Molina Healthcare: Medicaid Redetermination Provides Buying Opportunity

Summary

- Molina Healthcare is a managed care company that primarily focuses on Medicaid.

- The company’s focus on Medicaid makes the business highly resilient during recessions.

- The stock’s decline year-to-date is due to a restart of eligibility requirements for state Medicaid programs (known as redetermination).

- Under a new CEO, the company embarked on a growth plan that has so far been successful and provides a runway of at least 3-5 years of double-digit EPS growth.

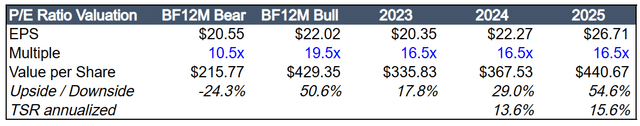

- We see potential upside of 25% to 50% over the next 1-2 years. Near-term downside is perhaps 15%. 3 to 5 year returns could be 15%+ annualized.

- This idea was discussed in more depth with members of my private investing community, Cash Flow Compounders. Learn More »

Andres Victorero

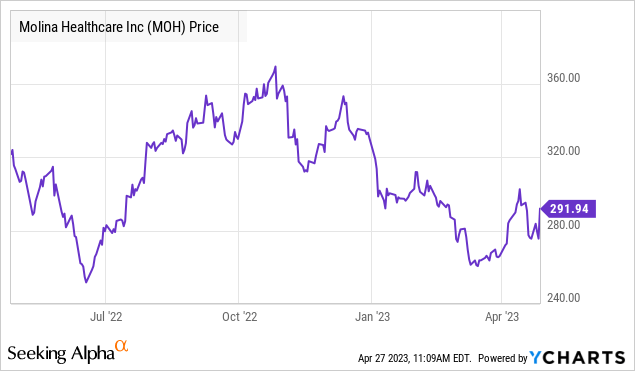

We are recommending shares of managed care company Molina Healthcare (“Molina”) (NYSE:MOH). The stock has fallen ~15% since the start of 2022, mostly over concerns regarding the impact of redetermination on the company’s Medicaid membership. The stock at recent prices represents an attractive opportunity to acquire shares.

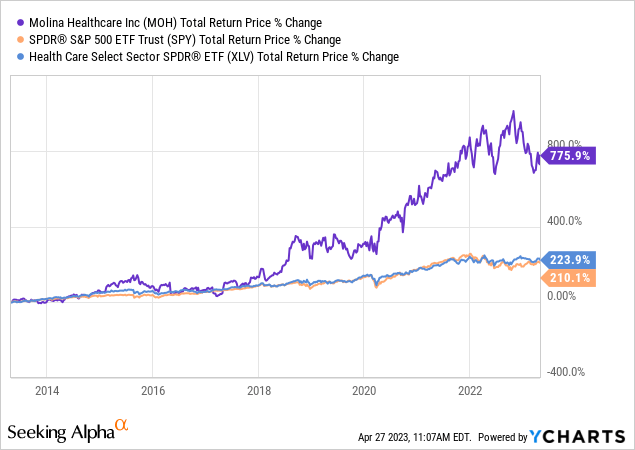

Molina has grown EPS annually since 2010 at 24.3% per annum. The company appears to be on a path to grow its EPS at a mid-teens rate for the next 3 to 5 years. Over the last 10 years, the stock has produced 24.7% annualized returns and outperformed the S&P 500 and the S&P 500 Healthcare Sector.

Molina’s stock seems to have a favorable risk/reward profile at current prices. The stock has potential upside of 20-50% over the next 12 to 18 months and the potential for 15+% annualized returns over the next 3 to 5 years. The stock’s downside in the near-term seems limited to 15% if you apply a Centene (CNC) multiple to Molina’s embedded EPS.

Given that the stock has underperformed the market this year and is down approximately 20% from its 52-week high of $374, we believe that the market has largely priced in the redetermination risks. Even if management is optimistic in their estimated impact Medicaid redetermination, the potential incremental hit to EPS would only be $0.60 to $0.80, or about a 3% to 4% hit to 2023 core EPS estimates.

