TeamViewer SE Guides For Moderate Growth In 2023

Summary

- TeamViewer SE provides remote access and support software for organizations of all sizes worldwide.

- The company has produced revenue growth and profits.

- 2023's growth guidance was only moderate and I'm cautious on the potential for a macroeconomic downturn in 2023.

- My near-term outlook for TeamViewer SE is Hold.

- Looking for more investing ideas like this one? Get them exclusively at IPO Edge. Learn More »

metamorworks

A Quick Take On TeamViewer SE

TeamViewer SE (OTCPK:TMVWF) provides an array of remote access and support software solutions to organizations worldwide.

The company's revenue growth outlook is moderate while profits remain reasonably strong.

I’m on Hold for TeamViewer SE in the near term until we gain more visibility into macroeconomic conditions and their effects on the firm’s operating metrics.

TeamViewer Overview

Göppingen, Germany-based TeamViewer SE was founded in 2005 to enable organizations to manage and support their IT operations remotely and across all devices.

The firm is headed by Chairman and CEO Oliver Steil, who has been with the firm since 2018 and was previously a Partner at private equity firm Permira and CEO of Sunrise Communications AG, a mobile service provider in Germany.

The company’s primary offerings include the following:

Remote - legacy remote access

Tensor - enterprise connectivity

Frontline - industrial augmented reality.

The firm acquires customers through its direct sales and marketing efforts and through a robust partner program for sales and implementation services.

TeamViewer’s Market & Competition

According to a 2022 market research report by Fortune Business Insights, the global market for remote desktop software market was estimated at $1.92 billion in 2021 and is forecast to reach $7.2 billion by 2029.

This represents a forecast CAGR of 18.0% from 2022 to 2029.

The main drivers for this expected growth are the ongoing impact of the COVID-19 pandemic pulling forward changes in remote and hybrid working arrangements for businesses worldwide.

Based on end-user type, the market is segmented into the verticals of healthcare, government, education, BFSI, IT & telecom, manufacturing and others such as media and entertainment.

The IT and telecom industry vertical is forecast to dominate demand by segment through 2029.

Also, distance education and e-learning applications continue to grow in adoption by consumers as product offerings have improved.

Competitive or other industry participants include:

AnyDesk Software

Zoho

Remote PC

GoToMyPC

Splashtop.

TeamViewer’s Recent Financial Trends

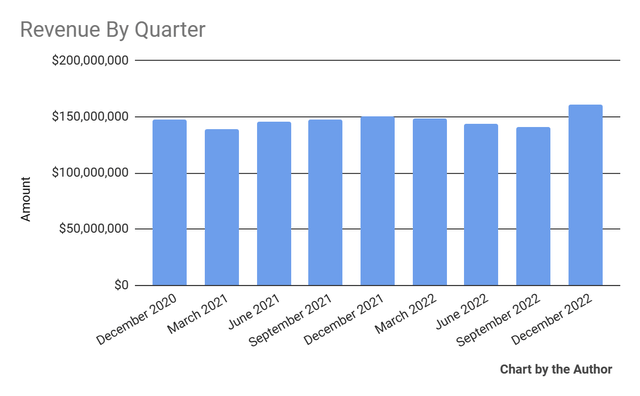

Total revenue by quarter has followed the trajectory shown below:

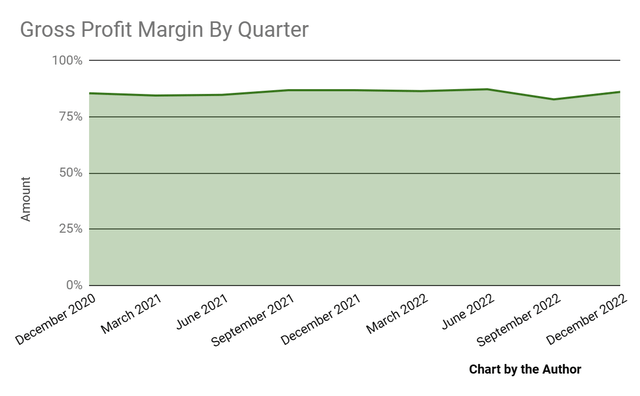

Gross profit margin by quarter has fluctuated within a tight range:

