Will The U.S. Dollar Lose Its Global Reserve Status?

Summary

- The US Dollar as an International store of value.

- The US Dollar's use in International trade.

- BRICS challenges.

- How you can learn more.

- This idea was discussed in more depth with members of my private investing community, Cash Flow Club. Learn More »

dem10

The decline of the US dollar as a world currency has been a topic of discussion among financial types for several years now.

Central Bank Reserve Assets: the US Dollar as an International Store of Value

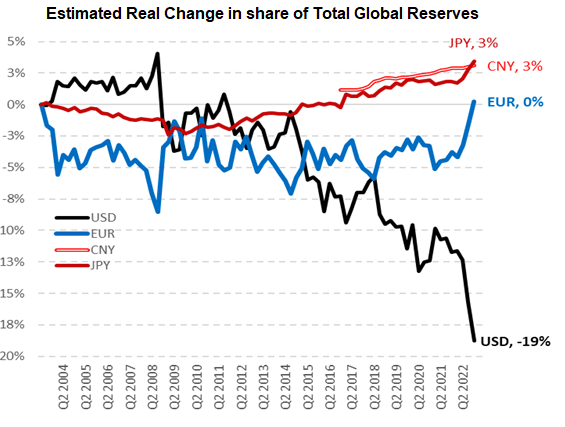

The US Dollar share of total global reserves in real terms has collapsed from about 66% in 2003, to 55% in 2021, to 47% in 2022. In particular, the 8% US dollar reserves decline over the last year is very concerning as it is roughly 10x the average annual decline over the past two decades.

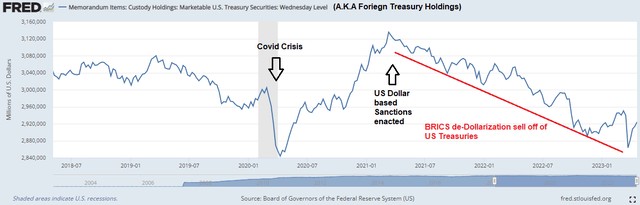

The US implemented currency-based sanctions in response to the Russia-Ukraine war. In response some foreign central banks have been emptying their coffers of US Dollar based assets.

Foreign Treasury Holdings (St Louis Fed)

As you can see below, however, the main reserve replacement hasn't been another major currency (Euro, Yen and Yuan reserves are up <4%).

Eurizon Capital

Rather, the main replacement for the US Dollar's decline in central bank reserves over the last year has been gold. 1,136 tonnes were added in 2022, the largest central bank increase in gold reserves on record. With emerging economies such as Russia and China leading the way.

International Transactions:

The US Dollar is still by far the dominant global reserve currency from a transaction point of view. In fact, between 2009 - 2019 it accounted for a whopping 96% of all international transactions. This in turn creates significant and lasting network effects. Basically, people throughout the world accept the dollar because they know others will and have been doing so for their entire lifetime. For now, people throughout the world continue to believe the US Dollar a useful tool for exchange. However, that percentage of global transactions while still high, has also been falling. The latest data available shows it declined from the 96% average previously stated to 88% by April of last year.

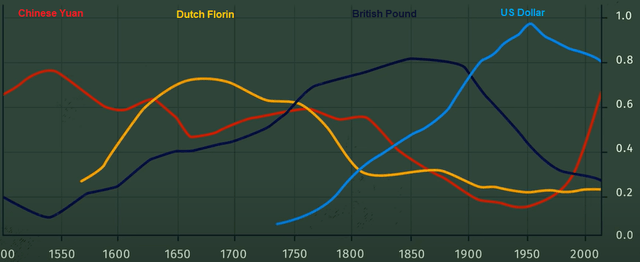

This level of decline is not unprecedented. Previous international trade currencies that dominated throughout the centuries have seen something similar. In fact there is a pattern, each of these currencies eventually fell in use as they first turned from asset backed to fiat, and then their percentage of world trade declined. In the chart below we can see over the centuries the Dutch Florin gave way to the French Assignat, which gave way to the English Pound, and then eventually to the US Dollar.