Molina has a long growth runway. Healthcare costs are rising, and the company is taking material market share from the larger insurers. Molina has just 5.25 million members (versus peers with 25 to 50+ million members) and is only present in a select number of territories across the U.S. Molina’s has grown its members by 16.4% per annum over the past 3 years and expanded into several new territories, notably Los Angeles County California.

The company’s focus on Medicaid results in a more recession resistant business model than other health insurers because managed Medicaid membership tends to grow when unemployment rates rise. The unemployment rate in the U.S. currently stands at 3.5% and is likely heading higher, which should lead to more people becoming eligible for Medicaid.

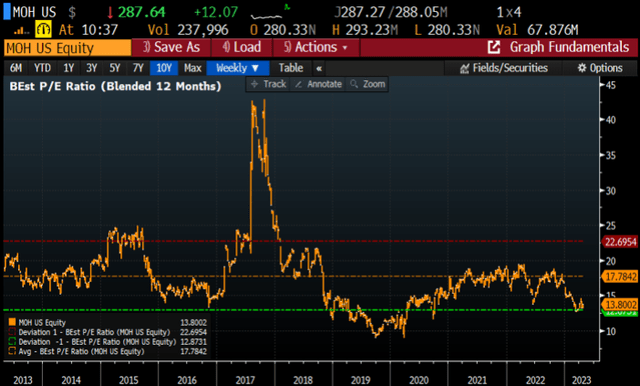

MOH is trading at 13.5x our blended forward (BF) 12-month EPS estimate and 10.4x our estimate of the company’s embedded earnings power. These multiples are well below the company’s 10-year average P/E of approximately 17.8x. EPS should grow at a mid-teens percent annualized rate for at least the next 3 years, which is in line with historical growth rates under the current CEO.

Background

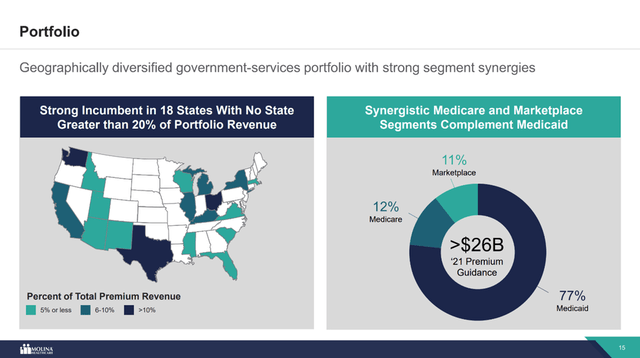

Molina Healthcare is a managed care company that primarily focuses on providing Medicaid insurance to individuals in the U.S. The company generated $32 billion of revenue from its ~5.25 million members in 2022. Molina operates in 18 states across the U.S. with no state making up more than 20% of revenues.

Molina Investor Day Presentation 2021

History

Emergency room physician David Molina founded Molina Healthcare in 1980 in Long Beach, California. Dr. Molina set up his first primary care clinic with the goal of treating the lowest-income patients regardless of whether they were able to pay. Dr. Molina ran the company until he died in 1996, at which point his sons J. Mario Molina and John Molina took over the operations.

Mario and his younger brother John took the company public in 2003 and remained in charge until 2015. From the stock’s IPO through the middle of 2015, MOH was one of the best performing managed care companies, generating 17.2% annualized returns. However, in 2016 and 2017, the company’s operating expenses spiraled out of control and EPS plummeted. The poor financial performance resulted in Mario and John’s removal from their positions.

After a six-month search, the Board of Directors hired the company’s current CEO Joseph Zubretsky. Zubretsky is a 35-year insurance and financial services industry veteran. Perhaps Zubretsky’s most relevant experience was the 9 years he worked as an Executive Vice President at Aetna from 2007 until 2016. Zubretsky ran Aetna’s National Business which was Aetna’s flagship business unit with $10 billion in revenues.

