Earn Double-Digit Returns With AGNC Preferred Stock AGNCO

Summary

- AGNC Investment Corporation has four exchange traded fixed to floating cumulative preferred shares outstanding.

- The E series converts to a floating rate on October 15, 2024 and is currently priced to provide a double-digit return approaching 30%.

- This article presents the investment thesis for achieving that double-digit return whether or not AGNC Investment Corporation calls the E series shares on October 15, 2024.

PM Images

Introduction

AGNC Investment Corporation (NASDAQ:AGNC) is an internally managed real estate investment trust [REIT] that primarily invests in residential mortgage backed securities (MBS) and collateralized mortgage obligations which have the principal and interest payments guaranteed by a US Government agency or an enterprise sponsored by the US Government. AGNC is headquartered in Bethesda, MD and has a market capitalization of just under $5.8B.

AGNC Investment Options

Investors have a couple different options for investing in AGNC. Investors could purchase AGNC common stock which closed Tuesday, April 25 at a price of $9.75. The common stock currently offers a $1.44 annual dividend that provides a whopping big yield of 14.77%. Along with that rich tax advantaged yield, investors in the common shares will participate in the capital gain or loss from the future value of the common shares. AGNC common stock is a popular investment for those investors focused on generating income because of its very generous yield. But, the common stock has been taking a beating since the Federal Reserve began to raise the Federal Funds Rate and reverse qualitative tightening (reverse of qualitative easing). Roughly two years ago on May 10, 2021, AGNC hit a price of $18.54. Today its price sits 47% lower than two years ago.

AGNC reported first quarter 2023 results April 25, 2023. First quarter 2023 earnings per share were $0.70, a drop of $0.04 from quarter four 2022 though better than the $0.65 analyst's consensus estimate. More telling tangible book value dropping from $9.84 to $9.41, likely due to the widening MBS spread in the first quarter of 2023. With the Fed expected to provide another round of interest rate increase on May 3 and the possibility of wider MBS spreads, the beating on AGNC common stock is likely to continue.

In addition, there is the possibility that AGNC will have to trim back the dividend if the US economy does fall into a recession. The last time this happened was March, 2020 when AGNC dropped the dividend from $0.16/mo to $0.12/mo. For the above reasons, I have steered clear of the AGNC common and focused on AGNC preferred shares which are less sensitive to changes in tangible book value and small drops in earnings per share.

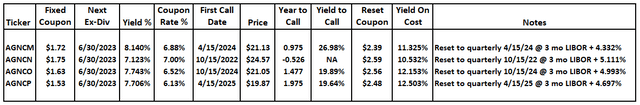

AGNC has five outstanding preferred series that are cumulative, four of which are fixed rate to quarterly floating rate conversions and one that is a 5 year reset rate conversion. Series G (AGNCL) converts to a reset rate October 15, 2027 tied to the 5 year Treasury rate plus 4.39%. The 2027 conversion date is far enough out that I'm not paying much attention to AGNCL now. In addition, Series C (AGNCN) has already converted to a quarterly floating rate on October 15, 2022. While AGNCN currently provides a nice double-digit yield, most of the potential capital gain has already been realized with the price close to its $25 par value. While I'm carrying series F (AGNCP) on my watch list, I'm not accumulating shares of AGNCP yet. May 15, 2025 is two years away and my crystal ball is too cloudy to predict where short term rates will be two years out, particularly with a potential recession on the horizon. That leaves series D (AGNCM) and series E (NASDAQ:AGNCO), which is the focus of the balance of this article. The chart below shows the important investment metrics for all four fixed to floating rate issues (series C, D, E, F).

To make sure everyone has the same understanding of the above chart columns, I've provided the definitions below.

- Ticker - the AGNC preferred ticker symbols are straight forward.

- Fixed Coupon - the original as well as current fixed coupon payment.

- Next Ex-Div - the upcoming Ex-Dividend date. You must own the units prior to the Ex-Dividend date to receive the next dividend.

- Yield - The current yield calculated as (Fixed Coupon/Price) x 100.

- Coupon Rate - The original yield at par value calculated as (Fixed Coupon/25) x 100.

- First Call Date - the date on or after which AGNC may call the units in at a par value of $25. This date is also the date of conversion to a quarterly floating rate.

- Price - the closing price as of Tuesday, April 25, 2023.

- Year to Call - the time till the first call date (also conversion to floating rate) in years.

- Yield to Call - the equivalent annual yield assuming all dividends are reinvested and the units are called at $25 on the first call date.

- Reset Coupon - the floating rate assuming the current 3 mo LIBOR rate (5.25%) plus the floating rate spread. Note that as of June, 2023, LIBOR is to be replaced in all contracts by SOFR + 0.26%.

- Yield on Cost - the future potential yield calculated as (Reset Coupon/Price) x 100.

- Notes - summary of the conversion date, base rate (3 mo LIBOR), and floating spread above the base rate.

A Double-Digit Return

I currently hold sizable positions in the series C (AGNCM shares) and series D (AGNCO shares). I accumulated most of my AGNCM shares October through December 2022. Currently, I'm accumulating AGNCO when the price dips to $21.00 or below. I was able to pick up a few shares of AGNCO on Tuesday right at $21. I believe it is rare to find an investment that, while not one hundred percent certain, is very likely to provide a return approaching 30% in a little under 18 months.

