCUF), Shopify (SHOP), CSL (OTCQX:CSLLY)

I had complained in 2022 Year in Review that "Sea was no MercadoLibre". What I meant by this was that while there were some broad similarities in terms of business model and relative market strengths, MercadoLibre was a much more financially disciplined, well-put-together outfit.

Sea surprised me with its focus on financial discipline in Q1, and how it may be able to turn on the profitability engines with a little more application to the task at hand.

While much of the improvement in performance, and hence stock price came as a result of reducing marketing spend, behind the scenes, there are some meaningful steps being taken to improve the take rate. This is being achieved by layering additional value-added services and reducing subsidies. I am watching these changes with a great deal of interest.

Among the large technology companies, Meta and Salesforce showed particular strength. Meta's drastic cost-cutting efforts appeared to win favor with Wall St this quarter. Strong hopes also persist that Meta's Click to Message business may make up for the damage that Apple's OTT changes have had.

Salesforce is showing surprising resilience across the board, with the performance of its very mature Sales cloud, which is still growing at a mid-teens growth rate. Salesforce is now becoming strongly cash flow generating and increasingly profitable.

Portfolio changes

Cutting Meta

I reduced my Meta holding by 50% at $190 during the quarter. This was largely done because I see Meta being increasingly challenged in the market by both Amazon and Apple in the push for advertising dollars. The strong growth of both Amazon and Apple's advertising business, from an admittedly lower base, raises fundamental questions about Meta's strengths and relative positioning moving forward.

I don't believe that Meta has fully overcome the hit from the removal of "opt-out" ad tracking initiated by Apple. Meta has aggressively responded to a challenging situation with intense cost cuts and employee layoffs, which are helpful but will only go so far.

The abstract and relatively unbounded bets Meta has made on the Metaverse have started to increasingly trouble me. Reality Labs is losing a meaningful amount of money, with unclear monetization and prospects for medium-term success.

It made no sense to sell Meta at $90 last year. However, at $190, I was happier to cut some of the position in light of uncertainties around the medium-term outlook.

Adding ASML holdings

I initiated a position in ASML (ASML) at an average of ~$640 during the quarter. For those that aren't aware, ASML is a high-quality business. It is a Netherlands-based company with a virtual monopoly on the highly complex machines integral to the high-end lithography process of etching the advanced semiconductors that power computers, cell phones, and most electronics today. There are significant tailwinds behind this business, with the number of connected devices set to increase exponentially over the next decade.

I like ASML's dominant market share in the space. However, more than that, the business produces significant operating cash flow and has a return on capital well north of 20%.

I love natural toll roads with limited regulation, and ASML strikes me as having this in spades. Geopolitical risks are real, though, and the current tensions with China not only have the potential to impact sales into China, but adversely expose ASML's geographic concentration in that region as well.

Increasing Datadog

Finally, I increased my Datadog (DDOG) position during the quarter. Datadog will likely struggle over the next couple of quarters as enterprises optimize cloud costs, given significant economic uncertainty. However, the core trend is clearly doing more in the cloud rather than less.

With that as the mid-term thesis, the need to better understand the complexity of what happens in cloud infrastructure, isolate problems, and provide critical diagnostics to troubleshoot and resolve issues will become more important, not less.

With the business continuing to add new tools and modules to assist enterprises in this journey, Datadog will only play a more important role, not less.

Concluding Thoughts

Markets don't necessarily head in a straight line. Just as I believed that they wouldn't head down indefinitely, post-2022, I'm also not convinced that things will continue straight up in a rocket-like fashion for the duration of the year.

Still, even if there is some consolidation and sideways movement over the next few months, I like my positioning for not only the balance 2023, but also for the duration of the next few years through the Project's conclusion in late 2025.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

To see my most frequently updated, high conviction model portfolio comprised of exclusive ideas, please consider joining Sustainable Growth.

- Access to Large Cap, Emerging Leader and High Conviction Model Portfolio

- Exclusive Emerging Leader ideas for long term wealth builders in growing, secular markets

- Watch list that covers a broad universe of businesses with 'unfair competitive advantages' in fast growing markets

This article was written by

I am an investor who is focused on disruptive businesses that are transforming industries lead by visionary leaders with substantial skin in the game. I have spent nearly 20 years in a formal capacity in various investment banking and corporate advisory roles, having attained my MBA with a concentration in finance. This led me toward a path in Venture Capital and working with entrepreneurs building new technology businesses, and I have had the opportunity to not only invest in a number of amazing privately held businesses, but also play a meaningful role in growing several of these early stage enterprises as well. I am now focused on applying my lens of private market disruption and leveraging secular tail winds to the public markets. This was a journey which I started with my public Project $1M portfolio series and which I have deepened with my marketplace service, Sustainable Growth

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ALL PROJECT $1M PORTFOLIO POSITIONS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.