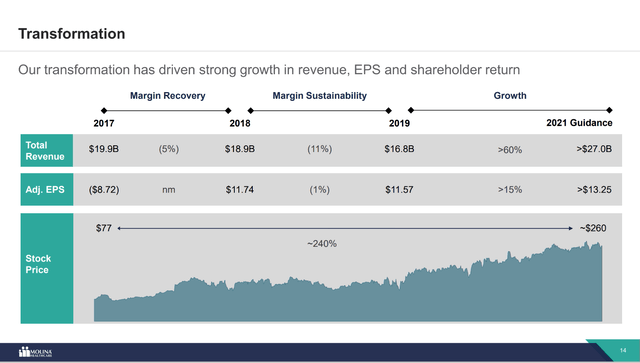

Business Turnaround

Zubretsky focused on turning around the company during the early months of his tenure. Within the first 6 months on the job, he cut out $235 million of selling, general, and administrative expenses (SG&A), strengthened the company’s balance sheet through taking the proper reserves, realigned management incentive programs to focus on earnings rather than premium growth, and brought in 4 new senior executives. The combined effect of these changes restored Molina’s margins to a competitive and sustainable level.

Zubretsky believed that if he could institute cost discipline within the company, he could then pivot to a growth plan that would generate significant shareholder value. Just one year after Zubretsky took over, Molina’s stock was up 75%. Adjusted EPS went from being negative in 4 out of the prior 5 quarters to one quarter of EPS exceeding any single year of EPS since MOH's IPO in 2003. Zubretsky’s plan was clearly working, and in 2019, he shifted the company’s focus towards growth.

Molina Investor Day Presentation 2021

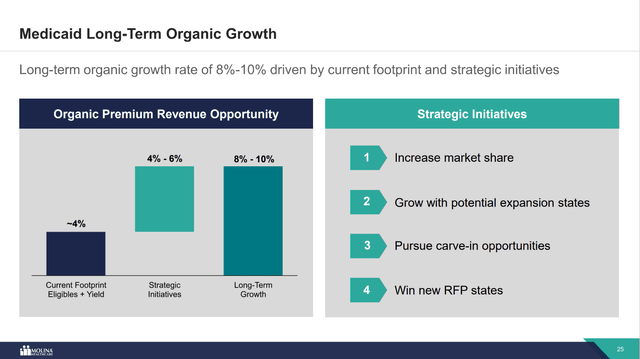

Molina is now on track to deliver mid-teens premium revenue growth over the long term. Most of the growth will come from the company’s Medicaid business. Management believes the company can grow 8% to 10% organically through new membership, higher premiums, and expansion into new markets. Simultaneously, acquisitions of smaller regional insurers will provide additional growth upside of 5%.

Key Investment Opportunities

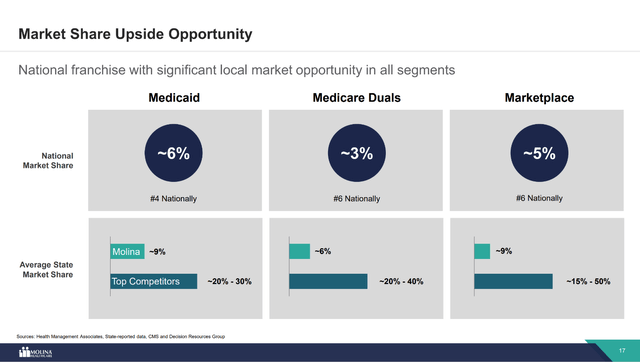

Market Share Gains Drive Organic Growth

Molina’s presence in just 20 states leaves the company with runway for 8% to 10% organic top-line growth over the next 5 to 10 years. The company has just 4.75 million Medicaid members, which represents only 5% market share. MOH’s major publicly traded competitor Centene is more than 3 times larger with ~16 million Medicaid members and a presence in 38 states, which means the company has significantly more territory to defend. Centene’s management sees their Medicaid business growing at a 6% to 7% CAGR long-term. That is 2 to 3 percentage points lower than the rate at which Molina’s management believes they can grow.

