ANTA Sports Products: Growing Market, Strong Fundamentals

Summary

- China's leading sportswear company ANTA Sports Products is seeing a weak price trend in YTD, in contrast with its exceptional performance over the past decade.

- With the return of demand in China, the company's continued growth, industry-beating margins, and international expansion promise well, however.

- Its P/E does indicate that it is fairly valued, but if its earnings expand, it can look far more competitive soon enough.

- Looking for more investing ideas like this one? Get them exclusively at Green Growth Giants. Learn More »

Young777/E+ via Getty Images

If there were any stock market investment to make a decade ago, it would have been China’s leading sportswear brand ANTA Sports Products (OTCPK:ANPDY), which has risen by almost 1400% since! Its returns over the past five years look good too, as it has more than doubled investor money. In 2023 to date, however, it is down by 9.3%. Is this a reason to buy on dip?

With China’s market getting healthier in 2023, after the lifting of COVID-19 restrictions last year, there is a possibility that it might still end up being a good year for ANTA Sports Products, nevertheless. Here I take a closer look at the company to assess what is next for its price.

The market and the company

China's sportswear market is promising indeed driven by fashion trends and greater health awareness. As of 2021 it had a value of USD 52 billion and projected to grow at 9% per annum between then and 2025. While big global multinationals like NIKE (NKE) and adidas (OTCQX:ADDYY) dominate China’s sportswear market, the homegrown ANTA Sports Products comes third.

It might be relatively less known in other parts of the world, but it did manage to capture the demand for international sportswear brands in China by acquiring ownership and management of the well-known Italian brand FILA in 2009. The significance of this acquisition is evident in the fact that it contributes a substantial share of 40% to its revenues today.

More recently, in 2019, the company acquired the Finnish Amer Sports for EUR 4.6 billion, to expand into the international market. Its own namesake brand, however, is the biggest contributor to revenues with a 51% share, with the remainder after ANTA and FILA coming in from all other brands, which include Wilson tennis rackets and Salomon ski boots.

Robust Financials

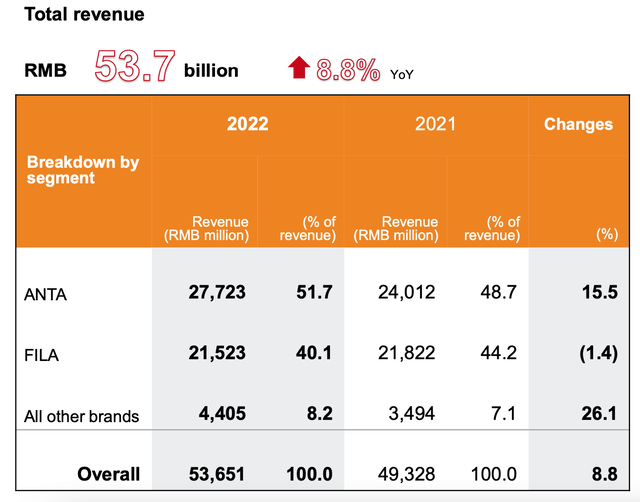

Notably, ANTA Sports Products has seen continued growth in 2022, of 8.8% in revenues, despite the COVID-19 restrictions that hurt demand in China last year. And even this growth has been dragged down only because of FILA’s underperformance, while ANTA and other brands grew at a much faster clip (see table below).

Source: Anta Sports Products

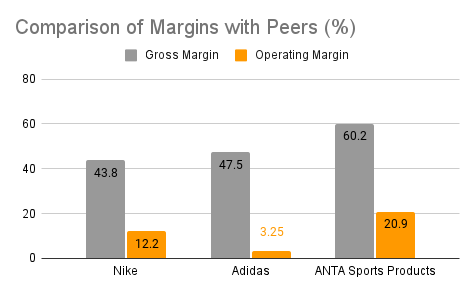

If its sales growth is notable, the company’s margins are impressive. Even though both its gross profit margin and operating margin corrected a bit in 2022 to 60.2% (2021: 61.6%) and 20.9% (2021: 22.3%) respectively, they are significantly ahead of their big competitors Nike and Adidas (see chart below).

