Grayscale Bitcoin Trust: Underappreciated Opportunity Amid SEC Battle And Upcoming Bitcoin Halving

Summary

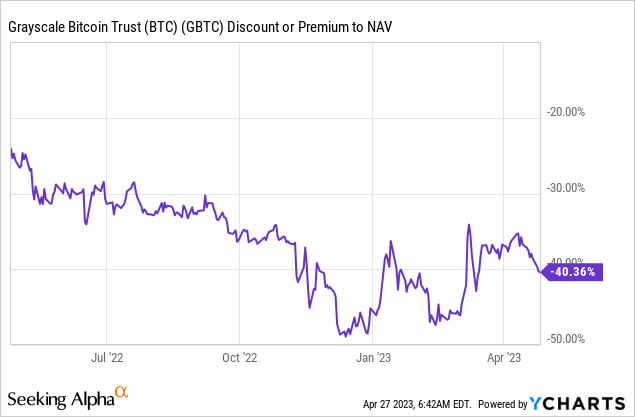

- I am accumulating Bitcoin, focusing on Grayscale's GBTC, which currently trades at a 40.4% discount.

- Grayscale vs. SEC case and lawmaker pressure on the SEC could result in the conversion of GBTC to an ETF finally being allowed.

- Anticipation of the next Bitcoin halving, expected in 2024, could lead to a price surge due to scarcity.

- GBTC's substantial discount and potential ETF conversion offer an attractive investment opportunity.

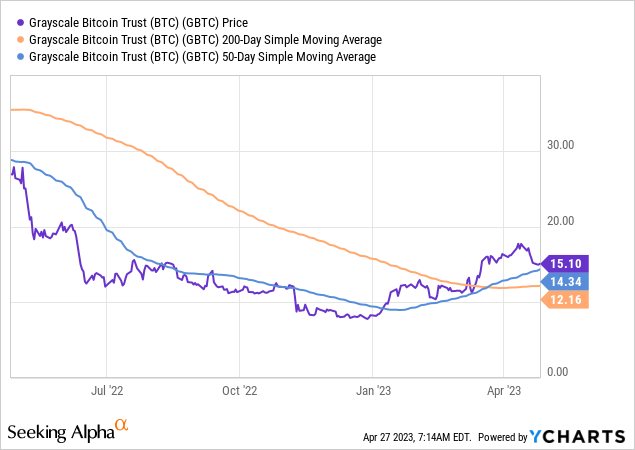

- Technical indicators generally support both GBTC and Bitcoin, despite setbacks and uncertainties.

- Looking for a portfolio of ideas like this one? Members of Special Situation Report get exclusive access to our subscriber-only portfolios. Learn More »

KanawatTH

Since October 2022, I have been strategically accumulating Bitcoin (BTC-USD) with a particular interest in Grayscale's crypto funds, such as the Grayscale Bitcoin Trust (OTC:GBTC). I plan to retain this investment until Grayscale transitions it to an ETF, consequently eliminating the discount to NAV present in this closed-end fund. Presently, GBTC trades at a substantial 40.4% discount-a notable discrepancy seldom seen in U.S. traded closed-end funds. This significant discount seems unjustifiable, particularly in light of Grayscale's legal action against the SEC (I discussed that case in more depth here) for preventing the conversion of GBTC into an ETF. The discount is wider than in my last article.

The litigation initiated by Grayscale indicates the firm's intent to transform the closed-end fund into an ETF/ETN, likely driven by obvious business motivations. Converting GBTC into an open-ended product would result in the creation of the largest crypto ETF based in the world. Typically, the largest ETF/ETN within a category begets a significant share of investment flows and therefore a very profitable fund to run.

Note that I'm generally bullish on Bitcoin, and I've written countless articles on Bitcoin for Seeking Alpha (from back when it traded sub $1000, and there was still debate whether it should be discussed as an investment at all). If you don't like Bitcoin, you could still like a GBTC position but paired with a short in Bitcoin through the futures or a close proxy like MSTR, but these are advanced tactics, and if you're not an experienced trader, it's probably better to move on to another idea.

There are 5 key drivers why I like a GBTC position.

1) Grayscale's oral arguments in the Grayscale vs SEC case went down very well. The court's decision can arrive between now and the end of the year (see timeline here)

2) The tensions around the financial system are flaring up again driven by the news flow around First Republic (FRC). The latest banking crisis has clearly been a catalyst for crypto. I don't think it is a sustainable driver or that it should necessarily be a driver but the market does what it does without my blessing. Bitcoin's popularity is partly a result of the GFR and the resulting widespread unhappiness about the financial industry. That sentiment is now salient again.