Molina Investor Day Presentation 2021 Molina Investor Day Presentation 2021

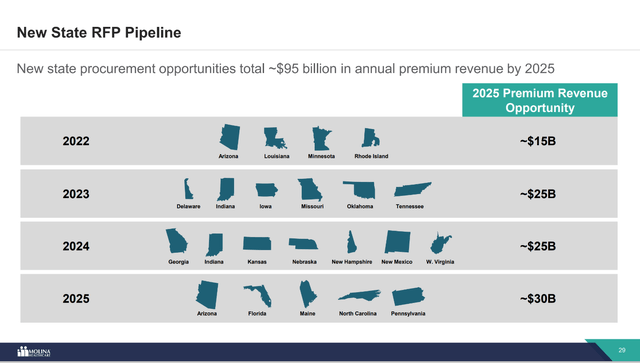

Every couple of years, states go through a re-procurement process where they will put out a request for proposal (“RFP”). Managed care providers then submit bids offering Medicaid services in the state. Since Molina’s footprint represents just half of the 41 states with managed Medicaid, the company has a large addressable market to go after when it comes to responding to RFPs.

Management has succeeded in winning new business through state re-procurements. During 2022, the company doubled the size of its business in California by winning a major contract in LA county away from Centene. Molina also expanded into Iowa and Nebraska, while renewing its contract in Mississippi.

Management indicated on the fourth quarter 2022 conference call that their RFP pipeline is strong.

“Our acquisition pipeline remains replete with actionable opportunities. While the timing of transactions remains difficult to predict, the strength of our pipeline and our track record of success gives us confidence in our ability to drive further growth from this important element of our growth strategy.”

-Molina Fourth Quarter 2022 Earnings Call Transcript

The company is seeking to further expand into New Mexico and Florida in the near term. Additionally, there are several states that are expected to put out RFPs over the coming years. Management’s historical execution gives us confidence that Molina will continue to win new contracts.

Molina Investor Day Presentation 2021

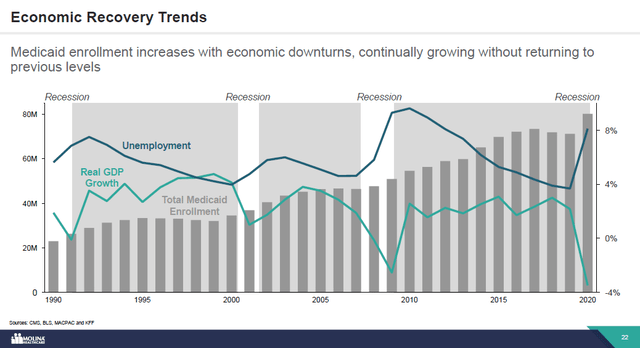

Defensive Business Model

Managed Medicaid, which represents 90% of Molina’s membership, tends to be an economically defensive business model. During weak economic times when unemployment rises, Medicaid enrollment tends to increase. If managed properly, higher membership typically leads to higher premium revenues and higher profits.

As the Fed continues to raise rates to fight inflation and many leading economic indicators continue to flash red, the probabilities of a U.S. recession and thus a weakening of the labor market in the U.S. seems to be rising. A weaker economy would generally be good for Molina’s business.

Molina Investor Day Presentation 2021

Given Molina’s organic growth opportunities, MOH is a bit of a win-win situation for macro-concerned investors. Since the company has several growth opportunities, it is likely to continue to grow whether the economy is in good or bad shape.

There’s evidence that the company can still do well even in a strong economy with declining Medicaid membership. For example, when Medicaid enrollment declined between 2017 and 2019, Molina’s EPS in 2018 and 2019 still grew.

On the other hand, if the economy turns south and unemployment rises, that should lead to a rise in Medicaid eligibility, which means Molina will grow membership, which in turn leads to higher premium revenues and high profits.

