Medical Properties Trust Earnings Weren't Bad, Dividend Declared, Shorts Should Be Worried

Summary

- MPW's Q1 2023 earnings showed a profit, and reiterated similar guidance for 2023 where the low end was the same and the top end declined.

- MPW is forging forward with its lawsuit against Viceroy Research and we will have to wait and see what the court decides, but MPW did reiterate they are not dropping the suit.

- MPW declared its upcoming dividend at full freight and proved all of the bears wrong about a dividend cut.

- Based on the numbers, MPW still looks undervalued if you believe MPW and PwC rather than Viceroy Research.

Ninoon

Over the previous year, Medical Properties Trust (NYSE:MPW) shares have declined -54.61%. While MPW has faced the same microenvironment as other REITs, MPW has endured a short attack as short interest has increased to 19.48% and an outright onslaught from Viceroy Research. It's one thing to disagree with a valuation and formulate an opinion based on factual research; it's completely different to engage in a steady barrage of statements calling MPW a fraud, scam, and making claims without proof. Once again, MPW has released earnings, and in Q1 2023, MPW delivered $0.37 in FFO and $350.2 million in revenue. While this was a slight miss, it's clear that the situation isn't what Viceroy Research claims, as MPW declared its regular quarterly dividend of $0.29 per share to be paid on 7/13/23 to shareholders of record on 6/15/23. I think the shorts are crazy continuing to bet against MPW as all the research reports from Viceroy look incredibly weak, considering MPW continues to deliver net income, positive FFO, and maintains its dividend. It may take some time, but I believe shares of MPW are undervalued, and at some point the shorts will get squeezed out of their positions.

An Update on the Viceroy Research Lawsuit

In my previous MPW article (can be read by clicking here) I outlined all of the allegations Viceroy had made against MPW, including revenue round tipping, executive compensation, concealment concerning Steward, and the accusations of scamming, fraud, and encouragement of criminal investigations. I also linked their research reports, tweets against MPW, and the letter Viceroy sent to PWC, who is MPW's auditors.

In the press release that MPW issued today, they provided a litigation update, as MPW had sued Viceroy Research and its principals, including Fraser Perring, in federal court for defamation and related wrongs arising from their campaign of malicious falsehoods. MPW has demanded a trial by jury on the following claims:

- Count one, Defamation

- Count two, Civil Conspiracy

- Count three, Tortious Interference with Contractual or business relations

- Count four, Private Nuisance

- Count five, Unjust Enrichment

Here is the latest update. Instead of answering the allegations MPW has cited, Viceroy Research has filed motions to dismiss the claims before they reach a jury. Viceroy Research is arguing that their research reports are a matter of opinion and not facts. Viceroy Research also alleges that the court lacks jurisdiction. MPW is holding strong, and their stance is that the statements published by Viceroy are false, misleading, and defamatory statements of purported fact whose fundamental character cannot be altered by disclaimers. MPW is not dropping its lawsuit against Viceroy Research and is pursuing a trial by jury.

I am not a lawyer, but here is my opinion on the matter. If a person or a research firm wants to create an investment thesis that is supported by factual numbers as to why a company is overvalued, that is perfectly fine. For instance, if shares of a company have remained flat, but the revenue and profits have declined sequentially over a period of time, it's perfectly fine to voice an opinion that the fundamentals based on the financials don't support the current share price. That's not what is happening here. I think it's ethically wrong to go on Twitter which is a public forum, and say MPW is a ponzi scheme reliant on roundtripping, that MPW is a fraud, saying subsidiaries are crooked and to expect arrests, and that MPW has made fake purchases of massively inflated assets without solid proof is wrong. Viceroy has released public research reports and made tweets on Twitter with definitive statements about wrongdoing without evidence. Put aside that I am a shareholder for a moment, PwC is a big four accounting firm and has been MPW's auditor since 2008, and MPW has been able to pay more than $4 billion in dividends to shareholders. Until the courts sort this out, I am going to believe the numbers are real that PwC is certifying, considering Viceroy has offered no actual evidence on their claims.

