Rubis: Poised To Weather Possible 2023 Recession

Summary

- Rubis has sustained a steady level of profitability and has successfully weathered numerous economic cycles.

- The company is expected to continue growing at a rate of at least 5% per year while offering a dividend yield of 7.43%.

- A recent breakout of a falling wedge technical pattern suggests a positive outlook and should help improve investor sentiment.

- It appears to be undervalued based on its earnings.

Jarretera

Introduction

When in search of a stable cash-generating business, I believe it's worth considering Rubis (OTCPK:RBSFY), not only because of its recession-proof fundamentals but also because of its low valuation. Despite having an impressive track record of consistent long-term growth throughout the previous decades, it's currently being given a low earnings multiple of 9.25.

In my view, this can be attributed to the earnings instability observed in the past few years. As earnings are now stabilizing, it is probable that positive growth in profits will boost investor confidence and lead to an increase in the earnings multiple.

Considering the possibility of an impending minor recession, I strongly suggest considering Rubis due to the nature of its business, consistent growth in EPS over the years, and quick normalization of profits following the COVID-19 pandemic. Despite the challenging market environment, Rubis remains a strong contender for long-term value creation.

Recession-proof Business

Rubis is a French multinational company that operates in the energy and chemicals sectors. It specializes in the storage, distribution, and marketing of petroleum products, liquefied petroleum gas (LPG), and chemicals. The company has a presence in over 45 countries and operates through its subsidiaries and joint ventures. Rubis is known for its expertise in the management of complex supply chains and its ability to adapt to local market conditions. Its main focus lies in the retail and marketing of fuels, through its service stations primarily located in Africa, and in the distribution of liquefied gas in Europe and the Caribbean.

Although no business can guarantee immunity from a recession, Rubis seems to come as close as possible to achieving it.

If a mild recession occurs towards the end of 2023, as indicated by JPMorgan Chase CEO Jamie Dimon, Rubis' diverse operations should aid in navigating a decelerating economic environment. Rubis generates gross profits that are nearly equally distributed among Africa, the Caribbean, and Europe. Given that a majority of African countries are surpassing other nations in terms of GDP growth, it is likely to help alleviate any downturns caused by a recession, as Africa's growth prospects remain positive.

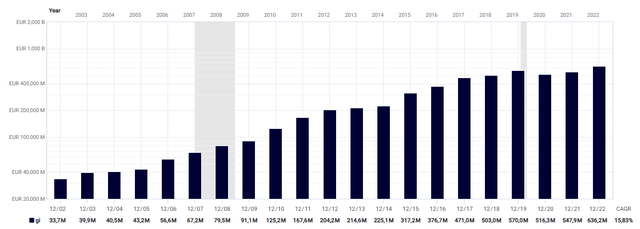

Despite concerns about a possible recession, simply taking a brief look at the businesses' annual gross income should help alleviate any anxieties. In fact, based on the graph below, it's difficult to discern the 2008 recession, and the impact of Covid19 on gross income is only barely visible as a small decline.

Rubis' gross income has been growing due to their successful reinvestment strategy. The company consistently reinvests a portion of its earnings at a rate of around 10%. Even during the financial crisis, they maintained this rate, and have already recovered from the dip in 2020. A testament to the strength of the business and its ability to navigate volatile market conditions.

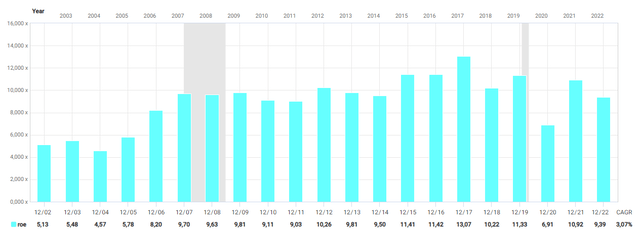

Strong Show Of Resilience

The graph seen below illustrates Rubis' remarkable consistency in EPS growth. Despite experiencing numerous economic cycles, Rubis has sustained a steady level of profitability. It successfully weathered the financial crisis and subsequent recession, and even managed to recover fully from the Covid19 lockdowns without significant difficulty.

In the future, I anticipate a decrease in Rubis' growth rate. Historically, Rubis has maintained a return on equity of approximately 10% by distributing half of its profits as dividends and reinvesting the remainder. This reinvestment has resulted in a yearly EPS growth of around 5%, while the remaining 3.5% has been achieved through balance sheet leverage. However, with a net debt of roughly 1.6 billion in relation to a market capitalization of approximately 5 billion at a 15 price-to-earnings ratio, the balance sheet is already well utilized.

If Rubis returns to its average price-to-earnings ratio of 16.24, which is typically regarded as a fair multiple for consistently profitable and growing businesses, it could result in a gain of nearly 100%. In the meantime, the company is expected to continue growing at a rate of approximately 5% per year, excluding any potential benefits from acquisitions, while also offering a dividend yield of 7.43%.

Technical Analysis In Line With Fundamentals

Quick disclaimer: A technical analysis in itself is not a good enough reason to buy a stock, but combined with the company's fundamentals, it can greatly narrow your price target range when investing.

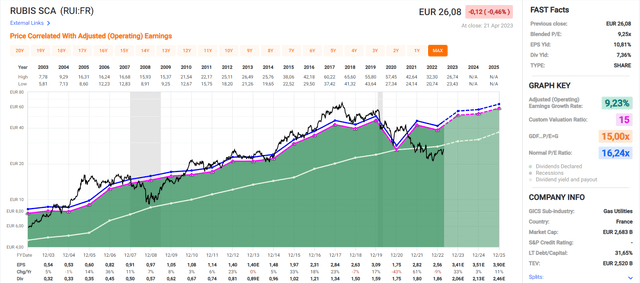

The notion of the stock being undervalued is further supported by a simple technical analysis as well. The stock is currently trading significantly beneath both its 50-month and 200-month moving averages, a rarity for consistently profitable and growing businesses. Since the low valuation is primarily driven by sentiment and not by the business's performance, it is likely that prices will rise again. Although the duration of this increase is uncertain, technical analysis indicates that it may happen soon. The chart below shows the break out of a declining wedge pattern three months ago, indicating a bullish technical pattern and implying that a bottom may have already been established.

It also indicates that there is great upside potential to be found, as the price target for a falling wedge is equal to its height, which would result in a gain of well over 100%.

Final Thoughts

Investors looking for stability and predictability in anticipation of a possible recession should consider Rubis. While no business can guarantee complete immunity from a recession, Rubis has demonstrated resilience in the past. With a long-term investment horizon, the current valuation appears attractive, with a single-digit P/E ratio and expected annual EPS growth of at least around 5%. It's uncertain how long the current prices will last, but a recent breakout of a falling wedge technical pattern suggests a positive outlook and should improve investor sentiment.

With the price target of the falling wedge suggesting roughly the same amount of upside potential as the fundamentals, a "Strong buy" rating is given.

Editor's Note: This article was submitted as part of Seeking Alpha's Best Investment Idea For A Potential Recession competition, which runs through April 28. This competition is open to all users and contributors; click here to find out more and submit your article today!

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RBSFY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.