While EPS did decline year-over-year in 2020, this was largely because states tried to retrospectively recoup money paid to managed care providers that was not spent on benefits during Covid. These actions resulted in a one-time hit to EPS in 4Q22 of $2.14. Excluding this one-time hit, EPS would have grown 10.7% to $12.81 in 2020 versus 2019.

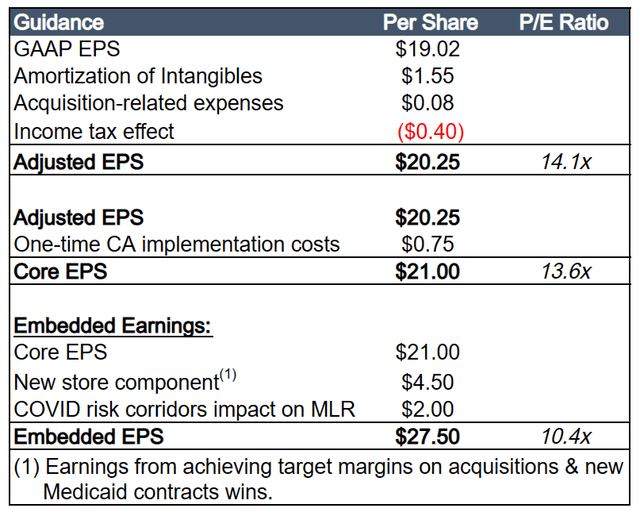

Significant Embedded Earnings Power

Since Molina began implementing its growth strategy, the company has made acquisitions and won numerous state Medicaid contracts. The benefit to the bottom line from these activities generally takes a few years to be realized. The delayed benefits generally come in the form of one-time implementation costs as well as what Molina refers to as a “new store” component. The “new store” component includes earnings that are expected to be realized from achieving target margins on acquisitions as well as new Medicaid contract wins.

Between 2020 and 2022, Molina completed ~$1.0 billion in acquisitions. Deals of note include the company’s $850 million acquisition of Magellan Complete Care in December 2020, the $176 million acquisition of Affinity Health Plan in October 2021, and the $150mm acquisition of My Choice Wisconsin, which is expected to close in mid-2023.

These tuck-in deals quickly became accretive as Molina’s management team implements their operating strategy to boost profitability by cutting costs and growing membership. Once these deals are fully implemented, they are expected to provide an additional $4.50 per share in EPS over the next 1 to 3 years.

On January 3rd of this year, Molina announced that the California Department of Health Care Services (“DHCS”) confirmed its previously awarded contracts to Molina. DHCS granted Molina a contract to provide services in Riverside, Sacramento, San Bernardino, and San Diego Counties and as a subcontractor in Los Angeles County. The contract is expected to commence January 1st, 2024, and to grow Molina’s California membership from 600 thousand to 1.2 million. Annual premium revenue from Medi-Cal is expected to more than double from $1.9 billion to $3.9 billion.

The win in California is large and preparing for its new members will require one-time implementation costs. Management has quantified these costs at $0.75 per share and these numbers are included in the 2023 guidance of $20.25 per share. Excluding these one-time costs, Molina’s embedded earnings power in 2023 is approximately $21 per share, which implies that the stock is trading at just 13.6x EPS at recent prices.

One final factor that is suppressing Molina’s earnings is the temporary implementation of risk corridors in response to the Covid-19 Pandemic. According to management, these Covid risk corridors negatively impact EPS by approximately $2.00 per share. Below is the excerpt from the company’s 2023 10-K explaining the impact of the corridors on the financial statements.

Beginning in 2020, various states enacted temporary risk corridors in response to the reduced demand for medical services stemming from COVID-19, which resulted in a reduction of our medical margin. The current rate environment is stable and rational. We continue to believe that the risk-sharing corridors previously introduced are related to the declared PHE and will likely be eliminated as the COVID pandemic subsides. However, the risk corridors continue to contribute an added level of variability to our results of operations. We recognized approximately $197 million [of additional expense] for the impact of risk corridors in the year ended December 21, 2022, compared to $323 million recognized in the year ended December 31, 2021. The decrease in 2022 is due to the elimination of most of the COVID-19 risk corridors.