AGNCO will pay six more quarterly dividends between now and October 15, 2024 , the date it converts to a floating rate and can be called. Investors must own the shares before roughly June 30, 2023 (Ex-dividend date TBA) to receive all six dividends before the call/conversion date. The sum of the six quarterly dividends is $2.44. If AGNCO shares are called at $25, I'll get an additional $4 which is the price difference between my $21 limit orders and the $25 par value. The total ($4 + $2.44 = $6.44) and my return over the roughly 18 month period would be ($6.44/$21) x 100 = 30.67%.

Some readers will ask "What if AGNC does not call the AGNCO shares on October 15, 2024?". I'll still get a hefty return. AGNCO will tether near the $25 par value after its call/conversion date. We only need to look to AGNCN to see that effect. AGNCN's call/conversion date was October 15, 2022 and, because it can be called at any time, the price is hanging around $24.50 with a yield of 10.53%. If AGNC does not call AGNCO, I should be able to sell the shares at near the $25 par value. If I decide to continue to hold the AGNCO shares, the Yield on Cost in the above chart shows that, after conversion to a floating rate, my continuing return from AGNCO, ignoring any capital appreciation, could be as high as 12.153%.

Why did I say "could be as high as 12.153%"? It is unclear when the Federal Reserve will pivot to a looser monetary policy. Several FOMC members have stated the expectation that the Federal Funds Rate will be higher for longer but the Fed's crystal ball is nearly as cloudy as ours. If the economy does fall into recession early, say the latter half of 2023, the Fed may decide to shift to a looser monetary policy at the end of 2023 or beginning of 2024. If that happens, short term rates could easily be 100 bps lower than my current estimate by October, 2024. So, my expected 12.153% forward dividend could be closer to 11.15% on the October 2024 call/conversion date. Whether the yield going forward from October 2024 is 12.15% or 11.15%, AGNCO's price will tether close to its $25 par value. I can decide then whether to sell the shares or continue to hold and collect the higher dividend.

Some readers will ask "Why are you so certain you will receive more than your cost basis if you sell the shares?". Today, AGNCO shares yield 7.74% and are priced at roughly $21. At conversion to floating rate on October 15, 2024, the coupon will increase from $1.625 to around $2.50. The price of the AGNCO shares will adjust up because of the increase in the coupon rate and we can estimate the increase in price that would provide the equivalent of today's 7.74% yield as ($2.50/$1.625) x $21 = $32.31 Because the AGNCO shares can be called at $25 par value after October 15, 2024, I doubt that they will re-price up to $32. I think the most likely re-pricing will push the AGNCO to between $25 - $26. I'll still get around a 30% return.

If the Fed lowers short-term rates by 100 bps by October 15, 2024, a 4.25% base rate plus the 4.993% spread gives a floating rate at conversion of 9.243% and the new coupon rate would be $2.31. Estimating the equivalent price/yield to today's values would give us ($2.31/$1.625) x $21 = $29.85 which is well above the $25 par value. We should also understand there will be an increase in the price of the AGNCO shares simply due to the Fed aggressively lowering short term rates. Bottom line here is, I'm very likely getting a return approaching 30% on my AGNCO investment.

What Are The Risks To This Thesis

I've pretty well covered interest rate risks in the text above. The other potential risks to my 30% return thesis are market risks.

One could postulate that the housing market crashes similar to the 2008/2009 "Great Recession". First, this is highly unlikely as we have had tighter residential mortgage lending standards for over a decade meaning do not have and will not have homeowners walking away from their homes (and mortgages) in droves because they are upside down. We don't have banks and investment houses holding toxic MBS. I'll also reiterate that AGNC invests in MBS and collateralized mortgage obligations which have their principal and interest backed by US Federal Government agencies or sponsored enterprises. If the US economy does tip into recession, AGNC could find it necessary to trim their common dividend as they did in the March 2020 COVID pandemic market crash. There are a few advantages to holding preferred shares, the key advantage here being at the head of the line for dividend payouts.

If I'm reading AGNC's 2022 annual report correctly, the REIT paid out $105M in preferred stock dividends and $820M in common stock dividends. Even if AGNC had to cut their common dividend in half, the coverage ratio on the preferred stock dividends would still be 4.9X.

Conclusion

AGNCO shares current pricing along with the conversion from a fixed $1.625 coupon to a floating rate with an initial $2.5 coupon October 15, 2024 is very likely to provide investors a return approaching 30% in a little less than 18 months. All five of the AGNC preferred securities have ample dividend coverage in the event the US economy slides into recession.

Editor's Note: This article was submitted as part of Seeking Alpha's Best Investment Idea For A Potential Recession competition, which runs through April 28. This competition is open to all users and contributors; click here to find out more and submit your article today!

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AGNCM, AGNCO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: This article is intended to provide my opinion to interested readers and to serve as a vehicle to generate informed discussion in the comment posting. I have no knowledge of individual investor circumstances, goals, portfolio concentration or diversification. Readers are strongly encouraged to complete their own due diligence on any stock, bond, fund or other investment mentioned in this article before investing.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.