VEGI: A Future Market Leader, Just Not Yet

Summary

- Agribusiness is a $4 Trillion global market, so it is one of those essential industries investors should track.

- VEGI does a solid job of doing that, through a focused, global equity portfolio that emphasizes the stocks that drive agribusiness bull markets.

- I rate VEGI a Hold, given the current global equity market malaise. But I am starting to track it for when bear turns bull again.

Phynart Studio/E+ via Getty Images

iShares MSCI Agriculture Producers ETF (NYSEARCA:VEGI) is more than just a cute ticker symbol. It is a solid access point for the global agribusiness market. That is, this ETF allows investors exposure to the returns of agriculture-centric stocks. Since those stocks can be influenced by fluctuations in agricultural commodity prices, VEGI offers some exposure to that aspect of market price trends as well. So, when investing in VEGI, influential factors are varied. Some are company-specific. Others derive from global supply of and demand for food and the ease with which it can be produced and transported.

Of course, as the stock and commodities markets remind us regularly, even strong companies can have their stock prices rattled by exogenous events that have no direct impact on the day-to-day operations and success of those businesses. In other words, the current stock market malaise, which has seen the S&P 500 go up, down and sideways, only to end up where it was 2 years ago, impacts every stock, sector and industry. That likely puts a lid on VEGI's upside potential for now, and thus limits my enthusiasm to a Hold rating.

Agribusiness: an undeniably critical industry

According to Ibis World the global agribusiness market is about $4 Trillion. That's too big to ignore when it comes to seeking out alpha-driven ideas in the stock market. By Ibis's count, there are more than 5 million businesses in this field. Their summary of the past 5 years sings a familiar tune to investors: a decent uptrend, disrupted by a trade wars and then a historic pandemic, from which it is still recovering. Quoting their recent report directly:

Over the past five years (2018-2023), revenue for agribusiness has declined at a CAGR of 0.7%, reaching $4.1 trillion in 2023. Revenue will fall an estimated 1.9% in that year, while profit will likely comprise 4.9% of revenue. Unstable international markets cause revenue to fall. Export markets were disrupted during the beginning of the current period, when a trade war between the United States and China caused tariffs on US soybeans to skyrocket. COVID-19 resulted in a major decline in spending, so exports fell. Even as the economy recovered from the pandemic, supply chain disruptions made it difficult to transfer materials abroad, so international markets remained muted. For those who want to dig deeper into the forward-looking opportunity in the agribusiness sector, I suggest reading this piece from one.org.

Here are a couple of key points I am highlighting from that review:

* While the US population spends only 10% of income on food, in the developing countries, food is life for much of the population. They spend 60-80% of their income on food.

* More than 9 out of 10 farms globally are family-owned, and they provide more than 80% of the world's food supply. "Farm to table" is a popular term here in the US, perhaps because the sheer size of our country makes it so that eating what is grown locally is not a given. And, while I'm not naive in recognizing that many such farms are at the behest of giant global businesses in the "food chain," it is apparent that agribusiness can't simply fade away, like taxi cabs or travel agencies.

Consumer staples businesses are often referred to as relatively recession-resistant, since we'll brush our teeth, eat and drink and buy other life essentials, even when the economy is rotten for a while. I think that agribusiness belongs in a similar category, albeit with somewhat higher cyclicality.

The natural tie-in with commodity prices, which are part of the input costs for agribusinesses, makes VEGI an inflation-fighting candidate for equity investors. And, since the world is currently experiencing the highest inflation in years, this ETF is one that I consider to be "in play" the next time the market starts to seriously reward such stocks. And, with about 30% of assets in non-US stocks, that could represent some helpful diversification here.

VEGI vs. MOO (though I like them both)

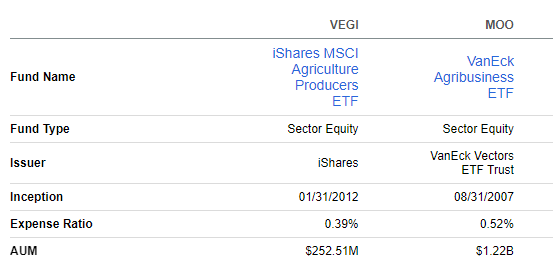

This table shows that while VEGI is 1/5 the size of (Van Eck Agribusiness ETF) MOO, its expense ratio is lower. That's a "win" for VEGI. That said, I like MOO as well. But other than for comparison purposes, I am not discussing it here. My focus as an ETF researcher for my own portfolio and in general is those ETFs that are relatively "undiscovered." One would think that with iShares behind it, VEGI might have been the bigger ETF after more than 11 years in business. The fact that it is not only adds to its appeal to me.