-Molina Healthcare 2023 Form 10-K

Risk corridors have been eliminated across the country, so the elevated expenses from this policy are expected to abate in 2023.

The combination of Molina’s acquisitions, new contract wins, the one-time California win implementation costs, and the Covid risk corridors result in future additional earnings of $7.25. Assuming the Covid risk corridor costs go away in 2023 or 2024, the California implementation costs are a one-time hit to 2023 EPS, and the “new store” component of Molina’s acquisitions and new contract wins fall into earnings over the next 2-3 years, the company is well on track to grow EPS to $27.50+ in the next 2 to 3 years. This number assumes zero organic growth, i.e., further new contract wins and membership growth.

At $27.50 in embedded earnings, Molina’s stock is trading at just 10.4x earnings.

Company Reports, Author’s Spreadsheet

Buyout Potential

At a $15.3 billion market cap, Molina is a quarter of the size of its next largest competitor Centene. This leaves the potential for Molina to be an attractive acquisition target. MOH has relatively attractive margins given how much smaller the company is versus its peers, so there’s likely some solid room for synergies.

The most likely buyer of Molina is probably Cigna (CI) given the strategic overlap. Cigna has very little Medicaid business and a large commercial marketplace business. The defensiveness of Molina’s Medicaid business would help reduce Cigna’s sensitivity to economic cycles.

Mr. Zubretsky is 65 years old and owns $87 million of equity in MOH. We wouldn’t be surprised if he decided to seek to sell the company and retire in 3 to 5 years.

Redetermination Risk Seems Priced In

Redetermination is currently the forefront of investors' concerns. In 2020, Congress enacted the Families First Coronavirus Response Act (FFCRA). In exchange for enhanced federal funding, the FFCRA required Medicaid programs keep people enrolled through the end of the month in which the COVID-19 public health emergency (PHE) ends. The continuous enrollment provision was an important contributor to the ~28% increase in Medicaid enrollment between February 2020 and October 2022.

The increase in Medicare enrollment has benefited Molina. The company’s Medicaid membership between the first quarter of 2020 and the end of 2022 grew 60% to over 4.7 million members. Not all this increase was the result of the continuous enrollment provision, but Molina certainly benefited.

In December of 2022, Congress passed a bill that ended the continuous enrollment provision on March 31, 2023. The passing of this bill coincides with the underperformance of Molina’s stock price this year. A strong economy does pose a potential downside risk given that wages have increased significantly, and employment is strong. A strong economy tends to coincide with a decline in Medicaid enrollment.

However, it seems more than likely at this point the redetermination risks have been priced into the stock.

Molina’s management team has communicated to the investment community that embedded in 2023 guidance is approximately a $533 million negative impact from the resumption of redeterminations that will began to take place in 2023. On the first quarter 2023 earnings conference call, management further outlined their expectations,

Within our guidance, our outlook on the resumption of redeterminations and the impact on our business is unchanged. Through March closing. We estimate we gained approximately 800,000 members organically since the start of the pandemic. We continue to expect to retain roughly half of the members gained. We expect the premium impact to be approximately $1.6 billion. And that portfolio average margins. The earnings impact to be approximately $1 per share. Due to the timing of when members dis enrolled, we are projecting one-third the premium and earnings impact to emerge in 2023. With the remainder mostly in 2024.