Interestingly though, while FILA and other brands contributed significantly to its high gross margins, ANTA actually has the highest operating margin, slightly ahead of the rest. This is partly because of an increase in ANTA’s gross margins during the year as the company transitions increasingly to the more profitable direct-to-consumer [DTC] model. But it is also because of a decline in FILA’s gross margins as well as increased operating expenses for the brand.

Source: Anti Sports Products, Seeking Alpha

Why did its price fall?

This leaves the puzzling question, if its financials are robust and demand is expected to pick up, why is its price falling? One reason is its decision to raise funds via a stock placement last week at an 8.8% discount to its last traded price, which led to a fall in price. The company has undertaken this placement to refinance its debt and add to its working capital. This in no way suggests that it has debt trouble, though. In fact, its balance sheet looks fine. It has a debt ratio of 0.3x and a working capital ratio of 1.6x.

But the fact remains, that its price trends have been uncertain through 2023, even before the stock placement. It did see a run-up in early January, in line with a rise across consumer discretionary stocks. And saw another spike when it released its annual results in March. But it otherwise has seen weak price movements. An explanation for this could be its market multiples. Its trailing twelve months [TTM] price-to-earnings (P/E) ratio looks strong at 30.6x. This is significantly higher than the 15x for the consumer discretionary sector and even its own long-term median P/E of 25.1x.

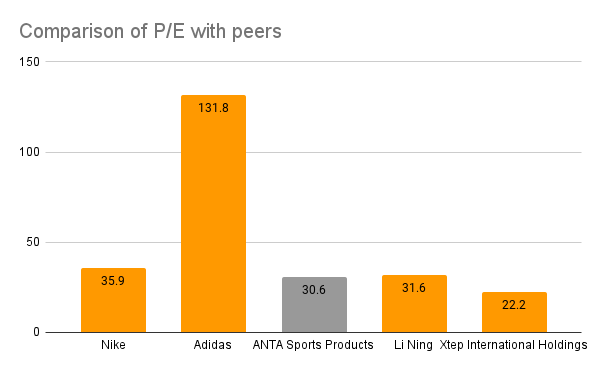

Comparing P/E with peers

However, compared to the subset of its closest peers, it does not appear that high-priced. I compared it to Nike and Adidas on the one hand which have the biggest share in sportswear in the Chinese market and with domestic counterparts Li Ning (OTCPK:LNNGY) and Xtep (OTCPK:XTEPY) on the other.

Source: Seeking Alpha

Adidas is the priciest of the lot with a P/E ratio of 131.8x after it fell into a loss in the final quarter of 2022 resulting in a huge dip in profit for the full year compared to 2021. If we leave it aside and focus on the remaining three peers, ANTA Sports Products’ P/E looks fairly priced. It is lower than that for both Nike and Li Ning at 35.9x and 31.6x respectively, but in the vicinity anyway. It is higher than only that for Xtep at 22.2x. Further, the average P/E of these companies, leaving aside Adidas, is at 30.1x, which is just a tad smaller than that for ANTA Sports Products. In other words, broadly speaking, it looks fairly priced for now.

What next?

However, I do not believe that its current P/E will necessarily be a deterrent to further price rise. It has the advantage of functioning primarily in the China market, which looks good this year, especially in comparison to the US and Europe. This can make it attractive relative to the competition and also spur sales growth.

With inflation in check in the economy, its already industry-beating margins could expand too. Also, if its earnings increase, the P/E would decline in the coming quarters. The company’s balance sheet looks alright as it is and it also has a leadership position among Chinese sportswear companies as well.

The recent share placement at a discount is disappointing, and clearly, investors have expressed that. This adds to the already uncertain price movements YTD. On the whole, though, I think there is more going for ANTA Sports Products than not. Besides the points already mentioned above in the section, its long-term growth is exceptionally encouraging. And there is no real reason to believe it will be any different in the near future. It is a Buy for me.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

--

This article was written by

Manika is an investment researcher and writer as well as a macroeconomist, with a focus on converting big-picture trends into actionable investment ideas. She has worked in investment management, stock broking and investment banking. As an entrepreneur, running her own research firm, she received the Goldman Sachs 10,000 Women scholarship for certification in business. She is also a public speaker, having shared her views at multiple international forums and has been quoted in leading international media.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in ANPDY over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.