The situation at MPW isn't as bad as the current environment makes it out to be

MPW delivered an earnings miss, but that was good enough to solidify MPW as a business, not in shambles. MPW generated a profit on a per-share basis of $0.05 in net income, and the normalized FFO was $0.37. MPW agreed to sell the Healthscope portfolio in Australia for AUD$1.2 billion, with proceeds targeted for repayment of the Company's Australian term loan. MPW received notice that Prime Healthcare will exercise its right to repurchase three hospitals in Kansas and Texas in the third quarter for roughly $100 million.

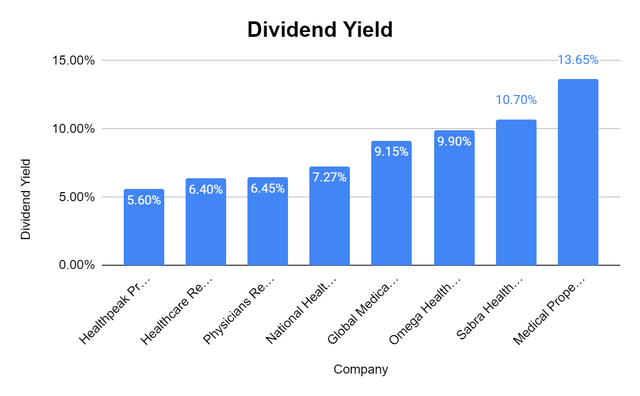

MPW generated $33 million in net income during Q1, a decline from the $632 million produced in Q1 of 2022. MPW had a $90 million impairment and other non-cash charges related to the expected sale of hospitals and no rent or interest revenue recognized from Prospect leases or loan investments in Q1 of 2023. In Q1 of 2022, MPW's net income included a $452 million gain from an asset sale and showed a write-off of roughly $125 million of straight-line rent related to the partnership transaction with Macquarie Asset Management. MPW's NFFO in Q1 2023 was $222 million compared to $282 million YoY.

MPW updated its 2023 outlook to factor in the Q1 2023 results. The lower end of the FFO guidance remained unchanged, at $1.50, while the upper end declined from $1.65 to $1.61. The range of $1.50 to $1.61 accounts for scenarios where certain amounts related to Prospect are recognized as revenue during 2023 and the possibility that the revenue related to Prospect is recognized subsequent to 2023. MPW expects to allocate $1.4 billion toward debt reduction from deleveraging asset sales.

How MPW looks with updated numbers compared to its peer group

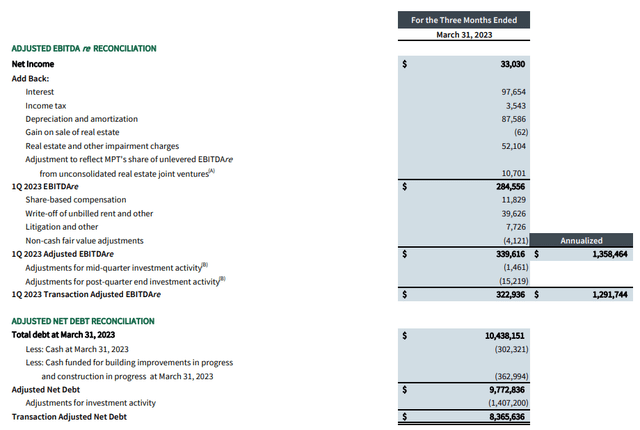

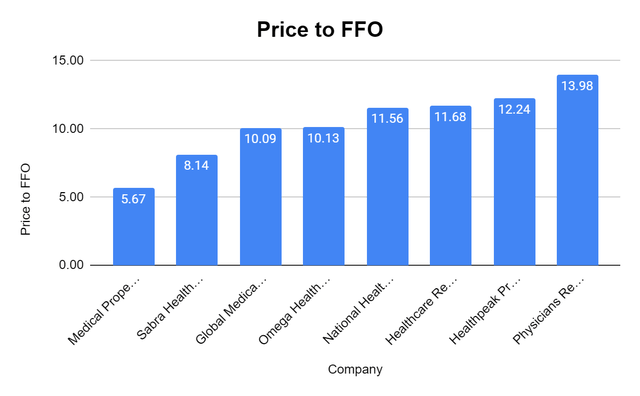

I am looking at MPW based on its peers against its price to FFO and total debt to EBITDA. I am using the post-quarter EBITDA number of $1.29 billion in the figures.