-Mark Keim, CFO, Molina First Quarter 2023 Earnings Call Transcript

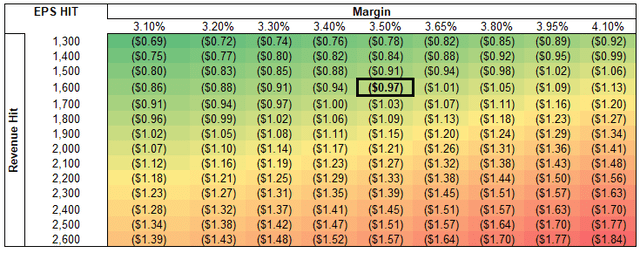

If we assume an after-tax margin of 3.5%, the hit to EPS is $0.97 over the course of 2 years. Using management’s $533 million guidance for 2023, that’s approximately a $0.32 hit to EPS. This amount has already been accounted for in management’s FY 2023 guidance of at least $20.25 per share.

Running a sensitivity analysis on this impact shows that even if management is off in their $1.6 billion estimate by $1 billion (~65%) and we assume these are higher margin revenues, the total impact to EPS over the course of 24 months is just $1.84. Applying a historical average multiple of 17.3x to this impact worst case scenario impact implies a $31.80 hit to Molina’s stock.

Again, Congress’s decision to end the continuous enrollment decision at the end of 2022 is what sparked the decline this year. Molina’s stock started the year at $330, so at most the penalty to the stock should be to $300 if you choose to ignore all the other potential upside contributors.

Molina’s management team is notoriously analytical with their projections, and they tend to beat earnings estimates too. It is safe to say we would be dumbfounded if their estimates were off by 60%. The numbers show that the redetermination risks have been more than priced into the stock at this point.

Key Investment Risks

Medical Cost Trends

Medical loss ratios (“MLR”) are historically a significant mover of managed care companies. It is not uncommon to see a health insurance company beat on revenue and EPS but still fall 5% to 10% because their MLR was higher than what investors were looking for.

MLR ratios are almost impossible to predict because so many factors can weigh on health insurance usage. For example, a bad flu season may send more people to the hospital, which results in higher healthcare usage. While over the long-term Molina should generally be able to maintain 87% to 89% MLR ratios, any type of event that may cause the company’s MLR to spike could result in volatility for the stock.

Legislation / Regulation

While any adverse legislation is unlikely in the near-term, new regulations are always in the back of investors’ minds when it comes to investing in healthcare companies. For example, during 2018 and leading up to the 2020 election, the idea of Medicare For All significantly impacted health insurers with large marketplace businesses. More recently, rhetoric from congress surrounding pharmacy benefit managers (“PBMs”) and their impact on drug prices has hurt the stocks of managed care companies with significant PBM businesses (CI, ELV, CVS) are all down significantly over the past few months.

In general, more regulation in healthcare has often benefitted the largest players. However, healthcare investors are notoriously finicky. We’ve seen the impact of Congress’s decision to end the continuous enrollment provision on the stock. Molina has approximately 7% hedge fund ownership as well. Hedge funds tend to be fast money shareholders.

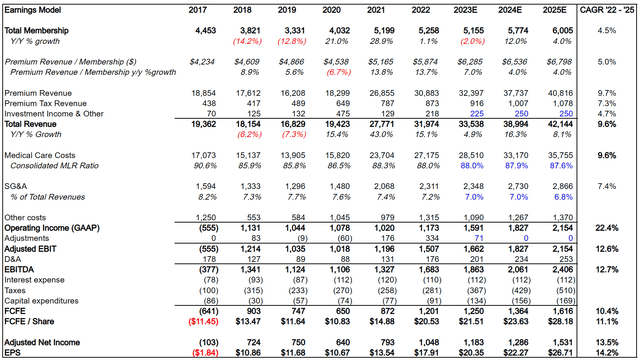

Model

Below is a summary version of our operating model. We are projecting a 9.6% revenue CAGR through 2025 and margin improvement as the company scales and integrates acquisitions. Margin improvement results in EPS growth exceeding revenue growth.

