Erasca: A Pivotal Trial Will Help Make It Stand Out

Summary

- ERAS has a vast pipeline for a small company.

- There's a lot of scattered data.

- We need a pivotal trial for one of these assets to stand out.

- Looking for more investing ideas like this one? Get them exclusively at The Total Pharma Tracker. Learn More »

FatCamera

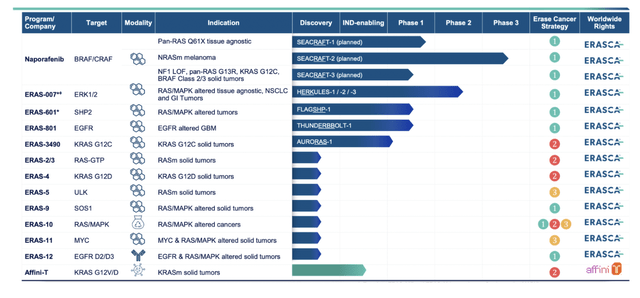

Erasca (NASDAQ:ERAS) is a small, undercovered developer of RAS/MAPK targeted molecules for cancer. It has a long pipeline of mostly discovery stage molecules, but a few assets are in phase 2, and there’s data.

Erasca’s pipeline, seen above, is impressive, and it is meant to impress. Note, though, that anybody can produce graphics on a website, listing assets; what is important is data, and only those assets are worth considering which have data. The rest are promises.

So we jump directly to Naporafenib, lead asset, which we see was inlicensed from Novartis (NVS) in December 2022 for $20mn upfront with another $280mn in milestone payments, plus royalties. Erasca has not run any trials with Naporafenib, however, Novartis ran 5 trials - here. I was trying to figure out why Novartis gave away this molecule after 6-8 years of experimenting with it, but there’s not much information available.

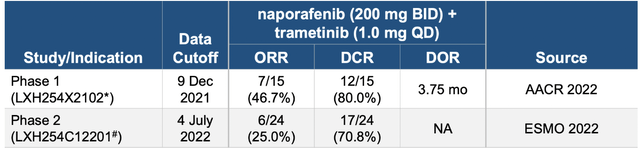

So, anyway, these trials that they ran produced data, the latest being at ASCO last year. This was from the expansion arm of a phase 1b study of Naporafenib in combination with trametinib in patients with advanced/metastatic KRAS- or BRAF-mutant non–small-cell lung cancer (escalation arm) or NRAS-mutant melanoma (escalation and expansion arms). Here’s the raw data:

Thirty-six and 30 patients were enrolled in escalation and expansion, respectively. During escalation, six patients reported grade ≥3 dose-limiting toxicities, including dermatitis acneiform (n = 2), maculopapular rash (n = 2), increased lipase (n = 1), and Stevens-Johnson syndrome (n = 1). The recommended doses for expansion were naporafenib 200 mg twice a day plus trametinib 1 mg once daily and naporafenib 400 mg twice a day plus trametinib 0.5 mg once daily. During expansion, all 30 patients experienced a treatment-related adverse event, the most common being rash (80%, n = 24), blood creatine phosphokinase increased, diarrhea, and nausea (30%, n = 9 each). In expansion, the objective response rate, median duration of response, and median progression-free survival were 46.7% (95% CI, 21.3 to 73.4; 7 of 15 patients), 3.75 (95% CI, 1.97 to not estimable [NE]) months, and 5.52 months, respectively, in patients treated with naporafenib 200 mg twice a day plus trametinib 1 mg once daily, and 13.3% (95% CI, 1.7 to 40.5; 2 of 15 patients), 3.75 (95% CI, 2.04 to NE) months, and 4.21 months, respectively, in patients treated with naporafenib 400 mg twice a day plus trametinib 0.5 mg once daily.