Seeking Alpha

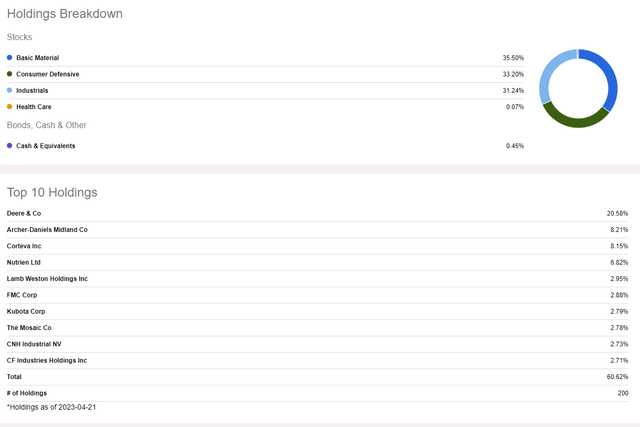

The table below shows that the number of stock holdings is often irrelevant when evaluating ETFs. The key is how focused it is as the top. I prefer more "concentrated" ETFs and do not consider it a risk as much of the ETF analyst community does. I view ETF investing as a way to access a basket of companies, but where I actually know what I own. As such, with just 10 companies making up more than 60% of VEGI's assets, that box is checked for me. MOO is similarly concentrated at the top, so I don't see a huge difference there.

Seeking Alpha

I will note that since VEGI has 190 stocks that make up its remaining 39% of assets, while those stocks collectively may often have limited impact on the ETF's performance, I view that group as akin to a private equity fund philosophy. That is, it only takes a few "home runs" from that group to supplement long-term performance here. After all, that's the story of how the Nasdaq 100 came to be so popular.

Taking the holdings analysis to the next level of depth, I'll note that "agribusiness" when converted to traditional investment sector terms translates equally to 3 of the S&P 500's 11 sectors: Basic Materials, Consumer Defensive and Industrials each comprise about 1/3 of VEGI's portfolio.

As seen above, Deere & Company (DE) is currently a significant 20% allocation in VEGI, and the next 3 stocks make up another 23%. While some would balk at the idea of 43% across 4 stocks, I see it completely the other way. "Deere and friends" as I might call them make it easy to assess VEGI's reward and risk going forward. And, since I don't tend to allocate more than 20% of my portfolio to a sub-sector like this at one time, that keeps any one stock or group of stocks in this or any ETF from dragging the whole portfolio down.

VEGI: ready for the next bull market (yes, we'll get one someday!)

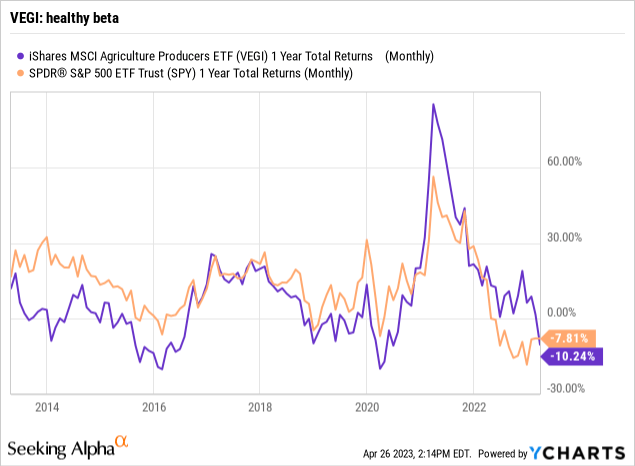

Finally, when I look at 1-year rolling returns of VEGI versus the S&P 500, I like what I see: a recent trend toward outperformance, albeit with some additional beta attached. There are many ways we can speculate about what drove the recent outperformance, including post-Covid supply chains loosening up. But I think there's more to it. As noted earlier, the global agribusiness is not just another industry. It is an essential piece in solving a substantial future issue for populations around the globe.

VEGI is part of my "undiscovered ETF" list. And while I limit my current enthusiasm to a Hold, along with nearly any ETF I like amid this period of broad stock market indecision, there are several future catalysts that make this one an upgrade candidate in the foreseeable future. That might come from a true trend shift in commodity prices, the operating efficiency of these companies, continued inflation fears, greater emphasis on owning non-US stocks, or all of the above.

This article was written by

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.