Currency Dominance (Ray Dalio)

Today the US Dollar, while still dominant appears in decline. The Chinese Yuan in ascension. Even more threatening in my opinion, the US Dollar's dominant position may soon also be challenged by a new BRICS currency designed specifically for international trade and backed by hard assets.

BRICS is an organization like the G7, only for emerging economies rather than developed. The group which includes -- Brazil, Russia, India, China, and South Africa --currently encompasses 26% of the world's land, 41% of the world's population, and 32% of the world's GDP (slightly higher than the G7's 31% of GDP). BRICS, however, may also be about to grow. It has been discussing the potential addition of new members, including Middle Eastern countries such as Saudi Arabia, UAE, Egypt, and Iran, as well as South and Central American countries like Mexico and Argentina. This would further increase its importance relative to the US and the G7. The next BRICS meeting is scheduled for August in South Africa, where they are likely to discuss or possibly even announce the addition of new members and the formation of a new commodity-backed currency.

Recent developments also suggest that the BRICS countries have already been making progress in their efforts to reduce their dependence on the US dollar for international exchange. In January 2023, China and Brazil signed a deal to ditch the US dollar for trade, with the two countries agreeing to use the Chinese Yuan and Brazilian Real instead. India has also been offering Rupee trade options to nations facing a lack of dollars. Additionally, Russia has been advocating for the use of a non-US currency in payments between Russia and countries in Asia, Africa, and Latin America. According to Alexander Babakov, the Deputy Chairman of Russia's Duma,

"The transition to settlements in national currencies is the first step. We've already seen this occur with oil deals between India and Russia [as well as deals between Russia and China, Brazil and China, among SouthEast Asia, and even between France and China]. The next [step] is to facilitate the circulation of digital currency or any other fundamentally new form of currency in the near future...a single currency would likely emerge within BRICS, pegged to gold, or other groups of products.."

Russia's equivalent to the US Speaker of the House is telling the world BRICS is going to form an international, digital, hard asset backed, currency designed specifically for international trade. Believe him.

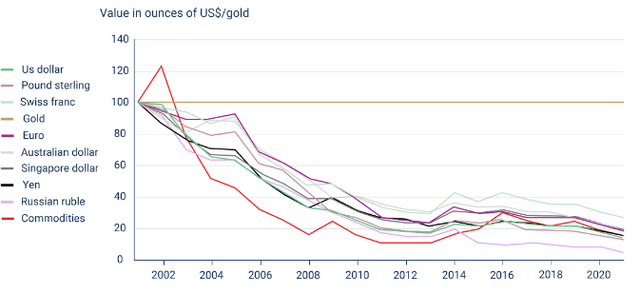

Some experts believe that this trend towards de-dollarization is due to the declining value of the US dollar relative to real assets such as gold. However, we note there's nothing special about the US Dollar in this respect, the reality is all fiat currencies have been declining in value relative to gold.

Price of Gold in various currencies (Gold Avenue)

For this reason, a commodity based international currency is particularly attractive (vs. say the Yuan becoming a world reserve currency).

It's really only the US dollar's status as the current global reserve currency that makes it more vulnerable than other countries' fiat currencies. Roughly half of all US dollars in circulation are currently located outside the US. If foreigners and foreign entities no longer want to use dollars for transactions and a store of wealth, those Dollars will come flooding back to the US. This in turn would be felt as a persistent above average inflation rate as more dollars in the US chase the same amount of goods.

Senator Marco Rubio has acknowledged the situation, stating,

"we won't have to talk about sanctions in 5 years because there will be so many countries transacting business in currencies other than the dollar that we won't have the ability to sanction them."

I don't however mean to imply it is only foreign influence which will take down the dollar. Rather great economies tend to fall from within. It is our decades of profligate spending, international missteps, and willingness to print ourselves out of troubles, that have created the problem.