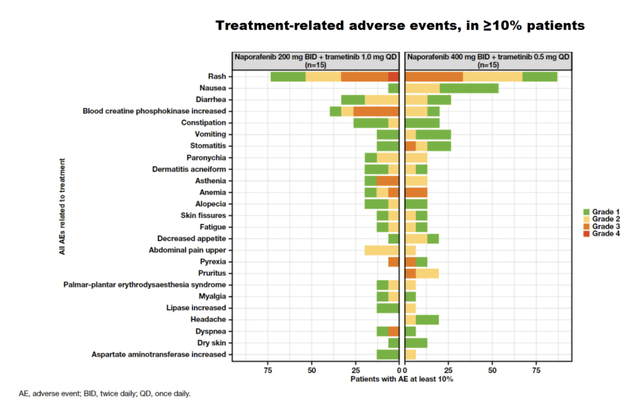

First, the trial was marred by severe toxicities. I would like to see more granular data on this, but here’s a graphical picture:

Thus, there were severe grade 3 and 4 adverse events, including Rash, blood creatine phosphokinase increase, stomatitis, asthenia, anemia, pyrexia, pruritus, and dyspnea. From the chart, it appears that the 400mg arm had more AEs, but both arms had a problematic tox profile. The ASCO report says “Prophylactic strategies aimed to lower the incidence of skin-related events are under investigation.”

As for efficacy, here’s the data in a table:

200mg | 400mg | |

ORR | 46.7% | 13.3% |

mDOR | 3.75 | 3.75 |

mPFS | 5.52 | 4.21 |

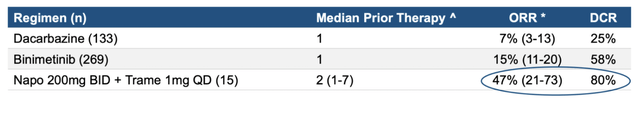

The difference is clear, and quite stark. Since they increased naporafenib and decreased trametinib, it becomes difficult to see whether the decline at the higher dose is due to an increase in an otherwise efficacious drug (seen commonly enough in clinical trials), or because of the decrease of the drug which actually produced the efficacy in the first cohort. Thus, no conclusion can be rightly drawn from this data about naporafenib alone, although, about the combo, here’s the comparative picture:

naporafenib data (ERAS website)

Thus, the combo did superbly better than the other two comparators in ORR and DCR.

Interestingly, some of this data was reproducible - per the company - in phase 2:

However, the data doesn’t exactly prove that. There was a near-50% reduction in ORR and some decline in DCR as well. Recall that the difference between ORR and DCR is simply that the latter includes patients with stable disease as well.

The company also has data from two other assets, ERAS-007 and ERAS-601, both of which showed positive activity in a basket trial of various BRAF-mutated solid tumors.

Financials

ERAS has a market cap of $421mn and a cash balance of $436mn. Last quarter, they raised $100mn (seems to be included in the cash balance). R&D expenses were $29.4 million for the quarter ended December 31, 2022, while G&A expenses were $8.7 million. At that rate, they have a cash runway of some 7-8 quarters.

The CEO recently purchased half a million dollars of ERAS stock. Insiders regularly purchase, and there are almost no insider sells. The company is heavily institution-owned; however, there’s also a solid retail presence. Novartis is a large holder, while City Hall, LLC is the largest shareholder (which is founded by the CEO, Dr Jonathan Lim).

Risks

This is a small company with a large number of trials. Their cash balance is quite good, but it is certainly not enough to run through all these trials.

Moreover, too many trials and assets in an active pipeline at the same time makes the company lose focus. It is not only expensive, but it is inefficient as well. At some point soon, they need to focus on a single asset, or at most two of them, and take them closer to approval.

I am also concerned by the large number of adverse events in the naporafenib phase 1b trial.

Bottomline

This is a brief overview of a company with a vast pipeline and data from multiple assets. There’s a lot of data thrown at the hapless retail investor, and what we need now is some of the data to stand out. This will only happen with a pivotal trial. On the positive side is the CEO’s considerable investment in the company. I will keep looking at ERAS if it crosses my radar again.

About the TPT service

Thanks for reading. At the Total Pharma Tracker, we offer the following:-

Our Android app and website features a set of tools for DIY investors, including a work-in-progress software where you can enter any ticker and get extensive curated research material.

For investors requiring hands-on support, our in-house experts go through our tools and find the best investible stocks, complete with buy/sell strategies and alerts.

Sign up now for our free trial, request access to our tools, and find out, at no cost to you, what we can do for you.

This article was written by

Dr Dutta is a retired veterinary surgeon. He has over 40 years experience in the industry. Dr Maiya is a well-known oncologist who has 30 years in the medical field, including as Medical Director of various healthcare institutions. Both doctors are also avid private investors. They are assisted by a number of finance professionals in developing this service.

If you want to check out our service, go here - https://seekingalpha.com/author/avisol-capital-partners/research

Disclaimer - we are not investment advisors.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.