Daqo New Energy After Q1 Earnings: Too Cheap To Ignore

Summary

- Daqo New Energy Corp.'s recent Q1 earnings release showed that growth is expected to slow further as average selling prices for polysilicon could continue to fall.

- However, Daqo has a remarkably low-cost base to mitigate the impact, helping it to stabilize its gross margins.

- Daqo New Energy stock fell more than 25% from its early March highs as investors positioned appropriately for a less-robust Q1 earnings score.

- However, management reminded investors it has about $615M (about 20% of market cap) from its share repurchase authorization to deploy to defend against further weakness.

- We assess that Daqo New Energy Corp. seems cheap at the current levels, bolstered by constructive price action at its crucial support level.

- I do much more than just articles at Ultimate Growth Investing: Members get access to model portfolios, regular updates, a chat room, and more. Learn More »

Anatoly Morozov

Leading high-purity polysilicon producer Daqo New Energy Corp.'s (NYSE:DQ) Q1 FY2023 earnings release showed further weakness in growth from Q4 FY2022.

However, we assessed that market operators previously anticipated the less robust release, as DQ had fallen more than 25% from its early March highs through this week's lows.

Notably, we gleaned buyers have stepped up to defend the selloff, returning after the earnings release. Management also reminded investors that Daqo had started to execute its massive $700M share repurchase authorization that was approved in November 2022.

Accordingly, Daqo has deployed about $85M so far, buying back its shares at an average cost of about $50.4. Management highlighted the company is expected to consummate its repurchase authorization fully by the end of 2023.

As such, based on the remaining authorization of about $615M, it represents nearly 20% of DQ's current market cap, a significant support to defend against steep selling pressure.

CFO Ming Yang articulated that while there's "no specific timing for [the] share repurchase," management will consider the "share price attractiveness" in making its move.

Hence, we assessed that management's commentary suggests that the company will likely be a buyer on significant dips, providing more support for buyers who decide to add exposure.

With that in mind, it likely helps assure investors that the company can manage the potentially falling average selling prices, or ASPs through the rest of the year, as it impacted Q1's results.

Accordingly, Daqo posted revenue of RMB709.8M in Q1, down 44.6% YoY, as ASPs fell significantly.

However, the company's ability to lower its production costs helped mitigate the drop in its gross margin.

Daqo posted a gross margin of 71.4% in FQ1, down from 77% in the previous quarter. However, it was well above the 63.5% mark the company posted in the previous year.

Management also highlighted that it's confident in its ability to drive down costs further as it expands production capacity in 2023.

Notably, Daqo highlighted that the construction of its Phase 5A 100K MT Inner Mongolia facility had been completed. As such, the company "expects to ramp up production to full capacity by the end of June 2023."

With that in mind, the company should see a remarkable bolster for its Q2 production capacity to about 45K MT at the midpoint, representing about a 33% increase from Q1's capacity.

In addition, the company is targeting a full-year production of about 190.5K MT for FY23, representing a YoY increase of about 46%.

While the demand/supply dynamics remain in flux and could potentially impact the ASPs moving forward, the company has demonstrated that its low-cost base has remained resilient.

Moreover, management reminded investors that it does not expect an oversupply currently, as "the supply and demand are relatively balanced overall."

Furthermore, if necessary, the company has the levers to pull to curtail production increases to deal with unforeseen circumstances leading to potential overproduction.

Coupled with its solid profitability, strong cost controls, and execution track record, Daqo's operating performance should remain robust, even though investors should anticipate further ASP impact in the next few quarters.

DQ quant factor ratings (Seeking Alpha)

Moreover, DQ is given the best possible A+ grade for its valuation by Seeking Alpha Quant, suggesting it remains highly attractive.

Despite that, DQ still suffered from selloffs at critical resistance zones in August 2022, November 2022, and March 2023.

As such, we believe investors must choose their buy levels carefully to avoid buying into momentum surges and improving their risk/reward profile.

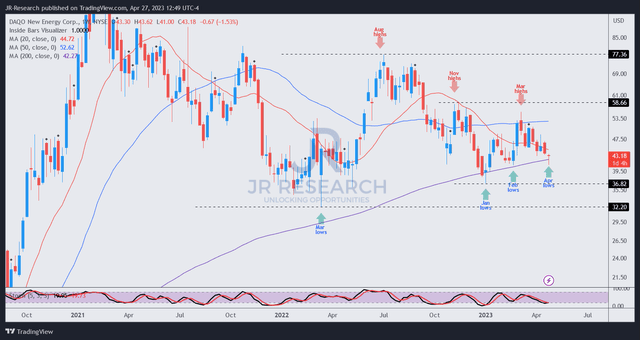

DQ price chart (weekly) (TradingView)

However, the recent surge in DQ has already been digested.

As seen above, DQ dropped significantly from its early March highs toward its lows this week.

Buyers came back to defend against the selloff (but the week is not over yet), likely holding the line against the 200-week moving average or MA (purple line).

As such, we assessed that buying sentiment in Daqo New Energy Corp. remains constructive at the right support levels and, therefore, is conducive to adding more positions on weakness.

Rating: Buy (Reiterated).

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn't? Agree or disagree? Comment below and let us know why, and help everyone in the community to learn better!

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA's bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!

This article was written by

Seeking Alpha features JR Research as one of its Top Analysts to Follow for Technology, Software, and the Internet. See: https://seekingalpha.com/who-to-follow

JR Research was featured as one of Seeking Alpha's leading contributors in 2022. See: https://seekingalpha.com/article/4578688-seeking-alpha-contributor-community-2022-by-the-numbers

Unlock the key insights to growth investing with JR Research - led by founder and lead writer JR. Our dedicated team is focused on providing you with the clarity you need to make confident investment decisions.

Transform your investment strategy with our popular Investing Groups service.

Ultimate Growth Investing specializes in a price action-based approach to uncovering the opportunities in growth and technology stocks, backed by actionable fundamental analysis.

We believe price action is a leading indicator.

Price action analysis is a powerful and versatile toolkit for the informed investor because it can be used to analyze any publicly traded security. As such, it offers investors with invaluable insights into understanding market behavior and sentiments.

Plus, stay ahead of the game with our general stock analysis across a wide range of sectors and industries.

Improve your returns and stay ahead of the curve with our short- to medium-term stock analysis.

We not only identify long-term potential but also seize opportunities to profit from short-term market swings, using a combination of long and short set-ups.

Join us and start seeing experiencing the quality of our service today.

Lead writer JR's profile:

I was previously an Executive Director with a global financial services corporation. I led company-wide award-winning wealth management teams that were consistently ranked among the best in the company.

I graduated with an Economics Degree from National University of Singapore [NUS]. NUS is Asia's #1 university according to Quacquarelli Symonds [QS] annual higher education ranking. It also held the #11 position in QS World University Rankings 2022.

I'm also a Commissioned Officer (Reservist) with the Singapore Armed Forces. I was the Battalion Second-in-command of an Armored Regiment. I currently hold the rank of Major. I graduated as the Distinguished Honor Graduate from the Armor Officers' Advanced Course as I finished first in my cohort of Armor officers. I was also conferred the Best in Knowledge award.

My LinkedIn: www.linkedin.com/in/seekjo

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.