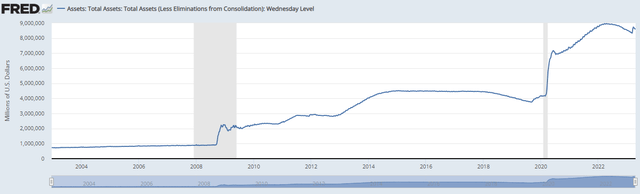

Fed Balance Sheet (St Louis Fed)

The dollar is getting weaker, and foreign countries are starting to determine US Dollar hegemony is no longer in their best interests. Yet, BRICS wouldn't have a chance of taking down the almighty US Dollar if we hadn't been sending it in that direction ever since Nixon took us off the gold standard in the 1970's. Get yourself used to the idea now, it may very well happen over the next decade.

Takeaway:

The decline of the US dollar as a world currency is a complex issue with various factors at play. However, the trend towards de-dollarization is becoming more apparent as BRICS nations and other countries seek to minimize their exposure. As the global financial landscape continues to evolve, it remains to be seen whether the US dollar will be able to retain its supremacy for another couple decades.

My point here isn't to scare anyone. Nor do I think the fall of the US Dollar is going to suddenly happen this year. It's always been a gradual process in the past and will likely be this time too. Nevertheless, like anything with high potential loss but low potential chance (e.g. your home burning down), I suggest you buy insurance.

I also seek to forewarn so people have time to educate themselves, get used to the idea and prepare accordingly. My goal is similar to what I did a couple years ago when I warned publicly of inflation, and posted links in my service each week to the cheapest low rate, fixed, 30-year mortgage I could find. Here I'm suggesting you continue to consider inflation friendly hard assets and assets that benefit from higher rates even as those rates are looking like they are about to pause. Here I suggest you do further research and make your own determination.

One great way of preparing would be to borrow in dollars, especially if you can get a low fixed rate, and investing the proceeds in hard assets (gold, real estate, oil, etc.). For now, that opportunity has mostly passed, but we may get one more swing at the ball. If something serious enough breaks, the Fed may not just pause, but then start to lower rates significantly. Even if the Fed just stops raising interest rates, however, US Dollar based inflation will become a greater concern. Hence, at least some hedging now is called for.

Again, I encourage readers to learn more and make up their own mind. Clicking on a few of the dozen links I have provided in this article is one way to do so. The video, "Principles for Dealing with the Changing World Order" by Ray Dalio is a good place to start. Understanding and internalizing big macroeconomic swings like this before they potentially become too stressful helps one to prepare. It increases the chance you will be able to act logically instead out of fear should the challenges/opportunity come to fruition.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Are you looking for a Reliable Income Stream that beats the rate of inflation?

Cash Flow Club seeks to produce an overall yield in the 6% - 10% range. We accomplish this by combining several different income streams to form a stable and growing portfolio payout.

Focusing on corporate cash flows and management capital allocation alignment is a key part of our approach. We then overlaying sound money management strategy that helps income grow while also reducing volatility.

Capture an income stream that helps you both beat inflation and stay logical when times are uncertain. Start your free two-week trial today!

This article was written by

Darren's started his career as the Assistant Manager of a 7-Eleven; eight years later he was responsible for 14 stores. This imparted a business sense he still finds quite useful today.

After getting his MBA, Darren then moved into doing strategic financial planning and analysis for Silicon Valley firms, eventually achieving Director's status. These strategy, modeling and analysis skills, as well as a lot of hours in boardrooms talking with executives, transferred well into stock investment. It allowed him to first retire in 2006 at the age of 40.

With Cash Flow Club, Darren is now seeking to help others by sharing the analysis and real-world strategies that allowed him to retire early. He remains a full-time investor whose primary source of income is dividend and interest from his investments. He eats what he kills.

Education:

- Bachelors in Economics

- Masters in Business Administration

- Certificate in Personal Financial Planning

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.