Company Reports, Author's Spreadsheet

Comps

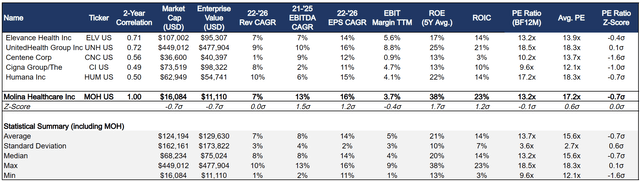

The best publicly traded comp for Molina is Centene, which is really the only other managed care company that primarily focuses on Medicaid. While Centene does only trade at 10.2x EPS, the company has been facing challenges. Centene has been the subject of regulatory scrutiny, legal disputes, operational issues, and competitive pressures. Their overly aggressive acquisition program has led to some dis-synergies and missed earnings expectations.

The company just appointed 5 new board members and brought in an entirely new management team over the last year. Given the turmoil, Centene lacks the market share gain opportunity that we believe Molina has. Similar to Molina, Centene has significantly de-rated over the past few months.

Bloomberg

As for the other managed care providers, these companies focus on marketplace and/or Managed Medicare. Managed Medicare is a secular growth story. UNH and Humana are the largest providers of managed Medicare in the country, which results in their stocks trading at high teens P/E multiples. The other marketplace focused players trade in the low double-digit to mid-teens P/E multiples.

Company Reports, Bloomberg, Author's Spreadsheet

Valuation & Return Forecast

Molina has historically traded at a P/E ratio of between 13x and 20x. The stock occasionally has traded as low as 9x and as high at 25x. The stock’s average P/E over the last 10 years is 17.8x, while its median is 17.2x.

Absolute downside is probably ~$245 or ~15%. In our downside calculation, we include the $7.25 in embedded earnings from one-time California implementation costs, “new store” EPS from recent acquisitions, and the elimination of Covid risk corridors (see explanation above). The math implies the downside on the stock is ~12x our BF12M EPS estimate of $20.55.

Longer-term, we apply a 15x multiple, in line with Centene’s long-term median P/E ratio. Given the growth profile, market share potential and industry leading ROEs, we think 15x is a conservative multiple. This also represents a 10% discount to the S&P 500’s 10-year median P/E ratio of 17x.

At 15x in 2-3 years we see the opportunity for ~14.6% annualized returns.

Conclusion

Molina’s stock at recent prices represents a compelling entry point and offers the potential for longer term market beating gains. Every couple of years it seems patient investors are able to pick up shares of solid healthcare companies as the markets focus on short-term issues and ignore the longer-term story. A similar situation offered attractive entry points for Cigna and Elevance Health (ELV) in 2018 and 2019, when fears over Medicare For All were at their absolute maximum. While Cigna and Elevance Health were volatile stocks for several quarters and looked like dead money, patience was rewarded.

The defensive nature of Molina’s managed Medicaid business in combination with the strong organic growth profile make Molina a solid name to own during a recession. If the Fed continues to keep its bias towards high rates, a recession is a real possibility, resulting in strong membership growth for Molina and capital flows into the stock.

Editor's Note: This article was submitted as part of Seeking Alpha’s Best Investment Idea For A Potential Recession competition, which runs through April 28. This competition is open to all users and contributors; click here to find out more and submit your article today!

Thanks for reading! Join our service Cash Flow Compounders: The Best Stocks in the World and build a durable, market beating portfolio. We have over 25+ years combined experience as institutional portfolio managers from mutual funds to hedge funds. Our high return on equity, high free cash flow stocks have a proven track record in compounding earnings over time. Sign up for a free 2 week trial to get my latest ideas!

This article was written by

I contributed the 3rd most Top Ideas on Seeking Alpha in 2022.

I am a writer for Cash Flow Compounders where we seek to find the best companies in the world that will outperform the market.

Quality is the most important factor to me in stock picking. I believe that investing in companies with high free cash flow, low debt, and strong growth prospects will typically lead to market beating returns over the long term.

Valuation plays a critical role in my investment process. I rely on quantitative models to determine valuation and find good entry points for stocks.

follow me on twitter @njvalueinvestor as I'm looking to provide more of my daily musings there.

If you're looking for more in depth ideas, check out Cash Flow Compounders.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MOH, ELV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.