Gross Profit Margin (Seeking Alpha)

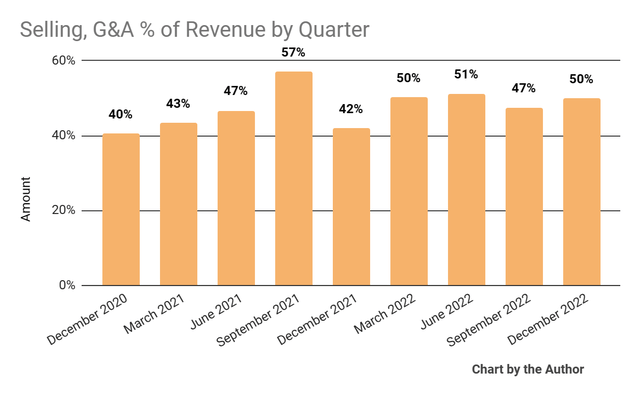

Selling, G&A expenses as a percentage of total revenue by quarter have trended higher recently:

Selling, G&A % Of Revenue (Seeking Alpha)

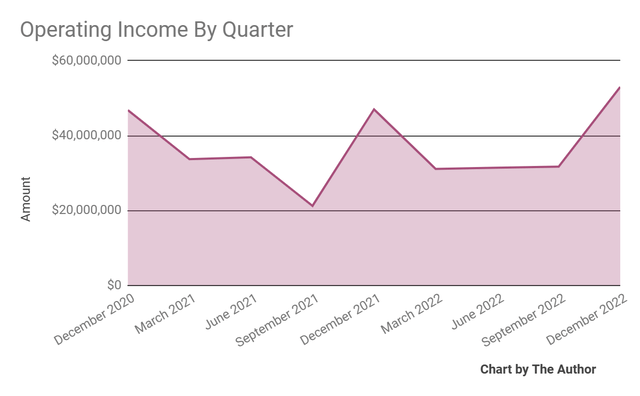

Operating income by quarter has risen in Q4 2022:

Operating Income (Seeking Alpha)

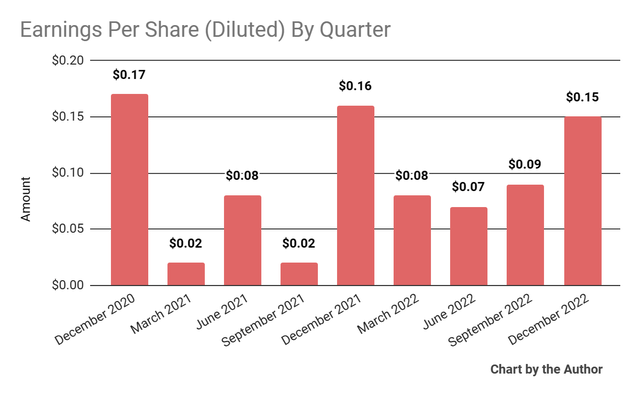

Earnings per share (Diluted) have fluctuated as follows:

Earnings Per Share (Seeking Alpha)

(All data in the above charts is IFRS.)

For the balance sheet, the firm ended the quarter with $179.9 million in cash, equivalents and short-term investments and $640.4 million in total debt, of which $108.9 million was categorized as the current portion due within 12 months.

Over the trailing twelve months, free cash flow was an impressive $213.3 million, of which capital expenditures accounted for only $5.5 million. The company paid $29.6 million in stock-based compensation in the last four quarters.