I am comparing MPW to:

- Healthpeak Properties (PEAK)

- Healthcare Realty Trust (HR)

- Physicians Realty Trust (DOC)

- National Health Investors (NHI)

- Sabra Health Care REIT (SBRA)

- Omega Healthcare Investors (OHI)

- Global Medical REIT (GMRE)

I used $1.50 for MPW's FFO because it's the low end of guidance. MPW trades at a price to FFO of 5.67x compared to a peer group average of 10.44x. Even at the low end of the range, MPW's price to FFO is very discounted.

Steven Fiorillo, Seeking Alpha

MPW's total debt to EBITDA is 8.08x, which is slightly above the peer group average of 7.36x. MPW has an annualized EBITDA of over $1.29 billion, and with its places to reduce debt by over $1 billion in 2023, this metric isn't large enough for me to worry.

Steven Fiorillo, Seeking Alpha

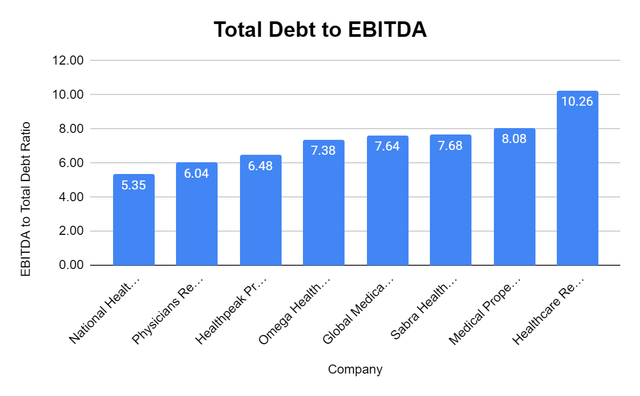

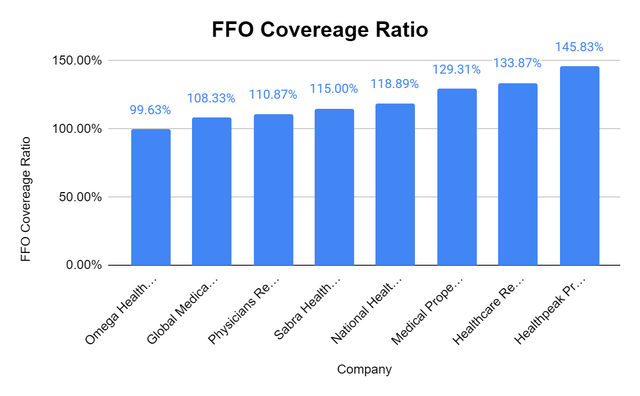

Shares of MPW have declined so far that its dividend yield is 13.65% compared to the peer group average of 8.64%. MPW, at the low end of guidance, still generates a dividend coverage ratio of 129.31% which is higher than the 120.22% peer group average. Some had speculated that MPW would need to cut the dividend, but that didn't occur as MPW announced its upcoming dividend at full freight, and the numbers show they produce more than enough FFO to sustain the payment.

Steven Fiorillo, Seeking Alpha Steven Fiorillo, Seeking Alpha

My takeaways from MPW's Q1 earnings

I just checked my cost basis in my main dividend account, and my average price per share for MPW is $11.46. I believe the Q1 results will serve as a turning point for shares of MPW as the situation doesn't seem as bleak as what Viceroy Research or the short interest portrays. I have to base my investment choices on the facts available to me, and Viceroy hasn't presented evidence based on their claims while MPW continues to issue certified financials by PwC and pay its quarterly dividends in full. I think that MPW is undervalued, and I may buy some more under $9 as I believe there is a possibility shorts will look to cover their positions in the future. MPW is still generating large amounts of EBITDA, and even at the low end of guidance, their price to FFO is meager compared to its peers. We will need to see what the courts decide, but if MPW is victorious in its lawsuit, it could act as a catalyst to the upside. Either way, based on the financials and the commentary provided in the press release, shares of MPW look undervalued to me.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MPW, OHI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.