3) Representative French Hill (of the Digital Asset Committee) and majority Whip Tom Emmer sent a letter (read the full text here) to SEC Chair Gary Gensler, expressing concerns about the regulatory inconsistency in the treatment of spot bitcoin exchange-traded product applications. They argue that the SEC's refusal to approve spot bitcoin ETPs is inconsistent and doesn't consider other jurisdictions where similar products have been approved. They also criticize Gensler's differential treatment of bitcoin futures ETPs, which are allowed to trade in the U.S., and bitcoin spot ETPs, which are continually denied.

Basically, this letter echoes Grayscale's argument in Grayscale vs SEC. However, I do think it is important there is additional pressure on the SEC to mend their ways. I happen to believe in the long-term viability of Bitcoin. However, I have tons of other investments, and I won't lose much sleep if it goes away. So, I'm biased but I don't think I'm emotionally overinvested in this asset class. While trying to weigh the merits objectively, I really do think the SEC has been treating Bitcoin a bit unfairly Grayscale has a good chance to be vindicated.

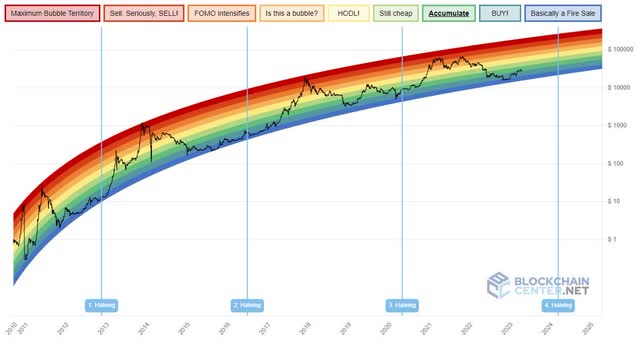

4) The next Bitcoin halving is likely less than a year away. In essence, the Bitcoin halving refers to the process where the rewards that miners receive for verifying and adding new transactions to the blockchain are cut in half. When Bitcoin was first introduced in 2009, the reward for successfully mining a block was 50 Bitcoins. Since then, halvings have occurred in 2012, 2016, and 2020, reducing the block reward to 25, 12.5, and 6.25 Bitcoins, respectively. The next halving is anticipated to take place around 2024, further reducing the reward to 3.125 Bitcoins per block. The reduction in supply (because the reward goes down but also because older mining equipment suddenly turns unprofitable) this tends to create a supply-demand imbalance, which can lead to an increase in the value of Bitcoin. As the number of new Bitcoins entering the market decreases, investors often anticipate a price surge due to scarcity.

I browsed the internet looking for a chart that illustrates the effect of the halving and I found this fun chart by Blockchain center:

Bitcoin halving chart (Blockchain center)

Don't take the rainbow channel too seriously I guess, but the chart shows where the halvings happened and the price action afterward. You would expect traders to increasingly anticipate this event, and I have noticed talk of the halving starting to pick up. I believe that chatter will increase as the date comes closer and when Bitcoin's bullish price action corroborates that narrative.

5) The fifth reason is, of course, the discount. If Grayscale turns the closed-end fund into an ETF that's a 66% uplift by itself. That is compounded by Bitcoin price action. Given the fact that I'm bullish on Bitcoin that's a very attractive proposition. The

6) Technical generally still seem to be supportive of GBTC and Bitcoin. The 50-day GBTC MA just broke through the 200-day which is a classic technical signal but others paint a similar picture (although not exclusively so).

In conclusion, despite the setbacks in the crypto world and the ongoing battle between Grayscale and the SEC, there are compelling reasons to maintain a bullish stance on a GBTC position. The Grayscale vs. SEC case developments, increased pressure on the SEC from lawmakers, the anticipation of the next Bitcoin halving, and the substantial discount on GBTC all contribute to an attractive investment opportunity. Additionally, technical indicators generally support both GBTC and Bitcoin, offering further encouragement for investors. While the future remains uncertain, the potential for asymmetric returns (through the compounding effect of the discount and the price of Bitcoin) makes GBTC an appealing prospect for those with confidence in the long-term viability of Bitcoin and the transformation of the closed-end fund into an ETF.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

I gravitate towards special-situations. That means situations around companies or the market where the price can move in a certain direction based on a specific event or ongoing event. This eclectic and creative style of investing seems to suit my personality and interests most closely.

Since 2020 I host a podcast/videocast where I discuss (special-situation/event-driven) market events and investment ideas with top analysts, portfolio managers, hedge fund managers, experts, and other investment professionals. I highly recommend it (pick episodes around topics that interest you) for the amazing guests that come on with regularity.

I've been writing for Seeking Alpha since 2013 after playing p0ker professionally. In 2018 I founded Starshot Capital B.V. A Dutch AIF manager. Follow me on Twitter @Bramdehaas or email me Dehaas.Bram at Gmail

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GBTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.