Valuation And Other Metrics For TeamViewer

Below is a table of relevant capitalization and valuation figures for the company:

Measure [TTM] | Amount |

Enterprise Value / Sales | 6.0 |

Enterprise Value / EBITDA | 19.4 |

Price / Sales | 5.4 |

Revenue Growth Rate | 12.9% |

Net Income Margin | 12.0% |

EBITDA % | 30.9% |

Market Capitalization | $3,110,000,000 |

Enterprise Value | $3,620,000,000 |

Operating Cash Flow | $218,810,000 |

Earnings Per Share (Fully Diluted) | $0.39 |

(Source - Seeking Alpha.)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

TeamViewer SE’s most recent Rule of 40 calculation was 43.8% as of Q4 2022’s results, so the firm has performed well in this regard, per the table below:

Rule of 40 Performance | Calculation |

Recent Rev. Growth % | 12.9% |

EBITDA % | 30.9% |

Total | 43.8% |

(Source - Seeking Alpha)

Commentary On TeamViewer

In its last earnings call (Source - Seeking Alpha), covering Q4 2022’s results, management highlighted the successful implementation of price increases and growth in moving customers up to higher value-added tiers.

Notably, the company gained with enterprise customers who produced 47% billing growth for the year, while SMB billings were up 18% in comparison.

The company’s net retention rate for 2022 was 107% versus 98% in 2021, indicating strong growth in sales & marketing efficiency.

Total revenue for Q4 2022 rose by 7.1% year-over-year and gross profit margin was only slightly lower than Q4 2021’s results.

SG&A as a percentage of revenue has generally been in a rising trend while operating income grew sharply in Q4 2022, as did earnings per share.

Looking ahead, management guided 2023 revenue growth to be around 8.5% at the midpoint of the range.

Leadership will continue to prioritize R&D spending to ‘strengthen our high-quality product offering…and extending the Frontline platform.’

The company's financial position is good, with plenty of liquidity, some long-term debt but impressive free cash flow performance.

Regarding valuation, the market is valuing TeamViewer SE at an EV/Sales multiple of around 6.0x.

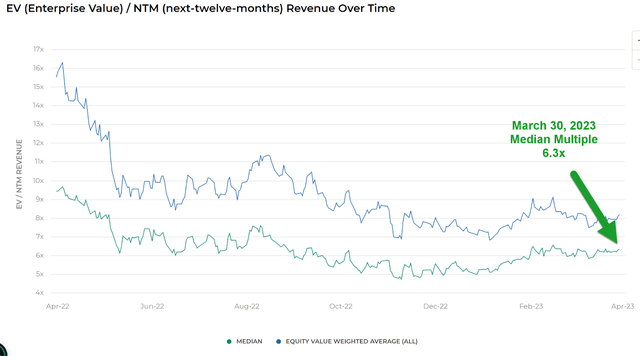

The Meritech Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 6.3x on March 30, 2023, as the chart shows here:

EV/Next 12 Months Revenue Multiple Index (Meritech Capital)

While the company is not a pure SaaS play, by comparison, TeamViewer is currently valued by the market at a slight discount to the broader Meritech Capital SaaS Index, at least as of March 30, 2023.

The primary risk to the company’s outlook is the potential for a macroeconomic slowdown or recession, which may accelerate new customer discounting and lengthen sales cycles.

In the past twelve months, the firm's EV/EBITDA valuation multiple has risen 25%, as the chart from Seeking Alpha shows below:

EV / EBITDA Multiple History (Seeking Alpha)

So, the market is rewarding TeamViewer’s performance with growing valuation multiples at a time of a higher cost of capital environment.

If cost of capital assumptions begin to plateau or reverse, the firm’s valuation multiples may benefit from upward re-evaluation.

However, if a recession occurs, the resulting drop in demand may weigh on revenue growth and/or profitability.

So, TeamViewer’s future is a toss-up at this point depending on the direction of the economy in the markets in which it operates.

I’m on Hold for TeamViewer SE stock in the near term until we gain more visibility into macroeconomic conditions and their effects on the firm’s operating metrics.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis.

Get started with a free trial!

This article was written by

I'm the founder of IPO Edge on Seeking Alpha, a research service for investors interested in IPOs on US markets. Subscribers receive access to my proprietary research, valuation, data, commentary, opinions, and chat on U.S. IPOs. Join now to get an insider's 'edge' on new issues coming to market, both before and after the IPO. Start with a 14-day Free Trial.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.